Summary

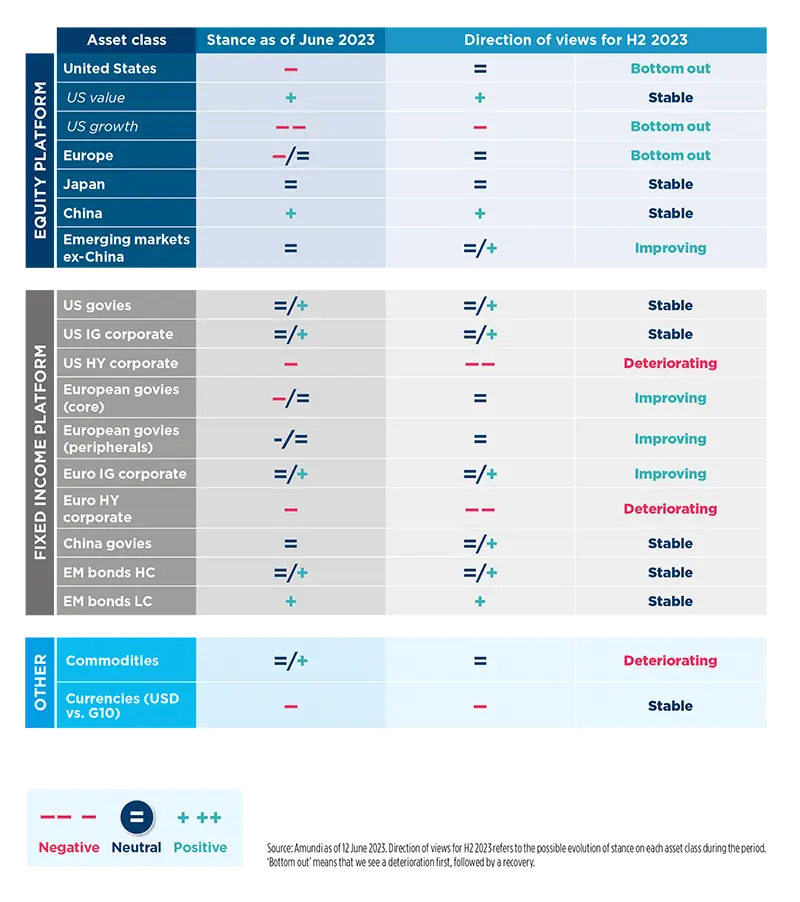

Amundi asset class views

DM equity: focus on quality, entry points in the case of correction

US recession to outweigh the good of a Fed pause

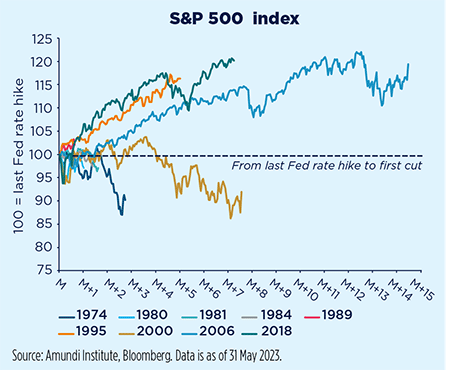

Caution in equities is still required while Fed rates plateau. Market performance between when the Fed stops raising rates and the first cut could be positive or negative, depending on economic conditions.

This was positive when there was no recession (1984,1995, and 2018) or when a bubble was building (2006). In our scenario, we see a risk of recession in H2, triggered by a weak earnings seasons in Q2-Q3. As such, we remain on the cautious side for H2.

We consider the current risk-reward as unattractive for equities entering a US recession. However, when inflation drops from high levels, equities tend to react positively earlier when the Fed relaxes monetary policy, as was the case in 1953, 1974, and 1980. As of today, we expect this phase to only happen next year.

Quality first, across the board

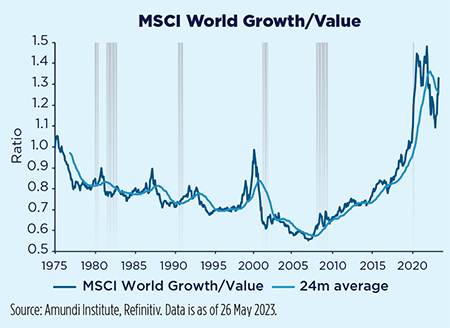

In March 2003, the correction of the Growth vs. Value overvaluation found another impulse in favour of Value as the market bottomed out.

