Summary

January’s end brought a bout of extreme volatility across commodity markets. Several commodities appear to have been hit by a correction after short-term euphoria, likely prompting the unwinding of speculative positions at month-end in silver, platinum, tin, US natural gas (NG) and the euro.

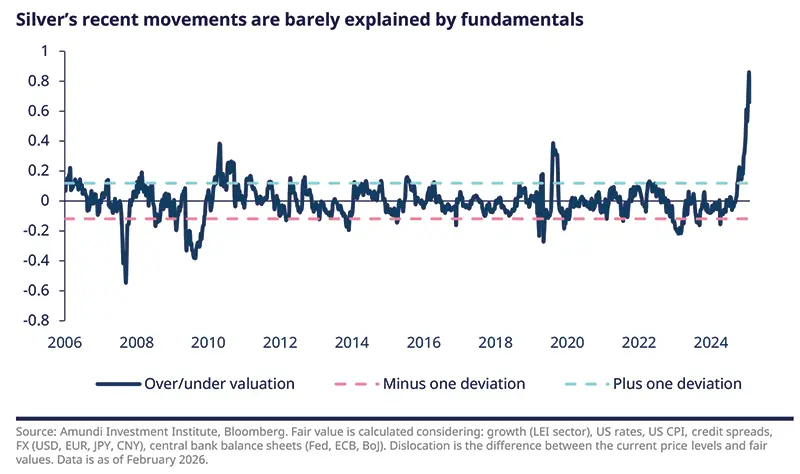

Silver tumbled about 26% on Friday, January 30, and US natural gas suffered a similar decline on Monday, February 2. As a result, volatility in precious metals and gas has surged to more than double its historical levels.

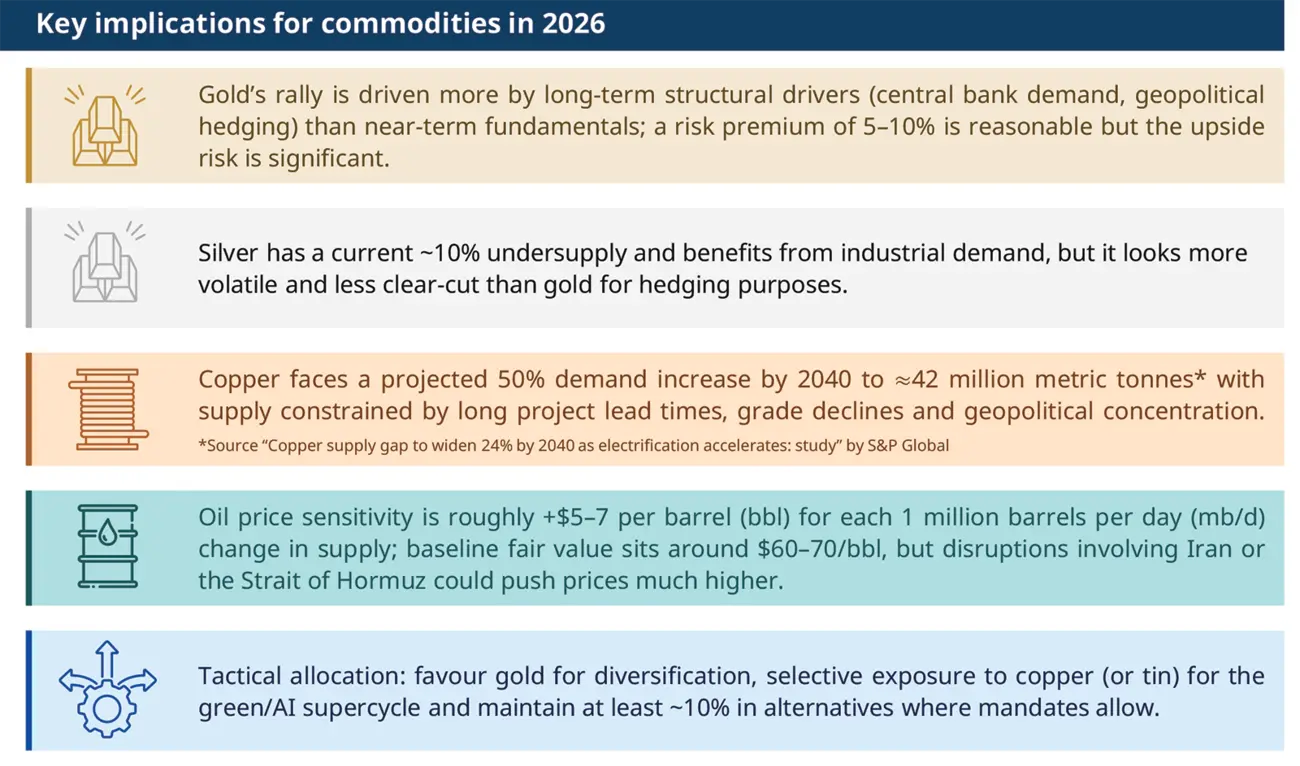

Gold, silver, copper and oil are reacting to a mix of structural demand shifts, geopolitical risk and short-term speculation. While central bank buying and safe-haven flows underpin gold, silver’s rally is partly explained by a near-term supply deficit and industrial demand. Copper faces a long-term structural gap driven by electrification and the AI buildout, and oil remains exposed to asymmetric geopolitical tail risks.

