|

Equity investors will have to cope with greater trade protectionism and regional rivalry, delayed climate transition, and technological transformation in the next decade. In our 2025 Capital Market Assumptions – which examine long-term return expectations for 40 global asset classes – we see shifting dynamics across equity markets, characterised by strong earnings growth in select regions, tempered by valuation challenges.

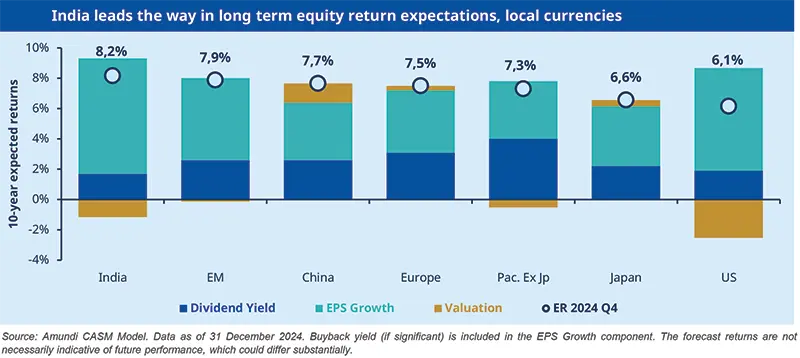

We expect emerging market equities to outperform developed ones over the next 10 years, with variations across countries. While the outlook for Chinese equities has improved because Beijing’s policy support has restored some confidence to markets, their performance will depend on domestic policy measures and US trade policies.

Our central scenario assumes fiscal support will offset the economic impact of the current tariffs on US imports from China, but these expectations will be tested if the US administration hikes them back towards their recent peaks.

Indian equities continue to top the equity expectations scoreboard at 8.2% annualised returns, with robust earnings growth prospects outweighing stretched valuations. The Indian market appears better insulated from tariff pressures that are hitting Asian factory hubs like Vietnam and Indonesia. Moreover, India is emerging as a beneficiary of the ongoing tech rivalry between the US and China. Multinationals looking to diversify their supply chains are turning to India as an attractive alternative innovation destination. India’s rapidly growing start-up ecosystem is also appealing to global investors looking for new growth opportunities. Demographics and a rising middle-class further bolster its appeal.

The outlook for European equities is supported by improving earnings growth, relatively favourable valuation levels, and reforms to boost productivity and restore competitiveness – as detailed in the Draghi and Letta reports. Germany’s recent fiscal push and a potential ceasefire and reconstruction in Ukraine could further drive the area’s appeal, beyond our 7.5% return expectation.

The Pacific shares a similar positive outlook. Japanese equities are benefitting from improved corporate governance, driving higher shareholder returns. Moreover, the end of the country's long battle with deflation should support further rerating of its equity market.

Turning to US stocks, the market was still significantly overvalued at the end of 2024, with the valuation gap widening compared to the previous year, due to the strong rally. The valuation component continues to weigh negatively on US return prospects. This means that it may be worth considering a reallocation to less overvalued regions.

Investors should further diversify their strategic equity allocation, rotating from concentrated and expensive US markets towards

Europe and Emerging Markets.

Concerns about a potential bubble in US stocks are offset by strong corporate earnings growth and technological innovation driving prices higher, particularly among the largest tech companies, creating a performance disparity with the broader market. Excluding big tech, valuations, though elevated, are closer to historical averages. Nevertheless, high market concentration and the potential for shifting investor sentiment could amplify negative market movements. Geopolitical risks, including protectionist trade measures, add further uncertainty.

At the sector level, Artificial Intelligence will continue to support Information Technology, followed closely by Healthcare, with the benefits gradually extending to other sectors. The democratisation of AI and rotation from 'hyperscalers' to 'enablers' in the software sector should help boost global productivity and long-term equity returns.

Climate change and geopolitical dynamics will favour capital expenditures, benefiting Industrials more than Consumer Staples and Discretionary sectors. Energy, Materials, and Staples face the most negative impact from climate change and ESG considerations, while Utilities fare slightly better but remain below regional market averages.

Policy changes supporting deregulation should improve capital efficiency and shareholder returns, particularly benefiting the Financial sector. This support will manifest differently across regions – through deregulation in the United States, unwinding of cross-company shareholding in Japan, and high shareholder returns in the Eurozone.

For investors, this evolving landscape points to the need to seek opportunities in emerging markets, Europe, and the Pacific ex-Japan region. Sector allocation will prove crucial, with particular attention to how artificial intelligence, climate initiatives, and policy changes reshape investment returns across industries and regions.