Repetition is a strong possibility. In the meantime, we favour quality (low leverage, earnings recurrence and protected dividends). However, at a regional level, the United States — usually a quality play — is too expensive and deserves to be underweight entering H2 2023.

Europe needs a breather and will not be immune to a US recession but looks a bit better due to its exposure to China’s recovery and is really cheap. Japan is an interesting diversifier due to its unhedged currency (domestic recovery, China exposure and improving corporate governance).

DM fixed income: stay with quality credit and core govies

Core govies: good value and diversification qualities

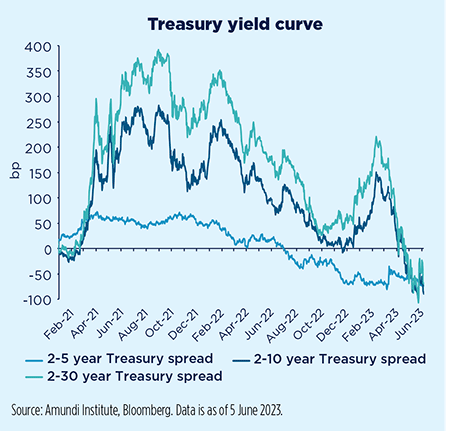

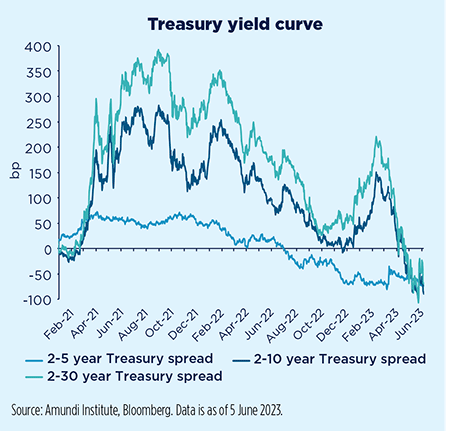

DM fixed income investors remain focused on sticky inflation and the need for CB to do more. We expect the Fed to push the US economy into recession to bring inflation closer to 2%. The ECB remains focused on inflation despite disappointing economic data and Germany’s slide into recession. In the Eurozone, growth should remain subdued and inflation sticky. On fixed income markets, in the United States this translates into a slightly positive stance on duration. We see curve steepening opportunities (5-30y). In the Eurozone, investors should stay slightly underweight on duration and move gradually towards neutrality. Inflation protection strategies remain in focus for H2 2023.

Overall, core government bonds retain good value and investors can consider bonds as risk diversifiers in the current market environment. At this stage, most of the expected tightening is already reflected in current yields, especially for US rates.

Investment Grade favoured in an economic slowdown

The upcoming economic slowdown is not priced by credit markets. We maintain a quality focus, with a preference for Investment Grade credit over High Yield.

The impact of monetary tightening on corporate fundamentals has been limited so far, because of the huge liquidity accumulated during the Covid-19 crisis and low short-term refinancing needs. The transition towards higher funding costs will be more painful and faster for low HY-rated corporates, which have less ability to generate cash flow and higher short- term refinancing needs. Current valuations do not reflect this risk. As such, we favour quality credit, for which fundamentals remain good and valuations fair or even very cheap for European investment grade.