A balanced barbell strategy, combining gold with industrial metals exposure, plus a modest allocation to alternatives, can improve portfolio resilience.

As structural shifts and short-term speculation drive commodities, a barbell strategy pairs gold for protection with industrial metals to benefit from electrification and the AI buildout.

The current commodities market is best read as a mix of enduring structural shifts and short-term speculative positioning. Expectations about the coming years — not narrowly defined price targets — are driving much of the action. Investors should therefore think in scenarios and risk premia rather than single-point forecasts.

Gold: structural support, geopolitical hedge

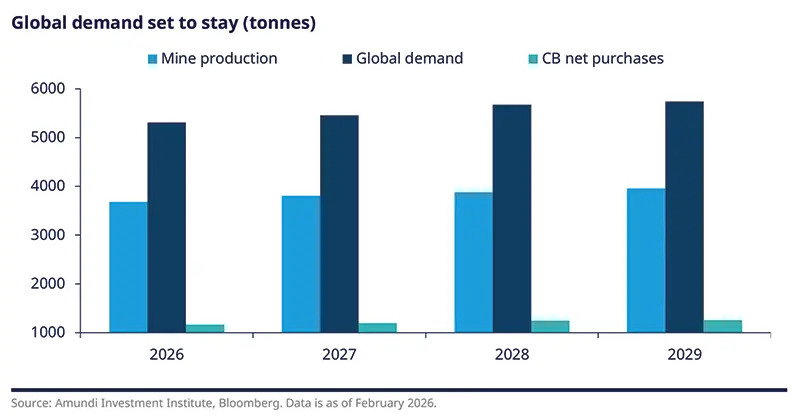

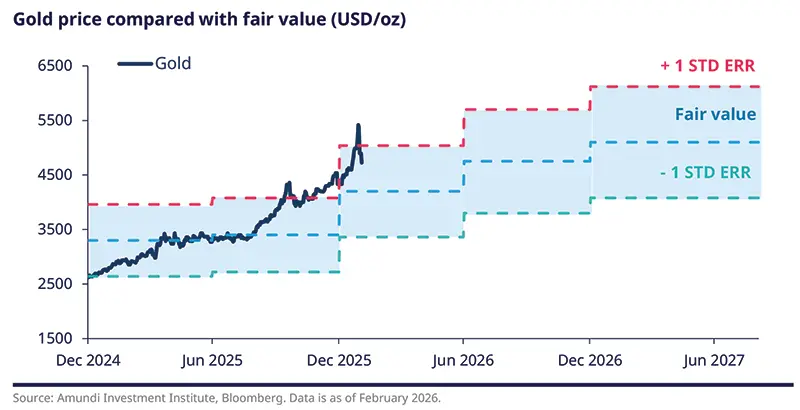

Gold’s recent advance can be justified more by medium-to-long-term structural factors than by immediate fundamental changes. Central banks in emerging markets remain significant buyers — conservative estimates point to large cumulative purchases (on the order of several thousand tonnes) that would create persistent demand despite slowing purchases in the second half of 2025 due to skyrocketing prices (central bank purchases in 2025 totalled 863 tonnes).

These flows, combined with elevated geopolitical risk and the metal’s portfolio diversification role, create a risk premium that we peg broadly in the 5–10% range today. That premium could expand materially if market participants increasingly price in structural undersupply.

Technically, price action has been strong and there are few reliable short signals; strategically, gold is the clearer hedge among precious metals. For investors seeking a safe haven against geopolitical shocks and policy uncertainty, gold offers a more visible and defensible case than silver.

Silver: a 10% undersupply, but more vulnerable

Silver’s market dynamics differ from gold’s. Current estimates suggest roughly a 10% undersupply — a fact that helps explain much of the investor interest — and the metal benefits from both precious-metal demand and an expanding industrial role in the green transition and AI hardware. China’s increasing appetite for silver, alongside its use in photovoltaics (solar panels) and electronics, reinforces the demand backdrop.

However, silver’s price move has at times outpaced what clear macro fundamentals would dictate. It remains more exposed to speculative flows and can be more volatile than gold. From an investment standpoint, a light stance on silver makes sense for investors who want the insurance qualities of precious metals but prefer the relative stability of gold.

