Summary

Key takeaways

Scope 3 greenhouse gas (GHG) emissions include all indirect emissions that occur in a company’s value chain, both upstream and downstream. These emissions are crucial for understanding a company's full climate impact.

Upstream emissions can include those from the production of raw materials, transportation, and business travel. Downstream emissions can include those from the use of sold products and their end-of-life treatment.

Scope 3 emissions often represent the bulk of a company's total green GHG emissions and are thus essential for understanding the full climate-related risks and opportunities associated with an investment.

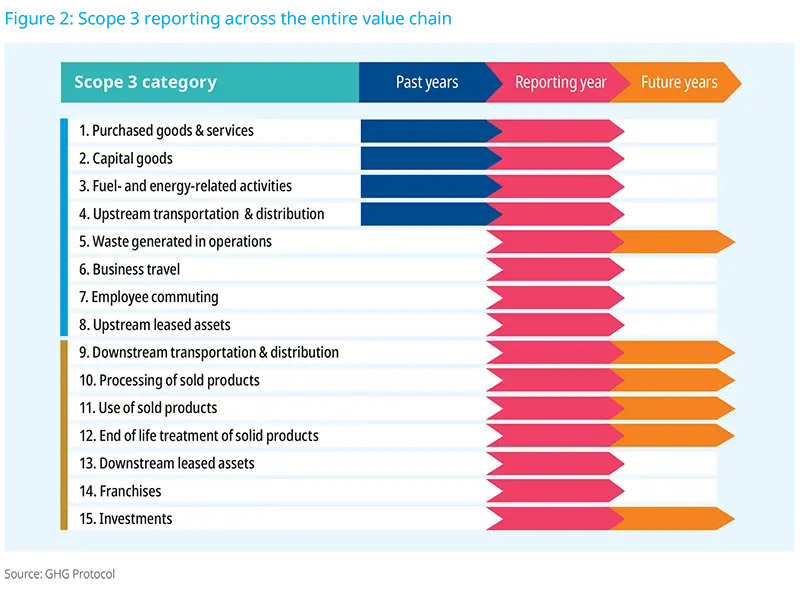

The GHG Protocol’s Corporate Value Chain (Scope 3) Accounting and Reporting Standard classifies Scope 3 emissions into 15 distinct categories, covering both upstream and downstream emissions. These categories are designed to be mutually exclusive to prevent double-counting of emissions.

Increasingly, regulatory frameworks are also encouraging companies to disclose their Scope 3 emissions. Key jurisdictions like the EU, the United States, and California have specific requirements or proposals for Scope 3 reporting.

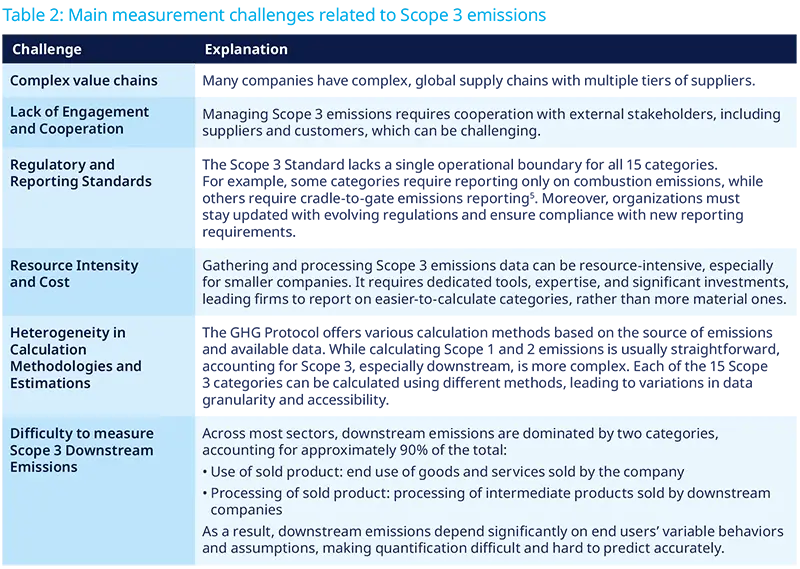

However, measuring and reporting Scope 3 emissions is a challenging task due to the complexity of value chains, the heterogeneity in regulatory standards, the resource intensity and cost required to process Scope 3 data, and the high degree of variability in calculation methodologies.

Despite these challenges, investors should gradually consider Scope 3 emissions in their investment decisions. Incorporating Scope 3 emissions into investment decisions will ultimately allow investors to rely on a more robust risk assessment and align their portfolios with a transition to a low-carbon economy.

