Summary

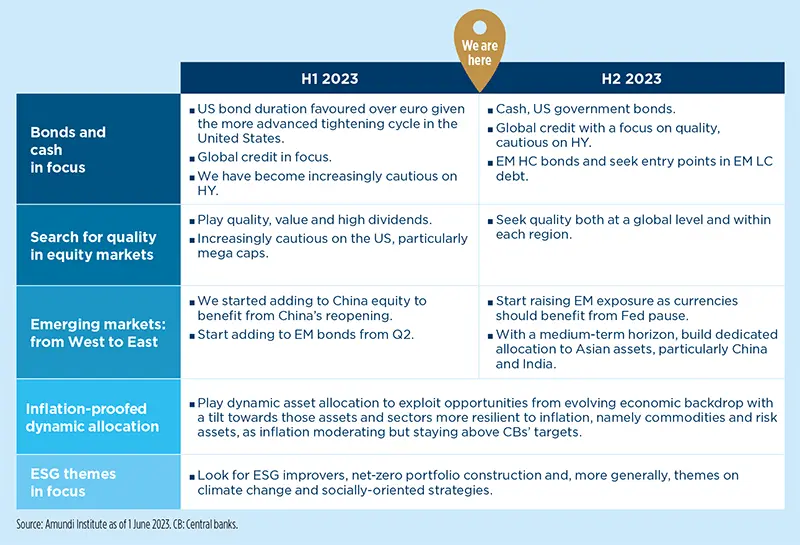

Key CIO convictions for H2 2023

Markets are at a critical juncture as central banks are hitting the pause button after the fastest hiking cycle since the ‘80s. Quality is the compass for navigating this phase.

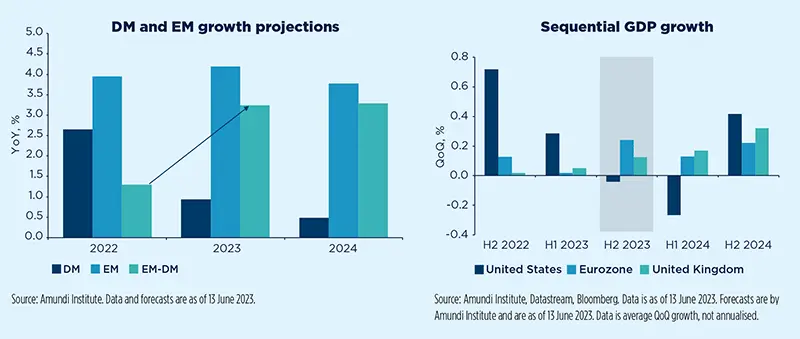

1. Narrow and uncertain path to growth, with a bottom in H2 2023

The lagging effects of tightening in the real economy will lead to a further deceleration in growth with divergences: a mild US recession, anaemic growth in Europe and more resilience in emerging markets. With low absolute numbers, both on the positive (Europe) and negative (United States) sides, the path ahead remains very uncertain.

2. Gradual slowdown in inflation

Inflation is trending lower, but the speed of adjustment is slow as core inflation remains sticky and stubborn. Evidence from past episodes of high US inflation suggests it will take about two years to bring core inflation down by half from its peak level. This is also our view this time.

3. Monetary tightening is close to peaking, but do not expect a U-turn

We believe that Fed and ECB rates are close to their cyclical peak and do not expect any cuts for the remainder of 2023, as inflation remains above central banks’ targets and the slowdown is pushed back towards year-end.

4. The growth premium of emerging markets remains wide, with Asia in focus

The resilience in emerging market (EM) growth is leading to a wide growth gap vs. developed markets (DM). We expect Asia to continue to attract investment flows and also to benefit from China and India moving towards more sustainable and inclusive long-term growth models.

