Summary

Key highlights

Context for European insurance companies

- Opportunities: interest rates and spreads* retracement* (higher yield environment), closing of duration gap

- Headwinds: Recession risk / lapse risk / liquidity risk

Three factors contributing to the shift of portfolios towards more liquid assets

- Concerns about the lapse risk*

- A desire to capitalize on interest rates as well as market spreads

- A greater attention on portfolio liquidity risk

Four actionable ideas to adapt your existing portfolio to the transition

- Restrike existing portfolio yields to remain attractive for clients: reinvesting in a higher yield environment or liquidate assets maturing in 2023, early 2024 or early 2025, while offsetting potential negative accounting impacts through realizing gains (e.g. through the selling of existing equity investments which have fared rather well).

- Adapt your accounting budget, tools & execution capacities

- Pay attention to potential recession risk: review your allocation to higher quality and traditional assets to prepare for potential complexities to come on the growth space and stabilize your balance sheet volatility through the use of overlays

- Manage liquidity risk: conduct stress test and set up repo capacities to be able to mobilize funding through the portfolio

Four investment opportunities to transition to more liquid assets

- 3-5 year credit: a sweet spot between yield optimization and potential drawdowns

- Covered bonds: capitalize on swap spread repricing

- Govies and Agencies or alternatively receiver swaptions to minimize the risk of reinvestment

European Insurance companies started 2023 with high solvency ratios and a good outlook to improve their underlying profitability thanks to strong rate increases in reinsurance, and commercial P&C, while 2022 prices increases in retail P&C are slowly mitigating inflation. Besides, companies have good prospects of improving further their recurring investment income, with Q4 2022 reinvestment rates being much higher than FY 2022. Arguably, the insurance sector is also facing several headwinds, some of which are just a continuation of 2022 themes. This is impacting several dimensions – be it on the assets or the liabilities side.

In this Insurance Fixed Income Outlook, we focus mainly on the asset side of the equation, looking at how insurance entities have begun to adapt to this new environment and suggesting some avenues to explore for the years to come.

1. Transition to more liquid assets

Lapse risk has been a big topic in recent weeks notably in the wake of Silicon Valley Bank (SVB), Credit Suisse (CS) and Euro Vita stories. Even if those events can be seen as specific, this situation has led to the emergence of several interrogations in the market.

Lapse risk* concern

In an environment of increased uncertainty, we are seeing a preference for liquidity among our insurance clients. Indeed, the potential redemptions of their client base require more liquid assets in the portfolios, in a context where there are still some natural impediments to lapse risk.

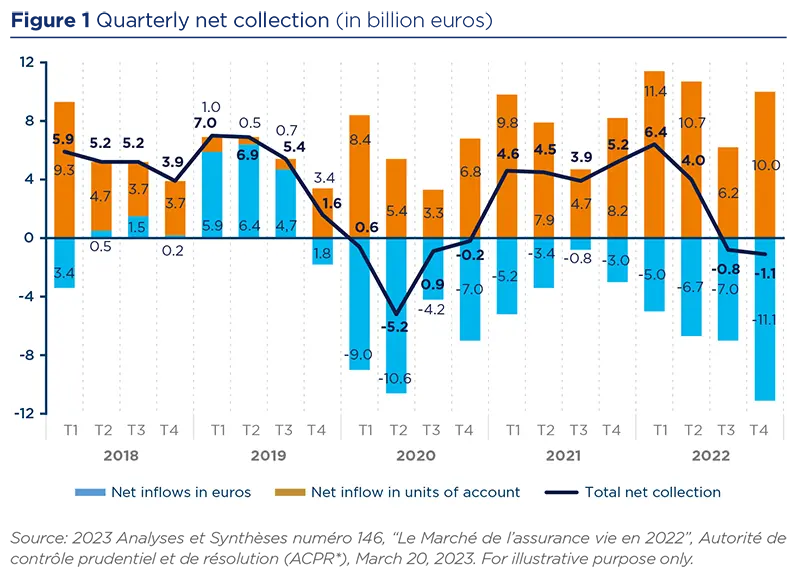

As seen below in Figure 1, in the French market, euro-denominated products experienced high outflows in the last quarters – €11.1 billion in the last quarter of 2022. In contrast, unit-linked products have seen a historic net inflow.

