Summary

The Fed’s employment mandate taking centre stage

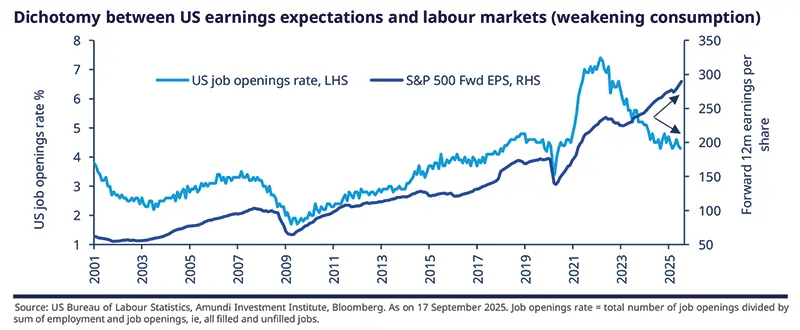

US bond yields have declined over the past couple of months, and gold has touched records levels. Global and US equities have also reached new highs on the back of expectations of continued economic strength in the US, the monetary easing cycle, earnings resilience, and AI-led momentum. We see an inherent contradiction here, but agree with the monetary easing aspect. The contradiction arises from the view that if the Fed implements rate cuts mainly to address a slowing economy, then the effects of a slowing economy should already be evident in weak labour markets, consumption, and eventually in corporate earnings.

The aforementioned topics, including economic growth, inflation, and monetary easing, will likely unfold as follows:

A stagflationary environment gaining ground in the US (slowing economic growth, with high inflation expected in the near term). A deceleration in consumption will be the key variable affecting growth in the second half this year, as labour markets continue to soften and concerns over wage growth persist. On the other hand, we expect the CPI to remain above the Fed’s 2% target in the near term, and pick up in the coming months. Consequently, real income growth and disposable income will be squeezed.

The Fed and BoE may be forced to reduce policy rates (despite sticky inflation) as pressures on the growth front increase. We maintain our expectation of two further rate cuts by the Fed this year, each of 25 basis points, and two more in 2026, with terminal rates reaching around 3.25% by the end of the first half of next year.

We see one risk on monetary policy: the ECB turns out to be (over) cautious and cuts policy rates by less than what’s needed, sticking to its price stability mandate.

In contrast, the ECB is expected to cut rates less than the Fed. It will still remain data-dependent before taking any action on rates, once this year and once next year, in our view. Our terminal rate expectations remain unchanged at 1.50%, to be reached in the first quarter. While the ECB has raised its growth forecasts for this year, it has importantly lowered its projection for next year.

Fiscal policy pressures will persist in the Eurozone, the US, and UK. Germany is one exception in Europe given its fiscal space, and that should be supportive of growth, but to what extent it boosts the European economy remains to be seen. In the US, we could see volatility around negotiations to avoid a government shutdown as we enter the last part of the year.

- Chinese growth is slowing, but the deceleration is unlikely to prompt authorities to implement substantial fiscal/monetary stimulus because growth is still expected to remain close to its target, and external uncertainty has been receding. However, uncertainty over relations with Taiwan still lingers. Regarding India, the case for additional secondary tariffs by the EU is weak, as talks between the EU and India are progressing well. Even in the case of the US, we expect relations to improve gradually.

While we note some divergences in monetary policies, a willingness to support the economy is there. In this backdrop and when risk assets valuations are high, market volatility could present an opportunity to add risk on the more stable, quality segments of the market.

| Amundi Investment Institute: ECB-Fed divergences and impact of US inflation on Europe |

The divergence between the US and EU will pose dilemmas for the ECB. As the Fed continues on its path to reduce rates more aggressively than the ECB, an appreciating EUR/USD exchange rate, coupled with US tariffs, would significantly weigh on EU exports and, ultimately, on growth. At that point, the ECB will have to decide how to respond. Second, rising US inflation and higher term premia may put upward pressure on US yields at the long end of the yield curve. This could affect long-end yields in Europe as well, and may pose challenges for governments burdened with high debt and fiscal deficits. Services constitute a larger component of the overall US CPI, so we are monitoring whether changes in goods prices (due to tariffs) will impact services. Second, companies’ ability to pass on higher goods costs to consumers depends on several micro-level factors, such as corporate pricing power, the expected extent of substitution by consumers, and the elasticity of demand. We believe a combination of price hikes and absorption of higher costs by companies is the most likely scenario. |

