Summary

Seven insights for navigating trade war turbulence

Key takeaways

As the global economy faces significant disruptions due to ongoing trade wars and tariffs, we believe it is crucial for investors to adapt their strategies to navigate this volatile landscape.

While the situation is too fluid to predict accurate economic patterns, we believe a profit recession could arise due to higher costs, lower demand, and increased uncertainty. Although markets have focused on growth damage from tariffs, inflation risks are also rising.

We have entered an era of structural shifts that will drive investment opportunities. Overall, we favour European fixed income and a highly diversified equity stance, while also continuing to balance the overall allocation with hedges and gold.

1. Balance risks in a world with no economic winners

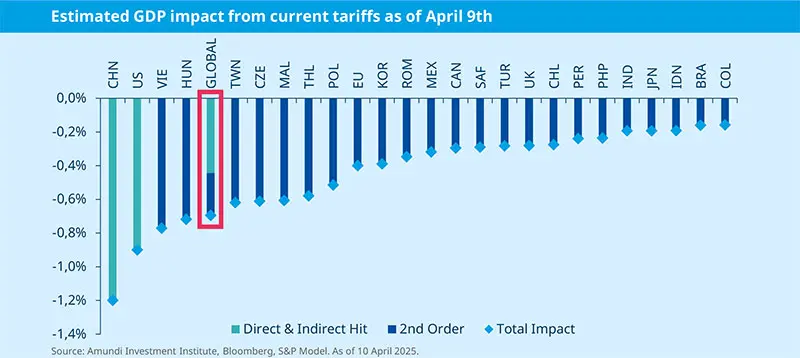

We believe the severe disruption of the free trade model will have immediate and profound consequences, affecting all economies involved. The extent of this ‘detoxing medicine’ and the resulting retaliation will impact economic growth and hurt corporate profits.

Therefore, a profit recession could materialise ahead of, or even without, an economic recession, resulting in continued higher volatility. The ongoing uncertainty about whether tariffs will be imposed or paused is not changing the overall direction; instead, it is likely to increase volatility in financial flows.

This could result in more frontloading of orders before tariffs take effect, while also causing a halt in investment and capital expenditure plans due to the extreme uncertainty ahead.

® Investment implication: After the strong sell-off, a significant deterioration of the market environment is already priced in. While it’s too early to add risk, it is also not time to panic into an extreme risk-off stance, as the situation remains fluid. Favour a balanced risk stance.

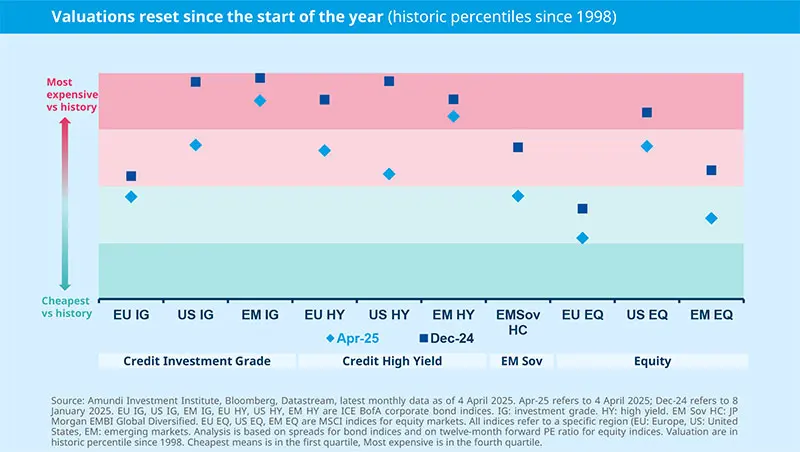

2. Reassess valuations

In our view, the recent market volatility has led to a rapid re-rating of US equities, with valuations dropping from a P/E ratio of 25 to 20. We believe that valuations remain high compared to historical averages. As we assess the landscape, we must consider the risk of further compression in multiples, particularly in sectors closely tied to growth, such as IT and communications.

® Investment implication: Stay cautious in areas where valuations continue to be tight such as US mega caps and tech stocks, look at opportunities in European equities (including small cap), be selective in Emerging Markets, such as the LatAm countries less impacted by tariffs, and sectors/names where valuations have become more appealing.

