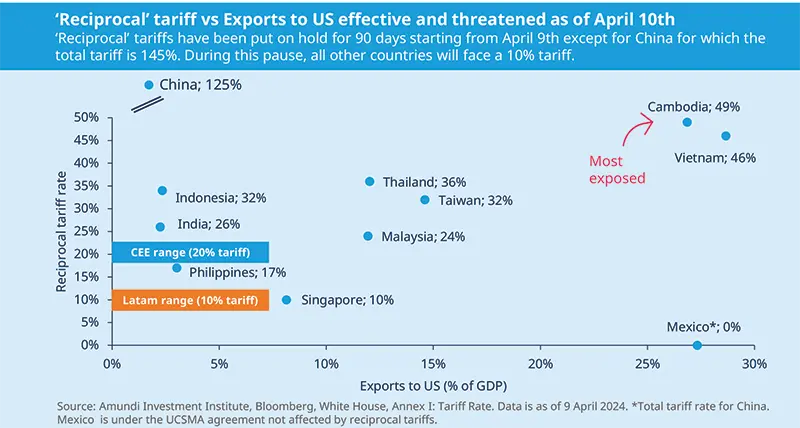

President Trump has announced a 90-day pause on tariffs higher than 10%. However, in the meantime, he has further increased tariffs on China to 125%. In retaliation, China announced an 84% tariff on all US imports starting from April 10th. While the situation remains quite fluid, we will address some concerns from an economic standpoint regarding growth and inflation.

Despite this pause, the final effective tariff for the US is unlikely to change dramatically from previously anticipated levels, largely due to provocations from China. As a result, the global economic outlook continues to trend downward, with global inflation pressures likely to be further exacerbated by the recent US-China trade war escalation.

The announced tariffs should hit Asia the hardest, a predictable outcome given the region’s high level of integration in the production and export of goods to the US, which has resulted in a significant external surplus. The highest rates were initially levied on small countries such as Vietnam, Cambodia, Laos, and Sri Lanka, but soon escalated to China following its retaliation.

For Central and Eastern Europe (CEE), the impact is more indirect and linked to the perspective of tariffs for Europe and Germany, as well as any macroeconomic deterioration there. The most vulnerable countries are Hungary and the Czech Republic, as they are highly integrated into the Germany-led EU automotive supply chain. By contrast, Romania and Poland appear more shielded, considering their less direct trade linkages.

The trade war's impact will be profound for Asian countries, while some Central and Eastern European and Latin American countries appear more insulated.

More surprisingly, South Africa’s tariff was initially set at 30% despite its existing trade agreement with the United States under the African Growth and Opportunity Act (AGOA). This casts doubts on AGOA’s future and sparked uncertainty about US-Africa trade relations more broadly.

Latin America saw the least impact from the announced tariffs, and key trading partners like Mexico were granted a temporary pause.

In addition, copper (a major export for countries such as Chile and Peru) was for the time being exempted from the tariff schedule.

The inflation outlook in EM is now even more uncertain, and highly dependent on several interrelated factors:

A healthy currency devaluation would help to absorb the external shock, keeping some competitiveness at front of higher tariffs. With that resulting in higher imported inflation.

Retaliation and temporary supply chain disruptions could result in temporary inflation spikes.

On the opposite side: global oil prices are moderating, offering a counterbalance to tariff-driven inflation pressures; in addition, cheap Chinese products need to find other destinations than the US, therefore, amplifying the disinflationary trend.

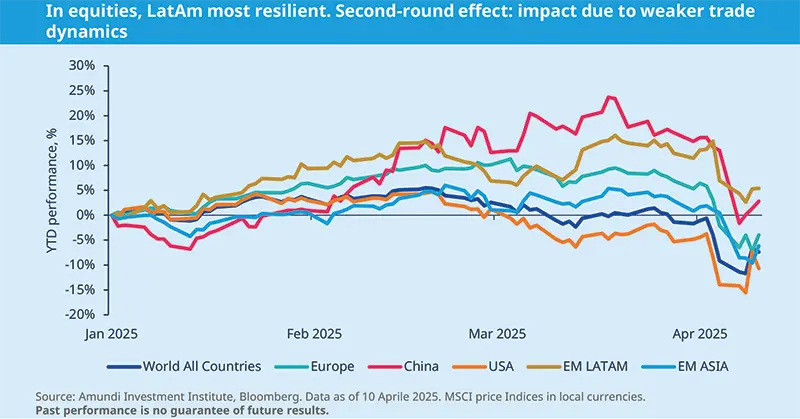

What is the market impact?

The reset of equity valuations across emerging markets allows for an improved upside potential. However, our earnings per share forecasts at 12 months, which had already been positioned below consensus, are now at risk of further downward reduction due to a more tepid export outlook.

Asia ex-China stands to benefit the most from current valuations: India and the Philippines may emerge as relative winners thanks to their lower vulnerability to tariffs and supportive domestic demand trends. Meanwhile, the outlook remains neutral/constructive for LatAm and CEEMEA at a regional level; Mexico continues to be favoured, supported by its tariff pause.

In fixed income, our ongoing call for a weaker USD supports a selective and tactical allocation across the EM FX universe. We have marginally become more constructive on the Indian rupee offering high carry and less volatile dynamics.

Local debt performance continues to hinge on the path of the Fed and the reaction of EM central banks. US yields’ term premia introduce an element of risk. In hard currency debt, spreads widened across the board in the wake of the tariff announcements, affecting both investment-grade and high-yield segments. However, we remain constructive and notably, for the first time in a while, we anticipate some value in EM IG as spreads are expected to tighten.