Summary

What Trump 2.0 means for the global economy

Key takeaways

Our simulations indicate that tariffs could negatively impact economic growth by 0.2-0.3% and increase inflation by approximately 0.3% in both imposing and affected countries.

The size, timing, and sequence of these measures are key to understanding their impact, with the strategy likely targeting specific sectors and products rather than broad measures.

China is likely to implement fiscal support measures to shift production chains to Asia and Latin America, reducing US imports and mitigating tariff effects In contrast, Europe lacks this flexibility but could accelerate reforms and investments.

The policy environment in the US has become very uncertain making conventional macro forecasting difficult. But the early indications from executive orders, policy announcements and orders to review bilateral trade relations suggest that President Trump intends to follow through on immigration control tariffs and tax cuts. Withdrawing the US from the OECD agreement on corporate taxation is new and has potentially very adverse consequences tax competition will reduce competitiveness and the tax base in many advanced economies.

Expected impact on the US and global economy

Overall, we expect the Trump policy package to reduce growth by about 0.2% to around 2% in 2025 and below 2% in 2026 and raise inflation to around 2.5% in 2025 (similar to what the Fed now expects). Deregulation and tax cuts will provide a near term boost, but they also have the potential to keep yields high given elevated public debt and constrain private spending. Reversing part of Biden’s Inflation Reduction Act will also weigh on investments.

Uncertainty also complicates the Fed’s task. Until there is more clarity, we expect a near term pause from the Fed and market expectations of higher for longer.

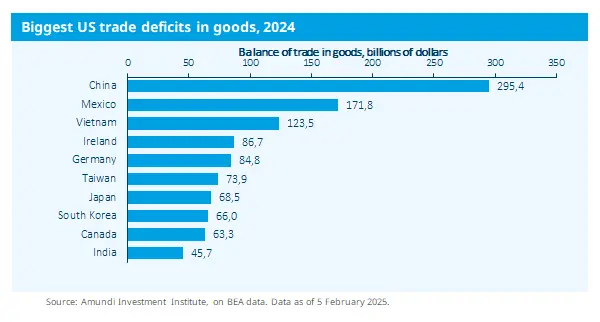

The global implications of tariffs are more difficult to discern because Trump may be transactional for many countries. But given Trump’s primary concern is large bilateral trade deficits, it is difficult to see how these can be brought down without tariffs (or fiscal restraint in the US). Moreover, countries with large trade surpluses with the US ( China, Canada, Mexico, for example), may not be in a position to credibly offer to reduce these surpluses through lower tariffs on US exports and pledges to buy more from the US, at least not in the near term.

Impact on Europe

With a trade surplus of more than 200 bn with the US, the EU will be bracing itself to be next to suffer US tariffs. The US is the biggest destination for EU exports - at over €500 bn 20% of exports) it is a bigger market than China. Even relatively low tariffs of 10% would have a substantial impact, with Germany, Ireland and Italy the most exposed, while France and Spain are more insulated. We estimate growth would be reduced by around a quarter of a percentage point to 0.8% in 2025 potentially derailing the recovery to potential growth this year. It is difficult to gauge how the EU might respond because, even though EU officials will have been drawing up a retaliation list, consensus among political leaders may take time. Some have called on the EU to exercise restraint. The EU has the legal competency to respond, including through tariffs, which it did in 2018 when the Trump 1.0 administration raised tariffs on iron and aluminium from Europe. But with surprisingly high proposed tariffs on close and integrated allies (Canada and Mexico), the EU may consider how to limit the risk of a wider trade war. Some EU leaders will want to negotiate to try to meet President Trump’s demands, but the outcome of such negotiations is very uncertain. Though the EU can agree to buy more LNG and defence equipment from the US (consistent with Trump asking Europe to raise its Nato contribution), this would only reduce Europe’s large bilateral trade surplus over the medium term. Beyond the immediate challenge, the EU (like China) will seek to extend its network of bilateral and regional trade agreements (such as the recent Mercosur agreement) to reduce its dependence on the US.