3. Seek opportunities arising from new trade alliances

We believe that the ongoing trade tensions will prompt countries to rewire their economic relationships, seeking new alliances. This is not a new phenomenon; tariffs have been a part of the landscape for some time. For instance, Europe has successfully closed eight trade deals, while China has secured nine.

® Investment implication: We see this as an opportunity for investors to identify regions and sectors that may benefit from these shifts, particularly as China looks to Eastern Europe for manufacturing.

4. Focus on European fixed-income opportunities

In our view, the current environment presents a compelling case for European government and investment-grade corporate bonds (particularly banks) over US bonds. The volatility in the bond markets, with the 10-year UST fluctuating from 4.80% to 4%, indicates a market pricing in a higher probability of recession. We believe that the ECB is in a better position than the Fed, focusing primarily on growth impacts from trade tensions, while inflation should be less of a concern.

® Investment implication: Seek opportunities in the Euro aggregate bond space, play duration tactically.

5. Prepare for inflation pressures

We believe that markets may be underestimating long-term inflation pressures. The initial market reactions have focused on growth, but we see a risk that inflation could become a more significant concern.

® Investment implication: Investors should consider strategies to protect their portfolios against inflation, such as incorporating commodities or inflation-linked securities, especially as breakeven rates suggest a need for inflation protection.

6. Navigate equity volatility with a diversified stance

In the current trade war environment, we anticipate ongoing market rotations and sustained high volatility. We believe that diversification is more crucial than ever, especially as the dollar loses its traditional role as a safe haven. Selection is also increasingly important to assess which sectors and businesses are best positioned to navigate rising costs from tariffs and relocation trends.

® Investment implication: We balance exposure between cyclical and defensive sectors. Small-cap stocks, which have historically traded at a premium to large caps, are now available at significant discounts. We believe that their domestic focus makes them more resilient to tariff impacts, particularly in Europe and Japan.

7. Keep a strong focus on risk management, include gold and hedges to navigate uncertainty

We believe that maintaining agility in portfolio management is vital as we navigate these turbulent waters. With earnings expectations likely to be revised downwards, investors should be prepared to adjust their exposure based on evolving market conditions.

® Investment implication: Hedging strategies, including the use of gold and derivatives, can help investors to manage risk effectively.

The typical USD negative correlation with equities has been tested since ‘Liberation Day,’ confirming one of our key assumptions for the outlook of FX. Tariffs may be bad for the global economy but given the huge accumulation of USD assets since the Great Financial Crisis, repatriation flows (or higher hedge ratios) will likely hurt the USD.

The growth-inflation mix is not yet conducive of an extremely dovish Fed, but holding rates steady in the short-term could still suggest deeper cuts ahead. A bull-steepening of the US yield-curve has historically translated into a lower USD, and there is room to correct, given the still solid premium to fundamentals.

Despite this, the USD remains one of the most expensive currencies globally. Risks to global growth suggest that it is premature to sell the USD across the board. For now, 'core currencies' in the G10, particularly the euro (EUR) and Japanese yen (JPY), appear to be safer options. In contrast, cyclical currencies are not yet out of the woods.

Trade war takes us into uncharted waters

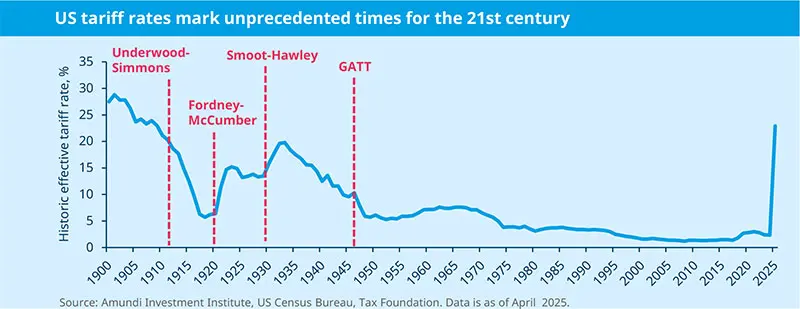

A significant increase in protectionism and uncertainty

In the midst of still extreme uncertainty and the unprecedented high tariffs imposed by the US, constructing any medium-term scenario is fraught with equally high uncertainty. Even with the 90-day suspension of reciprocal tariffs, uncertainty will be high, including on domestic economic policies in the US. As a result, US growth will be marked down substantially.