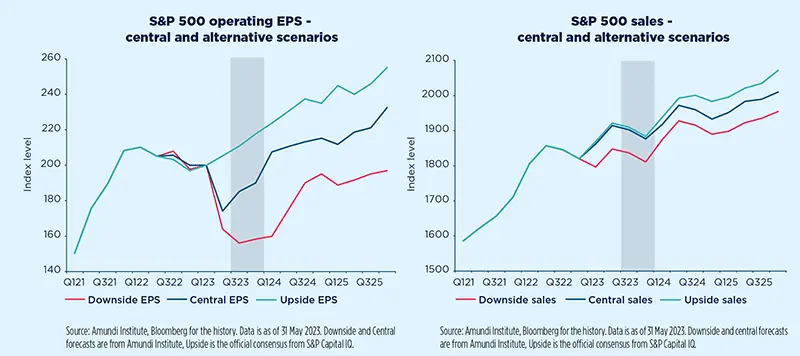

5. US consumer resilience is a key variable to watch

So far, strong demand has allowed companies to pass through higher costs to consumers, but these benign conditions should fade. Savings will dry up and tighter lending conditions are worsening the outlook for consumers. We expect a deterioration in US sales and EPS.

6. The cyclical outlook calls for a cautious start to H2

The uncertain macroeconomic outlook and weak corporate earnings growth call for allocations to remain cautious as upside is uncertain and downside risks persist, while risky assets valuations are expensive. The summer earnings season could shine some light on the resilience of companies. A Fed pause, moderating inflation and a persistent recovery in earnings should spark the move into a late-cycle phase and be more favourable for equity markets towards the year-end.

7. Rates close to peak support bonds, govies and high-quality credit

Bonds are back is the key 2023 investment theme. Moderating inflation, growth slowing down and a Fed pause will support global high-quality credit, while inflation protection also remains in focus. Investors should stay cautious on high yield, and be mindful of liquidity risk and corporate leverage.

8. Equity: focus on quality, look beyond mega caps and seek to add to cyclical markets

Concentration risk is high, as US equity market upside has been driven by just a few names. Opportunities are now in the quality space in the search for earnings resilience and in moving down the capitalisation spectrum to avoid areas of excessive valuation. Later in the year, the move towards a late cycle could favour cyclical markets, such as Europe.

9. Play emerging markets’ growth advantage in equity and bonds

Attractive valuations, an end to Fed tightening and a possible US dollar depreciation bode well for EM assets. Selection remains crucial, as there are areas of fragile economic conditions and the inflation-monetary policy outlook is mixed.

10. Asset allocation resilient to inflation in the spotlight

Inflation remains above normal levels and calls for additional sources of diversification such as private markets (particularly infrastructure) and hedge funds (global macro). Addressing the direction of inflation will be key to tilting sector allocation towards areas more resilient to inflation.

Amundi Institute forecast

Infographic - Investment themes for H2 2023

Investment themes for H2 2023

Follow the sequence

Uncertain growth path calls for allocation to remain defensive

It is time to rein in a defensive stance and look beyond the cyclical slowdown to seek opportunities ahead.

Economic resilience and a smoother adjustment of supply chains and sources (transformative globalisation) both in developed (DM) and emerging markets (EM) have led us to upgrade our near-term growth projections despite the weak global backdrop. We expect global GDP growth at 2.9% in 2023. DM should slow to 0.9% from 2.7% in 2022, decelerating less than previously anticipated, while EM growth should reach 4.2%, widening the EM-DM growth gap. Despite this, high inflation within a restrictive macro policy setting and a deteriorating geopolitical environment lead us to expect low overall global growth for 2023. The growth outlook is even more mixed across regions and countries, especially where upgrades reflect better near-term momentum rather than expected future tailwinds. Monetary tightening is close to a peak, even if its lagged effects are still underway, but we expect a restrictive monetary policy stance to be maintained for an extended period. As such, liquidity should be monitored. Central banks are engaging on two fronts: rate rises to fight inflation and ample balance sheets to preserve the economic cycle and financial stability. We expect anaemic growth in Europe, while the UK may also avoid recession, amid strong employment and better tax revenue. High inflation and tight credit conditions should cap household and business spending. Despite below-potential growth, inflation should remain above target up to mid-2024. Despite some resilience, we expect a mild US recession from Q4 2023 amid tighter credit conditions stemming from ongoing stress in the regional banking sector and the progressive transmission of monetary policy tightening to the real economy. US inflation should remain above target throughout the year.