For investors, it is important to note that integrating Scope 3 emissions data has a significant impact on the nature of portfolio decarbonization. For example, integrating Scope 3 data can multiply a portfolio’s carbon intensity by four, on average, according to Amundi and Trucost data. Moreover, the integration of Scope 3 emissions changes the contribution of each sector to the total intensity of the portfolio, highlighting the need for sector-specific strategies to manage and reduce carbon footprints effectively.

In this context, we believe that investment constraints should be disaggregated – Scope 1 and 2 emissions on the one hand, and Scope 3 emissions on the other – to avoid overshadowing previous decarbonization efforts by integrating much larger Scope 3 emissions.

Going forward, we are confident that ongoing updates of voluntary standards and Net Zero Initiatives, coupled with regulatory frameworks will help improve data quality.

Finally, Amundi is actively engaging with companies on their Scope 3 emissions disclosure and reduction targets. This includes encouraging them to set short-, medium-, and long-term targets and to follow standards set by the GHG Protocol.

The importance of accounting for Scope 3 GHG emissions

“For many companies, the greatest climate-related risks and opportunities lie within their supply chains, which means addressing Scope 3 emissions is essential.” Mark Carney, Former Governor of the Bank of England said in 2020.

Scope 3 greenhouse gas (GHG) emissions, which refer to all indirect emissions that occur in a company’s value chain, are crucial for companies to get an understanding of their full climate change impact. As a result, to have a complete view of a company's environmental performance and potential risks, an increasing number of investors are considering Scope 3 emissions in their investment decisions.

This data is particularly important given that, according to a recent report from CDP, the overwhelming majority of emissions (92%) disclosed by European companies in 2022 came from Scope 3.1

Moreover, it is impossible for companies to assess their full transition risk exposure without the measurement of their Scope 3 emissions. This exposure to transition risk can be due to a rise in costs due to carbon pricing policies, or to reduced demand for highcarbon products from changing consumption habits.2 Additionally, companies are expected to face more significant increases in costs and reduction in revenues with time, as the pace of transition policies accelerate.

As a result, it is key for companies and investors alike to be able to measure Scope 3 emissions, in order to have a holistic view of their exposure to transition risk.

Moreover, certain jurisdictions are already including the reporting of Scope 3 emissions in their regulatory requirements. For example, the EU's Corporate Sustainability Reporting Directive (CSRD) requires listed companies to report material and significant Scope 3 emissions from 2025 onwards.

As regulations related to Scope 3 emissions continue to evolve, it is important for asset owners and asset managers to stay up-to-date and be prepared to evaluate companies’ carbon intensity based on their Scope 3 emissions.

This paper delves into the significance of Scope 3 emissions, the challenges related to data measurement and the implication that their integration has on portfolio construction.

What are Scope 3 emissions?

To effectively integrate Scope 3 emissions into investment decisions, we first need to have a deep understanding of what these emissions entail and of how they differ from Scope 1 and 2 emissions.

Scope 1, 2, and 3 emissions: What’s the difference?

Unlike Scope 1 and 2 emissions, which relate respectively to direct operations and energy usage, Scope 3 emissions can arise from a wide range of sources. We commonly describe Scope 3 emissions as the result of activities from assets not owned or controlled by the reporting organization, but that are indirectly impacted by the organization in question. Scope 3 covers areas ranging from acquiring and preprocessing raw materials to distributing, storing, using and disposing of the end-products sold to customers. These emissions are classified as either “upstream” or “downstream” emissions. Upstream emissions refer to the emissions that are produced as a result of activities from the point of extraction or production of raw materials up to the point they are processed by the reporting company. These emissions are mainly historical and can be calculated or estimated based on past activities in the supply chain.

Downstream emissions occur as a result of the processing, use, and end-of-life treatment of the company's products and services. They are, in many cases, projections or estimates of future emissions resulting from the use or end-of-life treatment of sold products.

Scope 3 emissions categories and Boundaries

The GHG Protocol’s Corporate Value Chain (Scope 3) Accounting and Reporting Standard3 allows companies to assess their entire value chain emissions impacts and identify where to focus reduction activities. The Protocol classifies Scope 3 emissions into 15 distinct categories of upstream (categories 1 to 8) and downstream emissions (categories 9 to 15). These categories are designed to be mutually exclusive to prevent doublecounting, yet firms within the same supply chain or across different supply chains may include the same source of emissions in their Scope 3 reporting.

Why do scope 3 emissions matter?