Lapse risk has been a big topic in recent weeks notably in the wake of Silicon Valley Bank (SVB), Credit Suisse (CS) and Euro Vita stories. Even if those events can be seen as specific, this situation has led to the emergence of several interrogations in the market.

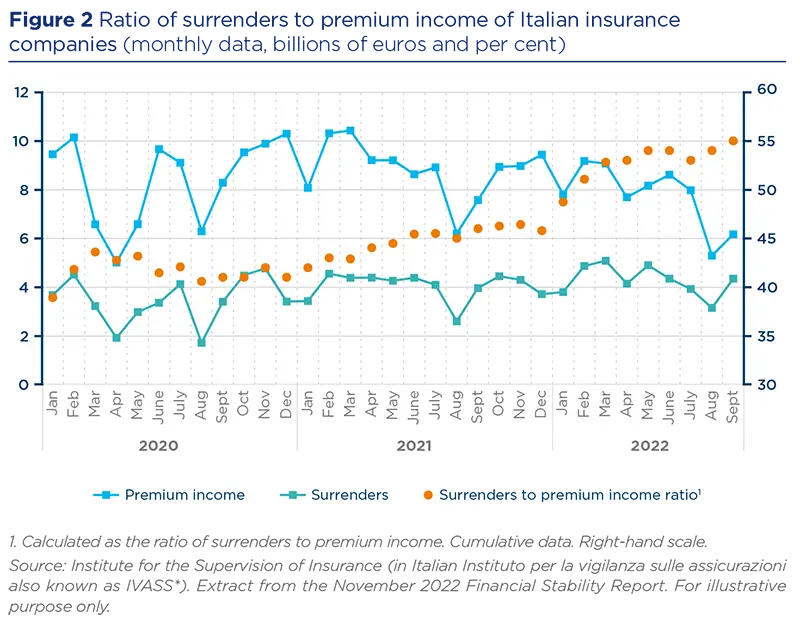

The Figure 2 below shows that the ratio of surrenders to premium income of Italian insurers rose to 55% in September 2022, 9 percentage points higher than in the previous year. This results from an increase in surrenders along with declining premium income, which can be attributed to competing products such as BTP, and to the need for increased liquidity of policyholders brought about by the macroeconomic environment.

However, comparing banks and insurance companies solely based on their lapse risk exposure may overlook their differences too quickly, notably with regards to the various impediments that prevent general account policyholders from redeeming in mass.

Looking at a few European countries

In France, there are significant tax incentives not to lapse one’s life insurance policy:

- Inheritance tax: Both general account and unit linked policies can be transferred to the next generation in an inheritance process without tax, up to a certain amount

- Policyholder tax benefits kick in after 8 years. If the policy holder lapses before, they lose this favorable tax treatment

If a product is held in Germany for more than 12 years, half of the capital gains are tax free. In addition, if customers lapse in the first few years, then they can lose their terminal bonus accrued.

In Italy, there are no tax advantages related to life products. However, several companies do charge a surrender penalty in the first 5 years, e.g. a 2% charge if the surrender occurs in year 2, or 0.5% charge if the surrender occurs in year 5. In addition, these products are often sold as bundled products with protection riders and insurance coverage, so they are not comparable to pure financial investments.

Life insurance products in Belgium limit lapse risk through a mechanism of market value adjustment if the policyholder lapses before the maturity of the contract, on top of more negative tax treatment.

Lapse Risk Stress under Solvency 2

On top of that, under Pillar 2 of the Solvency Framework, insurers use their own risk and solvency assessment, in which they identify and assess in particular some specific risks related to their business.

Life insurers have to hold capital under the Solvency framework for various types of risks, including lapse risk, which is part of the Life underwriting risk module.

This obliges insurers to stress the lapse situation by using three scenarios and taking the most costly in terms of own funds for the company:

- The first scenario shows a permanent increase in lapse rate by 50% of the rate

- The second shows a permanent decrease in lapse rate by 50% of the rate

- The last scenario shows a mass lapse event, with an immediate shock putting the lapse rate at 40%

The company then has to hold an amount of own funds reflecting the most punitive of the three scenarios. This is conducted as part of Pillar 1 of the Solvency 2 Framework. Lapse risk is also covered by the liquidity risk module, which stresses the liquidity position of the insurance company.

