Summary

Markets content with a 'not too cold' economy

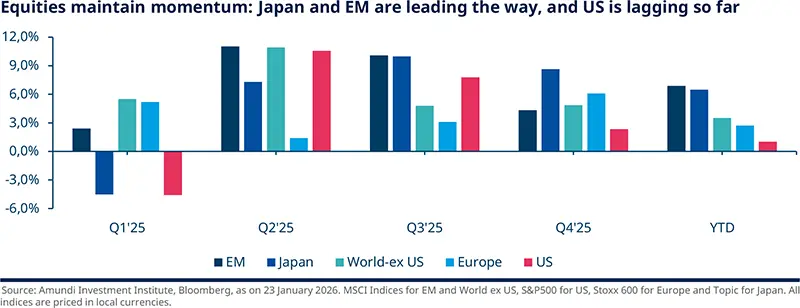

The year began eventfully, with the US using its military strength and economic leverage to achieve President Trump’s foreign policy goals. The Fed receiving subpoenas and military action in Venezuela did not move oil prices and risk assets. But his threats to the sovereignty of a NATO ally sparked temporary volatility, with markets eventually recovering from that scare and US lagging the other regions. Fiscal profligacy and inflation concerns in Japan pushed bond yields up.

We think economic growth that is neither too hot nor too cold to trigger a recession, along with a high degree of complacency among markets participants, could explain the continued appreciation of risk assets. In this scenario, modest GDP expansion and disinflation is allowing central banks to move cautiously, preserving market liquidity.

The path ahead is fraught with risks to the independence of the Fed, and Trump’s domestic policies as well as his stated intention to shake-up traditional alliances. Any challenge to the Fed could result in de-anchoring of inflation expectations (not our base case but risks are rising). All this favours our views of diversification out of US assets, and for Europe to pursue its strategic autonomy. For now, we observe strong US economic momentum, and have raised our Eurozone (EZ) growth projections:

EZ growth slightly better than our previous expectations, but not as high ECB projections (1.2% vs 1.0%, real GDP). We now expect 1.0% growth, mainly due to strength in France and Spain. Our projections are supported by real disposable income, a boost to investment from rate cuts already implemented, and funds deployment under the NGEU in peripheral countries. However, we are monitoring the consumption dynamics and labour markets across the region.

We expect US GDP to expand this year at below-potential level of 2%, after accounting for fiscal support.

US CPI revised down for the year, from 3.0% to 2.8%. But we expect inflation to remain above the Fed’s 2% target for longer, particularly if we consider the fiscal push and upcoming mid-term elections. We expect shelter inflation – about a third of CPI – to decelerate, which would pull down overall inflation. Second, the pass-through of higher tariffs to consumers has been limited, and businesses are absorbing the higher costs. We continue to monitor this. On growth, consumption will be supported by tax refunds mainly in the first half, and we maintain our projection of 2% real GDP growth.

Chinese GDP looks set to decelerate this year to 4.4% from 2025, owing to both weak domestic activity (correction in the housing sector and consumption) and softer external demand. We believe the government will deliver mild, targeted stimulus to avert a hard landing, but it is unlikely to implement a large-scale policy stimulus. The recent end-December announcement is in line with this view.

Gold prices see a structural boost. Gold will be driven higher by geopolitical tensions (including Trump’s unorthodox policies), structural trends (higher deficits/debt), and demand from central banks. While recent US actions in Venezuela did not move oil prices, any potential escalation with Iran is a more relevant upside trigger because the risk would be supply disruption (through the Strait of Hormuz) rather than additional supply. That said, oil markets are currently in surplus, and we expect downward pressure on prices in Q1. As the surplus diminishes in the second half, Brent prices could settle in the range of $60–70/bbl.

| Amundi Investment Institute: uncertainty rising on monetary policy in the EZ and US |

