Summary

Bond investing when Central Banks are in motion

2024 is establishing a new market dynamic for bond investors. After the great repricing of 2022 and 2023 when market attention was mainly tilted towards inflation, 2024 is increasingly seeing a more balanced focus towards both inflation and growth. Moving ahead, the slowdown in inflation should continue, although reaching the 2% target may take longer than initially expected by the market, and the route is going to be bumpy as inflation remains sticky.

This means that the next Central Bank move will most likely be a cut and so the focus is now on When and By How Much.

Central Banks are in different positions. The ECB could start cutting rates shortly, while the Fed will need more evidence of an inflation slowdown and economic cooling, yet it is still paving the way for rate cuts in 2024.

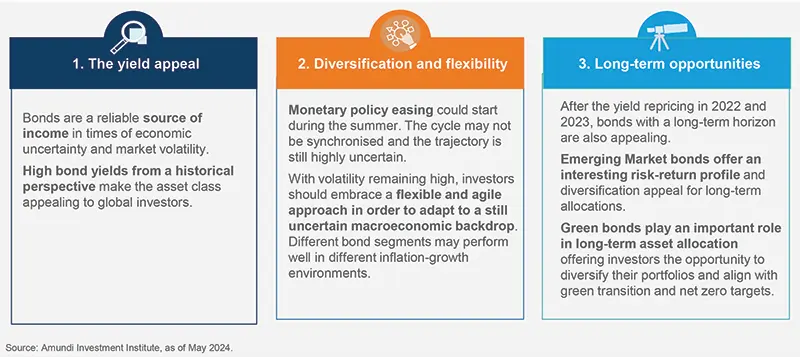

Against this backdrop, bond investors can benefit from appealing yields, regional and curve opportunities driven by the different timing and speeds of Central Bank action and also from a positive outlook for Emerging Market bonds. Fixed income investing is back as a core part of investor portfolios to deliver attractive risk/adjusted returns and seek portfolio stability at a time of high macroeconomic uncertainty.

Main themes for fixed income investors