Summary

Global growth resilience faces tariff tests

Key takeaways

US: Tariffs averaging 18% add stagflationary pressure by weighing on consumption, real income, and job growth, while inflation stays elevated but moderated by services disinflation. Powell’s Jackson Hole remarks shifted focus to growth risks, with markets now expecting a September rate cut and more accommodation ahead if the economy weakens.

Eurozone: Higher tariffs at ~15% will dampen growth into 2026, leaving domestic demand to carry the recovery as exports fade. Disinflation is ongoing, but sticky services and food inflation mean growth remains modest at around 1% with inflation converging toward target.

Emerging Markets: EMs maintain a growth premium with upgrades for China and India, while fiscal reforms and stimulus in BRICS cushion tariff impacts. Central banks show more independence from the Fed, but sustaining growth while managing stability risks will be the key challenge.

Fed shifts focus to growth as tariffs bite into the economy

With higher-than-anticipated tariff rates across the board — averaging roughly 18% (about 3 percentage points above our prior baseline), with several exemptions — we expect a slightly stronger stagflationary tilt to near-term macro projections.

We continue to expect the US economy to experience a soft patch into H2 2025 as tariffs effectively raise taxes on consumption. We would expect personal consumption expenditures to be subdued, and significantly lower than the unusually strong levels over the last two years. Real income growth is set to slow as wage and job growth moderate while inflation remains elevated, albeit not permanently.

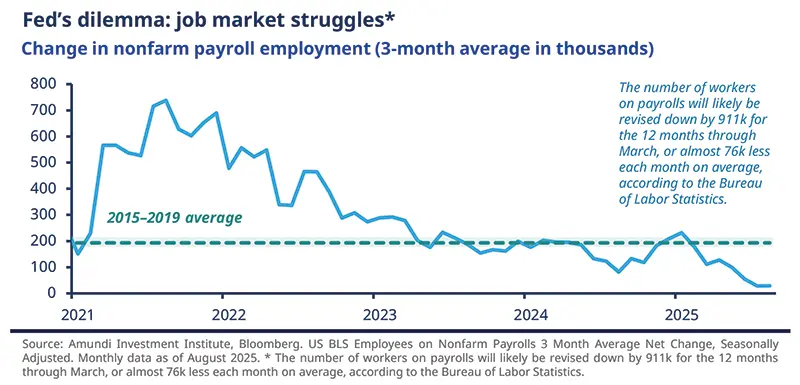

Based on the recent very large revision to employment growth, and very low private hiring, we expect weakening employment growth as firms remain cautious expanding payrolls when tariffs compress margins. We do not currently expect a major downturn in consumption because aggregated household balance sheets remain relatively strong and labour supply growth is constrained by lower immigration. In sum though, lower profit margins will weigh on employment growth.

As Powell acknowledged at Jackson Hole, there is evidence that firms are beginning to pass some tariff costs to consumers, especially on goods, but we think that aggregate inflationary effects may be moderated by offsetting actions.

Recent earnings-season commentary shows firms deploying diverse strategies in facing the new tariff environment: many negotiate with suppliers or reconfigure supply chains, while roughly half report passing costs through to customers — primarily those with greater tariff exposure. In a more balanced and weaker labour market, second-round inflation effects are less likely to be amplified, limiting the adverse impact on services which have a key role in defining inflation trends. Powell also emphasized the temporary impact of tariffs on inflation, despite the uncertainty on timing.

In aggregate, services inflation may partly offset tariff‑driven goods price pressures, but some service sectors will also face higher input prices. Owners’ equivalent rent and other services components — significant in the CPI and PCE baskets — have moderated and might continue along this trend, which could counterbalance upward pressure from goods prices. Overall, the net impact on headline CPI and PCE will depend on the degree of pass‑through, the speed of inventory adjustments, and the balance between goods and services inflation.

