Summary

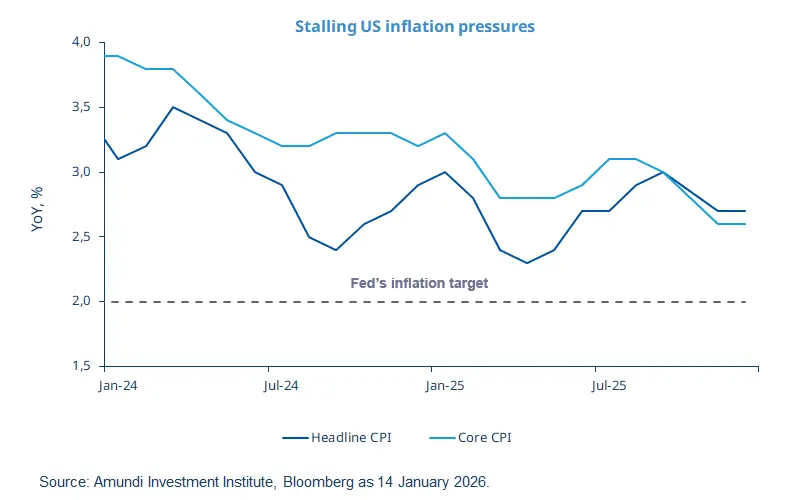

The direction of US inflation would be downward but disruptions to data collection caused by the government shutdown and potential tariff-related pressures make assessing inflation trend more difficult.

Productivity gains should help keep labour costs in check over the medium term.

The fallout from US tariffs has not yet fully shown up in inflation data. we are closely monitoring services inflation.

We think the Fed will cut interest rates twice this year. Political pressures on the bank may affect this view.

US CPI was up 2.7% YoY in December, unchanged from the previous month, meeting market expectations and significantly down from levels seen in early 2024. Core inflation — which excludes food and energy — rose 2.6%, slightly below expectations. It was weighed down by declines in used cars and trucks and by IT‑related goods.

Disruptions caused by the government shutdown and the challenges in data collection make it difficult to assess the current inflation momentum. While structural indicators confirm the ongoing disinflation trend (i.e. a slowdown in the inflation pace), we think shelter and services inflation is key to understanding the overall picture (Rental prices rebounded to levels close to those seen earlier in 2025.). Secondly, a potential increase in prices due to US tariffs may keep inflation elevated. Overall, we expect slightly volatile inflation ahead, which should keep inflation above the Fed’s 2% target throughout 2026.

This week at a glance

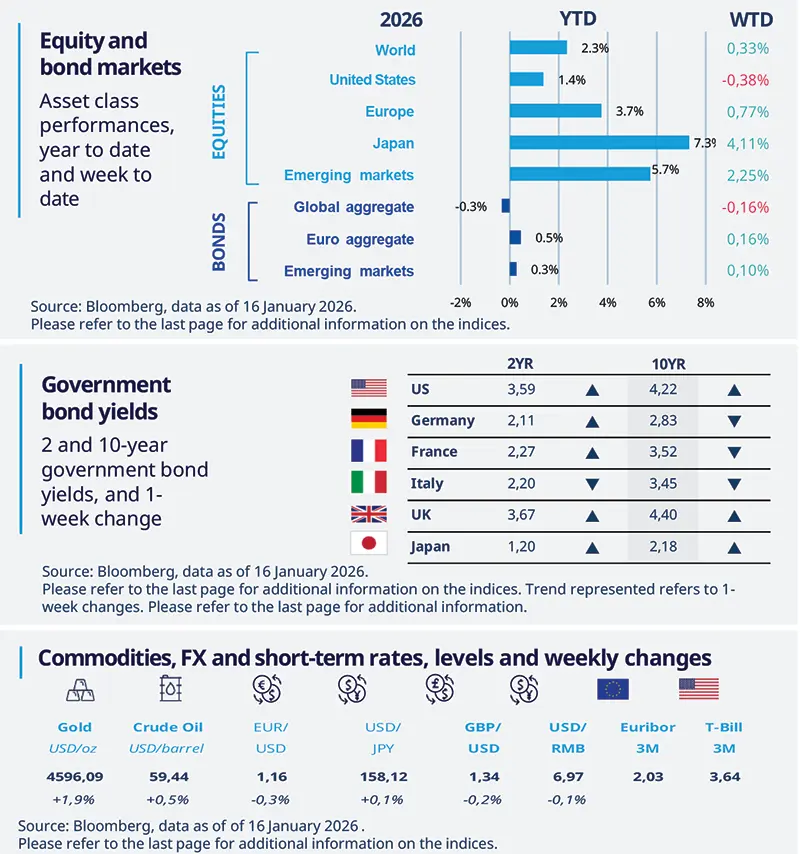

Equity markets were mostly higher last week, thanks to renewed optimism around AI. Japan’s government bond yields rose, with 10‑year yields reaching their highest level since 1999 after BoJ Governor Ueda reiterated that official rates should rise further. Gold prices rose amid ongoing geopolitical tensions.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 16 January 2026. The chart shows US headline and core CPI.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US consumer spending stays healthy in late 2025

US retail sales rose 0.6% month‑on‑month (MoM) in November, the largest gain since July. The increase was driven by a rebound in auto sales following a slowdown after the expiry of federal tax incentives for electric vehicles, and by strong holiday shopping. Notwithstanding some data uncertainty caused by the government shutdown, consumer spending has been growing faster than incomes; however, we expect some moderation ahead.

Europe

EZ industrial production stronger than expected

EZ industrial production increased by 0.7% MoM in November, beating market expectations. YoY growth accelerated to 2.5% from 1.7%, the steepest pace since May. Capital goods output surged 2.8% MoM, while output fell in energy, durable consumer goods and non-durables. Industrial production growth has been supported by strong investment, the lagged effects of policy rate cuts, and higher German public spending, likely lifting Q4 GDP growth into positive territory.

Asia

Asia: semiconductor tariffs narrower than feared

The Trump administration imposed a 25% tariff on a narrow set of advanced chips. Markets had feared a broader sweep, but the measures exclude chips used to support US technology supply chains, consumer electronics, data centres and industrial applications. The executive order therefore primarily targets China for re‑routed chip sales. Meanwhile, Taiwan -- a key AI chip exporter -- has secured a reduction in tariffs to 15%, aligning with rates applied to Japan and South Korea following recent trade negotiations.

Key dates

Germany and EZ ZEW survey expectations, UK unemployment rate |

US personal income and spending, PCE and core PCE price indices |

S&P global manufacturing and services PMIs |