Summary

- Election result: Former President Donald Trump will return to the White House for the next four years and, with the Republican party also taking the Senate and possibly the House, a “red sweep” is the most likely outcome. Financial markets reacted by extending popular “Trump trades” – pushing up bond yields, the US dollar and equity futures – as investors assign higher odds of Trump turning policy proposals into reality1.

- Policy and impact: We think the new President may prioritise tariff and immigration policies over tax cuts, as these can be implemented through executive orders without congressional approval. The sequence of policy implementation will be key to assessing the growth and inflation impact. Tariffs will act as a negative supply shock to the economy, increasing stagflation risk – the magnitude of this will depend on the eventual level of tariffs.

- Global spillovers: Full implementation of Trump’s far-reaching tariff proposal will leave no winners in a world of heightened trade uncertainty and protectionism. The transatlantic relationship may suffer from rising economic tensions, which could spill over into other areas of cooperation. Asia could be the hardest hit, with China bearing the brunt. However, Beijing has options to cushion the shock, through negotiation - for example towards areas where the US has a strong dependency such as pharmaceutical components and rare earth elements - currency depreciation, and trade re-routing.Tackling the external challenge alongside a slowing domestic economy will require considerably more policy decisiveness and boldness than seen to date. The large and domestically-oriented economies of India and Indonesia are better insulated.

- Investment implications: Higher inflation and a more hawkish Fed will pose risks to fixed income investments, while supporting the dollar in the short term. Tighter financial conditions will be transmitted across the globe, with Asian markets particularly vulnerable given the added shock from higher tariffs. US equities will be buffeted by conflicting forces, but deregulation and industrial policies under Trump 2.0 will likely benefit sectors such as banks and small/mid-caps.

Donald Trump is returning to the White House as the 47th President of the United States. The Senate has also swung to the Republicans, gaining 52 seats vs the Democrat’s 42 seats, at the time of writing. The votes for the House of Representatives are still being counted, but if Republicans maintain their current lead, a “red sweep” – control of both chambers – will give them significant leeway for their policy agenda.

The highest impact of Trump policies will be on inflation, putting the Fed in a trickier position.

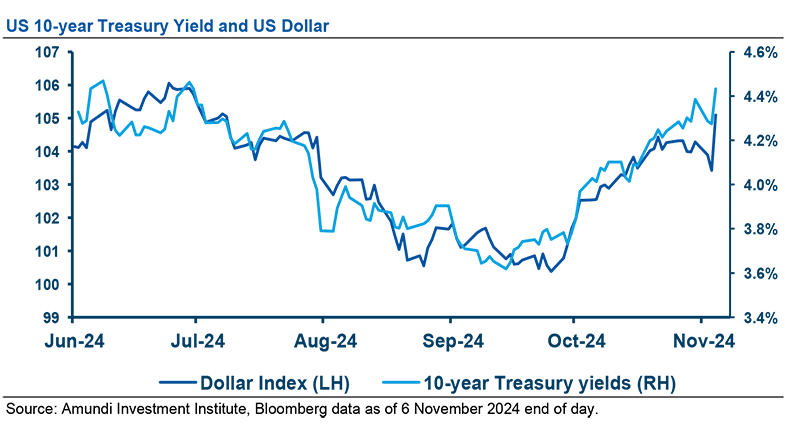

Markets reacted to these results by extending popular “Trump trades” which were already dominating cross-asset flows leading up to the election. The 10-year Treasury bond yield jumped to a 4-month high of 4.4%. The US dollar index gained 1.7% against a basket of currencies, strengthening notably against the euro, Mexican peso and other trade-sensitive EM currencies. The S&P 500 Index was up by more than 2.5%, while the small/mid-caps index Russell 2000 Index was up 5.8%. Interestingly, Chinese assets trading in offshore markets have taken a beating, with the Heng Seng index losing over 2% and the CNH/USD depreciating 1.2%. However, onshore equities and CNY have been more resilient, possibly due to investors expecting upcoming fiscal stimulus to help cushion the anticipated tariff shocks.

What to expect from the new President?

The policy platform proposed by President Trump – whether it’s trade, immigration, fiscal policies or regulations and the attitude towards the Fed – all represent a significant departure from the policy norms under the Biden administration. If implemented in full, this could have a profound impact on the growth, inflation and market outlook for the US and the rest of the world (see our recent paper 2024 US elections: macro, geopolitical and investment perspectives).

We assess the priority of Trump’s various policies through two dimensions. The first is the importance of a policy to the President, and the second is the degree of resistance to its implementation (primarily the need for congressional approval). On the first consideration, we think tax policies are at the core of Trump’s “Make America Great Again” economic agenda, where he has proposed to cut taxes for locals while [partially] paying for them with revenues raised from higher tariffs on other countries. Immigration was the President’s top election issue, on which he has made some staunch promises. Deregulation ranks lower on the importance list. His more aggressive role in policy-making (Monetary Policy), and interference with the Fed’s independence, have so far only been a threat.