Although the trade agreement with the US has reduced uncertainty over tariffs, we believe that once the effects of higher tariffs begin to weigh on growth in the EU, the ECB will be prompted to cut policy rates — once this year and once in Q1 next year.

Our mildly positive risk stance is outlined across asset classes below:

In fixed income, central banks in a rate-cutting mode (with some divergences) in a non-recessionary environment should be beneficial for corporate credit. On yield curves, we maintain our curve steepening views.

Global equities have been driven by multiple factors led by optimism around tech and tech capex. We would like to stay grounded and true to fundamentals, with a constructive stance on US value, and UK and European small and mid-caps. Our aim is to maximise idiosyncratic factors and get more granular.

A multi-polar world enhances the appeal of the diverging emerging world. Trade tensions between the US and emerging markets including China and India are important factors and so are Fed policies, and domestic central banks’ policies, in deciding EM returns. We remain positive overall on the asset class.

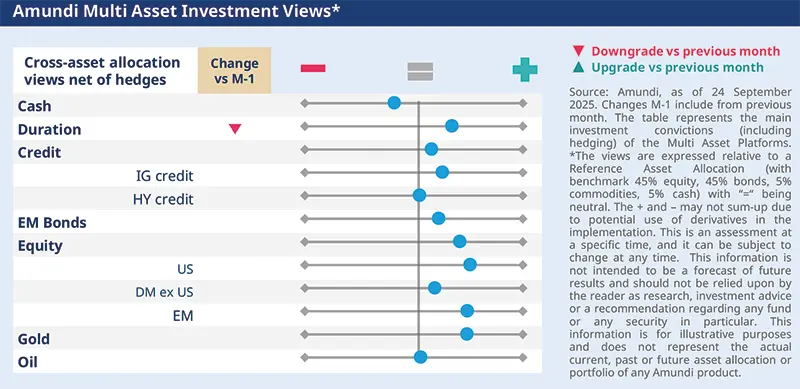

In multi-asset, we are assessing the short-term inflation outlook and fiscal pressures, in countries such as the UK. We moved tactically neutral on duration there but keep a positive view on duration overall. This is well-balanced through our constructive approach on equities, credit, and emerging markets. We also see the need for adequate safeguards in equities, and the role of gold as a portfolio stabiliser.

While staying positive on risk, we await signals on how AI technology could improve productivity and provide a boost to corporate margins. We prefer to play on fundamentals.

FIXED INCOME

Benefit from income potential in credit

Amaury D’ORSAY |

We are witnessing an odd combination of slowing economic growth in the US and some risk assets reaching record levels. In the Eurozone, the impact of US tariffs and German fiscal boost on growth is yet to be seen. Amid all this, the Fed has initiated its rate cut cycle, despite no signs of recession. Even the ECB, which we expect to stay data-dependent, will likely reduce policy rates as we enter the year-end phase.

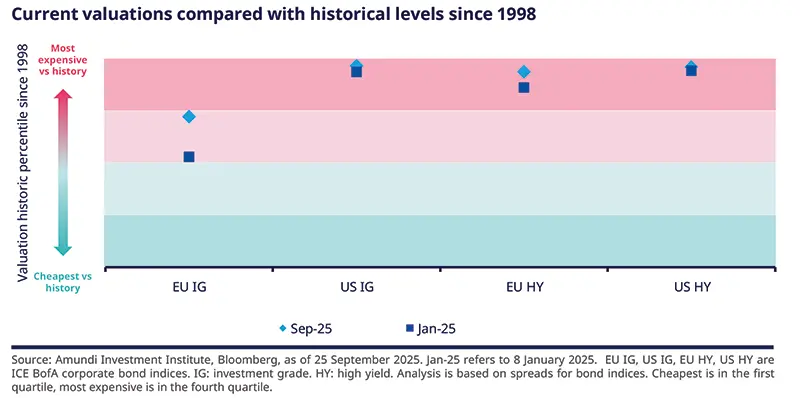

We think rate cuts by central banks could likely enhance the appeal of income-generation potential in credit markets, but investors should be mindful of valuations and quality. Hence, this is an opportune time for identifying those segments where carry is attractive and fundamentals reasonably strong.