Impact on China

Following the February 4 deadline, the 10% US tariffs on imports from China remain in effect. While we had not anticipated a sweeping 60% tariff on all imports or the removal of China from Permanent Normal Trade Relations ( status, a gradual and incremental protectionist approach has begun. As of today, China's response has been limited and targeted, allowing room for further negotiations, especially considering that the America First Trade Policy report, which includes a more thorough trade investigation, is due by early April. Starting on February 10, China is implementing a 10% tariff on crude oil, agricultural machinery, large vehicles and pickups, while imposing a 15% tariff on coal and natural gas. Additionally, China has initiated an antitrust investigation against Google. An extra 40% blanket tariff from US could reduce China's growth by an accumulated 1.2% over the period from 2025 to 2028 assuming no significant fiscal support from the authorities. However, we expect that the implementation of US tariffs over a four year period will be accompanied by additional fiscal stimulus to mitigate the negative impact. Adjustments and reassessments will be necessary as the situation evolves, ensuring that the effects on both domestic and international markets are carefully managed With the adoption of expansionary fiscal policies aimed primarily at stabilising domestic demand and countering the adverse effects of US policies, we anticipate GDP growth of 4.1% in 2025.

Trump's foreign policy

Trump's foreign policy will be influenced by various factors, including the desire to wield tariffs for policy goals, a push for reindustrialisation and an interest in weakening competitors, while leaving a legacy as a peacemaker. Trump's agenda will encounter both domestic and international constraints. The ‘landing zone’ of these overlying dynamics will likely lead to deteriorating US-China relations dominated by economic decoupling in key sectors. However, the relationship will also include upsides as both sides strive to start on good terms. Negotiations between Russia and Ukraine will begin in H1, although achieving a ceasefire will be challenging, with the US likely to impose further economic pressure on Russia. The US-EU relationship will remain unstable, with EU leaders facing a mix of intimidation and cooperation. Additionally, relations with Latin American countries and Canada will be strained as the US seeks to expand its influence.

Despite significant volatility, new winners will emerge amid global diversification efforts.

What Trump 2.0 means for markets

Since Trump's inauguration, the market has modestly revised down the ‘Trump trade’ (i.e., tech sector, US dollar, crypto) while maintaining an overall positive sentiment. Attention is now focused on trade announcements, as markets have yet to fully price in the potential mix of Trump’s policies. We expect volatility to persist with any additional news on tariffs. However, if Trump adopts a transactional approach rather than escalating into a harsh trade war, we anticipate that equity markets will remain resilient. On fixed income, inflation and expectations regarding the Fed’s actions will continue to be the primary drivers. With the Fed currently on hold, upcoming tariff announcements and economic data will be crucial in determining the Fed's next steps.

Overall, the market environment is likely to remain supported by the current positive economic backdrop in the first half of the year, but uncertainty is heightened. As we move into the latter part of the year, the impact of tariffs on economic growth and inflation could prompt earnings revisions, potentially harming risk sentiment. Tail risks – such as a full-blown trade war, higher geopolitical tensions, rising inflation pressures, and a new oil price war – appear little priced in. On the positive side, a ceasefire in the Russia-Ukraine war is not priced in either and could be a positive catalyst for European assets.