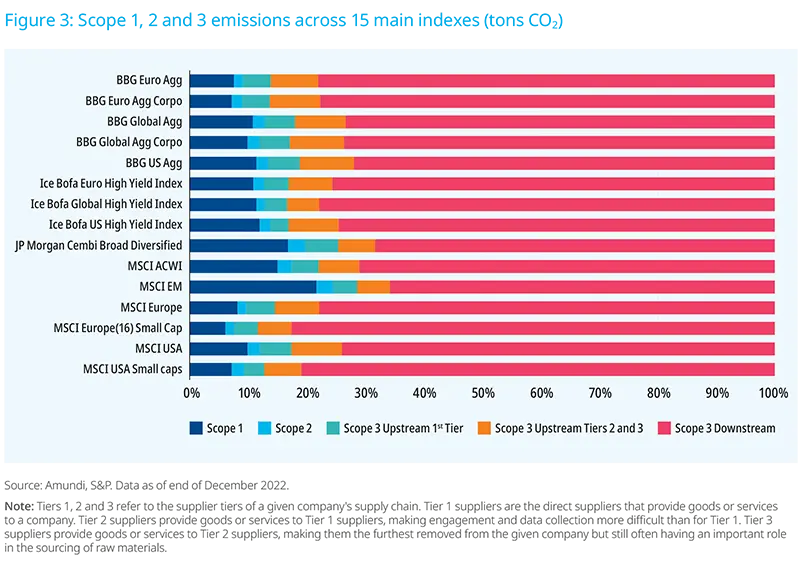

For investors, Scope 3 emissions offer a comprehensive view of a company's environmental footprint. Since these emissions often represent the bulk of a company's total GHG emissions, they are indispensable for understanding the full climate-related risks and opportunities associated with an investment. According to CDP, Scope 3 emissions account, on average, for 75% of total Scope 1, 2, and 3 emissions across all sectors. Moreover, Scope 3 downstream emissions appear to be dominant in almost all sectors, while upstream emissions turn out to be of limited size, with a total magnitude ranging between scope 1 and 2.

This is visible on the main Equity and Fixed income indexes, where Scope 3 emissions represent on average more than 90% total emissions. It is to be noted that this percentage is reduced to 70% on average for emerging market corporate entities (MSCI EM, JP Morgan Cembi Broad Diversified), as their Scope 3 reporting rate is lesser than across their developed market counterparts.

Thus, a full assessment of Scope 3 emissions is critical to understanding the end-to-end impacts of climate policies on individual firms and their respective climate strategies. Not including Scope 3 at all could lead to counterproductive outcomes, whereby companies significantly reduce their emissions footprint by simply outsourcing their most polluting activities.

As a result, investors who overlook Scope 3 emissions may miss out on identifying key financial risks linked to regulatory changes, reputation damage, and shifts in market preferences.

What do regulators say on Scope 3?

Regulatory landscape

Increasingly, regulations encourage companies to disclose their Scope 3 emissions, influencing investor expectations and market standards.

Mandatory Scope 3 disclosure requirements are also increasingly being discussed by regulators in several key jurisdictions.

Large companies in the European Union will be required to start reporting under the Corporate Sustainability Reporting Directive (CSRD) by 2025. In the United States, California has mandated Scope 3 reporting for companies operating in the State with annual revenue exceeding $1 billion. Other regulations and reporting standards, like those of the International Sustainability Standards Board (ISSB), are also being adopted by countries such as the UK, Australia, and Canada. As of November 2024, 30 jurisdictions are making progress towards introducing ISSB Standards in their legal or regulatory frameworks4.

However, it is worth noting that Scope 3 reporting has been excluded from the final rules on climaterelated disclosure by the US Securities and Exchange Commission (SEC). Across the 28,000 comment letters the SEC received in response to the original proposition, Scope 3 emissions were the most common objection, and the regulator cited this pushback as the reason for its decision to omit Scope 3 reporting requirements.

Materiality matters: what Scope 3 emissions should be considered ‘material’?

The materiality of Scope 3 categories for a company depends on its specific operational areas. Consequently, the most material Scope 3 categories are highly influenced by the industry and sector in which the company operates. For example, the Extractives and Minerals Processing sector primarily generates Scope 3 emissions in category 11, which pertains to the use of sold products. In contrast, the financial sector predominantly produces Scope 3 emissions in category 15, which relates to investments.

The materiality of categories varies among reporting entities, as their ability to gather data and calculate Scope 3 emissions is influenced by factors such as counterparties, policy context, market context, and in-house capabilities. As a result, companies within the same sector may not always report on the same Scope 3 categories. This makes comparisons of Scope 3 emissions disclosures unreliable without additional qualitative context on the component categories.