On top of that, under Pillar 2 of the Solvency Framework, insurers use their own risk and solvency assessment, in which they identify and assess in particular some specific risks related to their business. For Life insurance, lapse risk is a component of that evaluation: companies run stress scenarios and adopt mitigating measures accordingly.

Benefitting from rates and spreads retracement opportunity

Incidentally, the great repricing we have seen on the liquid fixed income market has led to three major consequences that have been impacting insurers’ investments in 2023:

- Overall, risk free rates and spreads retracement have led to fixed income becoming investable again, notably vis-à-vis the usual hurdles of minimum guaranteed rate levels and distribution networks remuneration

- Thanks to the actions mentioned above, we have now moved in a negative correlation world between equity / risk assets prices and bond prices, enabling fixed income to regain its diversification status in the balance sheet

- The pricing relationship between liquid fixed income and Alternative assets not being linear in nature – even between liquid and illiquid fixed income – the huge retracement and volatility of prices in the liquid space has sometimes led to some pocket of relative value in one universe vs. the other. As a result, a lot of Insurers have decided to review the hurdle rates they want to obtain on alternatives vs. liquid assets and to stick to this renewed discipline by targeting entry points.

As a consequence, we have seen insurers willing to capitalize on rates and spreads retracement to go for liquid investments, thereby reversing the last years trend of an increase in the Alternatives footprint.

That is not to say that they have completely retreated from Alternatives, but rather insurance companies have rebalanced their reinvestment flows towards more liquid assets.

Such moves do not really yet show in EIOPA asset allocation as of Q3 2022, because of last year’s -10% to -15% price impact on the liquid fixed income universe. However, it should show through time if this trend persists.

2. Investing in this new framework

An additional consequence of the 2022 risk free rate retracement has been the partial and sometimes complete closing of duration gaps (measured as the difference between the weighted average duration of the liabilities and the weighted average duration of the assets).

Hence, the search for duration is no longer a hot topic, meaning that Insurance companies can more simply allocate fixed-rate and floating-rate assets without having to limit themselves to long-term fixed-rate assets or to pair floating-rate investments with derivatives fixed rate receivers.

Our current recommendation for the 2023 Investment plans are therefore:

- Consider 3-5 year credit as it offers a sweet spot between yield optimization and potential drawdowns, especially in a recessionary environment

- Consider Covered bonds* that have a renewed interest thanks to swap spread repricing and a good rating profile, thus a low cost in SCR

- Govies and Agencies or alternatively receiver swaptions to minimize the risk of reinvestment

3. Restrike existing portfolio yields to remain attractive for clients

One of the fears behind the potential lapse risk materializing is the discrepancy between portfolio yields when the portfolio has been constituted in the past in a much lower yield environment and current market yields.

One of the fears behind the potential lapse risk materializing is the discrepancy between portfolio yields when the portfolio has been constituted in the past in a much lower yield environment and current market yields.

Due to this, if impediments are not strong enough, there is a risk that policyholders may shop around for products offering more updated yield targets, in the Insurance space or not. This can be seen as the equivalent to the increase of deposit Betas* for the banking sector.

Reinvest in a higher yield environment

One way to address this is to try to support such a rise by reinvesting in a higher yield environment. However, this approach takes time as it only involves the proceeds (by redemption and coupons) of the fixed income portfolio and new inflows.

Sell rapidly-maturing securities

To hasten the approach, insurers can liquidate assets maturing in 2023, early 2024 or sometimes going as far as early 2025, while offsetting potential negative accounting impacts through realizing gains. These gains can be realized in the equity side as these markets have been experiencing a fairly good period in recent months, generating a lot of unrealized gains across entities.

Pay attention to market access and quality of execution

In the execution of such program, great attention must obviously be paid to market access and quality of execution to avoid destroying value by penalizing bid/offer* being applied to those operations.

Allocate an adequate accounting budget

It also requires allocating an adequate accounting budget and adapting tools to track it over time through appropriate planning and execution monitoring to optimize performance while minimizing losses.

