Summary

Markets were highly volatile following President Trump’s threats to impose tariffs on several NATO members unless the US was allowed to purchase Greenland. Equities dropped sharply early in the week, with the Stoxx Europe 600 and S&P 500 both seeing significant declines, and volatility spiked. Sentiment improved after Trump ruled out military action and abandoned the tariff threat, leading to a relief rally. Japanese government bond yields rose, as doubts about fiscal trajectories remain a key risk to monitor. Gold remains the main beneficiary of geopolitical uncertainty and debt concerns, reaching new record highs.

Tensions have eased for now, but a regime of ruptures and controlled disorder on the geopolitical front is here to stay. If the tariff threat resurfaces or the Greenland deal falls through, the EU is likely to reinstate higher tariffs and pursue targeted retaliation. Legal developments, such as pending US Supreme Court decisions and the possible use of the EU’s Anti-Coercion Instrument, are also acting as constraints on further escalation. Trump will likely try to extract maximum concessions, but for now, the immediate tariff threat is off the table.

In this environment of geopolitical uncertainty but supportive economic fundamentals, a globally diversified stance is essential. We look to broaden opportunities in global equities, including, for example, small/mid-caps in Europe and Japan that can benefit from domestic demand, and EM equities like Brazil and India. We maintain a balanced approach in fixed income with a preference for EU/UK duration and Italian BTPs, and we favour in DM corporate credit (especially EU IG financials) and high-yielding EM bonds. Gold remains a preferred portfolio stabiliser amid ongoing uncertainty.

What is happening in the market and what are the driving forces?

Markets were volatile in the past few days following a weekend escalation centred on President Trump’s threats to impose additional tariffs on eight NATO members unless the US was allowed to purchase Greenland from Denmark.

Equities were hit hardest early in the first two days: the Stoxx Europe 600 and the S&P 500 fell early in the week, while the VIX (the equity volatility index) rose to 20 on Tuesday, its highest reading since November 2025. Sentiment improved on Wednesday after President Trump ruled out military action, announced the emergence of a “framework” for a Greenland deal following a meeting with NATO Secretary General Mark Rutte and abandoned the tariff threat against EU members, prompting a relief rally.

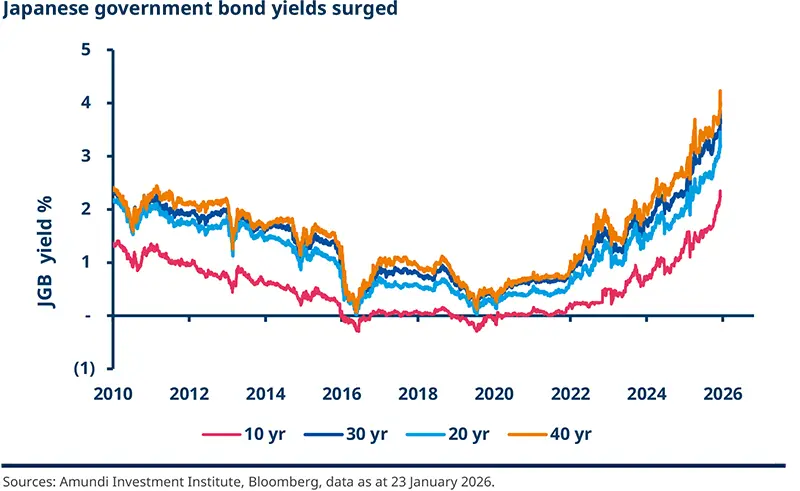

Japanese bond yields surged. The second theme that has affected markets in January is the prospect of Japan’s large fiscal boost in case of a victory for Prime Minister Sanae Takaichi at the upcoming election on 8 February. A general election win will validate the view of Japan’s pivot toward economic expansionism, weakening the long-standing expectation of fiscal restraint. Recent moves in Japan’s ultra-long yields pushed up borrowing costs worldwide, highlighting concerns about the fiscal positions of major economies. Yields on 40-year Japanese government bonds surged to levels not seen since their introduction in 2007 and long-dated US Treasury yields also rose to their highest levels since September 2025 before retreating. Secondly, we’ve seen a durable rise in Japanese inflation, which has been higher in the last three years than in the previous twenty. While we think the Bank of Japan (BOJ) is likely to increase key rates, it is unlikely to go higher than 1%. Third, waning bond demand from the BOJ has driven yields higher — particularly in the 20–40-year sector — as markets absorb the new reality of Japan’s reflationary era. Overall, we think a combination of all these factors has pushed Japanese yields up.