However, the increasing focus on emissions disclosures in policy and regulatory frameworks can offer valuable clarity to the market and assist investors in making informed decisions.

Challenges of measuring and reporting on Scope 3 Emissions

Challenges with Scope 3 emissions data

The diverse sources and indirect nature of Scope 3 emissions pose significant challenges in terms of data collection and consistency. The following are common challenges encountered when measuring and reporting Scope 3 emissions.

Due to these challenges, Scope 3 emissions are often estimated rather than reported by companies6.

Moreover, they can significantly vary depending on the calculation approach employed. In fact, in most sectors, we observe Scope 3 downstream data is more volatile and heterogeneous than Scope 1 and 2 data.

Over half of disclosed values vary at least 30% year-onyear, and over a third vary at least 50% year-on-year. This is mainly because, as explained above, downstream emissions include future emissions from product use, which depend on hypotheses about end-user behavior.

Additionally, comparing data from different providers, such as Trucost and MSCI, shows a lower correlation rate for Scope 3 downstream (25%) compared to Scope 1 and 2 (74%), reflecting significant divergences across providers.

Even looking at emission values across companies with similar characteristics, we see that Scope 3 emissions data tends to be inconsistent. Ideally, companies of the same size and sector should have similar emission values, but there is often a wide range, with some extreme outliers7. This variation can be due either to genuine differences in sustainability practices or to the lesser quality of data reporting.

All in all, while we observe variations across sectors and geographies, challenges related to data measuement, quality and volatility remain, making it difficult for investors to understand a company’s true environmental impact.

Is Double Counting a big problem?

For a given company, the three distinct GHG emissions scopes are designed to be mutually exclusive, ensuring no duplication of emissions within the same company’s inventory.

However, across different companies, Scope 3 emissions can lead to double counting, where the same emissions are unintentionally included by two different parties within the same value chain. For example, this can occur when an oil company and a car manufacturer both report emissions related to the combustion of the fuel sold by the former to the latter. Here, comparing a portfolio to its benchmark when considering Scope 3 emissions can limit the issue of double-counting.

In practice, accurately determining the extent of doublecounted emissions in a portfolio is often impossible due to unknown supply relationships across global value chains. However, this issue is less prevalent in most funds, as they typically do not include an entire company’s supply chain. Indeed, in investment management, the goal is ultimately to provide an overview of an asset’s exposure to carbon-intensive processes and transition risk for portfolio constituents.

Implications for investors: portfolio construction and stewardship efforts

Portfolio construction implications

Incorporating Scope 3 emissions into investment decisions enables investors to conduct more robust risk assessments, identifying potential exposure to carbon-intensive assets and aligning portfolios with a transition to a low-carbon economy.

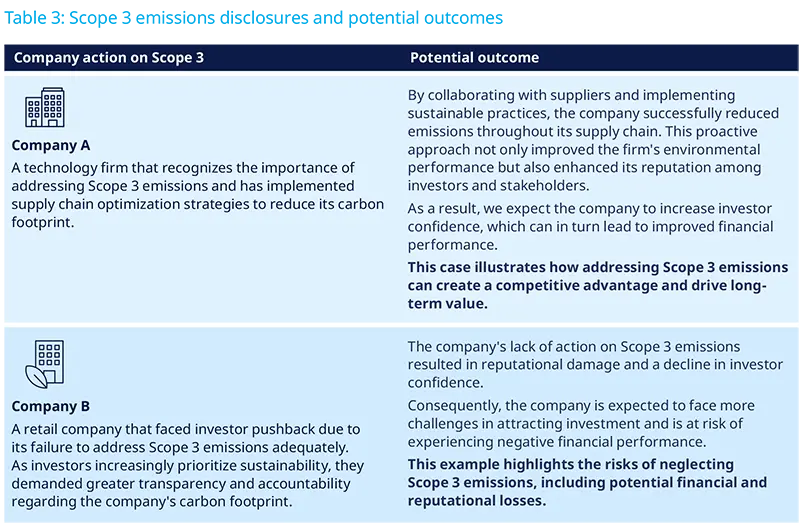

The two examples below are theoretical cases that show the potential impact of Scope 3 emissions on investment decisions and outcomes:

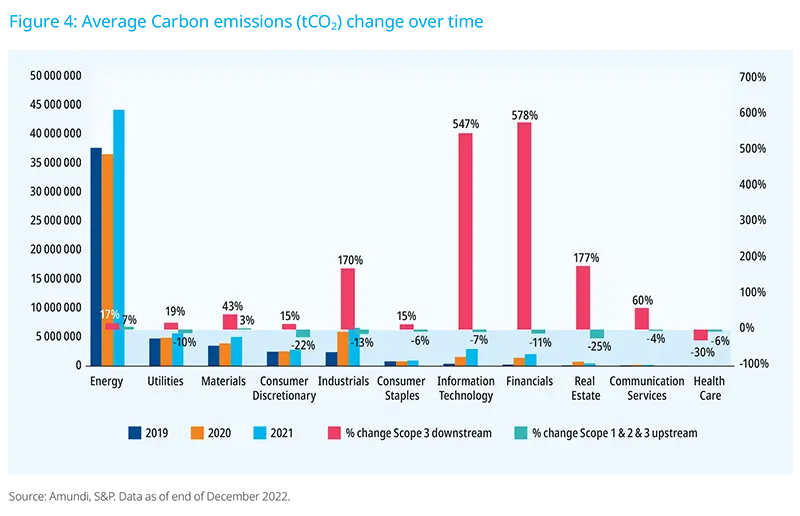

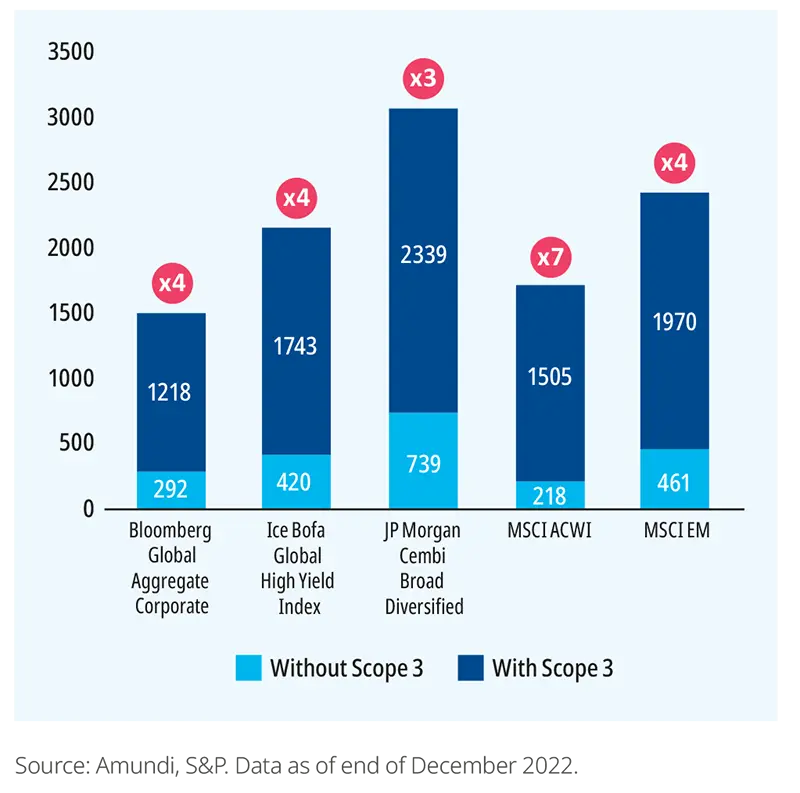

Moreover, including Scope 3 emissions changes significantly the nature of portfolio decarbonization. Indeed, the integration of Scope 3 data multiplies a portfolio’s carbon intensity by four, on average. This effect is especially pronounced for the MSCI ACWI index, where the inclusion of the entire Scope 3 emissions multiplies the carbon intensity by seven (see Figure 4 below). This significant increase underscores the importance of comprehensive emissions accounting to understand a portfolio’s true environmental impact.

Figure 5: Total carbon intensity across equity and fixed income indexes

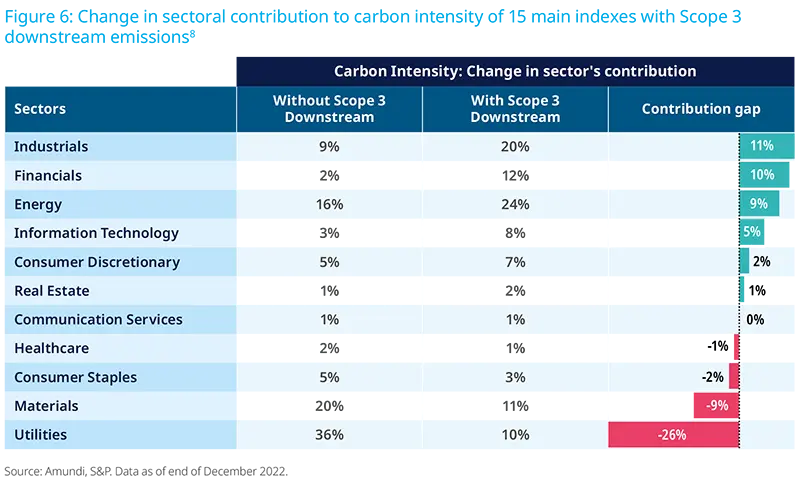

Furthermore, integrating Scope 3 changes the contribution of each sector to the total intensity of the portfolio. In particular, the Utilities and Materials sectors see their contributions decrease as a result of Scope 3 emissions integration, while the Industrial, Financial, and Energy sectors see their contributions increase.