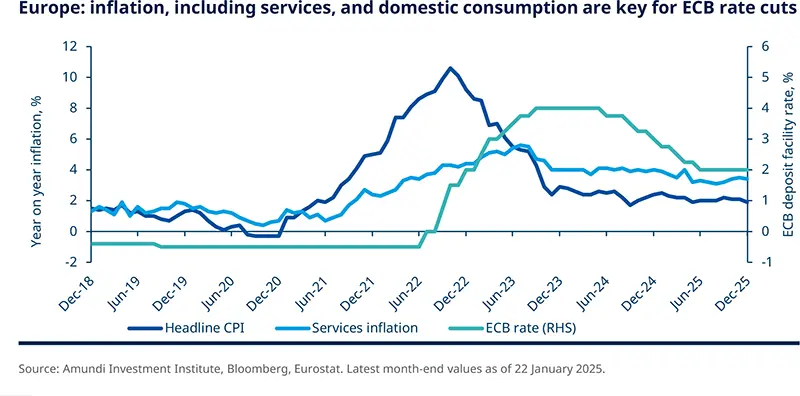

ECB rate cut projections postponed, but still two cuts on the cards this year.* We believe the ECB is comfortable with the current policy rates, given its assessment of EZ growth. While we have upgraded our growth forecasts, we think the disinflation process in the euro area is intact. As such, we now expect the first rate cut of the year to be enacted in Q2 (instead of Q1), after the ECB’s forecasts for the region are released in March. The second cut is expected in Q3, and the deposit rate is likely to reach 1.5% from 2.0% currently, with the ECB remaining data-dependent. Unprecedented pressures on the Fed.* We confirm our projection of two rate cuts, of 25 basis points each, by the Fed this year, but political risks related to Fed independence are high. Chair Powell’s pushback against what seems to be a politically motivated move shows his intentions to rely purely on the bank’s independent economic assessment to set monetary policy. In any case, this would mean volatility ahead. On duration, we do not see space for an outright view and instead prefer curve steepening on the 5Y-30Y segment, and remain constructive on breakevens. *As of 21 January 2026 |

We expect the ECB to reduce policy rates twice this year, provided consumption remains modest, inflation slows, and wage growth decelerates. We are monitoring how the ECB revises its assessment of inflation, which will give us greater clarity on the bank’s actions.