Tariffs and immigration will likely be at the top of Trump’s agenda.

On the second dimension – the ease of policy implementation – most of his tariff and immigration policies can be executed by Presidential executive orders, making them less susceptible to a split Congress, which remains a possibility. Most of the tax cuts and increased fiscal spending, however, do need the approval of the legislative branch. While the Democrats will likely vote for an extension of some of Trump’s 2017 tax cuts, his proposal to further lower corporate tax rates, from 21% to 15%, will likely run into stiff resistance. There are similar hurdles for some regulatory changes. With control of the Senate, Trump will have relative freedom with new appointments, including key Fed positions.

All things considered, we see tariffs/immigration being ranked at the top of Trump’s to-do list, followed by tax cuts and other fiscal changes, then deregulation.

How will the policies (re)shape the US economic outlook?

The economic impact of Trump’s policies will depend on the scale and sequencing of their implementation.

Raising tariffs and tightening immigration (possibly including the deportation of undocumented migrants over time) are negative supply shocks – they will hurt growth but raise inflation – creating stagflation dynamics for the economy. The question is, will Trump deliver everything at once – i.e., hiking tariffs by 60% on Chinese products and 10-20% on everything else, plus deporting 1 million of an estimated 13 million undocumented immigrants? A full and hasty rollout of these policies would be “shock and awe” therapy for the economy and markets.

The higher risk of inflation would be negative for bonds. For equities, small caps and banks could benefit the most.

Conversely, Trump’s fiscal proposal is a near-term positive for growth and inflation. However, the market could challenge the sustainability of US debt dynamics over time. Deregulation will have sectoral impacts but to what extent it affects the entire economy will depend on the scale and breadth of the change. Undermining the Fed’s independence won’t help in the battle against inflation, which has not yet been won, as recent data would attest.

Factoring tariffs into our model, we see initial negative growth shocks, stemming primarily from higher tariffs, followed by a modest recovery from 2026 onwards. Yet, this will depend on the trajectory of tariffs. If Trump embraces a gradual approach to tariffs and implements tax cuts earlier, this would delay the inflation shock and be more growth-positive for 2025. An early and sharp rise in tariffs would instead harm economic growth and lead to higher inflation in 2025. Rising stagflation risks will put the Fed in a difficult position.

China would be the most affected by tariffs. But Beijing can mitigate the impact through negotiation, FX depreciation, trade rerouting and stimulus.

What is the spillover of US tariffs into Asia?

The most consequential policy of the new President for the global economy is tariffs. Both the scale and breadth of tariffs touted during the election are larger and more far-reaching than those implemented in 2018 and 2019. With potential retaliation from trading partners, trade war 2.0 could be an order of magnitude more damaging than trade war 1.0. Our analysis shows that 10% catch-all tariffs, with the risk of tit-for-tat responses, will leave everyone worse off. Such an action could strain economic and political relationships with Europe, undermining future transatlantic cooperation. But Asia will fare worst, with China bearing the brunt under the 60% levy. Our modelling exercise shows that the peak impact could shave as much as 0.5 percentage points off China’s economic growth, without considering any additional fiscal or monetary stimulus.

However, there are a number of ways for China to cushion this shock. The first is through negotiation – an area in which Beijing had some success with the signing of the Phase One Trade deal with Trump in early 2020. China’s tariff retaliation strategy could also be tilted towards areas where the US has a strong dependency (pharmaceutical components and rare earth elements), while the damage to Chinese exports could be limited. The second is FX depreciation, which was used to help lessen the pain for exporters in 2018-19. Trade rerouting is the third option, which has helped Chinese firms to skirt restrictions in recent years. And finally, Beijing can step up domestic stimulus and channel some support to the export sector. The eventual impact could therefore be smaller than initially thought.

India and Indonesia are better insulated.

Besides China, other small and open economies in Asia – such as Taiwan, Korea, Singapore and Malaysia – would also suffer from 1) US tariffs imposed on their products, 2) weaker demand from China, and 3) higher global uncertainty weighing on business investment. However, the Tech sector impact could benefit from US deregulation policies, lessening the negative impact. The large and domestically-oriented economies of India and Indonesia are better insulated. In assessing the full impact, one also has to consider how the reorientation of global trade routes and supply chains may benefit countries like Mexico, India and Southeast Asia. These trends may well intensify under Trump 2.0.

What is the implication for Europe?