“The baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” Powell’s Jackson Hole remarks surprised markets, prompting a rally in equities and a notable fall in two‑year Treasury yields. He acknowledged that tariff effects on inflation are visible and indicated the Fed’s rising concern about tariffs’ leading to weaker growth. The Fed appears more focused on growth risks than on inflation, emphasising that longer‑run inflation expectations remain anchored and policy is still restrictive.

Our baseline is a 25 bp cut at the 17 September FOMC meeting, with market pricing moving toward that outcome following Powell’s speech. But stronger‑than‑expected September employment and CPI prints could forestall easing. On the other hand, some FOMC members who voted to hold at the last meeting may be swayed by the weaker revised employment data, which was not available at that time. Beyond September, we expect a gradual shift toward greater accommodation as the economy weakens further and senior personnel changes at the Fed shift the balance toward more accommodation.

Powell’s Jackson Hole remarks signal the Fed’s pivot toward growth concerns, with markets now bracing for a September rate cut and a more accommodative stance ahead.

Domestic demand must carry the Eurozone amid tariff drag

The US–Eurozone tariff agreement, while still subject to evolution, has reduced tariff‑related uncertainty. But with tariffs set higher than our previous baseline Raising the average tariff rate in our assessment from ~12% to ~15%, reinforces expectations of weaker growth through late‑2025 and entering into 2026. The ECB September forecasts revisions reflect this as well.

European activity has modestly surprised to the upside, partly because of front‑loading of trade flows ahead of tariff deadlines, which temporarily bolstered external demand and euro‑area exports.

Domestic demand, particularly consumption, has not shown a strong pickup despite monetary easing: the household saving rate remains elevated and consumer confidence low by historical norms.

We expect growth to remain weak in H2 2025 as tariffs take full effect, and net trade becomes a drag. Over the next 12–18 months, domestic demand must ‘do the heavy lifting’: private consumption should progressively normalise, and investment should pick up gradually. Our outlook depends on several conditions:

continued monetary easing that supports domestic activity;

fiscal policy that does not become restrictive and in some cases is expansionary (notably Germany);

employment growth persisting, albeit more slowly, with unemployment broadly stable; wage growth moderating but real disposable income supported by progressive disinflation as confidence improves and the savings rate declines;

a progressive pickup in investment and capex (infrastructure, R&D, residential construction) as monetary conditions ease, policy‑uncertainty shocks fade, and targeted fiscal programmes support infrastructure, defence‑related industry and R&D.

Inflation: HICP averaged 2.4% in 2024 with services the main driver. Disinflation continued in 2025 at differing paces. Lower energy and commodity prices, tariff‑related disinflationary pressures, euro appreciation and competitive pressures on non‑energy industrial goods should support the disinflationary trend into 2026, partly offset by higher food and services inflation. We forecast 2025 GDP at 1.1% (ECB Sept projection: 1.2%) and 2026 at 0.9% (ECB: 1.0%). Inflation HICP 2.1% (ECB Sept projection: 2.1%) and 2026 at 1.7% (ECB: 1.7%).

Emerging Markets: Key summer factors to reassess the EM Outlook

|

As summer comes to an end, it's worth highlighting two key factors to reassess the Emerging Markets (EM) Macro Outlook. The first factor relates to the growth outlook for EM, which depends on the more advanced status of tariff rates worldwide. While the current situation may still be adjusted through further agreements between the US Administration and specific countries, the tariff landscape is increasingly defined. The second factor concerns global monetary policy, particularly how it is influenced by the market’s more dovish repricing of the Federal Reserve’s future path, and more importantly, by Powell’s shift toward adjusting US monetary policy. Regarding growth, the economic performance in the first half of the year has been more resilient than expected across several regions. Despite some fluctuations, global trade has remained robust. Additionally, new tariff rates (with a few exceptions) show only marginal increases beyond our previous baseline. Based on this, Emerging Markets continue to enjoy a growth premium above their historical average, with upward revisions in growth rates for China and, more recently, India. That said, growth in the second half of the year is expected to moderate, with several countries already implementing supportive fiscal measures. Within the BRICS nations — some of the highest recipients of tariff increases — India has launched a new-generation Goods and Services Tax (GST) reform reducing the four GST slabs to two, effectively lowering the average GST rate to boost consumption. Meanwhile, Brazil has announced a contingency plan to extend credit to sectors affected by tariffs, defer taxes, and increase government procurement. Soon, the focus will shift to assessing the available policy space and macro-financial stability risks, especially if a new wave of fiscal stimulus emerges. Since the last rate hiking and subsequent easing cycles began, EM central banks have demonstrated a degree of independence from the Federal Reserve. The Fed’s recent narrative shift does not accelerate or extend a well-advanced easing cycle in EM. Over the past month, while markets repriced expectations for Fed easing, Bank Indonesia accelerated its easing on growth concerns, whereas central banks in Colombia and South Korea slowed their easing due to inflation concerns.

