Summary

- Three decades of expansionary monetary and fiscal policies coupled with low inflation may lead rate setters to overestimate their confidence that low inflation expectations will persist, or believe they have more time to act on inflation. The Fed (and other central banks) faces what we call the ‘Great Paradox of Monetary Tranquillity’. This reasoning implies much more aggressive actions will be required later on, at a much higher cost.

- To believe that inflation will disappear on its own is akin to wishful thinking: a credible and abrupt change in the policy regime is required to tamp down prices. To date, this seems highly unlikely, given the unsustainable legacy of the past regime, and the need to finance a new and critical set of public goods and priorities.

- Most authorities genuinely believe they should be credited for the low level of inflation seen over the last few decades. However, credibility does not last forever. Moving forward, this may result in a ‘chickening-out’, stop-and-go, tortuous type of process: the very definition of more volatility for the inflationary trajectory.

- The summer rebound in risk assets, fall in risk premia and bond yields, and tightening of credit spreads indicate that financial conditions have loosened rather than tightened. For investors, the global repricing of risk has not yet run its course. More flexible investment management will be required to avoid traps and pitfalls.

Inflation: It’s all about expectations

When it comes to inflation, there has historically been two opposing schools of thought. For the ‘adaptive’ camp (e.g. Friedman), inflation expectations are a hereditary phenomenon. Individuals extrapolate past inflation rates or the underlying rate of inflation, and project them into the future. Their expectations are self-sustaining, momentum-driven and sticky. Because adaptive expectations change slowly, a significant dose of policy restriction is required to stamp down prices, but this comes at a high (arguably unnecessary) cost in terms of output.

The ‘rational expectations’ camp, where private agents approximately understand their environment (similar to policy makers), bases its criticism of adaptive expectations on this reasoning (e.g. Sargent). According to proponents of this hypothesis, the battle against inflation requires an abrupt change in monetary and fiscal regimes in order to minimise the output cost. Where inflation is the driving force according to the first group, policy is the dominant factor for the second. In the following, we show that these two sides are in fact closer than it appears in today’s unique environment.

If inflation does not retreat of its own volition, a change in the prevailing policy regime from the last three decades or so will be required.

Monetary authorities face a new policy equation

The problem lies in accommodative, pro-inflationary, long-term trends in monetary and fiscal policy

We have extensively described the ongoing regime shift1. Among its many aspects, we observe two important points:

- Accelerating inflation, from the low and stable levels of previous decades (the past regime), distinguishes the ongoing shift from a pure ‘Volckerian’ environment;

- Intense stimulative fiscal and monetary policy, in part but not only in response to crises and shocks, have propelled this new trend.

At its core, the regime shift does not stem from an important and inflationary legacy from the last few decades. Arguably, some self-sustaining momentum is building today, but in recent years Western economies experienced low and stable rates of inflation. This distinguishes the current situation from the one Paul Volcker was confronted with when he arrived at the Federal Reserve’s (Fed) helm in 1979. The ‘mnemonic’ component, or inflationary legacy, was minimal when the latest inflationary cycle kicked-off. Rather, there has been a shift because people are more likely to expect higher rates of future inflation because past and, by extrapolation, prospective, monetary and fiscal policy has warranted such expectations. We call it an accommodative, pro-inflationary, long-term trend in monetary and fiscal policy. The long-term recollection of these policies has contributed to shaping long-term inflation expectations.

Although certain clues could be found in various asset prices, the long-term inflationary trend may have gone unnoticed thanks to what we call the ‘Great Misunderstanding’: a fortuitous combination of inflationary policy and subdued inflation in the traditional sense2. As the latter gradually picks up, the normal, positive correlation between accommodative policy, inflation and expectations is restored. The very reason to act is the entrenched, long-standing, long-term stance of policymakers. There is less of a problem regarding the long-term legacy of inflation itself. Instead, the problem lies in the legacy of monetary and budgetary profligacy.

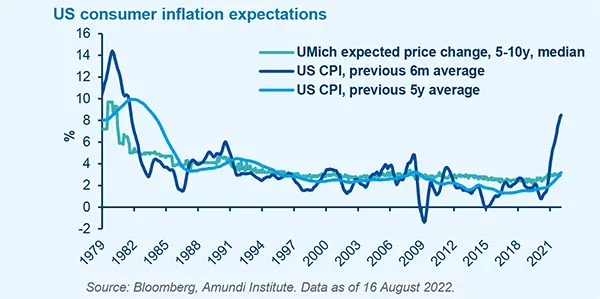

In the adaptive framework described above, the reason for aggressive policy normalisation (which comes at a cost) is the existence of a sticky inflationary legacy. This is not true of the current situation or, at least, it is not the main rationale for normalising today. The authorities may even believe they have some room to manoeuvre and require a lesser dose of policy restriction, compared to a situation where inflation is a long-term legacy. For example, assuming the 10-year average (equally-weighted) inflation rate is a well-documented proxy for long-term expectations, it would take several years before a ‘permanent’ increase in expectations and inflation itself became visible. This may be reduced by overweighting more recent years but would nevertheless take some time. In the same vein, real rates are arguably higher than is believed, given that expectations are stickier than currently estimated.