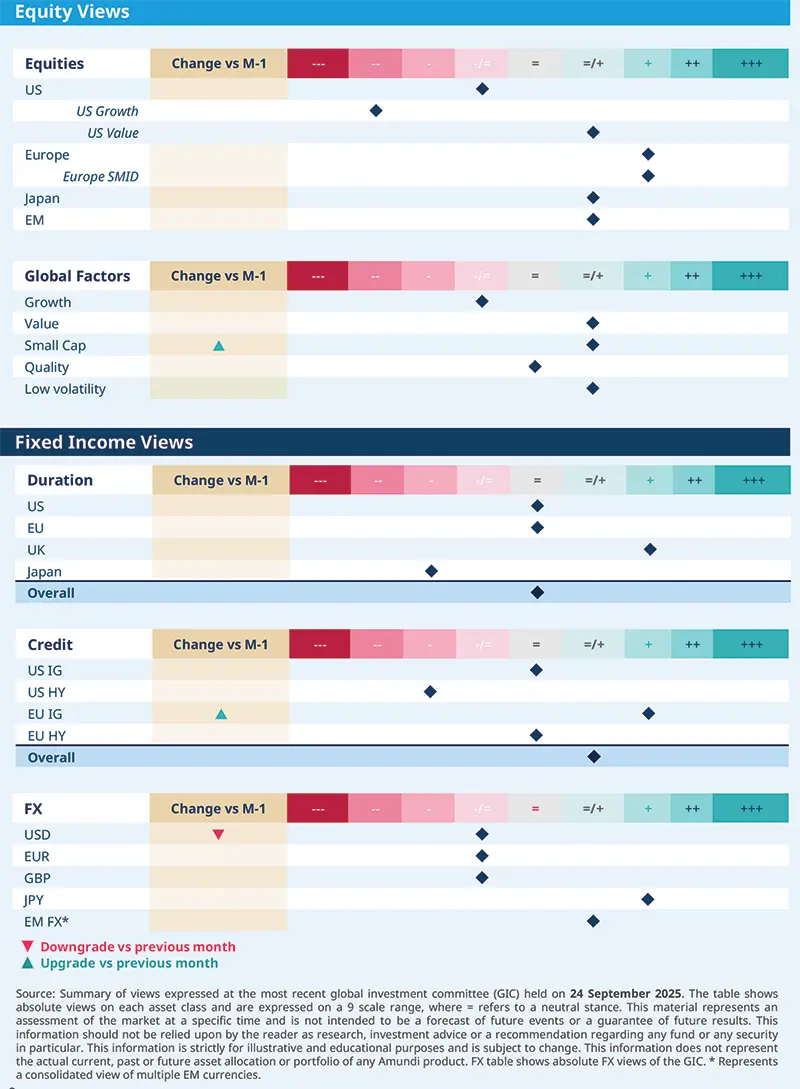

Our view on duration is neutral, including on the US and EU. In the US, we are tactically cautious on the short end (2Y) which is now expensive, but we are positive on inflation-linkers.

Relatively, we slightly favour the EU over the US, and also like EU peripheral debt.

On yield curves, we believe steepening in the US (5-30Y) and in EU (5-30Y) should continue.

Finally, we stay positive on UK duration and cautious on Japan.

We upgraded EU IG as corporate fundamentals remain solid and the trade deal with the US has boosted sentiment. In particular, we favour medium-term maturity (3 to 7 year) instruments in the BBB and BB-rated credit.

We also like short-dated instruments in subordinated financials and corporate hybrid securities.

