Summary

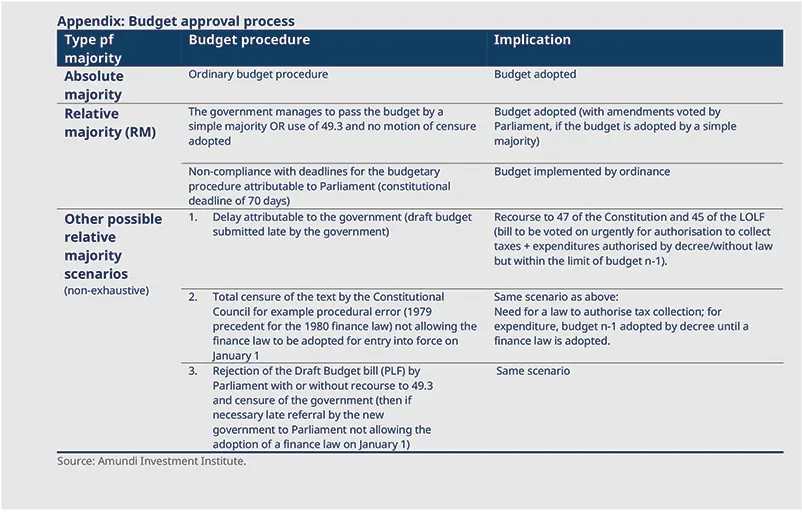

A narrow path ahead for the French government: French Prime Minister François Bayrou will seek a vote of confidence on September 8, ahead of the October 1 budget discussions, facing opposition intent on blocking his budget plan. Regardless of political outcomes, the French institutional framework guarantees budget approval; if a new budget is not enacted, the previous year’s budget remains in force by decree until a new finance law is adopted.

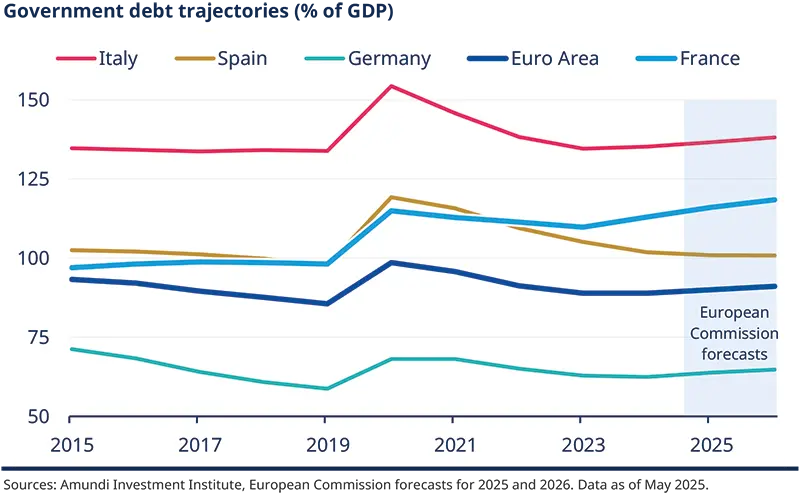

Outlook for the French economy and debt: France's economic growth is expected to mildly improve, supported by stronger consumption and investment, though policy uncertainty may weigh on confidence. While public debt is set to rise due to persistent deficits and higher interest costs, the low cost of debt compared to the past and a longer debt maturity profile have kept debt servicing manageable, reducing the impact of rising rates. However, accelerating fiscal consolidation next year will be key to signalling the direction of the debt trajectory ahead.