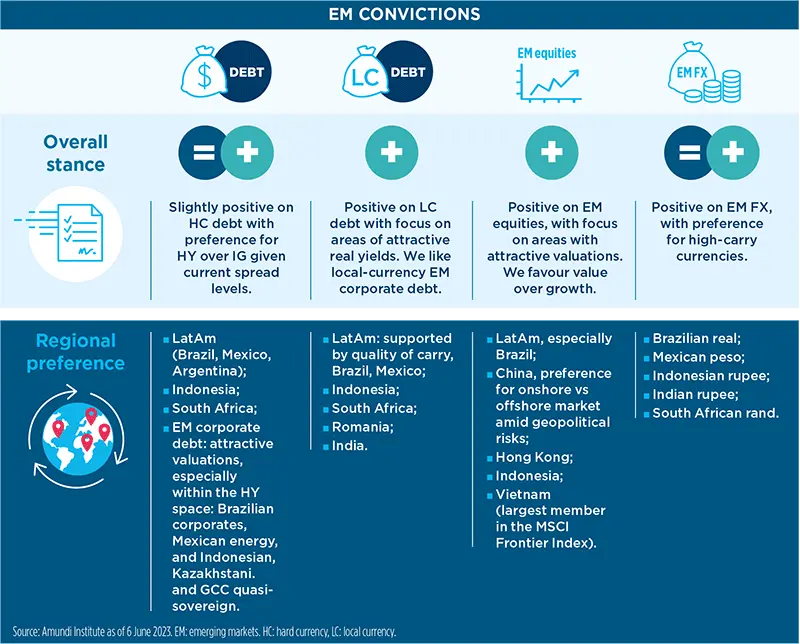

EM assets favoured due to tamer inflation and earnings recovery

The approaching end of the US tightening cycle, prospects of a weaker US dollar, stabilising or falling inflation, and an earnings recovery could make EM assets shine in H2.

EM equity: earnings growth is back in EMEA and Asia

After a challenging first half of the year for EM equity, harmed by negative sentiment towards China, we expect a better environment in H2 2023. EM equity could benefit from: 1) attractive valuations, particularly in LatAm and EMEA; 2) the approach of an end to the Fed tightening cycle (possibly transmitted into EM CB easing); 3) the expected dollar depreciation.

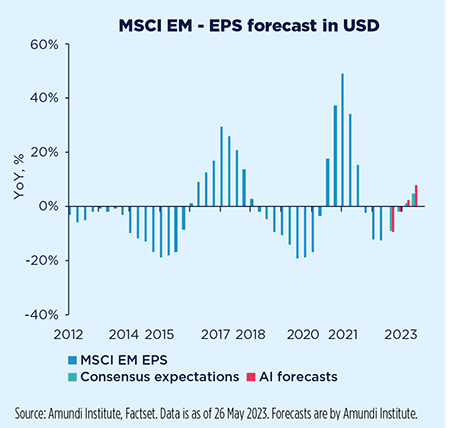

We expect earnings to return to positive YoY growth after two negative quarters — especially in EMEA and EM Asia — as EM economics should prove relatively more resilient in terms of growth trends compared to developed economies. Margins started to recover in Q1 2023. This trend should continue in H2.

In China, we see the risk-reward ratio as being more favourable for A-shares (onshore) than for H-shares (offshore) markets amid high geopolitical risk. We maintain a positive outlook on Brazil, but we are closely monitoring the progress of fiscal reforms.

EM fixed income: attractive yields and spreads

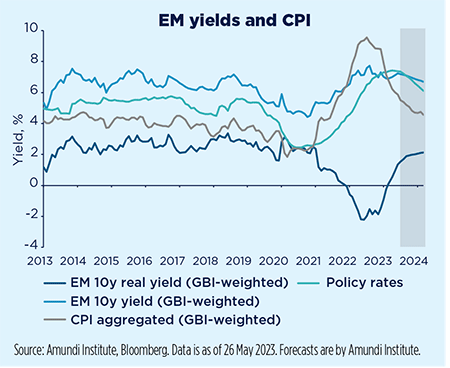

While EM bond yields have dropped in H1 2023, the asset class still offers an appealing entry point in terms of spread and carry, supported by a weakening dollar. We maintain an upbeat outlook, particularly for LatAm, where the hiking cycle has ended and should reverse in H2 2023 over decelerating inflation. Hard-currency bonds are expected to yield high-single-digit returns on a six-month horizon and volatility remains limited. We favour HY, which offers more appealing valuations. Conditions in the EM corporate bond space are improving, with corporate net leverage levels well below those in the United States.

Additionally, EM HY corporate defaults have peaked and should moderate in 2023 in LatAm and EMEA. However, China’s real estate sector still poses risks.