|

Lessons from the summer: earnings clarity and shifting yield curves

Key takeaways

The summer has not interrupted the strong equity markets rally that started on 8 April. The earnings season has even amplified the positive mood, even more in the US and especially in the case of the Big Tech. Financials, especially in Europe benefitted too. As a result, the S&P500 is even more concentrated than it was at the start of the year, and valuations are once again at their highest. This could provide an opportunity for other markets to distinguish themselves, at least temporary. In this game, Europe is a serious candidate if we consider its level of valuation.

US Treasuries rallied over the summer, with softer payroll figures and downward revisions supporting expectations for Fed rate cuts. In contrast, European, UK, and Japanese yields moved higher, driven by fiscal expectations in Japan and supply pressures in Germany. Credit markets remained resilient, with Euro IG near long-term averages and risk-adjusted returns supported by lower volatility.

Equity markets are up nicely this year (MSCI ACWI up 13% in USD). After plummeting following Liberation Day on 2 April, they rallied since 8 April, which marked the peak of fears about the tariffs.

Mag7* underperformed at the start of the year following the release of DeepSeek's R1 model, and their decline was accelerated by the stress episode at the beginning of April. Since then, they have once again outperformed the S&P500, taking the concentration level of the index to its highest. At their peak early this year, BATMMAAN stocks accounted for 37% of the S&P500, before falling to 34% on 8 April; they now account for 38% of the index.

While the vote on the US budget bill (OBBBA) at the beginning of July and a number of key tariff negotiation agreements, notably with Europe and Japan, helped markets climb the wall of worry, attention this summer turned to earnings releases, which reinforced this trend.

*Mag7 stocks: The seven major tech giants—Microsoft, Apple, Google (Alphabet), Amazon, Meta, Nvidia, and Tesla

** BATMMAAN stocks: MAG 7 + Broadcom.

A good earnings season, especially for US Big Tech.

Results were good overall, particularly in the United States and especially for Big Tech, but also for European financials.

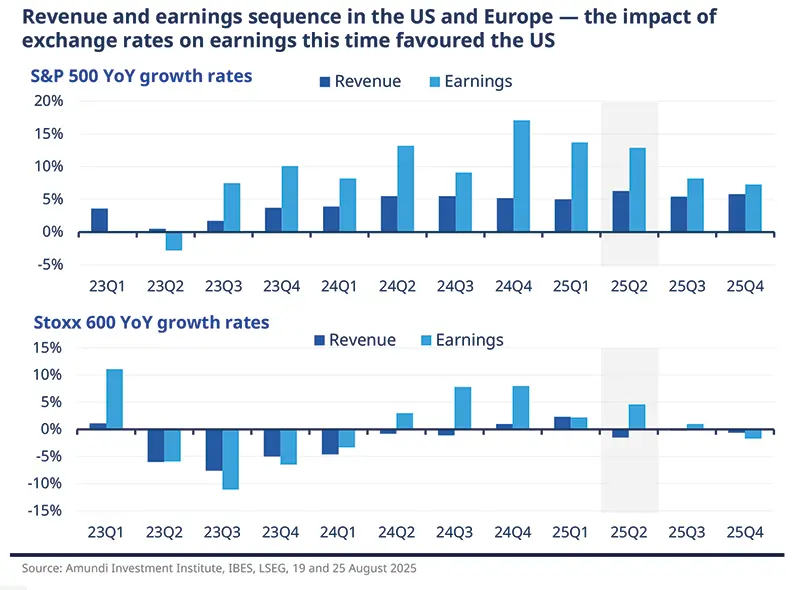

Overall, margins held up well on both sides of the Atlantic, given that most of the tariffs were not yet in force.