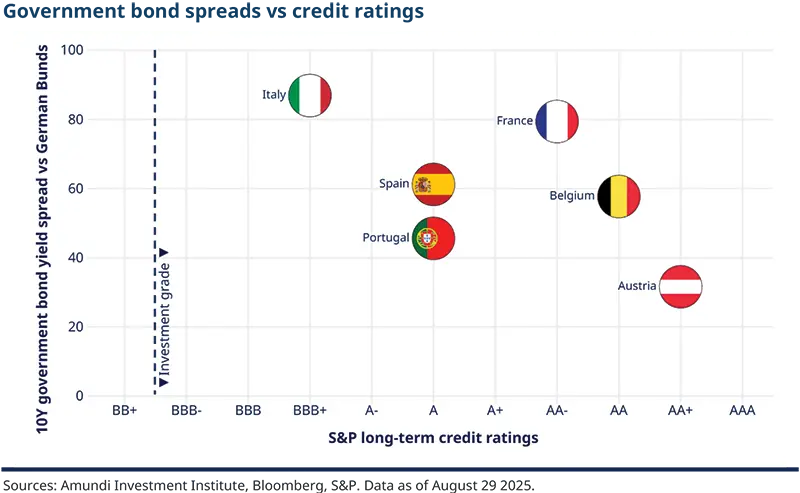

Fixed income implications: Political uncertainty has increased pressure on French government bonds (OATs), with the OAT-Bund spread widening to around 80bps. Volatility in spreads, and a 20-25 basis points ‘political risk premium’ versus its fair value now priced in, are likely to persist until political clarity improves, though the French government bond market enters this phase from a position of relative strength amid high liquidity and the ECB’s accommodative stance.

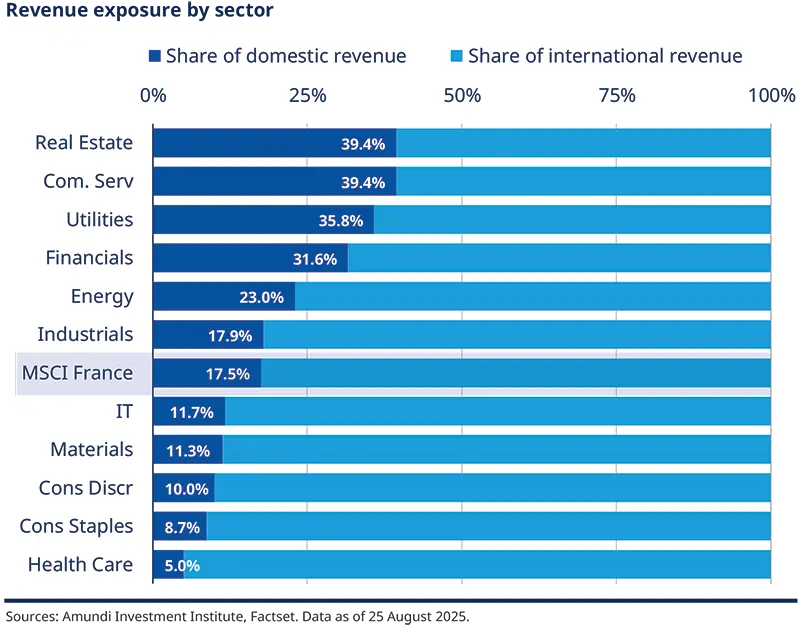

Equity market implications: The French equity market reacted negatively to the Prime Minister's confidence vote announcement, triggering profit-taking in domestic stocks like financials, which had outperformed in recent months. However, with political risk largely priced in and over 80% of French stock revenues generated internationally, previously impacted international names could help stabilise the market. More broadly, European equities continue to offer relatively attractive valuations compared to the US, presenting opportunities to strengthen exposure during any market pullback, particularly in long-term thematic areas.

A narrow path for the French government

French Prime Minister François Bayrou announced that he would request a vote of confidence on September 8, before the budget discussion that is set to begin on October 1, and following the presentation of the budget orientations in mid-July.

Opposition parties (RN, LFI, PS, PCF, Ecologists, representing a total of 315 seats out of 577) have already declared that they will vote against the confidence requested by François Bayrou in an attempt to pass a balanced budget, and find €44 billion in savings (1.5% of GDP). A simple majority of votes cast (not an absolute majority of MPs) is sufficient to topple the government. Despite the Prime Minister's attempts to persuade the parties involved, observers currently regard the prospect of a vote of confidence as highly unlikely.

If the motion of confidence is rejected, the Prime Minister must resign. President Macron then faces two options:

Appoint a new PM, possibly a technical one, amid a fragmented Assembly.

Dissolve the National Assembly and call for new snap elections. Considering the fragmented electorate, it would be again complex to form a majority. The President can wait to dissolve the National Assembly at any time, but once he decides to do so, according to Article 12 of the Constitution, parliamentary elections must be held within 40 days of dissolution.