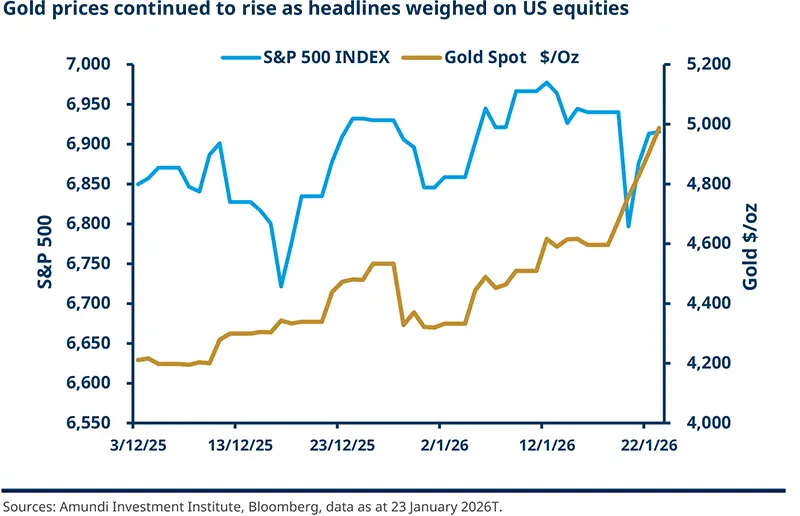

Gold continued to rise to new record highs at around $5,000 an ounce despite the easing of tensions, indicating that demand for safe haven assets remains firm. The US dollar weakened against major currencies, while international equities — particularly in emerging markets and Asia-Pacific — advanced as market participants favoured global diversification in an environment of still positive market momentum, but rising geopolitical uncertainty.

How is Trump’s push for Greenland evolving, and what could happen if the threat of additional tariffs resurfaces?

The week opened with Trump’s Greenland push entering a critical phase, as the US prepared to impose new tariffs on six EU countries, as well as the UK and Norway, with implementation expected on 1 February. The situation has since evolved, with a U-turn on the tariffs. In Davos, Trump also stated there is no intention to use military force to seize Greenland and claimed to have reached a deal on Greenland following his conversation with NATO Secretary General Mark Rutte. Details of the deal are not yet clear. Negotiations are ongoing through a high-level US-Denmark-Greenland working group. The agreement could grant the US 'total access' to designated defence areas and rare-earth minerals indefinitely.

For now, tensions have eased, with the EU expressing its intention to continue engaging constructively with the United States on all shared interests, including efforts to create the conditions for peace in Ukraine.

The initially announced tariffs, if enacted, would have breached the truce established last July, when the EU lowered its tariff rate to 15% and pledged not to retaliate. On 21 January, European lawmakers decided to pause the ratification of the tariff agreement and an extraordinary EU summit was convened in Brussels on Thursday evening. For now, tensions appear to have eased, with the EU expressing its intention to continue engaging constructively with the United States on all shared interests, including efforts to create the conditions for peace in Ukraine. The EU summit also stressed the importance of implementing the deal to stabilise trade relations, but also that the EU will defend its interests against coercion and is prioritising defence and competitiveness to strengthen its autonomy. On 12 February, EU leaders will meet informally to discuss (or, as they say, “brainstorm”) how to reinforce the single market in today’s changing global environment.

If Trump resumes the new tariffs or if, in the end, the deal is not ratified, the EU is likely to revert to its original 25% tariff rate, with an additional 10% applied to the countries specifically targeted by the US. In this scenario, the EU would likely resume its retaliation strategy. This would effectively break the current agreement. Notably, the EU’s approach to retaliation is expected to be more targeted, focusing on goods that are easily substituted to minimise consumer harm and on sectors that would exert maximum political pressure on US Republican constituencies.

Legal developments are also a key variable to watch. The pending IEEPA court decision may affect the legal basis for the US measures, and a Supreme Court ruling on the Trump-era tariffs is expected soon.

Another option for Europe that has been mentioned over the past week is the use of the EU Anti-Coercion Instrument (ACI), often referred to as the ‘trade bazooka’. This is a broader and potentially more disruptive tool, though consensus among member states is not guaranteed and operational deployment would take time. The ACI could also be accompanied by withdrawals of European capital from the US, which would have an even greater impact and seriously damage transatlantic relations. This is why the ACI is seen primarily as a deterrent rather than an immediate response.