This shift aligns with the share of Scope 3 emissions in total emissions by sector. According to CDP, for the Utilities sector, Scope 1 and 2 represent a little over half of total emissions, while for the Financial sector, Scope 3 can be up to 700 times higher than Scope 1 and 2.

This is illustrated in Figure 6 below, which shows the change in a sector’s contribution to overall carbon intensity, with and without the inclusion of Scope 3 downstream emissions. This reallocation of emissions highlights the need for sector-specific strategies to manage and reduce carbon footprints effectively.

In this context, we believe that investment constraints should be disaggregated – Scope 1 and 2 emissions on the one hand, and Scope 3 emissions on the other – to avoid overshadowing previous efforts by including much larger Scope 3 emissions. This approach ensures that companies’ direct efforts to reduce emissions are recognized and not diluted by the broader Scope 3 emissions.

This approach is aligned with the recommendation of the Institutional Investors Group on Climate Change (IIGCC), whereby Scope 3 emissions should be monitored and disclosed separately to Scope 1 and 2 emissions. The IIGCC also recommends asset owners to develop separate strategies to address portfolio Scope 3 emissions due to the aforementioned data and measurement challenges.

Engaging on Scope 3 emissions

For issuers with absent or incomplete Scope 3 disclosure and ambition, stewardship presents the opportunity to set expectations and explain the importance and benefits of a robust approach.

Amundi conducts engagement with issuers from all sectors on GHG emission target-setting and reporting practices. We believe this is key to improve ambition and disclosure of companies’ climate strategy, with the long-term goal to support the objective of the Paris Agreement.

Scope 3 is a fundamental criterion of our climate assessment framework, which indicates the key components for engagement with companies across each sector. At cross-sector level, developing an inventory for GHG emissions along the value chain is the minimum starting point, progressing to comprehensive strategies to manage and reduce GHG-related risks and realize opportunities.

Reporting of GHG emissions

Amundi considers the reporting of absolute GHG emissions on all scopes is crucial for all companies. While our requirements for scope 3 vary depending on the sector of activity, we recommend to follow the standards set by the GHG Protocol already mentioned in previous sections of this paper. For example, for power generation and power distribution companies, we would like to see disclosure of Scope 3 emissions embedded in the value chain for all categories deemed material for the company.

GHG emission reduction targets

On GHG emission reduction targets, Amundi encourages companies to set short-, medium-, and long-term targets. Short- and mid-term targets should cover at least 67% of company-wide scope 3 emission (when scope 3 represents at least 40% of the company’s total GHG emissions). Long-term targets should cover at least 90% of company-wide scope 3 emissions.

Moreover, Amundi encourages companies to set targets in line with the Science based Targets initiative (SBTi). While relative reduction strategies can be a great first step, it is essential to encourage companies to move away from relative to absolute reduction strategies. This will require companies to not only know where, exactly, in their supply chain, the biggest emission impacts are, but also create credible reduction strategies that are based on supporting suppliers where the emissions impacts are greatest.

Example: Scope 3 Emissions in the Fashion & Apparel Sector

It is estimated that the fashion industry is responsible for 10% of annual global carbon emissions, more than international flights and maritime shipping combined9, so engaging with this sector is essential. However, unlike many heavier industries, up to 99.5% of the emissions of the fashion sector can be found in the Scope 310, of which approximately 75% are found in the upstream supply chain, meaning that engaging with these sectors must take a fundamentally different approach.

In 2023, Amundi worked to define its Net Zero expectations more precisely for the fashion sector. We engaged with 48 fashion and non-food retail companies on climate and Net Zero in 2023, across a global span of geographies (including North America and Emerging Markets). Companies in these sectors are at varying levels of maturity in terms of their climate commitments, meaning the objectives we set for companies vary based on where they are in their climate journey.

