Summary

The uncertain reality of tariffs

| Monica Defend Head of Amundi Investment Institute | Aidan Yao Senior Investment strategist asia, Amundi Investment Institute |

The trade war is triggering a shift that could alter the current international framework and call into question the US dollar and US Treasury’s safe-haven status.

President Trump has highlighted the benefits of ‘Liberation Day’ tariffs, which include: 1) rebalancing trade, 2) reindustrialising America, and 3) reducing fiscal deficits by taxing those engaged in ‘unfair’ trade practices. While these issues are undoubtedly significant, it remains uncertain whether tariffs are the appropriate mechanism to address them. In order to ascertain the effectiveness of Trump’s tariff policy, we examine the current landscape and the possible implications for financial markets.

Trade imbalances and tariffs

The relationship between trade balances and tariff rates is not straightforward. If more protectionist countries were to benefit from tariffs, one would expect to observe a positive correlation between the tariffs a country imposes and its trade balances. However, this is not the case. According to economic theory, the size of trade imbalances is more closely associated with the disparity between domestic savings and investment. Unless tariffs can significantly alter the savings and investment behaviour of Americans, the prevailing economic theory—supported by empirical evidence—indicates that the likelihood of President Trump enacting a meaningful change to the US’s trade positions is low.

Structural changes needed for manufacturing revival

Structural changes, rather than tariffs, are essential for revitalising American manufacturing. The decline in the manufacturing share of GDP has coincided with the growth of the services sector (such as finance and technology) and rising costs for American workers. With unit labour costs rising substantially over time, many firms have relocated to remain competitive. The critical question is whether tariffs can revive manufacturing competitiveness and spur a needed resource re-allocation from Wall Street and Silicon Valley back to the rust-belt states. Scepticism abounds.

Tariffs as a revenue generator

For tariffs to effectively generate revenue, they must be sustained over time and primarily paid by foreign entities. But if the implementation lacks flexibility, their effectiveness as a negotiation tool diminishes. Moreover, the stagflationary pressure they create could heighten the risk of economic downturns and inflation, exacerbating the US government's financial challenges.

The question of who bears the cost is important too. While the US President hopes others will shoulder this burden, historic examples show that US consumers have largely absorbed the costs of tariffs. This concern has contributed to the recent decline in consumer confidence.

Consequently, globalisation may take a backseat, as the world’s two largest trading nations simultaneously turn inward.

The uncertain reality of tariffs

In summary, the reality of what tariffs can achieve is highly uncertain. While we doubt their ability to precipitate the substantial economic transformation necessary to fulfil the President’s objectives, there is a possibility that they will lead to significant rebalancing in trade.

A rewiring of the global trade system

The global trade system could undergo significant changes if the largest deficit-running country is able to rebalance trade. If there are no substitute buyers of global products, the rest of the world will be compelled to adjust their positions. A balanced trade position for the US does not necessarily imply a reduction in transactions with the rest of the world; rather, it implies that imports and exports will become more equal. However, if Trump is successful in reshoring manufacturing to produce goods domestically, this could lead to a more self-sufficient US economy with a diminished reliance on imports. Additionally, China is also attempting to reduce its export dependence by stimulating domestic demand for its own products. Consequently, globalisation may take a backseat, as the world’s two largest trading nations simultaneously turn inward.

The implications for financial markets are significant, particularly for the US dollar and the safe haven status of US Treasuries

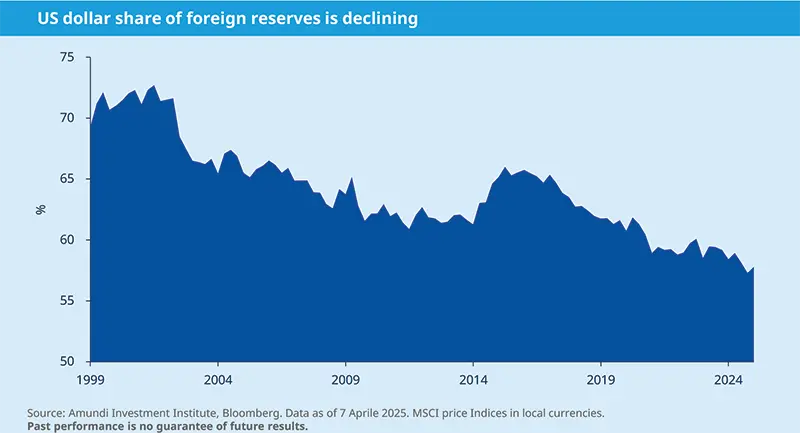

Chronic current account deficits have allowed the US to "export" its currency, establishing the dollar as the global reserve currency. However, rebalancing trade accounts may undermine demand for the dollar and disrupt its circulation, potentially eroding its reserve status over time. While there is no immediate threat to the dollar's dominance, increasing competition from hard and digital currencies could accelerate this decline.