Silver is supported by a roughly 10% undersupply and rising industrial demand, but recent gains have outpaced macro fundamentals, making it more volatile than gold.

Copper: the backbone of electrification and AI

Copper’s medium- to long-term outlook remains structurally bullish. Consumption is projected to rise by roughly 50% by 2040, driven by AI data centers, renewable energy build-outs, electric vehicles (which use about three times the copper of internal-combustion vehicles), and grid modernisation. That trajectory could push global demand towards approximately 42 million metric tonnes.

Supply, however, is slow to respond. New greenfield mines, built from scratch, typically require 10–15 years to come online; existing operations face declining ore grades; and production is geographically concentrated in countries such as Chile and Peru, which introduces political and social risk. Recycling helps, but it cannot close the gap by itself unless prices rise substantially enough to incentivise large-scale scrap returns. Taken together, these factors argue for a long-term structural deficit, making copper (and in some cases tin) a preferred industrial exposure to benefit from electrification and AI infrastructure investment.

Copper is central to electrification, with demand projected to rise about 50% by 2040 while supply remains slow to respond, supporting a structural deficit and making it a preferred industrial exposure.

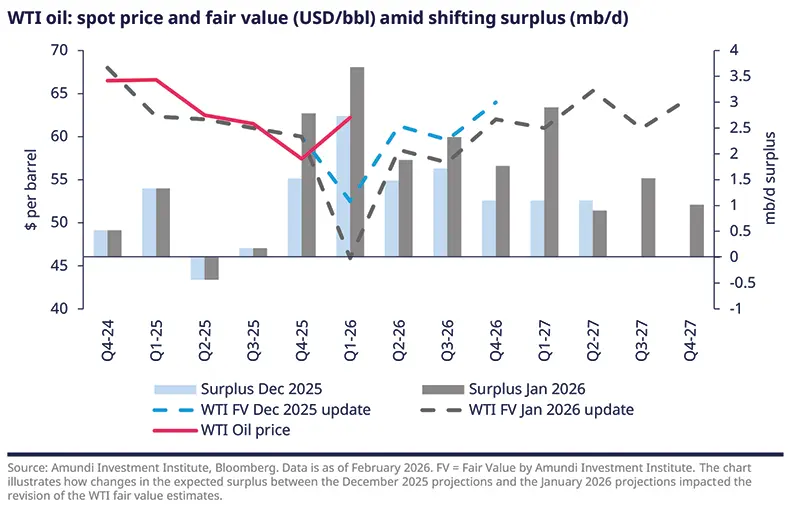

Oil: asymmetric risks, sensible baseline

Oil stands apart because its near-term price is highly sensitive to supply shocks and geopolitics. A useful rule of thumb is that each 1 mb/d change in supply tends to move the equilibrium by about $5–7 per barrel. This sensitivity frames scenarios: a rapid, large-scale ramp-up from sidelined producers (the ‘flooding’ story) is difficult to execute quickly and is therefore a low-probability driver for a sustained price collapse. In contrast, supply disruptions (the ‘upside’ story) — whether a large outage in Iran or a temporary blockage of the Strait of Hormuz — can generate sharp spikes.

Iran represents an upside tail risk because outages are disruptive rather than additive; a total Iranian outage (≈3.3 mb/d) could add roughly $17–23/bbl, potentially lifting equilibrium prices into the $80–100+ range in extreme circumstances. A significant Strait of Hormuz disruption would be even more consequential given approximately 20–25 mb/d transiting through the chokepoint, but prolonged closures are operationally and politically hard to sustain. Balancing these tail risks, a mid-cycle fair-value band around $60–70/bbl appears most defensible today, with the caveat that brief overshoots above $100 remain possible under severe disruption.

Investment implications: barbell strategy and alternatives

Given the mix of drivers, a barbell approach makes sense: combine gold for its hedging characteristics with selected industrial metals exposure (copper or tin) to capture the structural upside from electrification, AI and infrastructure spending. Silver can play a satellite role for tactical exposure, but core hedging should favour gold.

Portfolio construction should also consider increased allocations to alternatives and dynamic asset allocation tools in this complex environment. Where mandates permit, committing at least 10% to alternative investments — strategies that can include commodity-focused funds, real assets, and other diversifiers — can provide valuable convexity against stagflationary shocks and geopolitical tail events.

Short-term price targets are of limited use in markets driven by evolving expectations and asymmetric risks. Instead, investors should model scenarios (recessions, financial stresses, supply outages) and size positions to reflect both the probability and the potential impact of those scenarios. With long lead times for critical supply responses in metals and the persistent geopolitical overhang for energy, commodities are likely to remain an important element of diversified portfolios — but they require active management and a clear view on time horizon and risk tolerance.