Summary

What could a Warsh-led Fed mean for markets?

On 30 January 2026, Donald Trump tapped Kevin Warsh — a former Fed governor between 2006 and 2011, and prominent policy hawk in a few past episodes — to take over from Jerome Powell as the US Federal Reserve Chair when Powell’s term ends in May.

With markets digesting the implications of Warsh’s nomination and his recent statements, we turned to Alessia Berardi, Head of Global Macroeconomics, for her take on how investors are reading the news, the main themes emerging from Warsh’s communications, and what might lie ahead for Fed policy as the economic outlook continues to shift.

Alessia, how would you characterise Kevin Warsh’s policy stance based on his past speeches and the current economic environment?

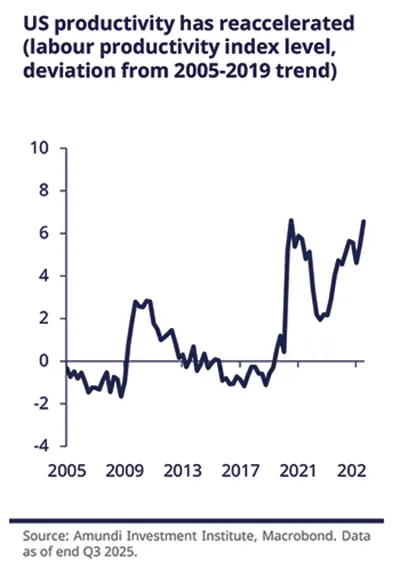

Having followed Kevin Warsh’s communications over time, it’s clear he has historically prioritised inflation control over growth targets, frequently criticising quantitative (QE) and suggesting that the Fed has, at times, exceeded its monetary remit. His recent statements acknowledge that the current strength of the US economy is rooted in an innovation-led cycle, with growth fuelled by productivity gains from unprecedented technological advances. In addition, this is supporting stronger growth with limited inflationary pressure, therefore justifying the ongoing normalisation of rates.

Given this background, a Warsh-led Fed is likely to continue the ongoing cycle in line with what economic fundamentals justify. Another key factor to look at is also whether Powell remains on the Federal Open Market Committee (FOMC), as each vote carries equal weight and could influence the committee’s direction.

While we continue to assess both opportunities and challenges presented by AI, the US economy’s strength remains uneven.

Warsh has historically prioritised inflation control, but today’s productivity-led growth could allow easing to continue cautiously, and only as fundamentals justify.

Turning to markets, how have they reacted to Warsh’s nomination?

Under Warsh, the Fed is perceived by the market as less aggressively dovish than expected before the nomination. Compared to the other names on Trump’s shortlist, Warsh appears the least dovish option, shifting the distribution of outcomes toward fewer or slower cuts, less appetite for re-accelerating balance-sheet expansion, eventually resulting in higher term premia. That could imply tighter financial conditions over time, even though he has also publicly pushed for lower rates recently.

Immediate market moves have reflected less uncertainty around the Chair appointment and a return to greater orthodoxy in monetary policymaking. The reduced uncertainty has impacted the speculative and crowded positions in precious metals, accumulated during January in gold and even more in silver; while the perception that a Warsh Fed would be less inclined to support markets with rapid cuts or new QE in response to volatility yields, has supported the dollar; yields have risen, while equities have fallen.

All in all, it is fair to say that the short end of the curve appears more anchored than before with more limited downside risk.

So, what are your expectations for the Fed?

The jury is out about what a Fed under Warsh is going to do, given that his views may have evolved alongside the economic and political regime shifts we all acknowledge. However, he seems to recognise that the current US momentum is driven by innovation and supply-side growth and the absence of inflation pressure continues to support the case for rate cuts that we now expect in the second half of the year.

There’s been speculation about whether Warsh might favour different monetary tools, but our outlook remains fundamentally driven — easing and QE serve distinct purposes and shouldn’t be seen as interchangeable. Given the macro backdrop, we expect the Fed to remain cautious and data-dependent, likely holding off on rate cuts in the near term and possibly keeping policy tighter for longer than previously anticipated. That said, in the event of liquidity shocks, for example, in the private markets, a broader toolbox is definitely on the table.

Looking ahead, we still see the Fed funds rate reaching the mid-point of the FOMC’s 2.8–3.6% range by the end of 2026, with cuts most likely between July and September. However, any further cuts will require clear evidence of sustained disinflation, without a re-acceleration in growth or second-round inflation effects.

We expect the Fed to remain cautious and data-dependent, with any cuts likely to come over the summer — provided there is clear and sustained evidence of disinflation.

Reassessing the US economic outlook

by Annalisa Usardi, CFA, Senior Economist, Head of Advanced Economy Modelling, AII

What is the economic context the next Fed Chair will inherit in terms of growth and inflation?

Activity indicators signal robust economic momentum ending 2025 and entering 2026 (associated with significant productivity gains) which cautions against further aggressive policy at this final stage of the Fed cutting cycle. This stronger-than-expected momentum has prompted us to revise our US growth forecast for 2026 upwards. We now expect GDP growth to be closer to 2.5% year-on-year, with Q4-on-Q4 growth expected around 2%, still on the lower end of the Fed’s central tendency projections. The risks, though, are still tilted to the upside. On inflation, we see it staying within a 2.4% to 3% corridor in 2026. CPI should show signs of more pronounced moderation in the coming months, followed by a modest pickup mid-year before resuming its downward trend. Core PCE is expected to decline gradually, holding near 2.5% through mid-year, with more evident moderation likely in the second half. Services inflation, largely driven by rents, should ease as measured components align with actual rent trends, supporting further disinflation in core services. |

|

Overall, we expect inflationary pressures to ease further, helped by moderating unit labour costs and improving productivity, alongside a gradual moderation in wage growth.

Turning to the job market, what are the latest trends and what should we expect going forward?

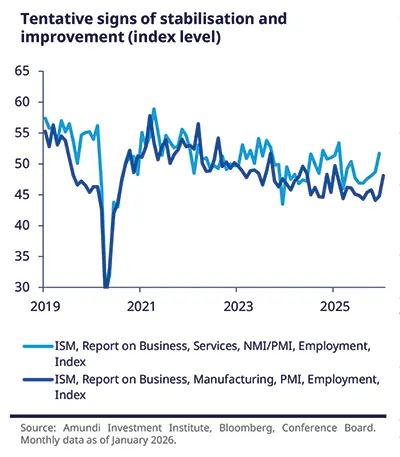

| Recent labour market data has been mixed, after a period where the numbers suggested early signs of stabilisation. On the positive side, surveys like the Institute for Supply Management (ISM) indices and the Purchasing Managers’ Index (PMI) are pointing to an improved outlook for hiring. Also, small businesses have recently reported the strongest hiring intentions and plan to increase compensation, albeit more modestly than in the past. Other figures are leaning more towards weakness. JOLTS (Job Openings and Labor Turnover Survey) showed an unexpected drop in job openings in December; ADP (Automatic Data Processing) payroll growth in January was weaker than anticipated; and unemployment claims have risen. However, employee layoffs remain contained. These indicators suggest the labour market conditions remain on the weak side, but they do not point to a crisis. |