At a sector level, we like banks, insurance, and real estate.

The dollar currently doesn’t show strong directionality. We turned cautious again, following the market’s repricing of the Fed’s rate cut expectations. It will remain our main focus in light of the political pressure on the Central Bank.

Wage inflation pressures in Japan are likely to encourage the Bank of Japan to increase policy rates. We remain positive on the yen. However, we are cautious on the EUR and the GBP.

EQUITIES

A pinch of salt on AI-euphoria

Barry GLAVIN |

US markets, and to some extent global stocks, have been led by positive newsflow around the AI theme, but we believe markets are over-optimistic on the massive capex plans around this theme. The key question is: what if something cheaper (like the ‘DeepSeek moment’) and faster emerges, and how could that affect the return on investment? Additionally, fiscal expansion and central banks cutting rates are adding to that enthusiasm. To us, this presents the biggest vulnerability.

And hence risk management is getting more important. At the same time, we are identifying granular themes such as corporate reforms in Japan, income generation in the UK, and fiscal boost in Europe (beneficial for mid and small-caps). Overall, our focus remains on quality business models and valuations.

We favour Europe and Japan over the US due to valuation and market concentration concerns.

Europe seems well-positioned to mitigate tariff-related impacts through fiscal and monetary policy reforms aimed at enhancing competitiveness at the EU level, and declining energy costs.

We retain a positive tilt towards UK equities given their attractive relative valuation multiples and higher yields. In addition, the market is attractive as a diversifier, given its defensive characteristics.

In Japan, we are positive on the corporate reform story, as the drive to improve profitability, capital returns, and valuations continues. Also, we are playing interest rate normalisation through the banks and insurance companies.

In the US, we prefer value stocks, as the top-heavy tech sector valuations are trading near record levels. We also like US banks, as we expect the current favourable market conditions to continue, with the banks benefiting from low credit costs, deregulation, and accelerating loan growth. Elsewhere, we are positive on the capital goods sector, as the industry is well-positioned to benefit from the secular themes of automation, sustainability, and reshoring driven by government policies.

In Europe, we like the mid-cap segment given its attractive valuations versus the large-cap stocks and potential to benefit from Germany’s fiscal shift and defence spending. Additionally, volatility in countries such as France could provide opportunities in quality cyclical stocks.

EMERGING MARKETS

Emerging markets in a multi-polar world

| Yerlan SYZDYKOV Global Head of Emerging Markets |

Although the US’s economic clout remains dominant, EM countries that can adapt and position themselves around new technologies (such as AI in China) and the reshaping of global supply chains (such as India) will be the beneficiaries of this shift towards multipolarity. More recently, for us, the main topic of internal debate has been the dollar weakness and how the Fed’s monetary easing and Trump’s policies and pressure could affect the currency.

From a structural perspective, EM continue to offer opportunities for selection and diversification, relatively delinked from the global cycle. Hence, we remain overall constructive with a keen focus on the Fed, EM country-specific factors, and geopolitical risks.

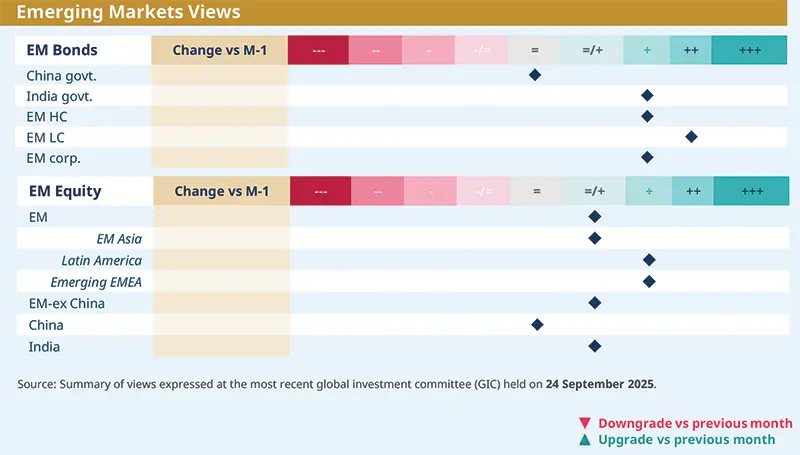

We are constructive on EM bonds and are particularly assessing monetary easing, inflation backdrop in domestic markets, and the dollar weakness.

