Summary

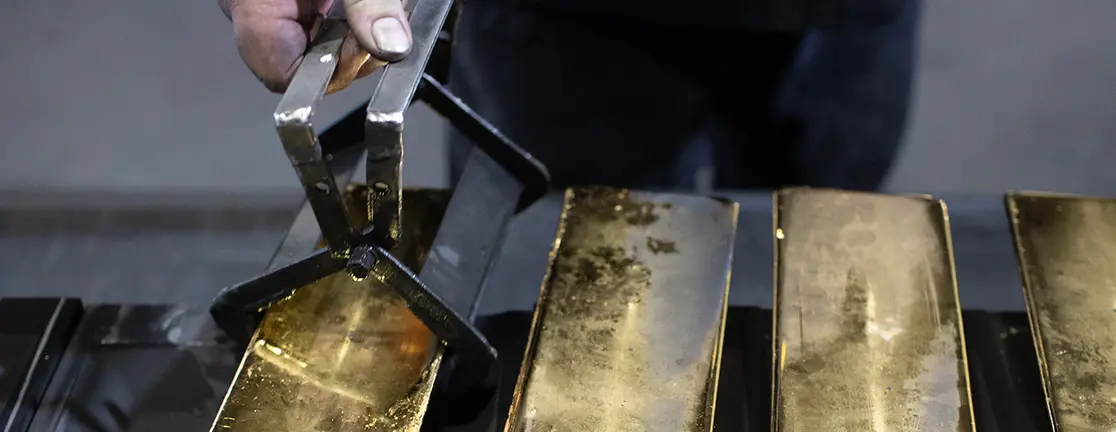

Gold, silver, copper, oil: forces shaping the market

January’s end brought a bout of extreme volatility across commodity markets. Several commodities appear to have been hit by a correction after short-term euphoria, likely prompting the unwinding of speculative positions at month-end in silver, platinum, tin, US natural gas (NG) and the euro.

Gold, silver, copper, oil: forces shaping...

What could a Warsh-led Fed mean for markets?

On 30 January 2026, Donald Trump tapped Kevin Warsh — a former Fed governor between 2006 and 2011, and prominent policy hawk in a few past episodes — to take over from Jerome Powell as the US Federal Reserve Chair when Powell’s term ends in May.

What could a Warsh-led Fed mean for markets?

Global Investment Views

Markets content with a 'not too cold' economy

The year began eventfully, with the US using its military strength and economic leverage to achieve President Trump’s foreign policy goals. The Fed receiving subpoenas and military action in Venezuela did not move oil prices and risk assets. But his threats to the sovereignty of a NATO ally sparked temporary volatility, with markets eventually recovering from that scare and US lagging the other regions. Fiscal profligacy and inflation concerns in Japan pushed bond yields up.