EM currencies: recovery is on track

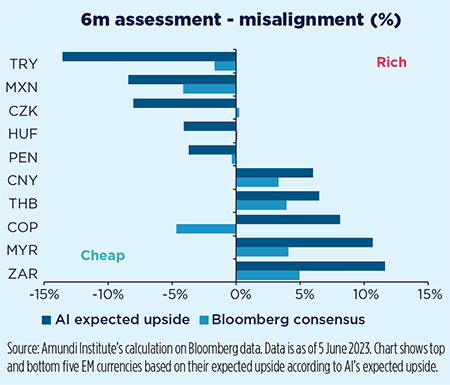

As the US economy loses its exceptionalism in economic growth and interest rates, investors should look elsewhere for higher returns, leading to a shift away from the dollar. With the end of the Fed tightening cycle, EM CB should turn towards an easing cycle, thanks to peaking inflation rates which should be on a declining trend in H2 2023. While undervaluation and light positioning on EM currencies could contribute to an asset class recovery, we recommend a selective approach.

We focus on commodity-exporter currencies, thanks to a resilient commodity cycle - driven more by supply than by demand - as well as high-carry currencies such as those in LatAm. Meanwhile, EMEA currencies may be harmed by their high vulnerability and persistent inflation.

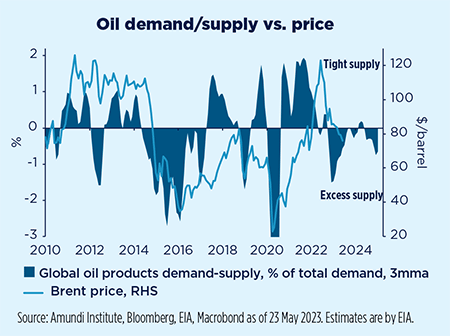

Oil to firm on evidence of tightness

Oil demand and prices are cyclical, sensitive to the economy and to consumer reaction to high prices. Yet, oil has disconnected from macro forces several times in the past. This has occurred when supply could be adjusted quickly, when macro deterioration was manageable or in times of an oil supply shock. We foresee oil demand to stay resilient, supported by China’s decoupling and amid a manageable contraction of the global economy. OPEC+ also has the upper hand – without heavy competition from US producers, with declining Western leverage and thanks to DM’s chronic under- investment – allowing the cartel to act on supply more decisively. Following a period of range trading, we see prices gaining traction later in H2 upon evidence of market tightness. We then expect Brent to reach $90/barrel.

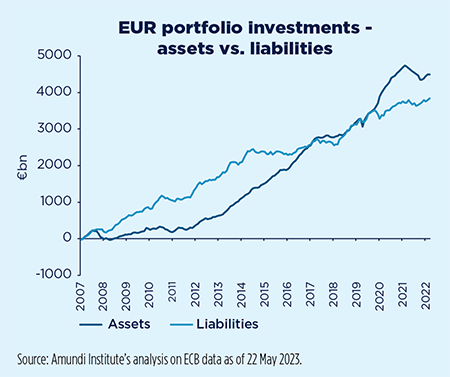

Another cyclical test for the dollar’s hegemony

In the past, the financial industry tended to downplay the USD’s dominance in global markets. While reality has invalidated this pattern – USD remains involved in 90% of global transactions – the current cycle has strengthened the argument. USD overvaluation is part of the story, but global capital flows may also be involved this time. A gradual repricing of the Fed’s rate path is the cyclical condition that we expect will reconnect the USD to where it should trade, based on the regime shift we experienced last year. The amount of outstanding negative-yielding global debt has plunged, and the interesting asymmetry arising from global portfolio activity – the potential for EUR-based investors to repatriate vast amounts of money into domestic bond markets – suggests a weaker USD profile moving into year-end.

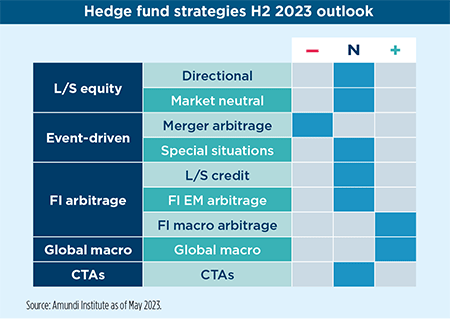

Alpha makes up for poor market conditions

We are at a complex, macro inflection point, shifting from rate hikes to a growth slowdown. Opposite forces will fuel above-par volatility, opening market- timing windows. CB are nearing peak rates, but sticky inflation will keep some unpredictability in bonds, providing relative rather than directional trades for macro managers. Meanwhile, the impact of tightening will deepen the growth slowdown, yet remain orderly thanks to China’s growth acceleration. Alpha should see asset differentiation with reasonable correlations, prices trading closer to fundamentals and country arbitrages.