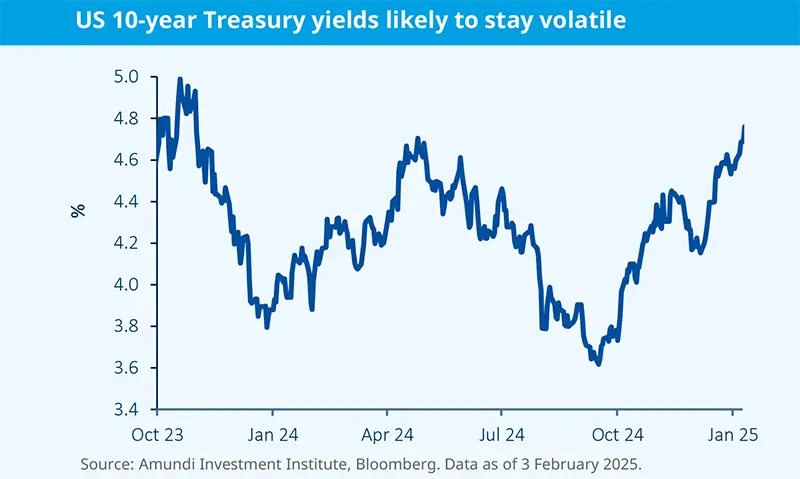

Fixed Income – Expect volatility to stay high

Fixed income markets are still trying to assess whether Donald Trump’s policies will change the outlook for growth and inflation, and central banks’ responses. Markets will remain focused on actual economic releases, with the recent below-expectations CPI reading driving yields lower. Yields continued to drop to 4.5% after the inauguration, while the 30-day realised volatility also fell. With renewed tariff threats, yields could again test the 4.8% level by the end of Q1, before moving lower as growth slows.

In the absence of a full-blown trade war, markets should remain resilient in the first half of the year, favouring a risk asset exposure with some hedges in place.

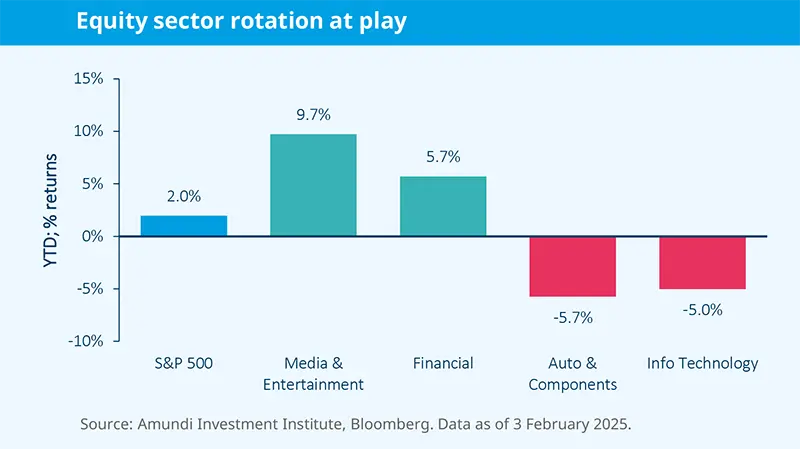

Equity – Rotations within the US market are set to continue

As the US government implements expected tariff policies, a clear divide is emerging between the winners and losers in the market. While some sectors stand to benefit, others may face significant challenges.

Tax cuts are anticipated to benefit companies with a strong presence in the US, particularly US small- and mid-cap firms and financials, as well as non-US companies with production facilities located in the US. In contrast, tariffs are likely to affect non-US producers, especially those from countries with significant trade deficits. Sectors reliant on goods exports, such as autos, face greater risk, while service sectors like software, media, and telecoms are expected to be more resilient.

In Europe, less than half of the European equities sales are domestic and therefore potentially exposed to an EU GDP slowdown. With regards to global sales, only about 6% of sales are at risk of tariffs, so the market should remain resilient overall. A relaxation of regulations is likely to spur corporate activity, further supporting the equity market.

Overall, US financials tick all the positive factor boxes: they are domestic, benefit from deregulation, and stand to gain from persistently high bond yields if inflation remains sticky or if a high budget deficit continues. The commodity and tech sectors may also see advantages from reduced regulatory burdens.

