Summary

Once again, Sanae Takaichi delivers - this time with a decisive general election result that provides a much needed public endorsement of her growth strategy for Japan.

Just two weeks before the vote, markets were still pricing a 50/50 chance of the LDP (Liberal Democratic Party) securing a simple majority (>233 seats). Nevertheless, the eventual outcome - an absolute majority for the LDP alone (>310 seats) - is a landslide few anticipated.

This result gives the LDP firm control of the Lower House, consolidating Takaichi’s leadership and her “Sanaenomics” agenda while providing Japan with political stability in the medium term.

We view the election outcome as positive for Japan’s equity market, though it is likely to exert near term pressure on the Japanese yen and Japanese Government Bonds (JGBs). That said, the knee-jerk reactions in the FX and rates markets have been much calmer than expected.

What would be the likely path of the country’s fiscal policy from here?

With the LDP winning a two-thirds supermajority in the Lower House, ‘Sanaenomics’ has secured public endorsement.

Often seen as Shinzo Abe’s protégé, Takaichi’s economic policies are frequently characterised as a continuation of ‘Abenomics’, and questioned for their effectiveness. Yet a key distinction lies in her approach. Abe was essentially a monetarist; despite his “three arrows” rhetoric, policy execution was inconsistent. The premature fiscal consolidation in April 2014, when the consumption tax was raised from 5% to 8%, stifled Japan’s nascent recovery.

Takaichi is unlikely to repeat that mistake. She is expected to rely more on fiscal levers and avoid reverting to monetary easing, particularly as households continue to face a cost of living crisis. The Bank of Japan’s credibility remains integral to her plan, as showcased in the December hike.

Her proactive and responsible fiscal agenda has two stages:

Stage one: the affordability campaign

From the FY2025 Supplementary Budget, Takaichi introduced a series of measures, including gasoline subsidies and tax cuts effective from November, forthcoming utility bill relief in February, free nationwide private high school education, and free lunches for junior high students from April.

Collectively, these measures are expected to shave at least 0.6 percentage points off headline CPI (Consumer Price Index), bringing inflation down from 3.2% in 2025 to below 2% in 2026. Core CPI (excluding fresh food and energy) should ease from 3% in 2025 to around 2% by Q2 2026, as tuition and lunch subsidies take effect and rice prices normalise.

Softer headline inflation will help restore real wage growth to positive territory, supporting consumption. In addition, Takaichi is likely to introduce a two-year exemption for food consumption tax, costing roughly 0.7% of GDP per year.Stage two: revamping growth potential

By delivering immediate relief, the affordability package creates a temporal window and political space for Takaichi to pursue broader expansionary fiscal measures intended to bolster Japan’s strategic autonomy, raise productivity, and enhance human capital quality (the so called “second demographic dividend”).

Government funds will serve as seed capital for capex across 17 critical sectors, supporting Japan’s leadership in key supply chains and advancing its AI and automation ambitions. With an absolute majority in the Lower House, Takaichi can now embed this plan as a long-term fiscal commitment.

Could the government utilise the country’s huge savings, a lot of which are in cash, for growth?

In an environment of rising yields and monetary policy normalisation, with the Bank of Japan implementing rate hikes, investors often question the effectiveness of fiscal easing and the potential tightening effects on financial conditions.

However, Japan’s private sector is cash-rich. Both corporates and households have long exhibited debt aversion and a conservative financial stance, consistently saving far more than they invest.

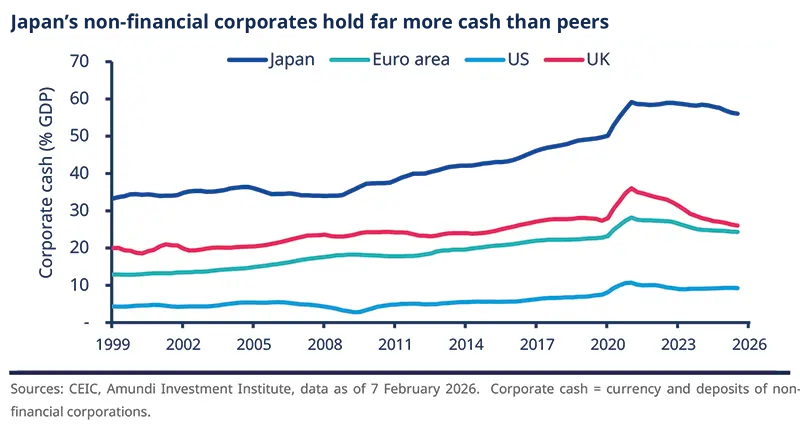

Japanese households hold assets worth 5.7 times their liabilities, with roughly half of those assets in cash. Meanwhile, Japan’s non-financial corporates hold more than twice as much cash as their peers in other developed economies.

This substantial financial surplus and elevated cash position effectively cushion the economy from the tightening impact of higher rates. In fact, rising yields may even support passive income generation for households, while aiding the normalisation of the financial sector.

The government and regulators recognise this persistent cash hoarding issue and are addressing it through capital efficiency reforms for corporates and investment incentives for households, such as the tax free NISA scheme.

Against this backdrop, Japan’s challenge is less about financial tightening and more about reshaping private sector behaviour under a new regime where inflation has returned. Takaichi’s fiscally driven growth strategy is well positioned to revive the country’s spirit and encourage a shift from saving to investing.

What are the implications for the financial markets in the medium term?

In the medium term, the yen is more likely to appreciate against the dollar, and we expect JGB yields to be capped.

Markets reacted positively to the election results: equities surged to record highs, the yen strengthened, and long-term JGB yields initially spiked before retreating. We see the outcome as supportive for Japanese equities, but expect near-term pressure on the yen and JGBs.

After initial volatility, yen intervention is likely and could briefly strengthen the currency. That said, the yen’s valuation has already cheapened significantly. Over the medium term, the currency is more likely to appreciate against the dollar, supported by attractive valuation, potential carry trade unwinding, and renewed repatriation flows.

JGB valuations have improved following the January sell-off. Market sentiment is now more balanced, with greater focus on fiscal risk. As Takaichi’s fiscal plan and growth strategy become clearer, confidence is rising. The FY2026 Initial Budget and debt issuance plan suggest a measured approach to spending, not unchecked expansion. As a result, we expect JGB yields to be capped in the medium term. We look for 10-year yields to stay near 2.25%.