Worsening funding access and costs will reveal hidden leverage. Without a hard landing, dislocations should be limited, providing extra alpha for bottom-up pickers. With markets staying versatile for longer, managers will remain focused on alpha, mitigating milder beta contributions. Managers’ positions remain cautious, but gross exposures suggest no shortage of ideas. Macro inflections are uncomfortable for top-down styles, but the medium-term outlook is promising. Alpha is already supporting bottom-up strategies, waiting for more catalysts and better valuations to deploy fully.

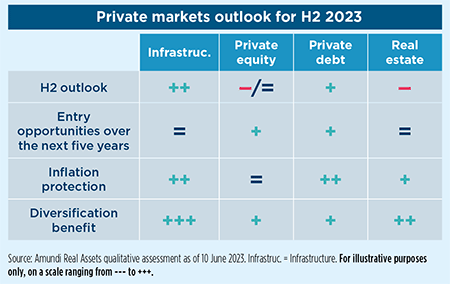

Private markets: look for resilient assets

Listed and private markets have not yet repriced for a worsening outlook. Looking ahead, while some areas could be affected by these weaker dynamics, we expected private markets to remain resilient with some differentiation among assets. We particularly favour infrastructure thanks to its cash-flow features, stable pricing and strong growth outlook, which is being boosted by the energy transition. Along with public funding, private capital is required to build renewable energy plants as well as enhance the digitalisation of networks.

We also remain positive on private debt, as these assets are diversifiers that benefit from strong bargaining power in negotiating lending contracts, as bank financing remains constrained. In the private equity space, many non-cyclical businesses (e.g., healthcare) possess pricing power and are profiting from strong structural growth trends. Conversely, cyclical businesses (less represented in this space) may be challenged. Turning to real estate, interest rate rises have been difficult for investors, but can create opportunities; inflation should favour rent indexation for ongoing leases. Over a medium- term horizon, current valuations offer an attractive entry point for investors, although a selective approach remains vital.

Main themes in Net Zero investing

We believe water scarcity risk is high and needs to be addressed with technological innovation. By recycling water, manufacturers reduce their dependency on freshwater resources, eliminate the need for extraction and, consequently, conserve natural resources. Treating wastewater can cut its emissions by 33%. We favour both water utilities - which are a mix of water supply and wastewater treatment operations - and water quality companies, which provide water treatment equipment and services.

Source: International Water Association, May 2020.

According to the International Energy Agency, renewable energy should account for 60% of the world’s total electricity production by 2030 and 90% by 2050. Investors can gain exposure to this theme by investing in renewable energy operators/utilities and suppliers of renewable energy equipment for wind, solar, or hydro markets.

Source: International Water Association, May 2020.

Another area of concern are the GHG emissions linked to the production of uneaten food. A notable amount is lost in supply chains due to a lack of refrigeration or spoilage during transport. In our view, there are strong tailwinds for innovative companies that can reduce food waste emissions. Investors can play this theme across the value chain, a good example being companies which produce fuel-efficient refrigeration units.

Source: Our World In Data, March 2020.

Real estate impacts energy efficiency, air quality, water and waste management, as well as biodiversity preservation. In this space, investors can look for companies that play a key role in facilitating the transition, such as building insulation businesses. These can play a major role in liaising with their suppliers to reduce carbon emissions across their value chains.

Source: Our World In Data, March 2020

Green bonds issued by governments or supranational entities channel money into green projects, particularly in EM. These projects are focused on areas such as energy efficiency, clean energy and climate change adaptation. Being less volatile than conventional bonds, they are considered an attractive investment vehicle. Sustainability-linked bonds (SLB) incentivise issuers’ achievement of predefined sustainability / ESG goals through KPIs and sustainability performance targets within a predefined timeline. These tools are another way to finance the energy transition.

Source: CMS study of the KPIs used in SLBs, May 2023.