Until a new PM is appointed or elections are held, the outgoing PM can stay in office and manage day-to-day affairs. According to some observers, the appointment of a new PM could happen very quickly.

Article 47 states that Parliament has a maximum of 70 days to examine and adopt the finance bill from the date of its presentation. The constitutional deadline for presenting a budget, which is the first Tuesday in October (7 October this year), may be adjusted in the event of dissolution.

The important thing is to respect the 70-day deadline and ensure that the budget is enacted before 1 January (see Appendix on the Budget process at page 6). If Parliament has not made a decision by the end of the 70-day deadline, the government may take measures by decree to ensure the continuity of public services. The precedent of 2025 (see box) recalls how an institutional crisis was avoided last year.

| The precedent of 2025: how an institutional crisis was avoided last year |

On 10 December, the Council of State issued an opinion on the interpretation of Article 45 of the ‘organic law on finance laws’ (LOLF). This article allows the government to propose a special bill to ensure the continuity of national life and the regular functioning of public services in 2025. This is in the event that Parliament does not adopt the Finance Act for the year before 31 December, and it is not possible to enact a Finance Bill before this date. The bill was presented to the Council of Ministers on 11 December and adopted by the National Assembly on Monday 16 December (481 votes in favour, 0 against). On 18 December, the bill was adopted by the Senate (345 votes in favour, 0 against). The special law was promulgated by the President of the Republic on 20 December 2024. This law does not replace the budget and was intended to manage a temporary situation until the Finance Law was adopted in 2025. Its scope being strictly limited, it authorised the collection of the necessary taxes and public resources to finance essential public expenditure. |

Economic outlook for France

France's economic growth is set to gradually pick up, driven by improved consumption and investment, but policy uncertainty could weigh on confidence.

Domestic demand is sluggish and external demand is moderate, as tariff uncertainty has weighed heavily on business confidence and investment.

Q2 2025: GDP growth was positive at around 0.3%, driven by temporary restocking. Household consumption increased 0.1% after falling 0.3% in Q1; business investment fell by 0.3%. Inflation also moderated, and stabilised at 1% YoY in July.

H2 2025-2026 outlook: Household consumption should benefit from higher real wages (due to disinflation) and more favourable credit conditions. Meanwhile, private investment should benefit from the clarification of US tariffs levels. We anticipate a pickup in growth at around 0.7% in 2025 and 0.8% in 2026.

Risks: Domestic political uncertainty could weigh on confidence, prompting businesses to postpone investment plans and households to maintain their high savings rates. Conversely, successfully implementing the expected fiscal consolidation measures could boost business confidence/private investment and encourage households to reduce their savings next year. This is particularly true given that Germany — France's main trading partner — is expected to experience a sharp economic rebound next year thanks to an expansionary fiscal policy.

Public finance and fiscal outlook

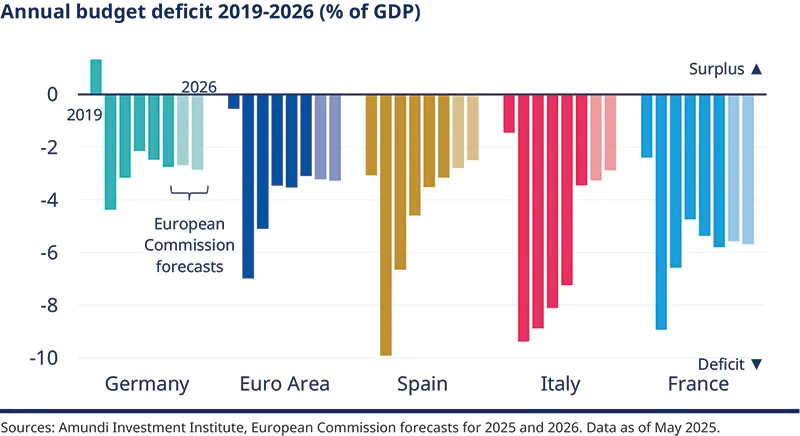

At the end of the Q1 2025, public debt is set at €3.35 trillion (114% of GDP), with over €1 trillion being generated since 2019, while the French budget deficit increased to 5.8% of GDP in 2024, up from 5.4% in 2023.