Artificial Intelligence (AI) will continue to be a key market theme, as evidenced by the ‘Project Stargate’ announcement. However, the emergence of the new Chinese DeepSeek model challenges the crowded AI trade – a symbol of US exceptionalism. Its cost efficiency points to a rotation from spending hyperscalers to adopters, with software likely to benefit. This also argues in favour of a broadening of participation in the bull market.

Beyond geopolitical constraints, all else being equal, increased competition and open-source Gen-AI models should enhance global productivity over the long term and remain a positive driver for equities.

Emerging Markets – FX and equity risk sentiment to stay weak in the short term

Tariff uncertainty will weigh on risk sentiment in EM markets, particularly in equity and FX. In equities, we moved to neutral ahead of Trump’s inauguration. Key risks include developments with China, Russia and Iran, which currently skew EM equities towards the downside but could also present significant upside potential if geopolitical tensions ease. India remains a long-term story but is at risk due to current high valuations, while Mexico and South Korea appear well-positioned for a rebound once tariff tensions ease. On China, we favour the domestic A-share markets which could benefit from fiscal stimulus targeted to sustain domestic demand. Renminbi depreciation is in China’s toolbox to offset tariff increases. Our target for Q1 2025 is 7.5 from 7.25 currently. Regarding EM bonds, we favour hard currency debt, particularly in the HY segment where yield levels are more appealing.

Financials, software, media and telecoms are expected to remain resilient, as they are less exposed to trade tariffs.

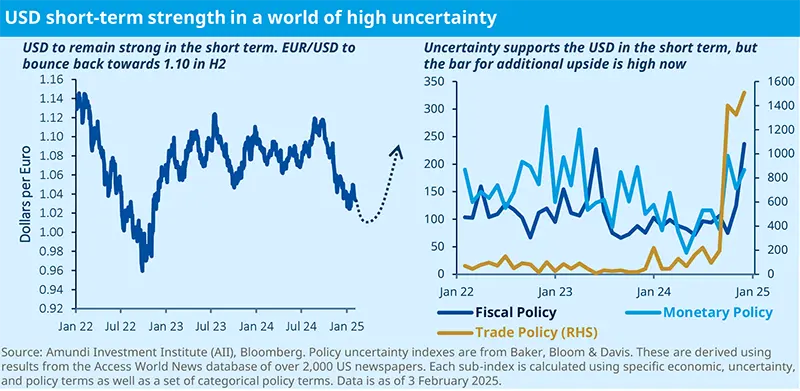

USD in the Trump era: strong, but not unstoppable

Since the beginning of Q4 2024, the US dollar (USD) has strengthened, affecting both G10 and EM currencies. Amplified by the outcome of the US elections (given the Trump administration’s aim to boost US growth at the expense of the rest of the world), the movement was further intensified by the Federal Reserve’s (Fed) shift in communication in December. In the wake of the subsequent bond and equity sell-off (which lasted until the miss in US CPI and PPI inflation), the USD has emerged as the only effective diversifier.

In the near term, we have a positive outlook on the USD, which still has a tailwind supported by its high carry vs G7 currencies. We are positive for its performance against the Euro in particular, due to contrasting macroeconomic fundamentals and divergent central bank policies. The January central bank meetings highlighted these differences: the Fed held rates steady amid risks of rising inflation from tariffs and immigration policies, while the European Central Bank (ECB) cut rates in response to slower growth and declining inflation.

Risks to this outlook include Trump's potential desire to weaken the dollar, increasing scrutiny of the Fed’s independence and the impact of a rising budget deficit, which may affect the medium-term perspective.

The medium-term perspective is more challenging for the USD

A strong USD trend (i.e. a repetition of what was experienced in 2022) seems unlikely to us, unless the market begins to price in interest rate hikes for 2025 and beyond. Consistent with the revisions we have made about the Fed (on hold in Q1 and reaching a higher terminal rate than previously expected) and the rising risks on trade, we expect a firmer USD in the short term, but still see EUR/USD around 1.10 for year-end.