In the rational expectations framework, the very reason to act is the entrenched, long-standing, long-term stance of policymakers. In our view, this is true today. The adaptive and rational expectation camps differ less in their fundamental approach, and more by their supposedly leading variables. In both cases, there are powerful forces of memory and forgetfulness at play. However, in the first case, inflation itself is the leading variable. In the second, policy is the root cause, with possible temporary short-term divergences, but ultimately positively correlated interaction with inflation over the long run.

It follows that the situation immediately presents conflicting legacies and memories in the short term, but medium-term interaction and positive correlation. There is a race against time between the persistence of memorised low inflation and the existence of a memorised, and extremely accommodative, policy mix stance. In the short term, inflationary momentum may continue to build, gaining additional traction from the long track record of accommodative fiscal and monetary policy.

Contrary to the Volcker age, today the Fed (and other central banks) faces what we call the ‘Great Paradox of Monetary Tranquillity’, which may lead it to:

- Overestimate its confidence that low inflation expectations will persist (i.e. no legacy), such that moderate interventions will suffice to fix the problem at a reasonable output cost.

- Believe it has more time. In the adaptive framework, long-term expectations are a reasonably sticky function of extrapolated past rates of inflation. This proxy for expectations, which the adaptive school also employs as an underlying rate of inflation, is slow to change. Hence, monetary and fiscal authorities are able to buy some time, to sit and wait comfortably behind the curve before deciding to intervene. Simultaneously, this reasoning implies more aggressive actions will be required, at some point, at a much higher cost in terms of output. This is a time paradox and a trap.

If these premises are correct, and if inflation does not retreat of its own volition, a change in the prevailing policy regime from the last three decades or so will be required. Isolated or non-linear incidents of monetary and fiscal restriction – viewed more as temporary deviations from the accommodative, long-term policy trend – are insufficient.

The monetary and fiscal regime change must be abrupt in order to be credible. Moreover, the change must address features that have become permanent, such as hyper fiscal and monetary accommodation, rather than inflation. ‘To predict precisely how rapidly and with what disruption in terms of lost output and employment such a regime change will work its effects’ is not an exact science, and ‘[it] would depend partly on how resolute and evident the government’s commitment was’3.

This is unlikely.

Departure from a long-term policy of persistently large deficits and money creation seems highly unlikely, given the unsustainable legacy of underinvestment4, and society’s consensual need to finance a new set of common goods.

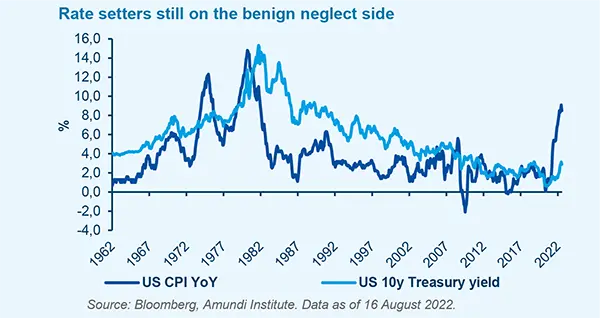

An abrupt change in the policy regime is also improbable. In contrast to the Volcker era, today there has been little experience of inflation over the last few decades, and rate setters will be inclined to lean on the ‘benign-neglect’ side of the policy equation.

A complete acknowledgment of the monetary origin of the inflationary sequence – not only since Covid, but retraceable to all the policy actions of the past regime – will be the prerequisite for credible, long-term action. However, this too is unlikely to occur, as has already been demonstrated. The legacy of what we call the ‘Great Misunderstanding’ is very powerful.

Most authorities genuinely believe they should be credited for the low level of inflation seen over the last few decades. However, credibility does not last forever. Moving forward, this may result in a ‘chickening-out’, stop-and-go, tortuous type of process: the very definition of more volatility for the inflationary trajectory.

Takeaways for investors: The global repricing is incomplete

The adaptive and rational expectation camps are converging: time and current policies are simply adding to the underlying inflationary trend.

According to the rational expectations camp, if no intervention occurs to stop the regime change already under way, the inflationary trajectory will continue to grow over time. This is precisely the point made by the adaptive expectations camp: the time factor adds to the current and underlying trend. To put it differently, the only way to unwind rising price spirals without a serious contraction in policy is for inflation to retreat on its own. Ultimately, this comes down to chance or a ‘magical disappearance’.