Local currency debt should be supported by continued EM growth and dovish inflation expectations. For instance, we like Latin America and high-yielding selective frontier markets.

Carry is attractive in hard currency debt in which technicals are suportive. Overall, we favour HY over IG, and are selectively positive on Sub-Saharan Africa, emerging Europe, and Latin America.

In Latin America, Brazil and Mexico present attractive investment cases given their low valuations and the outlook for declining US and domestic interest rates.

We are neutral on Chinese equities, and are exploring whether the technology sector could present opportunities.

In India, the positive long-term outlook is blurred by US tariffs. We are monitoring the negotiations with the US and EU closely. If Trump’s softening stance towards the country stays, sentiment may shift rapidly.

| Main convictions from Asia |

Strong performance across Asian markets continues, driven by fading tariff risks and rising global risk sentiment. Trade activity has remained resilient despite tariff scares, while limited inflation is allowing Asian central banks to maintain an easing bias. Globally, the Fed’s resumption of rate cuts should keep the dollar on the back foot. A weak dollar, combined with robust investor sentiment, typically creates a favourable environment for Asian markets. Asian assets well-positioned in a global context. Earnings forecasts for Asia remain mostly positive. Technicals and sentiment are also strong, and equity valuations remain attractive compared to developed markets. However, selectivity is crucial as market performance has been uneven. We are positive on India following recent market consolidation and solid earnings growth, while adopting a more cautious stance on Korea after its strong market re-rating. For bonds, we expect credit spreads to continue grinding tighter, supported by a strong technical backdrop. New issuances are easily absorbed by markets, with investors continuing to hold plenty of dry powder. Lower US Treasury yields are keeping Asian bond markets well supported. However, we are closely monitoring the political and social events in Indonesia and how that has affected government bonds. |

MULTI-ASSET

Fine-tune duration amid evolving inflation

Francesco SANDRINI CIO Italy & Global Head of Multi-Asset | John O’TOOLE Global Head - CIO Solutions |

While staying positive on duration overall, we are now neutral on UK gilts due to near-term inflation pressures and the fiscal outlook in the country.

US economic activity is likely to slow in the second half of the year due to weak consumption, which is a dominant part of the economy. We also expect some resilience in inflation in the near term. Even in the UK, the Central Bank is grappling with an uptick in price pressures. In Europe, however, the environment is slightly different in the sense that inflation is under control for now. On risk assets, while valuations are high in some segments, we maintain a slightly positive risk stance (without bold calls) led by fundamentals and earnings potential. At the other end, we reiterate the need for hedges on equities and other portfolio diversifiers/stabilisers such as gold.

Our constructive stance on equities is maintained through the US, the UK, and emerging markets. In the US, earnings momentum, a dovish Fed, and technological advances are positive factors for the benchmark markets. But we maintain a well-diversified approach and are positive on mid-caps, which have lagged the broader markets and are mainly focused on the domestic US economy, outside of the large-cap tech sector. Furthermore, we are optimistic on EM equities in general and on China. Monetary easing by the Fed opens up room for EM central banks to boost their domestic growth environment.

We remain positive on duration overall, including on the US (5Y), and core EU and Italian BTPs vs Bunds. However, we believe UK inflation, particularly in services, is showing an upward trend, at a time when markets are increasing the scrutiny of the yet-to-be-released government budget. As such, we have tactically downgraded UK duration to neutral, and stay cautious on Japan due to valuations and expectation of a rate hike by the BoJ. In credit, we are constructive on EU IG, and on EM spreads.

In the medium term, the USD looks set to be pressured by structural factors such as high debt, allowing us to stay cautious. We are positive on EUR, JPY/EUR and in EM, we continue to favour MXY over CNY.

VIEWS

Amundi views by asset classes

Definitions & Abbreviations

Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.