The Fashion for Good and Apparel Impact Institute estimated that just over $1 trillion will be required to help the industry reach Net Zero by 2050, and over half that figure is needed to finance existing solutions. These are essential elements for fashion brands to take into account in their climate reduction strategies, in line with the UN Fashion Industry Charter for Climate Action11. In particular, signatories must explicitly commit to phasing out coal from owned and supplier sites for Tier 1 and Tier 2 by 2030 at the latest, and commit to no new coal power in the supply chain by 2023. This includes creating engagement and incentive mechanisms for supporting a coal phase-out.

On climate and Scope 3 emissions, our engagement objectives included:

Measuring and reporting transparently on scope 3 emissions in line with the GHG protocol

Committing to setting science based approved emissions reductions targets

Upgrading emissions targets from relative to absolute reductions targets

Engaging with companies in the supply chain to calculate and develop strategies for reducing actual emissions within the supply chain, including through commitments and efforts to phase out coal boilers by 2030 in line with the UN Fashion Industry Charter for Climate Action.

A gradual integration of Scope 3 emissions into investment strategies is necessary

The integration of Scope 3 GHG emissions in investment decisions is a fundamental shift in how investors assess risks and opportunities to address climate change. However, poor quality and gaps in Scope 3 data make it challenging to systematically assess portfolio exposure and factor in these emissions in investment processes and reporting, and investors should be aware of the limitations of data sets.

Moreover, including Scope 3 emissions significantly changes the nature of portfolio decarbonization, making Scope 1 and 2 emissions less relevant due to the large Scope 3 downstream emissions. This can be counterintuitive as companies have more influence over their Scope 1 and 2 emissions.

Thus, integrating Scope 3 into investment strategies should be approached carefully and implemented gradually to allow data to mature. Ongoing updates of voluntary standards and Net Zero Initiatives (ISSB, TCFD12, SBTi, GFANZ13, etc.), coupled with regulatory frameworks (SEC, CSRD, BMR14, etc.), will help improve data quality.

In addition, we believe that investment constraints should be disaggregated – Scope 1 and 2 emissions on the one hand, and Scope 3 emissions on the other – to avoid overshadowing previous decarbonization efforts by including much larger Scope 3 emissions.

Finally, engagement with companies, as well as voting at Annual General Meetings is a critical and powerful tool for investors to encourage companies to accelerate the integration of Scope 3 in their accounting and reporting standards.

Appendix: Measurement challenges related to Scope 3 data estimates

Measuring Scope 3 emissions is challenging due to indirect nature and estimation reliance. As a result, companies often rely on estimates, and data can be inconsistent and incomplete.

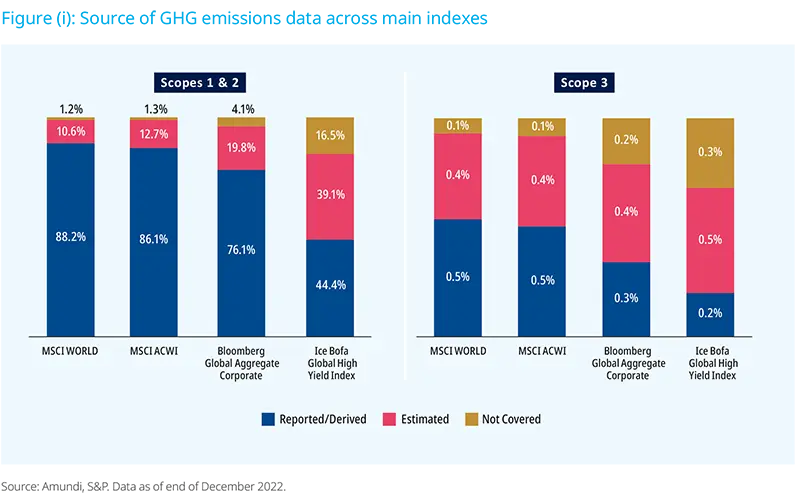

Given the indirect nature of Scope 3 emissions data providers use a mix of reported and estimated data. The proportion of reported data is lower for Scope 3, compared to Scopes 1 and 2. On average, only 10% of companies report on scope 3, while the proportion is 25% for the other scopes.

Moreover, as seen on Figure (i), the reporting rate is higher for equity indices than fixed income indices, no matter the emissions scope. This is due to the fact that equity markets face stricter regulatory requirements for disclosure than fixed income markets, leading companies to report more frequently and in a more comprehensive way on their carbon footprint.

