Summary

Fiscal easing on course: After months of anticipation, Beijing has revealed how it plans to keep the Chinese economy steady – growing at around 5% – in a challenging and uncertain macro environment. Its answer: ramping up fiscal spending, maintaining monetary support, and directing more resources towards boosting consumption and high-tech growth. Most of the numerical targets unveiled at the NPC were in line with the market consensus, although the fiscal plan fell slightly short of the average expectation. Investors will now look for more budget and spending details from upcoming ministerial meetings to gain a complete picture of the extent of the fiscal boost.

Uncertainty abounds: On paper, a spending package worth c2% of GDP may fall short of what’s required to counteract the macro challenges including the 20% tariff shocks from the US. However, if Beijing is committed to frontloading the spending and getting resources to the hands of consumers fast, the stimulus could provide more bang for the buck. Past experience also suggests that additional support can be allocated later in the year – confirmed by the NPC – if the existing plan fails to hit the targets.

Markets are content for now: The markets’ calm reaction, despite some disappointment in the fiscal plan, suggests muted policy expectations. Indeed, optimism about AI, as opposed to policy easing, has been behind the recent re-rating of Chinese equities, led by technology stocks. However, without a powerful policy shift to decisively turn around the economy, the ability for this rally to extend beyond tech may be questioned. We maintain an overall neutral stance on China equities, but stay selective across different sectors and indices. For fixed income, upward pressure on bond yields could persist in the near term, given the lack of immediate monetary easing. In relative sense, the growing US recession narratives and the volatility surrounding Trump’s policies are making China’s policymakers appear more accountable, which is encouraging global capital to flow back into China’s riskier assets.

Beijing’s macro agenda for 2025

Premier Li Qiang kicked off the annual meetings of the National People’s Congress (NPC) with the government’s Work Report, marking the nation’s biggest political event of the year. Besides a busy calendar of political decision-making, the NPC is also closely watched by markets as Beijing sets the course for the economy and macro policies for the remainder of 2025.

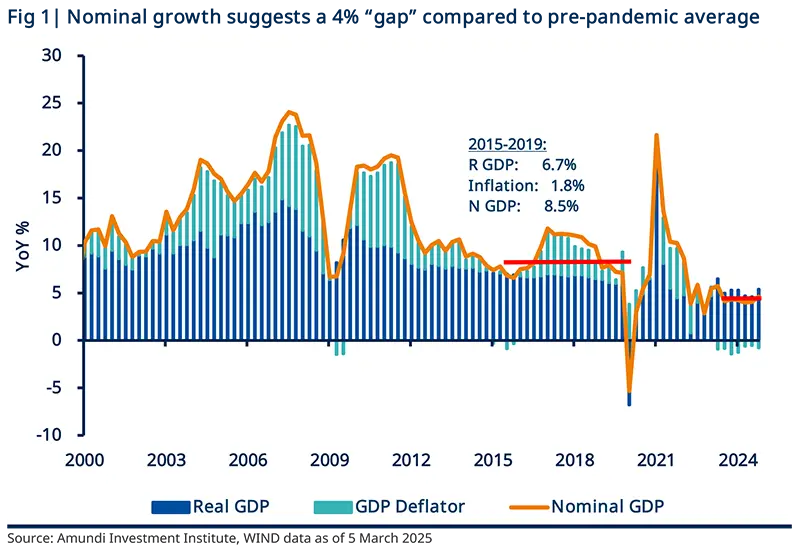

The overall desire to keep the economy on an even keel in a highly uncertain macro environment saw Beijing leave growth and inflation targets broadly unchanged from last year (Fig 1). However, achieving these goals will be an uphill battle against rising trade tensions and ongoing lacklustre domestic demand. The anaemic price dynamics, in particular, will make hitting the inflation target challenging despite a modest downgrade of the goalpost from 3% to 2%.

The overall desire to keep the economy steady in a highly uncertain macro environment has seen Beijing leave growth and inflation targets broadly unchanged from last year.

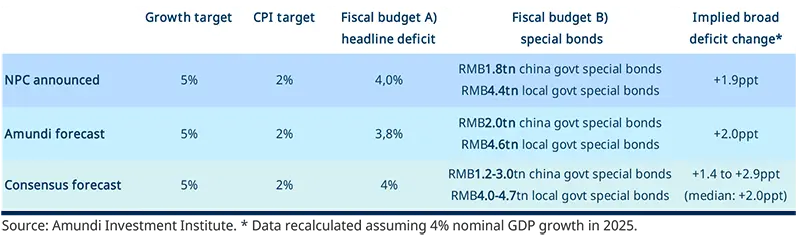

Table 1 | 2025 NPC targets vs. expectations

This is why, compared to where the targets are set, investors are more interested in how the targets will be met. Since the policy pivot last September, China’s authorities have been preparing the markets for a comprehensive stimulus package aimed at helping the economy through troubled waters. What was announced at the NPC on 5 March was the delivery of a buttoned-down set of policies that fall within a narrow range of consensus expectations.

The highly-anticipated fiscal plan contains few surprises. The official budget deficit for 2025 was raised to around 4% of GDP from 3%, surpassing the peak reached at the start of the pandemic. This will be supplemented by off-balance-sheet borrowing by central and local governments, via special bond issuance, reaching RMB 6.2 trillion in 2025. Together, a total fiscal firepower worth c10% of GDP (based on our estimate of the augmented deficit), 2% more than in 2024, is set aside to aid the economy.