In the US, with 94% of companies reporting, quarterly profits rose 12.9%, well above the 5.8% expected as of July 1. All sectors beat forecasts, led by Communication Services (+48.8% vs. 31.8%), IT (+23% vs. 17.7%), Consumer Discretionary (+6.9% vs. -3.5%), and Financials (+13.9% vs. 2.7%). Even sectors with declines, such as Energy, Materials, and Utilities, performed better than anticipated.

In Europe, where 72% of companies reported, earnings growth was lower than in the US but still exceeded expectations (+4.6% vs. 0.6%), driven by strong Financials (+14.4% vs. 2%).

Industrials, IT, and Healthcare also outperformed forecasts, with Healthcare proving the most resilient defensive sector in both Europe and the US this quarter.

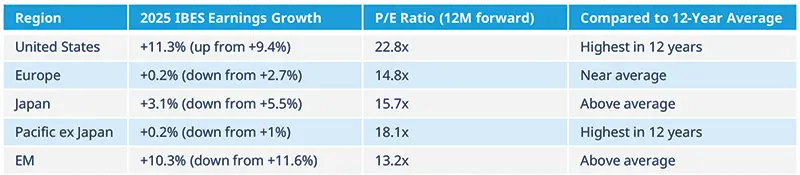

As a result, IBES earnings consensus for 2025 has been revised upwards in the U.S. to +11.3% (from +9.4% in June), while slightly lowered in Europe, Japan, Pacific ex Japan and Emerging Markets. All regions now trade at price-to-earnings (P/E) ratios above their 12-year averages. The U.S. P/E stands at 22.8x, and Pacific ex Japan at 18.1x — both the highest in over a decade, while Europe is closed to long-term average.

The depreciation of the US dollar this year has had a decisive impact on earnings and performance.

While the year-to-date performance of the MSCI indices of the US (+10%), Europe (+11.5%) and Japan (+9.9%), and even the Emerging Markets (+14.8%) in local currency terms, as of 22 August, was fairly similar, the variations expressed in dollars (+10%, +24.8%, +17.6% and +17.8% respectively) are a reminder that currency plays a key role in international allocation.

This movement operates in sequence. First, the new appeal of Europe (with the German budget reform at a time when Big Tech was less in vogue) boosted the euro and the equity market in that region at the beginning of the year. Then, with the publication of Q2 results, the market focused more on the impact of exchange rates on earnings, which this time tended to favour the US. After a sequence driven by the bottom-up (earnings season), it is likely that the next one will be influenced more by macro factors, giving some room for a broadening of opportunities to play out, at least temporarily.