The recent rebound in risky assets, the fall in risk premia and bond yields and the tightening in credit spreads tell a similar story: financial conditions have loosened rather than tightened. Nominal growth and inflation may arguably be higher than originally thought or feared.

This also implies that, to date, the bond market’s presumed, self-correcting properties have not yet had effect in the current cycle.

Adding to this, the leads and lags of policy transmission have widely been underestimated. The channel starts from broad policy action, which affects internal demand and then inflation, particularly within certain key sectors (e.g. housing via mortgage rates, prices and rents). To a large extent, the inflationary path has already been set and policies will merely be back-seat observers.

The directional and quasi-linear inflation trajectory is behind us. Investors will be faced with increased inflation volatility, which represents a different but nevertheless crucial challenge. More flexible investment management will be required to avoid traps and pitfalls. Duration is a case in point: while flexibility is necessary, investors should bear in mind that the short duration trend is their friend.

This volatility may very well stem from a combination of mechanical base effects on certain inflation components and the tendency for policymakers to ‘chicken-out’ and declare an early victory. A stop-and-go macro-financial development is in the cards.

Investors should think of the 10-year average inflation rate as a good proxy for long-term expectations. Its dynamics are telling.

Recent bond yield pricing and market inflation expectations are consistent with the current 10-year equally-weighted inflation average (i.e. still relatively low). This will be slightly less if the recent past is over-weighted, as it should be: in fact, memory tends to fade as the distance to the past increases.

From this it follows that:

- Inflation expectations are sticky, slow to move and to adjust.

- Today’s Mr Powell is different to Mr Volcker in the early stages of the ‘Great Battle’: the actual legacy of high inflation is merely limited to the last two years or so. In fact, the psychological dimension is different today compared to back then; psychological time appears to fly during periods of high inflation. Mr Volcker’s actions were based on almost double-digit 10-year average rates of inflation.

The current, low 10-year average inflation rate will only remain unchanged in around five to seven years from now (assuming the inflationary cycle started two years ago), if inflation falls sharply. This can only happen if inflation retreats on its own (the ‘Great Chance’) or if early policy interventions prove successful.

However, this is not consistent with the rational expectations framework: the long-standing legacy of current monetary and fiscal policy clearly points in the opposite direction.

- Consider the 10-year average for leading interest rates. They have remained below neutral and that is their recollected legacy.

- Concerns regarding policymakers’ determination to embark on a new regime change warrant a risk premium, which is close to zero today. The longer authorities continue to chicken out, the higher the 10-year inflation average will become over time.

- There are two ways to justify the current global pricing: the ‘Great Chance’ or the ‘Great Regime Change’ in monetary and fiscal policy. The first is akin to wishful thinking, the second is contradicted by facts over decades. The Global repricing is not yet completed.

Bibliography

Blanqué, P. Perrier, T. (2022), ‘Towards new fiscal rules in Europe’, Amundi Institute, July 2022.

Blanqué, P. (2022), ‘Stagflation and its roots in capital misallocation’, Amundi Shifts & Narratives, No.20, June 2022.

Blanqué, P. (2022), ‘The fiscal illusion: no free lunch for investors’, Amundi Shifts & Narratives, No.19, June 2022.

Blanqué, P. (2022), ‘Adding to the debate: “is the Fed behind the curve?’, Amundi Investment Talks, April 2022.

Blanqué, P. (2022), ‘The inflation psychology is kicking in’, Amundi Investment Talks, April 2022.

Blanqué, P. (2021), ‘Money and its velocity matter: the great comeback of the quantity equation of money in an era of regime shift’, Amundi Discussion Paper, No.52, December 2021.

Blanqué, P. (2019), ‘The Road Back to the 70s Implications for Investors’, Amundi CIO Insights, Spring 2019.

Friedman, M. (1969), ‘The optimum quantity of money, and other essays’.

Sargent, T.J. (1982), ‘The Ends of Four Big Inflations’, NBER Chapters, in: Inflation: Causes and Effects, National Bureau of Economic Research, pp.41-98

Sources

1 See Blanqué, P. (2019), ‘The Road Back to the 70s Implications for Investors’, Amundi CIO Insights, Spring 2019.

2 See Blanqué, P. (2021), ‘Money and its velocity matter: the great comeback of the quantity equation of money in an era of regime shift’, Amundi Discussion Paper, No.52, December 2021.

3 Sargent, T.J. (1982), ‘The Ends of Four Big Inflations’, NBER Chapters, in: Inflation: Causes and Effects, National Bureau of Economic Research, pp.41-98.

4 For a deeper analysis and interpretation see Blanqué, P. (2022), ‘The embarrassing legacy of financial capitalism’, Amundi Discussion Paper, No.54, June 2022, with a focus on the long but temporary role played by China and Asia.