4. Place greater awareness on liquidity risk

Alongside an increased scrutiny of portfolio liquidity and its liquidation schedule we also advise our clients to conduct stress tests with regards to their derivatives books in order to identify wrong-way liquidity risk* that may materialize during current volatile market episodes.

Paying more attention to liquidity risk can be done following a two-pronged approach: looking more closely at your investments and considering new tools and techniques, as described below.

Paying more attention to liquidity risk

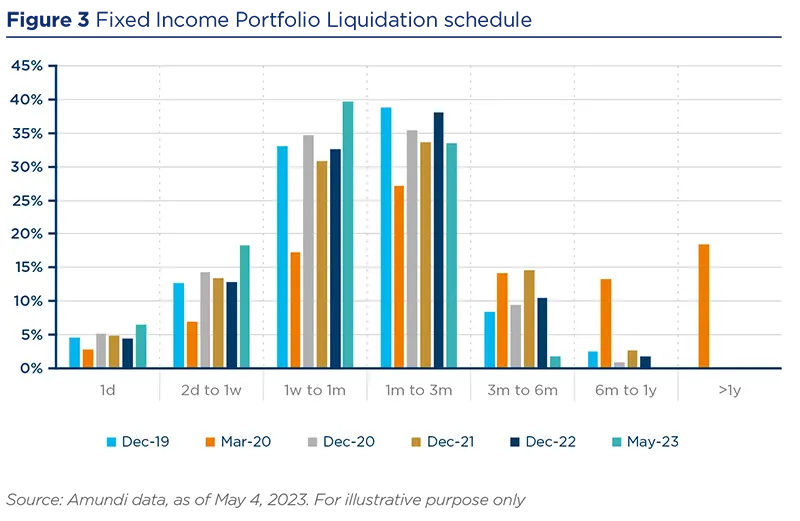

When considering adding new investments to their portfolios, insurers do not just consider the yield/SCR* and its diversification impact, but also the contribution of such additional flows to the overall portfolio liquidity of the scheme. As illustrated in the Figure 3 below, we regularly produce the analysis of portfolio liquidity for our clients based on our trading desk’s proprietary data.

Mobilizing funding through the portfolio: setting up repo capacities

Alongside an increased scrutiny of portfolio liquidity and its liquidation schedule we also advise our clients to conduct stress tests with regards to their derivatives books in order to identify wrong-way liquidity risk* that may materialize during current volatile market episodes.

Naturally, we also advise insurance companies to get organized to be able to smoothly mobilize a part of their portfolio against funding to cope with unforeseen lapse events.

The most natural instruments and techniques to use revolve around repurchase agreements (repos*). However, this implies following several steps that can prove complex for insurance companies:

- Negotiating market standard contracts (GMRA* and GMSLA*) with the different counterparties

- Identifying assets that can be mobilized and track prices & haircuts

- Testing operational frameworks

- Delegating, when relevant, certain parts of the value chain

- Correction of reinvestment policy and authorized vehicles

5. Reduce net risk in preparation of potential recession

Investigate avenues for stabilizing your balance sheet volatility through the use of overlays over your existing investment.

There are two essential angles to consider when managing an investment portfolio in anticipation of potential market complexities that may arise in the future:

- Review your current investments: This involves carefully examining your current fixed income portfolio and making adjustments to prepare for potential complexities to come on the economic growth space (notably the sector allocation of the corporate bonds bucket of your fixed income portfolio)

- Investigate avenues for stabilizing your balance sheet volatility through the use of overlays over your existing investment.

* Please refer to the glossary in the document for definitions of key terms used in this article.

Sources

- French Prudential Supervision and Resolution Authority (ACPR*), 2022.

https://acpr.banque-france.fr/sites/default/files/medias/documents/20230320_as146_av_2022_vf.pdf - Italian Insurance Supervision Authority (IVASS*), 2022.

- European Insurance and Occupational Pensions Authority (EIPOA) Statistics data, Q3 2022.

https://www.eiopa.europa.eu/tools-and-data/insurance-statistics_en

With the contribution of Fabien Wagner, Senior Credit Analyst, Amundi AM