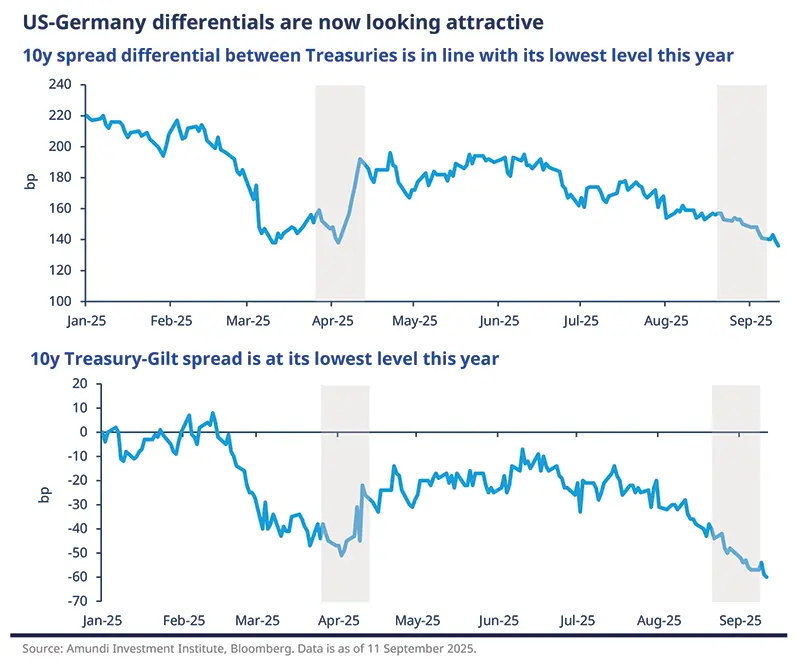

US Treasuries rallied this summer, with 10Y yields falling to around 4% after softer payroll figures and downward revisions boosted expectations of Fed rate cuts.

Rates: a summer of lower Treasury yields and curve steepening

The first big trend of the summer has been the move in US Treasuries, with 10y yields now at the bottom end of the range seen since Liberation Day, just above 4%. The catalyst for the fall in yields has been payrolls, with the weak July and August figures and the downward revision to the data over the past twelve months. At his speech in Jackson Hole, Federal Reserve Chairman Powell emphasised that the softening of payroll figures may justify further rate cuts. We expect three this year, starting in September.

By contrast, European, UK, and Japanese 10y yields rose this summer. Expectations that the Japanese government would push through a fiscal reflation drove 10y JGB yields over 1.6% for the first time this year. This in turn raised fears that Japanese investors could reduce positions in foreign bonds, including European positions. German 10y yields hovered around 2.7%, below the 2.9% peak of mid-March, but still well above the 2.5% levels of the early summer. Supply in Germany is also an issue, contributing to the increase in yields. In the UK, despite weak economic data, yields have tended to follow Germany rather than the US.

As a result, US-Germany and US-UK yield differentials are now looking attractive. The 10y spread differential between Treasuries and Bunds is in line with its lowest level this year, down from 190bp in early June. The 10y Treasury-Gilt spread is around -60bp, the lowest level this year.

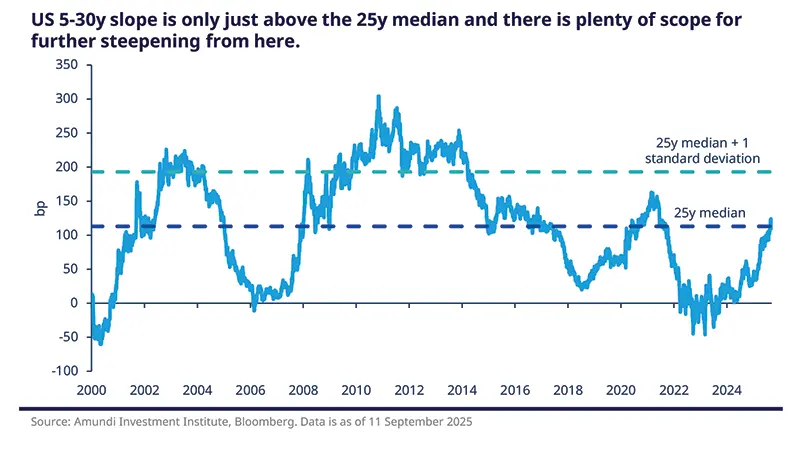

The second major market theme in the bond market this summer has been the steepening of the curves. US and European yield curves steepened sharply between January and May, but then stabilised. More recently, the US curve has flattened, with the 5-30y spread narrowing.

We think steepening will resume soon. Higher inflation expectations and higher supply should lead to higher term premia, while expectations that central banks will ease should push short-term yields lower. As a result, we think curves will move to at least one standard deviation above their long-term medians.

As the chart below shows, the US 5-30y slope is just above its 25y median and there is plenty of scope for further steepening.

US yield curves are steepening again, with scope for the 5-30y slope to rise well above its long-term median.