Summary

The Fed will face a delicate balancing act when setting monetary policy, as it faces a slowing economy and labour market alongside high inflation and the passthrough of US tariffs.

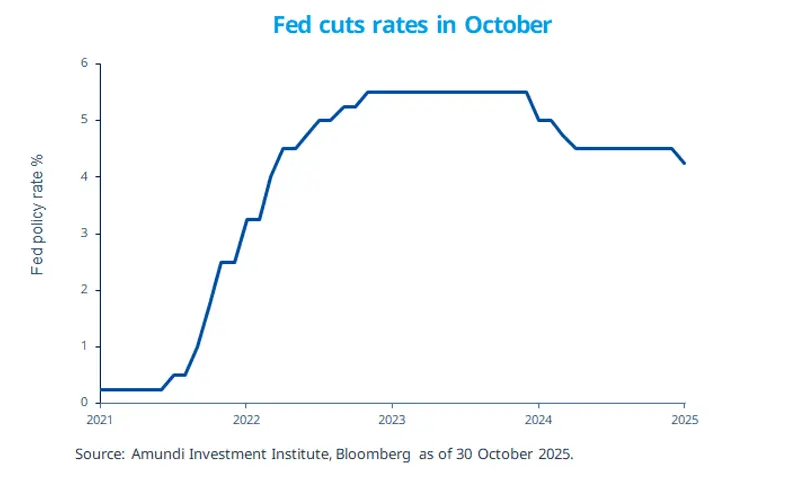

- The Fed cut policy rates, but the ECB left rates unchanged at 2% in October.

- The BoJ also kept rates unchanged at 0.5% after the January hike earlier this year.

- The BoE is expected to cut rates in December 2025; no move is expected this week.

At its October meeting, the Fed cut rates by 25bp to 3.75–4.00%, with Kansas Fed President Schmid dissenting in favour of keeping rates unchanged and Governor Miran preferring a larger cut. This reflects diverging views within the committee, with some members worried about inflation while others are more concerned about the slowing labour market.

At his press conference, Chair Powell said a December cut is not a foregone conclusion. They also announced the end of quantitative tightening -- that is, Fed balance sheet reduction to reduce the amount of liquidity in the economy -- from December. We judge that downside risks to the labour market are likely to prevail, potentially leading the US central bank to cut rates once more in December and twice next year, although we cannot rule out political pressure that may lead to more cuts. The rate path will also depend on the extent to which tariffs are passed on to consumers and on the speed of deceleration of services inflation.

This week at a glance

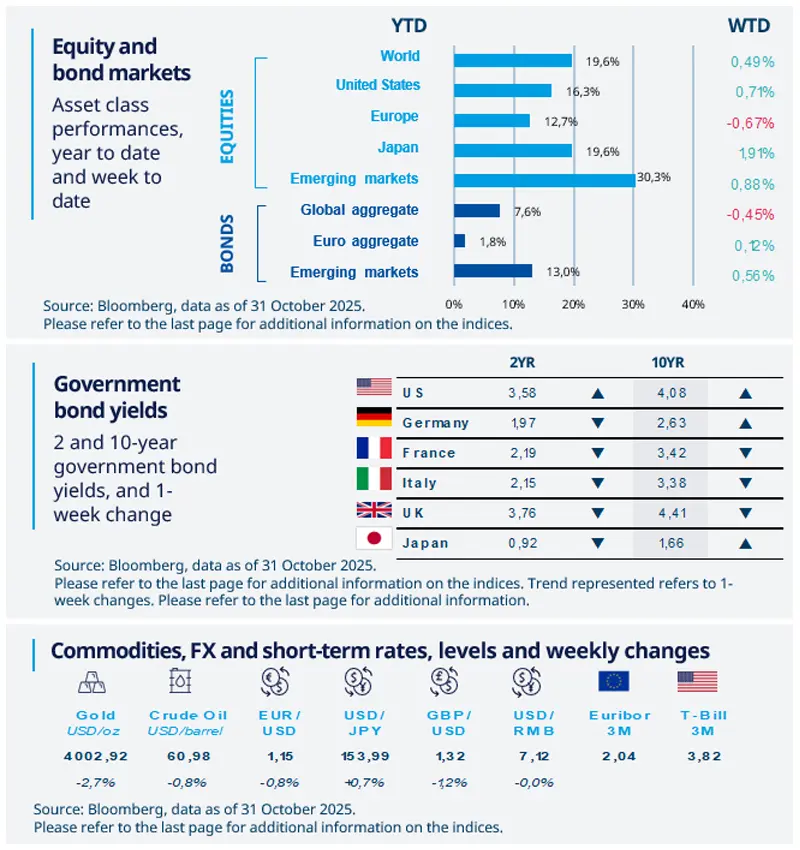

Most global stock markets rose following the extension of the US–China trade truce, strong US corporate earnings over the week, and optimism about the continuation of the artificial intelligence boom. However, comments from the Fed about future policy actions caused some volatility and led to a fall in gold prices. US bond yields rose.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 31 October 2025. The chart shows the Fed Funds target range (upper bound).

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Consumer expectations declined in October

US consumer confidence was slightly down to 94.6. The Present Situation Index improved, reflecting better views on current business and job conditions, while the Expectations Index declined due to weaker outlook for income, jobs, and business. Confidence varied by age, income, and political affiliation, with younger and higher-income consumers more optimistic. Inflation expectations stayed high at 5.9%, and expectations of interest rate hikes rose slightly.

Europe

EZ Q3 GDP surprises to the upside

Eurozone Q3 GDP rose 0.2% QoQ, above consensus and our forecast, implying modest upside risks to growth in 2025 and next year. France and Spain outperformed, driven by trade and investment in France and domestic demand in Spain. Germany and Italy were flat, with Germany’s weak outlook remaining intact. The print reduces immediate easing pressure for the ECB, but sector concentration, political/budget risks, supply constraints, and cautious consumers keep risks to the downside.

Asia

Asia: a dealmaking week

The US signed trade deals with Malaysia and Cambodia, and frameworks with Thailand and Vietnam, with reciprocal tariffs kept high at 19–20%. The US also finalised its trade deal with South Korea, keeping the $350bn investment pledge structure intact, with $200bn cash investments capped at $20bn annually and $150bn in shipbuilding cooperation, alongside a cut in auto tariffs from 25% to 15%. Korea’s funding for the investments will mainly come from FX reserve income and some USD bond issuance.

Key dates

China manufacturing PMI, US ISM manufacturing PMI |

BoE interest rate decision, Germany industrial production |

US non-farm payrolls and unemployment rate, China trade balance |