Summary

After years of dormant peripheral risk, the recent resurgence of fragmentation issues in Europe, amid rising stagflationary risks at a time of Central Banks committing to tame inflation, puts the delicate fiscal and monetary equilibrium under the spotlight. When facing a higher inflationary regime, we call for a new set of fiscal rules designed to overcome the limits of the old overly rigid one size-fits-all framework.

- The implementation of some rules seems realistic: the focus on a spending rule rather than on structural deficits, together with a larger use of stochastic debt sustainability analysis.

- Others can also probably be agreed: a stronger role for Independent Fiscal Institutions, positive incentives in terms of access to EU funds, more distinction between current and investment spending, and a closer interaction of fiscal and macroeconomic surveillance.

- There are rules that will be more challenging to achieve: an orderly sovereign default process and a blue debt / red debt system would involve very complex transformations, with many issues needing to be resolved in terms of governance, the treatment of legacy debt and interaction with other EU fiscal and monetary instruments.

Nonetheless, even limited reforms to EU fiscal rules could help reduce the specific “institutional fragility and complexity” risk premium that European assets (public, yet also private sector ones) carry in comparison to their equivalents in other regions.

CURRENT EU FISCAL RULES: A JOURNEY TO A DEAD-END

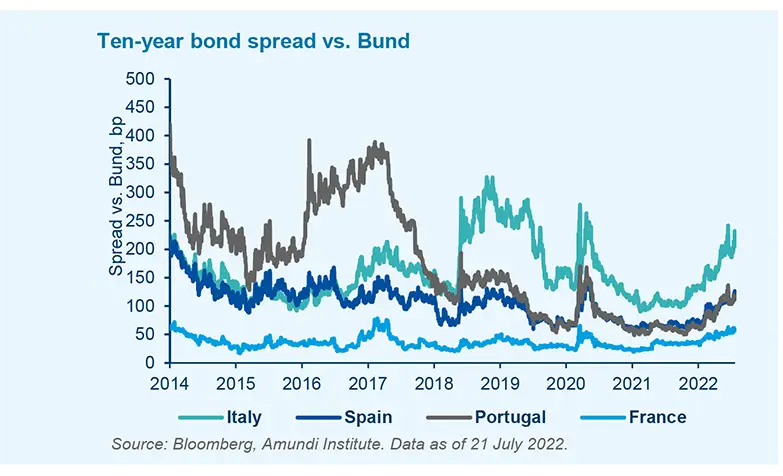

Over the years, markets have developed their own narrative, fuelled much less by EU fiscal rules than by their evolving beliefs regarding EU institutions’ reaction functions. The EU was trusted to deploy emergency fiscal safety nets, the ECB would act as a lender of last resort and compress peripheral spreads, and even that the union could also move towards jointly issued debt. This led to a containment of redenomination risk premia (on government bonds, but also on corporate bonds and equities) and to a preference for relative value over directional strategies. Co-movement and co-integration across member countries’ sovereign bonds was strong as investors arbitraged value (notably between BTP and Bund) around a perceived equilibrium.

In a more inflationary regime, the use of fiscal space must be rule-based and designed to promote a cooperative game between monetary and budgetary policies.

The equlibrium estimate was based on the assessment of the maximum yields and spreads that the ECB would tolerate before intervening. In the new post-COVID inflationary regime, investors need to adapt to a context where the cooperative game between monetary and fiscal policy can no longer be taken for granted.

We will likely see continued uncertainty leading to persistently higher bond volatility as long as markets weigh the possible outcomes. In fact, we could see a new Volcker moment of extreme monetary tightening to tame excessive inflation or, conversely, a “back to the 70s” scenario, where central banks would let inflation (and inflation expectations) run away.

