Summary

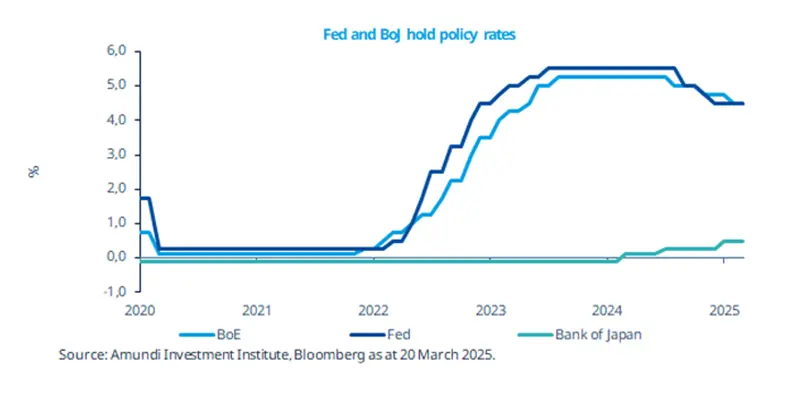

Central banks such as the Fed left interest rates unchanged amid increasing uncertainty over international trade; in this environment, quality fixed income assets in regions such as Europe could potentially offer attractive returns.

- In light of rising economic headwinds from uncertainty around global trade, the Fed kept a wait-and-see approach.

- Rising uncertainty amid higher US tariffs was mentioned by the BoJ as a factor to keep rates on hold in March. The BoE also left rates unchanged in March due to ambiguity over international trade and a weakening domestic economy.

- The BoE also left rates unchanged in March due to ambiguity over international trade and a weakening domestic economy.

The US Fed kept interest rates unchanged in the 4.25-4.50% range at its March policy meeting. Citing risks around elevated uncertainty from trade policies, the Fed prefers to wait and see given that the uncertainty is “remarkably high”. We think partly because of this uncertainty, the central bank slightly reduced its economic growth forecasts for this year and mentioned that US tariff policy may delay progress on slowing inflation. The Bank of England (BoE) and the Bank of Japan (BoJ) also held rates steady. The BoE still expects inflation pressures to ease but reiterated the need for a “gradual and careful approach.“ We think a global approach to quality credit and select bonds could potentially boost prospects for long-term returns.

Actionable ideas

- Government bonds

With high uncertainty, a global and flexible approach to investing in government bonds could potentially help investors benefit from different trends in yields.

- Global credit

Companies with robust fundamentals in regions such as the EU and emerging markets could be better placed to withstand uncertainty and may offer appealing returns.

This week at a glance

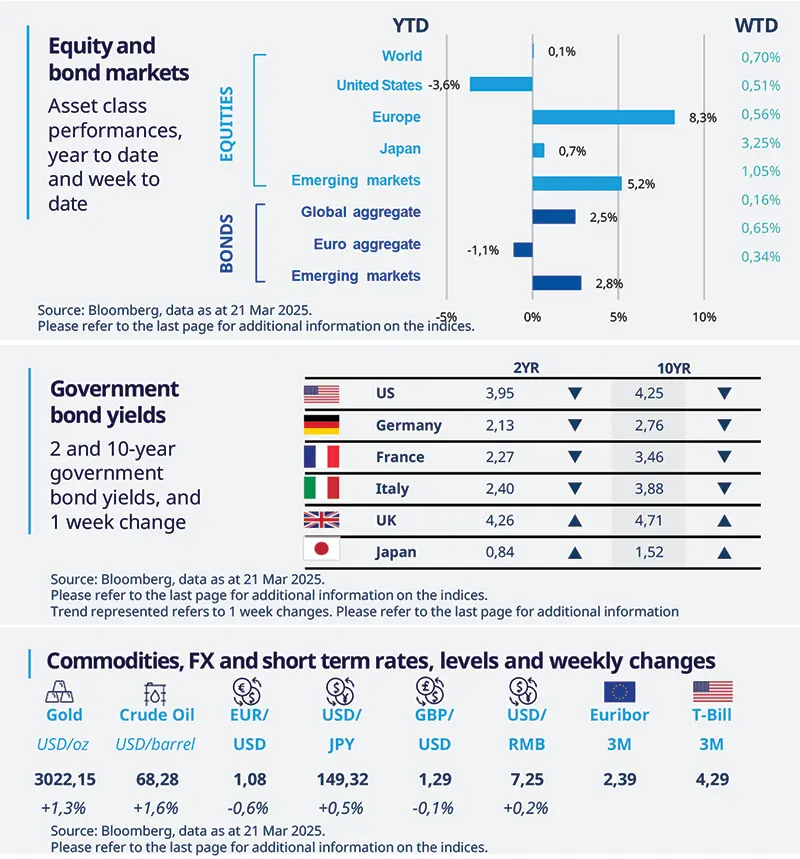

In a volatile week characterised by central bank actions and concerns over international trade policies, stocks recovered slightly. Japan was a clear outlier with strong performance. In fixed income, bond yields were mostly lower due to economic growth worries, and gold prices rose.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 19 March 2025. The chart shows official rates for the United States, Japan, and the United Kingdom.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US retail sales were weak in February

US retail sales were weak in February Retail sales for February grew by 0.2% (month-on-month). While the number is above the figure for January, it is still lower than market expectations. However, the retail control group (a number that excludes non-core spending and is used in GDP calculations) data was strong. We think the overall data may be an indication of slowing consumer spending. We expect more clarity on consumption and economic growth in the next few weeks.

Europe

Investor survey came in strong in Germany

The Zew Institute survey of economic confidence in Germany improved in March to 51.6, and was better than expected. This is due to positive sentiment around progress on the German fiscal policy which could potentially boost the country’ economic growth. We think the change in stance in Germany to spend and invest more is welcome. A lot will depend on how soon any concrete plans are decided and implemented.

Asia

China’s pivot to consumption

Chinese policymakers released guidance to enhance support in order to boost domestic demand through consumption. This signals a slight shift in Beijing’s policy, focusing now on household spending rather than infrastructure investment. Although all such cumulative efforts have stabilised the economy so far, we think uncertainties still remain with respect to US trade policies.

Key dates

26 Mar US durable goods orders, UK CPI GDP | 27 Mar US GDP, Mexico monetary policy, China industrial profits | 28 Mar ECB CPI expectations, US PCE |