Is gold still affordable? Yes

Jean-Baptiste BERTHON | Lorenzo PORTELLI |

…public finances and political stability are closely linked, and both are deteriorating in many DM countries. Gold, which backs only a fraction of these public liabilities, has substantial re-rating potential.

Gold remains an island of stability in a sea of uncertainties

Uncertainty surged to a new level as the Trump administration launched the biggest trade war of at least a century with no immediate prospect of relief. Gold stands out as one of the few stable assets, bolstered by a declining dollar and fears of stagflation. Moreover, gold and other precious metals are likely to remain unaffected by tariffs.

Public deficits are another strong mid-term driver for gold, historically impacting markets when they fall below -4%. This threshold has already been breached by most developed market (DM) countries. The credibility of government plans to address these deficits, as well as the nature of spending (productive vs. non-productive), greatly influences investor confidence. Consequently, public finances and political stability are closely linked, and both are deteriorating in many DM countries. Gold, which backs only a fraction of these public liabilities, has substantial re-rating potential.

Current geopolitical tensions are broad and persistent enough to influence market dynamics and inflation trends. Tensions in the Middle East could lead to surging energy prices, while intensifying protectionism could affect imported producers’ costs. Although a potential ceasefire in Ukraine could alleviate some tension, doubts about a lasting peace deal and increased EU defence spending are likely to maintain a long-term premium for gold.

In an effort to shield against currency fluctuations and geopolitical uncertainties, central banks are expected to continue purchasing gold, particularly those seeking to reduce their dependency on dollar transactions. Gold is also supported by its physical fundamentals. Weak growth in mining supply and rising extraction costs are contributing to higher spot prices, while jewellery demand is anticipated to increase in the medium-term, primarily driven by India.

| Assessing valuation: Gold is not cheap, but not excessively expensive either |

|---|

Gold continues to trade at all-time highs, even when adjusted for inflation. Determining whether gold remains affordable gets us back to its multiple roles: as a currency, a commodity, an investment asset, a luxury consumption good, and an industrial material. As a commodity, gold appears expensive, particularly compared to other precious metals. It seems pricey relative to traditional macroeconomic drivers, but not against uncertainties, which makes it fairly priced as an investment asset. As a consumer and industrial good, gold looks expensive vs. income or wealth per capita (but will get support from surging demand in India) but cheap vs. gold-user-intensive tech companies. Finally, gold still looks very cheap as a currency. The majority of public liabilities are not backed by tangible assets; instead, they rely on public and market trust, as well as the soundness of economic policies. In the US, for instance, every ounce of gold now backs $138,000 of public debt compared to less than $500 before the collapse of Bretton Woods. The re-rating potential of gold, as a currency, therefore, looks very significant. |

Gold stands a$3200/oz milestone, which would clear the way for $3500/oz

We expect gold volatility to increase as valuations rise and political dynamics – both domestic and international – remain unstable. However, we believe risks remain skewed to the upside. With gold at the $3200/oz milestone, we expect $3500/oz as the next target, as uncertainties remain high.

Potential for investors to increase their allocation of gold

We estimate that global investors currently allocate about 2% of their portfolios to gold, amounting to approximately $4 trillion. This allocation is substantially below what portfolio optimisation techniques suggest. A potential increase to 3% could provide significant upside potential for gold prices.

Investors can gain exposure to gold through various means, including direct investment in gold bullion, gold ETFs, and shares in gold mining companies, which can serve as an appealing complementary option to traditional gold investments and remain cheap in relative terms.

| The changing nature of Gold as a Strategic Asset in the 21st Century |

|---|

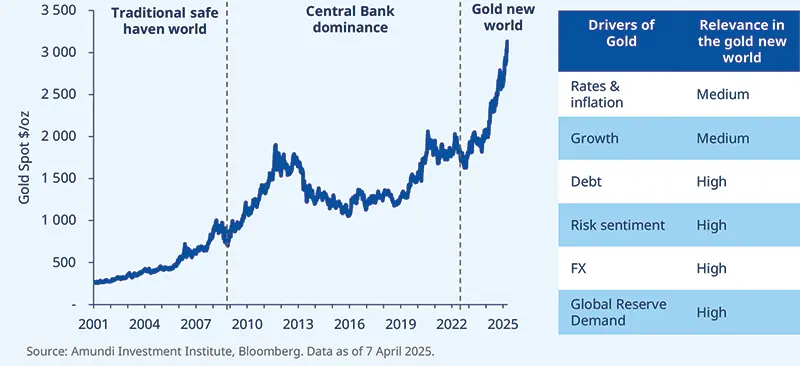

Our models identify three distinct gold phases in the 21st century characterised by changing market dynamics and investor sentiment.

|