France’s public debt is expected to rise in the coming years, driven by ongoing deficits and higher interest costs, as the debt-reducing effect of nominal GDP growth diminishes.

This overshot the budget law target of 4.4%, due to weaker tax revenues, high inflation-linked social benefits, and increased local government spending — only partially offset by energy savings and expenditure cuts. The 2025 budget law includes significant fiscal adjustments, including revenue-increasing measures of around 0.5% of GDP and expenditure cuts of around 0.3% of GDP. Despite the economic slowdown weighing on tax revenues and higher unemployment benefit payments, the deficit is forecast to decline to 5.6% of GDP this year.

However, interest payments, which rose already in 2023-24, are projected to increase further to 2.5% of GDP in 2025 and 2.9% in 2026. Meanwhile, the 2026 deficit is expected to edge up to 5.7% of GDP as some 2025 revenue measures expire.

Against this backdrop, public debt is projected to rise from 113% to 118-119% in 2026 driven by persistent primary deficits and rising interest payments, while the effect of nominal GDP growth in reducing debt is weakening. Pensions, the largest public spending item at 15% of GDP, face growing pressures from rising costs and demographic challenges.

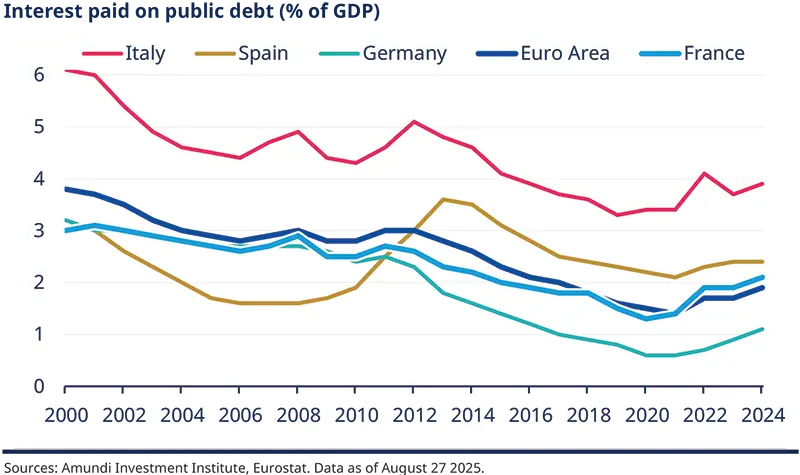

While France’s rising debt presents challenges, France continues to benefit from relatively favourable financing conditions.

The situation requires the fiscal consolidation to be accelerated next year. However, it is not as serious as some analyses may suggest. Indeed, despite public debt doubling since 2000, interest charges in 2024 were 0.9pp of GDP lower than in 2000. This was due to persistently low sovereign bond yields, which reduced the cost of servicing the debt.

In addition, the average maturity of outstanding debt has increased to about 9 years, thereby limiting the impact of a rise in market rates on the debt burden.

Against this backdrop, the expected increase in debt charges remains manageable. Stabilising public debt at around 110% of GDP in the long term is achievable. This would require an adjustment of around 3.5pp of GDP (approximately €100 bn in 2025).

This could be achieved by spreading the adjustment out over time to minimise its impact on growth. The rise in bond yields forecast until 2030 corresponds to a situation in which the long-term nominal interest rate would be close to nominal GDP growth (r-g=0). This should prevent the need for sudden fiscal adjustments to maintain debt sustainability.

In short, despite its high level of public debt and significant structural deficit, France continues to benefit from relatively favourable financing conditions. While stabilising the debt ratio will require significant effort, it is still manageable.

Investment implications

Political uncertainty has widened French spreads, but a low cost of debt, long maturity profile, and high liquidity will likely attract investors back if spreads widen further.

Fixed Income: political uncertainty meets structural strength

The recent political uncertainty has put renewed pressure on French government bonds (OATs). OAT-Bund spreads have widened on the back of the political news, with the 10Y spread going from 65bps in the summer to around 80bp now. This is still below the 90bp peak reached during December 2024 and the risk of a potential downgrade is already priced in.