Trump's victory could push European member states to strengthen defence cooperation, potentially advancing proposals from the Draghi report. The immediate economic outlook for the Eurozone appears more uncertain, especially in light of potential retaliation from the EU to higher US tariffs. However, Trump’s second term in office may yield some indirect long-term benefits, and trigger economic transformation in a region that is typically reactive to shocks. Re-routing of trade routes could help mitigate the impact of tariffs. Within Europe, Germany’s export-driven economy would suffer the most from tariffs. In Germany, the coalition government comprising the Social Democrats (SPD), the Greens, and the Free Democrats (FDP) was dissolved after Chancellor Scholz dismissed Finance Minister Lindner (FDP) last night. Disagreements within the coalition were very pronounced, particularly regarding next year’s fiscal policy. For the time being, Scholz heads a minority government made up of the SPD and the Greens, which is 42 seats short of a majority. It is therefore highly unlikely that the confidence vote scheduled by the Chancellor for 15 January will turn out in his favour, leading to early elections. Given the legal deadlines, these would likely be held at the end of March. This will initially increase political uncertainty in Germany. But it could also lead to a more stable coalition and, above all, open the door to a revision of the constitutional rule on the debt brake (i.e., German balanced budget amendment). In particular, the future coalition would have greater room for manoeuvre in terms of public investment and defence spending. The next coalition will seek to balance the economic damage from tariffs by implementing a recovery plan, while the expected ECB move to lower rates would support domestic demand.

A Trump victory could push Europe to strengthen defence cooperation and potentially advance proposals from the Draghi report.

What are the implications for investors?

The inflation impact of Trump’s policies will pose risks to fixed income investments, and these could be amplified by concerns about US fiscal sustainability. Current interest rates have already factored in a less favourable outlook on inflation. However, the lack of visibility on the sequence of policy implementation and its impact on the economy makes it difficult to have a strong call on duration. That said, a moderate steepening is expected, given the Federal Reserve's stance. Market expectations for higher inflation and a more hawkish Fed would be positive for the dollar in the near term. However, it is not clear if such a trend can be sustained in light of a further deterioration in the US’s already worrying fiscal trajectory. In addition, the negative growth shock from higher tariffs and rising global uncertainty could weigh on the US economy, raising the prospects of a recession further down the road. In such a scenario, the Fed may ease policy aggressively, creating a negative second-round shock for the dollar. Strong performance in well-known dollar alternatives, such as gold, could be consistent with investors hedging USD risks.

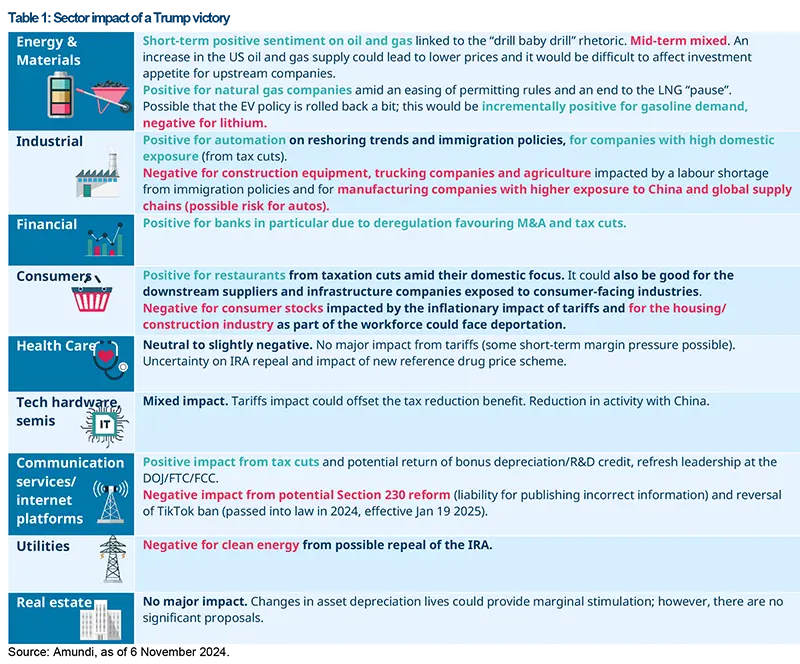

The Trump scenario favours a further rotation in equities. Globally, the US benefits from the prospect of lower tax rates. The intersection of Trump's policies may have greater implications for specific sectors of the US equity market, even though it may not be so clear-cut for the overall index. Deregulation and taxation could benefit banks and small/mid-cap stocks, while oil and gas companies may gain from the short-term positive sentiment of the “Drill Baby Drill” programme. If Trump decides to roll back support for renewables and EVs under the Inflation Reduction Act, stocks in those sectors could see a pullback. Among industrials, stocks with more exposure to global supply chains, China’s economy and immigrant workers may suffer the most, while those in the automation business could benefit.

A stronger USD in the short term is positive for Japan equities vs Emerging Markets which will also be impacted by tariffs. In general, domestic stocks will benefit more. In Europe, companies with local US production will be favoured. Within EM, Asia could be hit the hardest, due to its integration in the value chain with FX acting as the ultimate shock absorber. We advise caution on Asian FX (particularly RMB), equities and the credits of trade-sensitive companies.