Uncertainty supports the USD in the short term, yet too violent an appreciation seems unlikely.

Four conditions support our view.

A high bar for positive surprises in the US: The macroeconomic landscape in 2025 differs significantly from 2024 when expectations pointed to a gloomier economic outlook and markets were anticipating six or seven cuts from the Fed. Now, growth expectations are at around 2% and the market expects fewer Fed cuts ahead. If the rising uncertainty supports the USD, already high USD positioning among investors raises the bar for positive surprises.

Depressed sentiment outside the US: Weak growth in Germany and France, along with China struggling to revive its private sectors and risks to world trade from higher US tariffs, limit alternatives to the USD. However, the current depressed sentiment outside the US highlights that the bar is high for further disappointments. Potential game changers, like fiscal easing in China, the German elections or a resolution to the Ukraine war, could boost sentiment and challenge the USD.

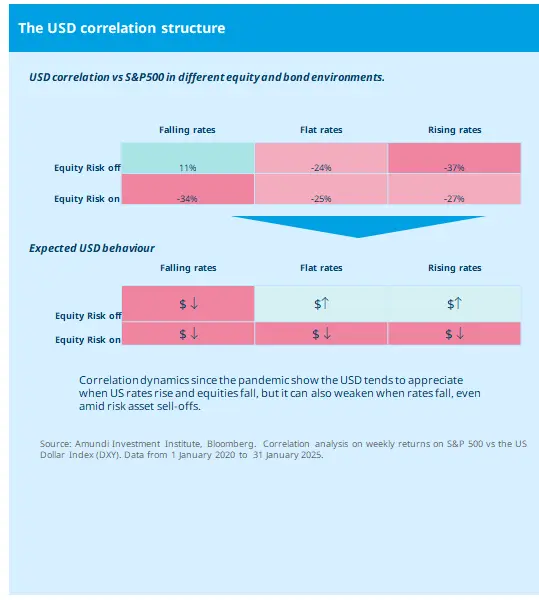

Impact of falling US rates: The USD typically appreciates when the US economy outperforms others or during global growth weakness (leading to safe-haven flows). While we expect the former condition to hold in 2025, we do not anticipate USD strength based on a risk-off environment driven by growth concerns. The correlation structure since the pandemic shows the USD appreciating mainly when US interest rates rise and equities fall, but also shows the USD has sold off when US interest rates drop, even in the presence of risk capitulation. Something we experienced in the summer of 2024 and, more recently, when DeepSeek drove the entire equities market down.

Peaking US core and services inflation: Although inflation remains above target, its most sticky components are subject to negative base effects and should experience little impact from US tariffs. This may alleviate pressure on the Fed and justify lower rate expectations

The outlook for the USD carries significant risks. The primary risk stems from the rising probability of interest rate hikes. Should the market start to price in a scenario where the Fed has to hike at the expense of growth, USD appreciation will become acute. This was the primary driver behind the USD surge against other currencies in 2022 and remains a key risk for 2025.

Short-term currency reaction from Trump’s tariffs

The magnitude, timing and scope of the recently announced tariffs by the US administration remain unclear, yet the initial market reaction has been predictable. The USD rallied across the board, except against the JPY – where growth concerns support the currency – and to some extent the GBP, which faces minimal tariff risks due to the UK’s lack of a trade surplus with the US. While this reaction is understandable, its long-term impact is uncertain. In the coming weeks we expect:

Prevailing uncertainty to support the USD, as investors will likely seek a higher risk premium before considering short positions.

Small open economies to face significant challenges, as a global trade shock will adversely affect export-oriented nations already burdened by high debt service ratios. This may lead to monetary policy divergence, putting pressure on their currencies (CAD and antipodeans).

While tariffs may impact inflation, we believe the net effect will be a drag on growth. The JPY will shine when growth disappoints.

Should Europe be the next target, the EUR trade-weighted index will have to adjust lower.