Besides “how much”, “how” this stimulus will be distributed is also a focus. Beijing has earmarked RMB 300 billion, out of the RMB 1.3 trillion special treasury bond issuance, to support the recently-expanded consumer subsidy scheme. In addition, a “special action plan” will be introduced to reinforce consumption supports, although the Work Report did not offer details. RMB 500 billion from the central government coffers will be used to recapitalise banks, while money raised via local government special bonds will focus on clearing property inventories, paying government arrears, and constructing strategic projects.

The overall message of the Work Report is clear that the fiscal programme is designed to support “The People”. More resources will be prioritised to boost social welfare, employment and income growth in order to cement consumption’s role as the primary engine of economic growth. In that regard, the RMB 300 billion “trade-in” subsidy – the only consumption stimulus with a “price tag” attached – seems light for fulfilling such big pledges. The markets will now wait for details on the “special action plan” and how budgetary spending will be allocated from the Ministry of Finance and NDRC.

Besides the fiscal push, monetary policy is expected to play its part too. Beijing has maintained a historically dovish stance, labelling monetary policy as “moderately loose”. Such a stance, however, has so far not translated to as much easing as anticipated, as the PBoC has been preoccupied by the task of maintaining FX stability and reining in leverage in the bond market. We think the need to lower real rates to tackle deflation will keep policy on a dovish course, although the timing and types of actions – high-profile tools versus low-key operations – will be determined by evolving macro conditions. We see Q2 as a possible window for the next reserve ratio requirements (RRR) and interest rate cuts as the current growth momentum runs out of steam amid higher tariffs and a weaker dollar creates policy space.

In addition to short-term stimulus, the Work Report reiterated the central role of the private sector in overall economic development. This is both a recognition – at the highest political body – of the progress the private sector has made in narrowing the innovation gap with the US, and a continuation of attitude shifts since President Xi’s symposium with private-sector entrepreneurs. All of this is expected, of course, at the NPC. The real question is to what extent this attitude shift will translate into improved policies and regulations for the sector. The Work Report has laid out some general principles, but fell short on details. The latter could be provided in various ministerial meetings over the coming week if Beijing is serious about restoring confidence in the dominant part of the economy.

Even considering some growth slowdown since the pandemic, a 2% stimulus package still falls short of what’s needed to close the “gap” and pull the economy out of deflation.

Is it enough to stabilise the economy?

This is a pertinent question, but not easy to answer. A precise assessment of policy effectiveness requires a thorough understanding of the current state of the economy, the size of the output gap, and how different types of fiscal spending impact growth (what economists call fiscal multipliers). None of these are easy to gauge given the availability of good quality data in China.

For what it’s worth, a back-of-the-envelope calculation using nominal GDP, which is seen as less problematic than real GDP, shows that the current level of growth is at least 4% below the pre-COVID average (Fig 1). Even considering some growth slowdown since the pandemic, a 2% stimulus package still seems light for what’s needed to close the “gap” and pull the economy out of deflation.

That being said, “how” and “how fast” the stimulus is spent matters. Last year’s “trade-in” programmes suggest that money spent on boosting consumption may have a larger multiplier effect. And, if money is distributed fast – say over the next 3-6 months, as pledged by the NPC – a more forceful resuscitation could help jumpstart the economy even if the size of the stimulus is considered tepid over a longer (12-months) horizon.

Moreover, Beijing has left the door open for more actions should macro conditions deteriorate. Remember that additional policy easing was provided in the Fall of the last two years against renewed economic weakness. With trade frictions adding growth risks this year, the level of support the economy receives could again go beyond what's been announced at the NPC. The pledge by the Ministry of Finance to “launch incremental reserved policy measures in batches” should be viewed in that context.

The significance of DeepSeek and the symposium is that they have added two new China narratives that excite global investors.

Is it enough to please markets?

The immediate reaction suggests Beijing has pulled off the test despite offering no tangible surprises. Chinese equities rallied after the announcement of the growth and fiscal targets, with the Hang Seng Index rising 2.8% and the CSI 300 up 0.5%. The CNY/USD also traded firmer for the day despite a further escalation of trade tensions as another 10% US tariffs kicked in overnight.

The benign market reaction reflects, in our view, limited prior expectations for a strong policy boost. This may seem at odds with the significant re-rating of Chinese equities in recent weeks. However, looking closely, most of the re-rating has occurred in offshore tech stocks spurred by optimism on AI, as opposed to policy stimulus. In contrast, ex-tech H shares and broad A share markets have seen muted year-to-date gains (Fig 2). A 2% spending package, in line with consensus expectations, therefore, did not “upset” the markets.

From here, we think the fate of the current bull market will be determined by three (mainly domestic) unknowns; 1) whether the macro policy is effective at putting a floor under the economy; 2) if there is an U-turn in regulatory policies for the private sector that helps restore confidence and vitality; and 3) whether AI can make significant further breakthroughs, spurring investment across tech sectors, and unleashing productivity for entire the economy.

The rise of DeepSeek and the recent symposium with the private sector have added two new macro narratives about China that excite global investors. More countercyclical policy easing remains important but is no longer the only way to put China back on the map.