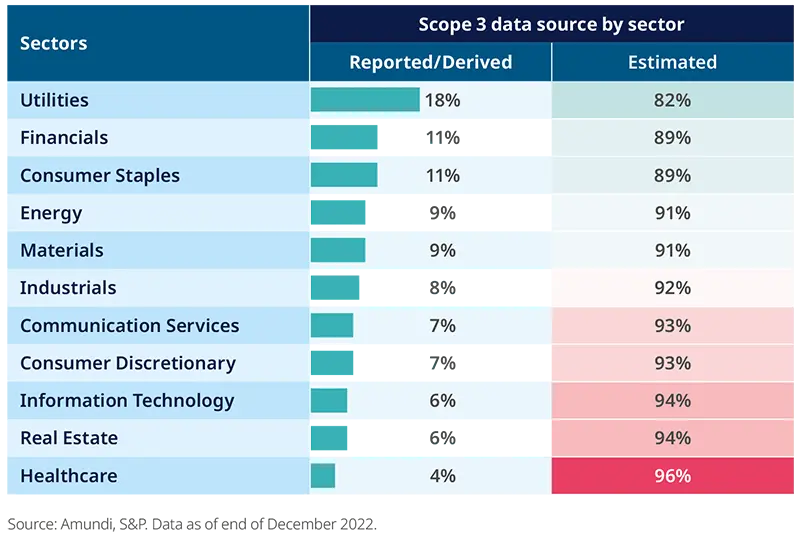

We also notice that companies from carbon-intensive sectors, such as Utilities or Energy, have a better rate of reported data (versus estimated data), as they tend to be more scrutinized on this topic than companies in less carbon-intensive sectors, such as Real Estate or Healthcare.

Figure (ii): Scope 3 emissions data source by sector

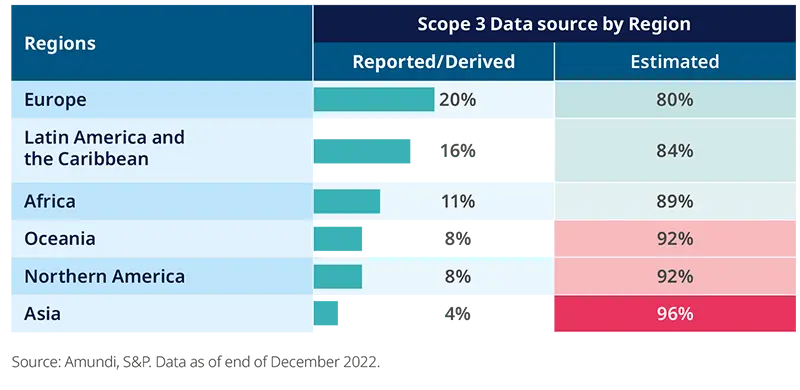

Finally, when looking at reporting rates per region, it is not surprising that companies report at a higher rate in Europe, due to the higher regulatory constraints they face, compared to companies located in other regions.

Figure (iii): Scope 3 emissions data source by region

Sources and References

1. https://cdn.cdp.net/cdp-production/cms/guidance_docs/pdfs/000/003/504/o…

2. For more information on the economic effects of the carbon tax: Thierry Roncalli and Raphael Semet (2024) “The Economic Cost of the Carbon Tax”

http://www.thierry-roncalli.com/download/Economic_Cost_Carbon_Tax.pdf

3. https://ghgprotocol.org/corporate-value-chain-scope-3-standard

4. https://www.ifrs.org/news-and-events/news/2024/11/new-report-global-progress-corporate-climate-related-disclosures/

5. Cradle-to-gate emissions refer to all of the emissions that occur in the life cycle of the product until it reaches the company premise

6. For more information on data quality challenges in particular, please refer to the Appendix of this paper.

7. MSCI data.

8. The 15 indexes MSCI USA Small Caps, MSCI USA, MSCI Europe Small Cap, MSCI Europe, MSCI Emerging Markets, MSCI ACWI, JP Morgan Cembi Broad Diversified, Ice Bofa US High Yield Index, Ice Bofa Global High Yield Index, Ice Bofa Euro High Yield Index, Bloomberg US Aggregate, Bloomberg Global Aggregate Corporate, Bloomberg Global Aggregate, Bloomberg Euro Aggregate Corporate, Bloomberg Euro Aggregate.

9. UNFCCC, 2018. https://unfccc.int/news/un-helps-fashion-industry-shift-to-low-carbon

10. https://www.ft.com/content/f514ad1c-fde8-429c-a1ce-10e9b8840781

11. https://unfccc.int/sites/default/files/resource/Fashion%20Industry%20Carter%20for%20Climate%20Action_2021.pdf

12. Taskforce for Climate Related Financial Disclosure

13. Glasgow Financial Alliance for Net Zero

14. European Union Benchmark Regulation