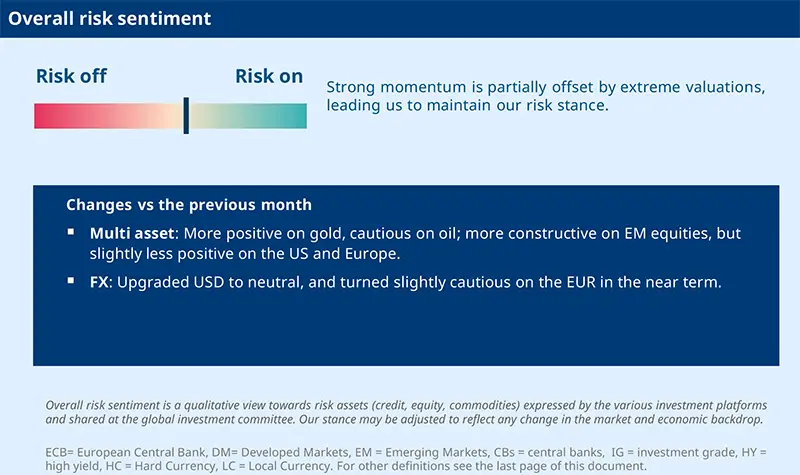

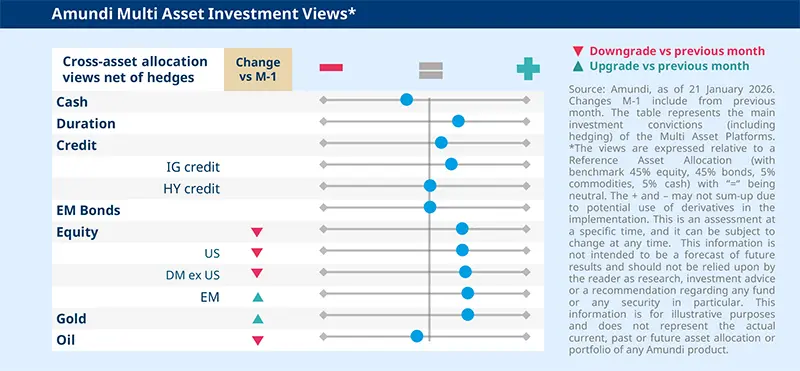

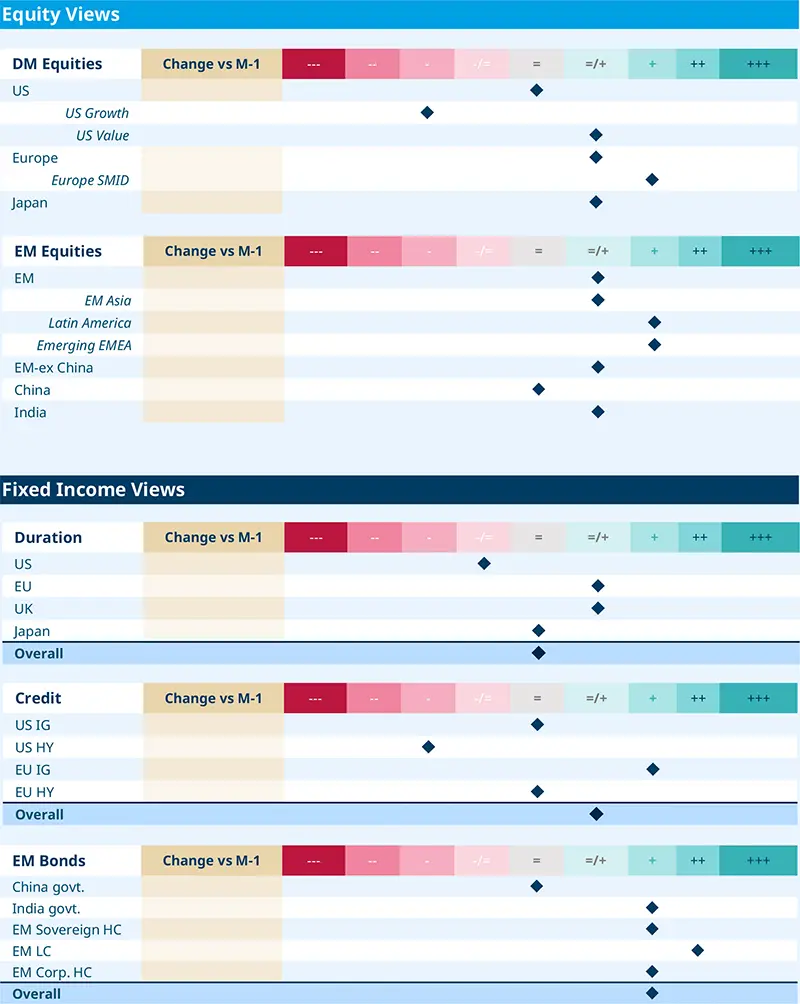

In an environment of disinflation in Europe, fiscal support and ‘political noise’ in the US, and China stabilising to a lower growth rate, we stay risk-on with our asset class views as follows:

In fixed income, we are neutral on duration overall, but slightly cautious on the US and positive on Europe, including peripherals, and the UK. Corporate credit offers good carry, particularly in EU IG BBB and BB-rated credit. Risks are around sticky inflation which is not our base case. We look for carry in emerging markets (EM) bonds – the global economic backdrop is encouraging – through a selective lens.

In equities, we favour structural stories in the form of corporate governance reform in Japan, fiscal stimulus in Germany, and exploring names outside of the artificial intelligence euphoria. EMs are another area where we are constructive due to strong economic activity and Fed easing.

In multi asset, we have upgraded our views on gold to benefit from its stability-providing characteristics and downgraded oil. In EM, we’ve cautiously raised our stance on Latin American equities. Overall, we prefer keeping a balanced, risk-on stance.

Trump’s actions on Greenland/NATO, the US mid-term elections, and tariffs and the European response will drive the near-term market momentum.

FIXED INCOME

Inflation: the key to the ECB’s policy puzzle

Amaury D’ORSAY |

Market pricing with respect to ECB rate cuts is asymmetrical, implying they do not expect a rate cut. However, we think the disinflation trajectory will be maintained in the eurozone (EZ), with price pressures undershooting the ECB’s 2% target. As a result, for us, the probability of interest rate reductions is much higher than the probability of a hike. We are also monitoring how the more dovish voices in the ECB could gain prominence and that could further tilt the case towards rate cuts.

In the US, the Fed’s independence, the leadership transition, and labour markets (showing signs of weakening) would keep the market’s attention. We maintain our global focus on yield curves, and look for carry through corporate credit and emerging market bonds in a selective manner.

We remain constructive on UK and EZ duration, with a positive stance on peripheral countries. We expect curve steepening in the medium term, but acknowledge that it is a consensual view that has progressed significantly. Hence, while overall rooting for curve steepening, we are tactically reducing this view on the 10y-30y part.

We are neutral on Japan and slightly cautious on US duration (2y and 30y), but are constructive on linkers.

From a global view, we like EU over the UK and US.

Prefer carry over beta in corporate credit. We favour financials over non-financials because of their strong capital buffers, and short-dated credit over longer-dated.

Additionally, we look for a balance between yield and quality. Currently, we believe credit at the low end of the capital structure (BBB-rated for instance) provides attractive carry.

Global macro backdrop is supportive for EM, but geopolitics could create volatility. We remain constructive, and believe 2026 will be a year of carry for EM bonds. In LC, HC and corporate bonds, we prefer high yield. Regionally, we like Sub-Saharan Africa, LatAm (e.g., Argentina).