In EM, the overall macroeconomic momentum is fragile but resilient, mostly where policy support is stronger. Fiscal support is overshadowing monetary policy support, as most measures to shield consumers from high living costs have not been phased out yet. H2 2023 should see stable, or easier, monetary policy across EM. In China, we see 2023 real GDP growth at 5.7%, with signs of weakness materialising in housing during May. Overall, EM economic conditions remain fragile, with most economic strength having been front-loaded in Q1 2023.

Defensive allocation is preferred during a correction phase

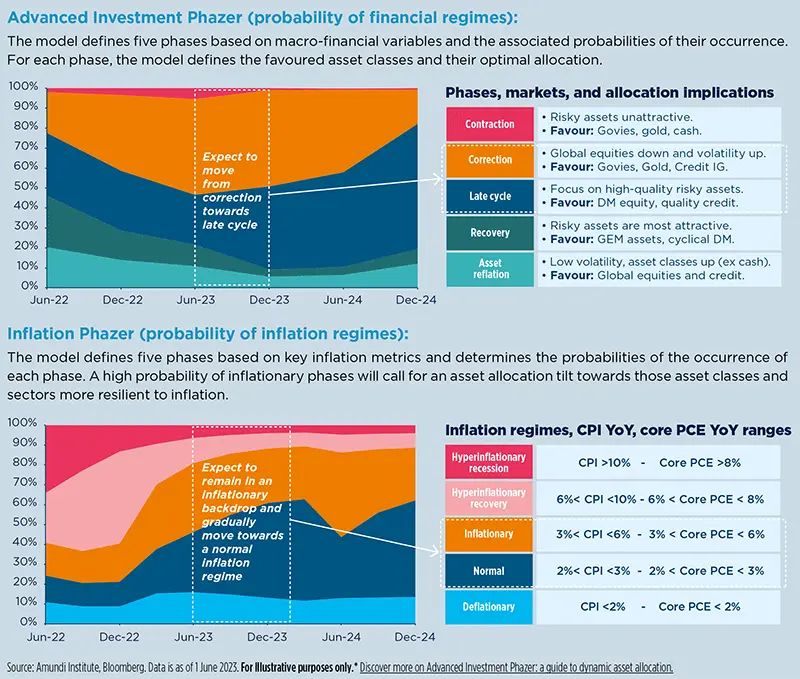

The expected economic backdrop should facilitate a continuation of the current Correction phase – according to Amundi Institute’s Advanced Investment Phazer (see the next page) – in financial markets until year-end, with even stronger conviction given to deteriorating US economic conditions and a profit recession that has not yet hit its trough. Markets have stayed buoyant on Q1 earnings. Amid strong demand, companies were successful in passing through higher costs to consumers, but these benign conditions should fade for Q2-Q3 earnings, reflecting a worsening outlook for consumers. We expect a deterioration in US sales and EPS, as we see a mild recession materialising. The next two quarters of the reporting season could lead to a market correction from current levels that could create entry points for equity markets. When it comes to inflation regimes, according to Amundi Institute’s Inflation Phazer, H1 2023 saw a shift from the Hyperinflation regime (featuring a YoY price change in the US >10%) that prevailed in 2022 to a more benign Inflationary one (featuring a YoY price change at 3-6%). For H2 2023, the combination of monetary policy tightening, lower commodity prices, and weakening demand should favour further price moderation, particularly in reference to headline inflation. However, the return to a Normal inflation regime – featuring YoY inflation changes at 2-3% – remains uncertain, as core inflation remains sticky and is expected to remain above central bank targets.

The resulting asset allocation suggests a defensive approach, with gold and duration among the favoured asset classes, while we keep a cautious stance on risky assets. Looking to 2024, a gradual recovery in H1 is more likely. However, it is too soon to call for a generalised risk-on move, given limited visibility on the extent of the cumulated impact of the financial tightening induced by the Fed rate hikes. A scenario of moderating inflationary pressures should make current valuations more sustainable. Upside risks could come from a less-painful-than-expected macroeconomic scenario, with a positive impact on corporate revenues, which are the main driver of any profit recession. Margins should benefit from a producer-price and labour-cost normalisation, alongside a weaker dollar. Downside risks relate to a credit event and its spill-over to corporates and the whole economy.