What the future evolution of the (currently suspended) EU fiscal rules will entail is further adding to this uncertain backdrop. Those rules now appear more suboptimal than ever, both in economic and political terms. From an economic standpoint, the focus on deficits has long been problematic, having built in pro-cyclical features. Politically, the many breaches of the rules have damaged their credibility, while most governments’ attitudes have become hypocritical in the hope they will not be fully reinstated amid fears this could cause new recessions

THREE CAVEATS REGARDING A NEW SET OF RULES

The topic of how to revamp EU fiscal rules has been well researched, both before and after COVID. Strong ideas have emerged to build a consensus on proposed changes, both in the investor community and in the wider society. However, before moving to recommendations, a few caveats need to be highlighted.

1| First, public debt sustainability is a probabilistic outcome.

The variables within the standard debt sustainability equation (debt to GDP ratios, nominal interest rates on debt inventory, nominal GDP growth and primary surplus to GDP ratio) influence each other through dynamic and complex linkages, including policy reaction functions heavily influenced by each country’s political preference. Under certain assumptions regarding these variables, practically any debt level can become sustainable or unsustainable. Thus, while basic debt and deficit rules are too simplistic, no fixed set of rules, however complex, can guarantee debt sustainability, or even a high probability thereof. A country-specific stochastic analysis, forecasting the probability of various outcomes under different conditions (including a stress test approach analogous to that conducted in the private financial sector) is thus the right approach.

2| Rules remain necessary and are preferable to pure “standards”.

Abandoning the very principle of rules altogether would be challenging, while a pure “standards” approach (defined as “general objectives of debt sustainability, qualitative prescriptions that leave room for judgment, and a codified process to decide if the standards are met”) with no ex-ante rules may open the door to too much flexibility and moral hazard. Moreover, it would likely be impossible to sell to Northern European countries, and even more so with a compromise that would also make room for more fiscal space specifically devoted to the pursuit of European public goods.

3| Rules need to be part of a political, institutional and cultural deal within each country while, at the same time, being politically workable across countries.

Much more than monetary policy, fiscal policy choices and the perception of these have a decisive role on many aspects of citizens’ lives and expectations. Rules should thus be understandable and, to some extent, country-specific. In terms of EU-wide agreement, while the bar is high for changing the Treaty on the Functioning of the European Union (TFEU) Treaty (the “primary” legislation), there is more scope for changing the rules and processes governing its interpretation (the “secondary” legislation).

A NEW FRAMEWORK FOR EU FISCAL SURVEILLANCE

Based on the above caveats, we believe that the EU fiscal surveillance framework could and should be amended along the following lines:

IMPLICATIONS FOR INVESTORS: POSITIVE FOR EURO ASSETS, THROUGH SEVERAL CHANNELS

Even limited reforms to EU fiscal rules can have implications on the way investors consider the region.

- First, new rules that would be more credible and less pro-cyclical at the same time should contribute to reducing, at least to a limited extent, the specific “institutional fragility and complexity” risk premium that European assets (public, yet also private sector ones) carry in comparison to their equivalents in other regions.

- Second, by reducing fiscal dominance, and allowing monetary policy to focus on price stability (with some room for counter-cyclical stimulus), revamped rules would open the way to a more balanced (even though not necessarily always cooperative) interaction of fiscal and monetary policies. While investors would probably continue to factor in the ECB’s safety net for some time when betting on maximum yield divergence, this should gradually fade in favour of a more classic mind-set where they focus again on sovereign issuers’ specific economic and financial characteristics. Restoring credibility for the rule-based framework would also reduce the risk that investors generate sunspot equilibria, based on misguided or unstable expectations regarding the EU’s response to new episodes of economic or financial stress.

- Finally, rules allowing an increase in investment spending, conditioned by reforms should also have positive spill overs on economic growth expectations over time. From a sectoral standpoint, assets related to new EU public goods and targets of investment programmes (such as environment, sovereignty and defence), should also benefit.

For an in-depth analysis of the topics covered in this paper see also the Themes in-depth paper by the same authors