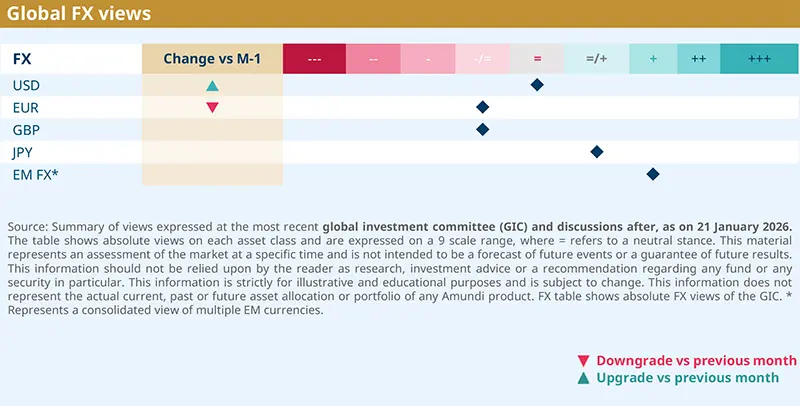

In FX, we have tactically downgraded the EUR and upgraded the USD to neutral. Two rate cuts by the Fed are already priced in the markets. On EM FX, we stay constructive.

EQUITIES

Prefer structural stories over euphoria

Barry GLAVIN |

US and European equities reached record levels in January despite mixed economic and geopolitical newsflow. Now, valuation dispersion across regions, together with earnings strength, will determine which markets outperform. The reporting season now under way will test EPS growth and, more importantly, capex. In the US, we are concerned about concentration risks, political uncertainty, and misallocation of capital in the AI space. These risks do not justify the current valuations that markets are demanding.

We reaffirm our conviction in diversifying away from the US and AI hyperscalers towards structural stories such as Japan, EM and Europe. Overall, we aim to benefit from volatility when presented with a good balance between valuations and earnings potential.

In Europe, it’s reassuring that earnings growth accelerated last year. At current valuations, high single-digit earnings growth this year will be necessary for European markets to do well. Sector-wise, we like financials, industrials, healthcare, and consumer staples. In Japan, near term volatility related to normalisation of rates, yen strength, and politics is possible, but the long-term structural story remains compelling.

There is a strong case for mid and small caps in Europe and Japan as the valuations discount to large caps is extreme. Quality, in terms of return on capital and debt ratios, is also improving.

In AI, we focus on the electrical engineering, power demand, and AI-deployment subsectors.

A combination of monetary easing by the Fed and ECB, and expectations of robust economic growth across the region (with divergences) keeps us constructive on EM.

We like LatAm, emerging Europe, and the UAE. LatAm valuations are attractive, and we are monitoring the political environment. In Brazil, we expect positive earnings growth in the next 12 months.

In China, we are assessing the government’s anti-involution policies and measures to rein in excess capacity, but for now we stay neutral. While the government is shifting the growth model to rely on domestic consumption, we think this will take some time. We are cautious on Taiwan and Saudi Arabia.

From a sector perspective, we like communication services.

MULTI-ASSET

Strengthen safeguards, finetune risk

Francesco SANDRINI CIO Italy & Global Head of Multi-Asset | John O’TOOLE Global Head - CIO Solutions |

The economic backdrop in the US and Europe is reasonable, but there are indications of slowing US labour markets when valuations are high across many asset classes. Additionally, recent geopolitical newsflow underscores the need for caution, with an overall mild pro-risk stance. Our positive views on equities and credit are supported by a solid profit cycle, robust momentum, and ample liquidity. Specifically, we explore areas of value in EM, and would like to underscore the need to amplify safeguards through gold and reinforce hedges in US and European risk assets.

While we are positive on equities through the Europe, the UK and US, we have carefully upgraded our stance on EM by turning positive on LatAm. In general, LatAm offers attractive relative valuations compared with the rest of the EM. Brazil, the region’s largest economy, is in a monetary-easing cycle; this, coupled with expectations of strong earnings this year, should be positive for Brazilian equities.

We are constructive on US (5Y) and EU (10Y) duration. In the US, weakness in labour markets is combined with a limited pass through of higher tariffs to inflation. We remain positive on USTs due to potential weakness in growth or corporate earnings, and any tightening of financial conditions but have hedged this view through derivatives. We also continue to prefer Italian BTPs over the Bunds, but are cautious on JGBs as fiscal pressures persist. Corporate credit in EU IG is likely to show robust demand.

In commodities, we have become more constructive on gold. While medium term catalysts persist, now an increased preference for physical deliveries of gold over derivatives signal market expectations of stress. On oil, however, we have turned cautious amid limited price support from OPEC. In FX, we are positive on NOK and JPY vs the EUR. BoJ rates normalisation could trigger a JPY rally, whereas high inflation in Norway should prevent the central bank from reducing rates.

We have raised our stance marginally on emerging market equities, and upgraded gold due to higher geopolitical tensions and benefit from its stability.

VIEWS

Amundi views by asset classes

Definition abbreviations

Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.