Not a good outlook for US growth

The impact will be widespread, and will primarily result in lower global growth, especially for the US’s largest trading partners. But the growth hit will be strongest in the US and longer lasting. While inflation will also be higher – expectations of inflation over the next two years have already risen markedly – we would expect weaker growth to weigh on inflation. The impact on growth will be more adverse and longer lasting. US growth is likely to come down to around 1 percent his year (from close to 3 percent last year), effectively stagnating this year, and with only a marginal pick up next year. Inflation could stay above 3 percent for a while. Inflation will also lead to a decline in real incomes with no offset this year from a neutral fiscal impulse.

The Fed’s near-term task will be complicated by tariffs raising inflation, but the weak growth backdrop should enable it to cut rates at least three times before the end of the year.

Stronger policy support elsewhere

China and the EU, will be incentivised to offer more macro policy support. China will likely implement a bigger domestic policy stimulus. And in Europe, fiscal consolidation efforts will be delayed, while the ECB could become more proactive as the inflation outlook continues to be benign and growth could fall well below 1 percent this year. We would expect ECB policy rate at 1.75 percent or lower by end year.

With almost all countries subject to a significant increase in tariffs, especially the US’s largest trading partners, the impact will primarily be lower global growth.

With almost all countries subject to a significant increase in tariffs, especially the US’s largest trading partners, the impact will primarily be lower global growth.

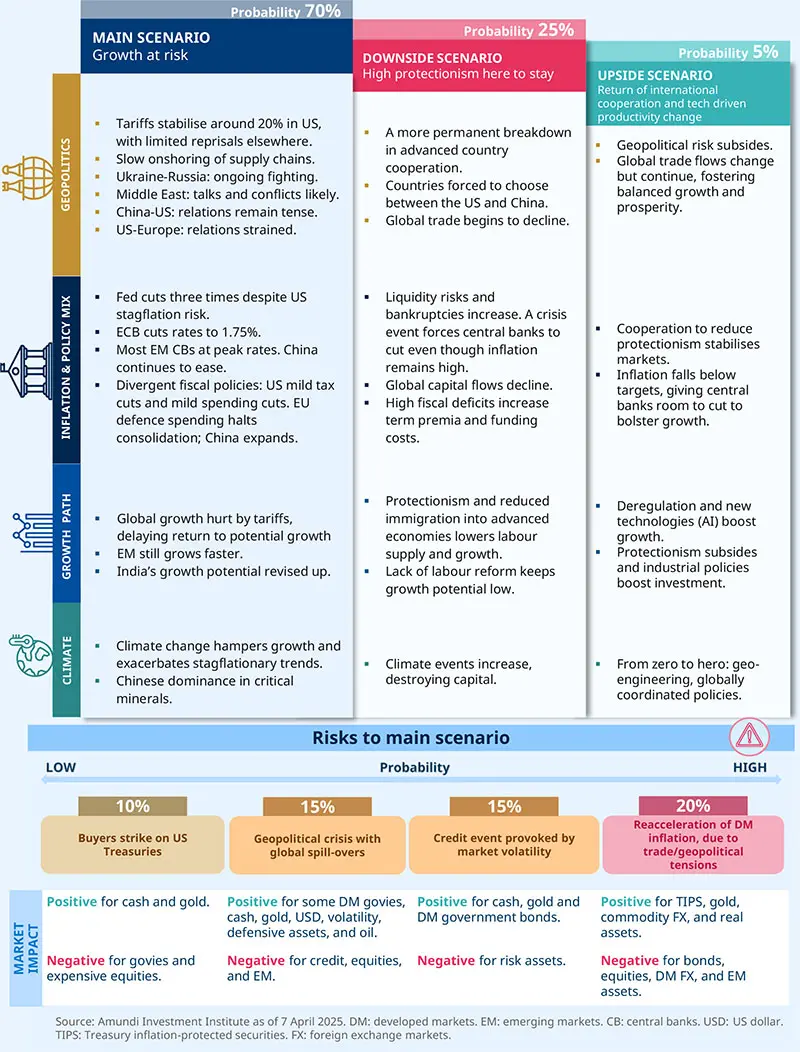

Main and alternative scenarios