The confidence vote scheduled for early September comes at a delicate time, as the government must implement credible measures to reduce the deficit to 3% of GDP by 2029. Until political clarity is restored, volatility in French spreads is likely to persist. That said, France enters this phase from a position of relative strength, having benefited from a decade of exceptionally low rates:

Lower cost of debt. The average financing cost stands near 2% today, down from 3–5% before 2010 and a low of 1% in 2021.

Longer maturity profile. Average debt maturity has lengthened from 6 years to 8.6 years.

Lower interest burden. Debt burden represented just 2.1% of GDP at the end of 2024, well below the level seen in 2010.

France’s sovereign bond market also remains one of the deepest and most liquid in the euro area, making it a preferred market for foreign investors. It retains strong fiscal capacity, with a broad tax base, solvent households, and a solid balance sheet. In addition, the ECB’s accommodative stance, combined with moderate growth and disinflationary pressures, continues to provide a supportive backdrop for fixed income.

Nevertheless, risks remain: credibility of fiscal consolidation, persistent political instability, and potential loss of investor confidence in the 2029 target. The evidence in terms of our fair value model on France is that the OAT-Bund spread is currently pricing approximately 25bps of ‘political risk premium’. Until the political situation clarifies, we believe that this premium will remain in place.

French equities could offer some stock-picking opportunities, while European stocks more broadly offer relatively attractive valuations compared to the US and exposure to themes like Germany’s fiscal push and defence.

Equity market: the strong international sales exposure could limit the downside

The CAC40 reacted negatively to the Prime Minister's announcement that he would ask for a vote of confidence. However investors should consider that market reactions to political events are generally temporary. Moreover, although the dissolution of the assembly on 9 June 2024 came as a real surprise, this time the political risk was on the agenda.

The announcement has sparked a rotation in the French market that could continue for some time. Domestic stocks, particularly financials, have largely outperformed in the past several months, enabling some reasonable profit-taking. Meanwhile, stocks that are considered at risk of losing government contracts — construction, concessions, and infrastructure sectors — are more vulnerable in this type of episode.

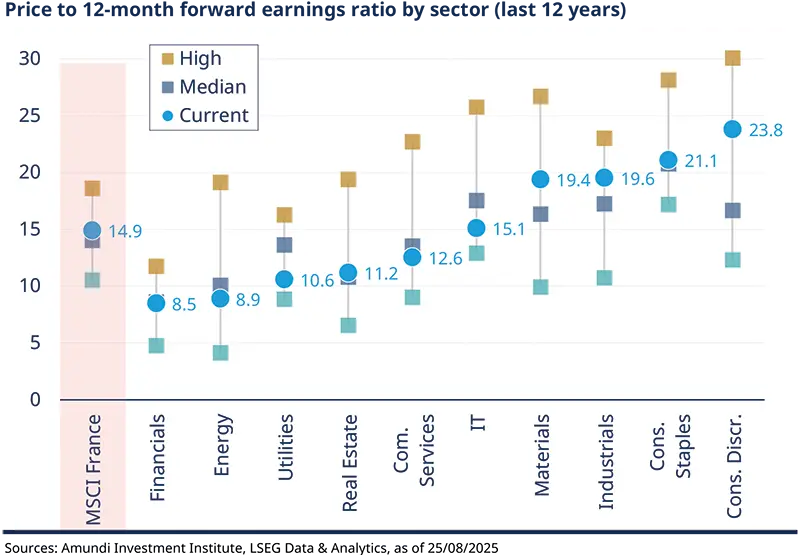

However, these sectors (financials, utilities) are not overvalued at this stage. Notably, over 80% of CAC40 revenues come from outside France. While international stocks have struggled recently due to tariff uncertainty and euro strength, they could now help stabilise the market and absorb some of the domestic impact.

The MSCI France index has underperformed the MSCI Europe index this year (+6.4% vs. +9.7%), with earnings growth also lagging. However, valuations in both markets align with historical averages, and the recent sell-off suggests political risks are largely priced in.

With US valuations at extreme levels, European equities present more attractive opportunities. Any pullback in European markets, including France, could offer a chance to strengthen exposure to the region, particularly in areas aligned with long-term trends such as the German budget plan and defence initiatives.