Low growth and high inflation suggest a cautious asset allocation. Gold and government bonds are favoured over risky assets in H2. Moving into 2024, an improving outlook for earnings could open up opportunities to add risk assets.

Dynamic asset allocation calls for a cautious start before adding equity

Amundi Institute’s Dynamic Asset Allocation (DAA) seeks to determine the medium-term (6 months to 3 years) optimal allocation, which is determined by assessing:

- Economic backdrop: what asset classes can deliver historically according to the expected financial and inflation regime*.

- Top-down valuation: what markets are pricing in and not pricing in. This is key to fine-tuning the allocation denoted by the economic backdrop.

According to Amundi Institute’s models for assessing the economic backdrop (Advanced Investment Phazer and Inflation Phazer), in H2 2023 we will gradually move from a likely correction phase (featured by a profit recession and tighter financial conditions) towards a late cycle scenario (featured by a stabilisation in EPS, GDP growth improving, but financial conditions still tightening), while inflationary pressures are likely to persist, albeit at a more moderate pace than in H1 2023. The certainty of uncertainty driven by close probabilities of more vs less constructive market phases, calls for a cautious allocation stance to start with, especially for equity markets where overall valuations are not supportive either. Once markets have corrected part of this overvaluation, or should the economic backdrop move into a late cycle more quickly, this will open opportunities to rebuild the exposure towards risky assets.

Economic backdrop assessment

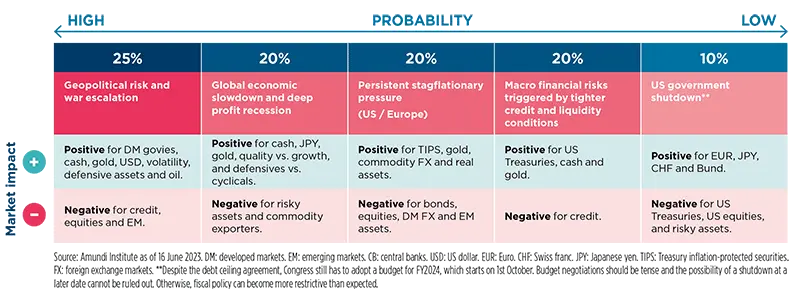

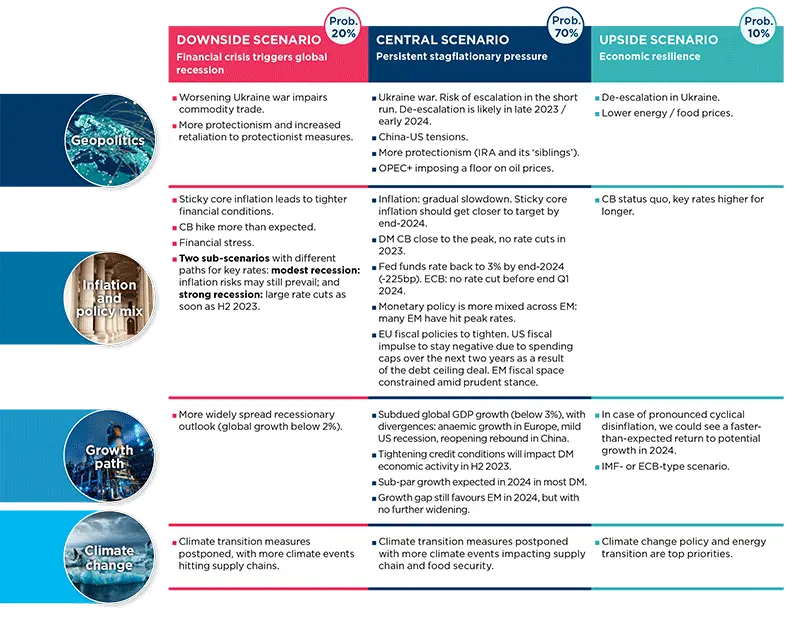

Scenarios and Risks

Central and alternative scenarios

Risks to central scenario