The ACI is a legal tool that enables the EU to retaliate swiftly when a third country uses trade or investment pressure to force a change in EU or member state (MS) policy. The ACI is an EU regulation, which has been in full force since December 2023 and forms part of the EU’s economic security toolbox. Its purpose is deterrence: to dissuade countries from economic coercion by credibly threatening targeted countermeasures if diplomacy fails. It has never been activated.

First, the EC investigates whether a third-country measure (e.g. tariffs, import bans or investment restrictions) amounts to 'economic coercion' aimed at influencing the policy choices of EU MS. If coercion is found, the European Council must confirm this by qualified majority. The EC will then seek a solution through negotiations with the third country. If there is no satisfactory solution, the EC can adopt response measures via implementing acts. These measures must be proportionate, targeted, temporary and are periodically reviewed and lifted once the coercive measures have ceased.

The ACI allows for a wide range of responses: Countermeasures include increases in trade tariffs, restrictions on imports/exports, blocking access to EU public procurement markets, limitations on foreign direct investment, and restrictions on services or intellectual property. The instrument is designed to be flexible. Indicative timelines give the EC about 4 months to examine a case, the Council 8 to 10 weeks to decide on coercion and the EC up to 6 months to decide on concrete measures.

Investment implications

In uncertain times, global diversification is key — look at equities in Europe and emerging markets, credit in particular in Europe and add gold and hedges.

In an environment marked by ongoing geopolitical uncertainty but a still supportive economic backdrop, we believe it is essential to maintain a globally diversified stance. This includes seeking opportunities in regions and segments — such as emerging markets — that stand to benefit from improving domestic demand. Additionally, investors should consider implementing hedges against potential equity downturns and incorporating structural diversifiers such as gold.

In particular, our main investment convictions are:

USD weakness remains a structural trend, but in the short term, we are neutral – We affirm our convictions that, looking ahead, diversification away from US assets, including the dollar, will continue, driven by structural trends such as higher US deficits and debt and global central banks diversifying their reserves into non-dollar-denominated assets and more appealing bond yields in international markets such as Japan and Europe that can attract investor demand. From a more near-term perspective, the number of rate cuts that we expect from the Fed are already priced in the markets, and the economy is also showing signs of resilience. Thus, we are tactically neutral on the USD.

Continue to search for opportunities in global equities, including emerging markets, be mindful of concentration risk and maintain hedges – We are constructive on themes based on economic resilience to tariffs and international trade. For instance, in Europe and Japan, we like the small and mid-cap segments that are more domestically-focused. Europe should also see this as an opportunity to accelerate on the path to its strategic autonomy, and in this context, German fiscal stimulus is positive from a long-term view. Secondly, corporate governance reforms are continuing in Japan and offer strong opportunities over the long term. Tactically, following the recent gains, we’ve become more selective on Japan. Third, we believe capex in the artificial intelligence sphere would continue as countries such as the US and China fight for global dominance in technology. But here we do not like the hyperscalers, and instead prefer businesses that will benefit from demand for increased electricity, related equipment and deployment of AI. Finally, a combination of robust EM growth and Fed easing is positive for EM equities. We are positive on Latin American countries such as Brazil, neutral on China and constructive on India.

Fixed income requires a global approach across yield curves – Our overall duration stance is close to neutral but our views diverge across the curves. For instance, we are slightly positive on EU and UK duration, and also like Italian BTPs, given the country’s cyclical recovery and improving fiscal outlook (vs other European peers). In contrast, we are marginally cautious on the US and neutral on Japan. Interestingly, following the recent moves in Japan, bond yields are becoming attractive. Furthermore, Japanese investors may be tempted to reinvest part of their maturing Treasuries back into Japan and they will have to assess rising volatility in the JPY and in the Japanese government bonds.

DM corporate credit and EM bonds – We believe carry is attractive and search for yield is thus very much in place, but the case for selection is high. We like EU IG, and financials over non-financials in DM corporate credit. In particular, we like medium-term maturity credit, and the banking and real estate sectors. Within EM, we favour high-yielding bonds, and regionally, are positive on Latin America, sub-Saharan Africa and Indian bonds.

Gold will continue to benefit amid ‘Controlled Disorder’ – Gold should be the beneficiary of debasement of fiat currencies and of high fiscal deficits and government debt. Its portfolio stabilising traits are particularly beneficial in times when geopolitical tensions have become part and parcel of the asset management world.