Summary

- The European Central Bank (ECB) raised its key policy interest rates by half a percentage point, lifting the deposit rate to 3.0%. It did not commit to future rate hikes, stressing that decisions will be made meeting by meeting and based on the data.

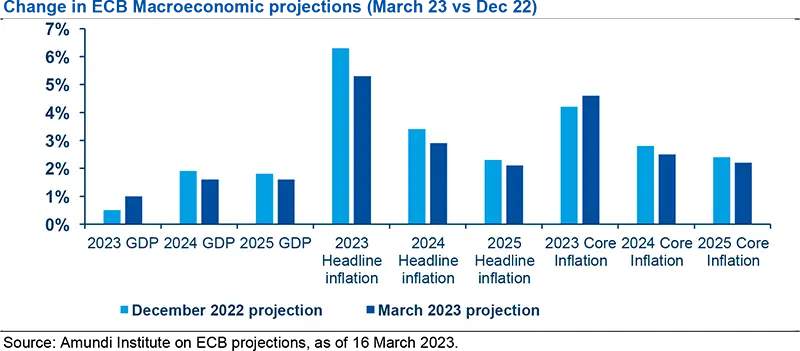

- Macro: The ECB lifted its 2023 GDP forecast while reducing its headline inflation projections. However, it also lifted its core inflation forecast for 2023.

- Banking sector stress: The ECB iterated its confidence in the euro area banking sector, which shows strong capital and liquidity positions. It did not announce new liquidity schemes but said it stood ready to act with its extensive policy toolkit.

- Investment implications: After a period where rate hikes have only had a muted impact on the economy, recent events tell us that a speed limit has been reached. We now wait for next week’s FOMC decision but, overall, steepening is coming. Agility is the name of the game, as dispersion will generate active opportunities.

What are the main takes from today’s ECB monetary policy committee?

The European Central Bank raised its key policy interest rates by half a percentage point, lifting the deposit rate to 3.0%. However, it did not commit to future rate hikes, Lagarde stated that “it’s not possible to determine at this point in time the future path for rates”. Decisions will thus be made meeting by meeting and based on the data, in line with Lagarde’s description of the current ECB reaction function “Rate decisions will be determined by its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.”

What is the ECB’s assessment of the inflation situation?

While admitting risks, the ECB sees the fight against inflation as its main priority.

The ECB stressed that inflation remains a major concern: “Inflation is projected too high for too long”. In particular, the ECB is concerned about the strong diffusion of high energy prices for the rest of the economy. Christine Lagarde underlined that 1. Demand is supported by expansionary fiscal policy; 2. The Eurozone labour market is tight, with wages accelerating; 3. Many firms were also able to raise their profit margins.

Indeed, the disinflation process is slower than expected: While headline inflation declined to 8.5% in February, this was mostly energy related. Both food prices and core inflation are on the rise. At 5.6%, core inflation is stronger than ever. Against this backdrop, the ECB’s projections for 2023 core inflation were revised higher to 4.6% versus 4.2% in December.

How were growth projections revised?

The new ECB projections confirmed a macro momentum that is less bad than previously expected.

Compared with the December forecast, baseline projections for growth in the euro area in 2023 have been revised upwards to 1%, due to lower energy prices and better resilience of the economy in relation to a difficult international environment. At the same time, the rebound in growth expected in 2024 and 2025 has been revised lower, due to the effect of tightening monetary policy. The ECB now sees GDP at 1.6% in 2024 and 2025 (vs. 1.9% and 1.8% previously). Moreover, there are risks: Lagarde stressed that "Persistently elevated market tensions could tighten broader credit conditions more strongly than expected and dampen confidence” and added, “We are monitoring current market tensions closely and stand ready to respond”. Major external risks also include the Ukraine war and new potential accidents in global growth.

How does the ECB view the recent surge in financial stress?

Regarding the recent episode in banking sector stress, the ECB reiterated its confidence in the banking sector, as well as its readiness to act to preserve price and financial stability in the euro area. Indeed, euro-area banks are in a much stronger position than in 2008, with strong capital and liquidity positions. The ECB did not announce changes in its liquidity framework, but its policy toolkit1 is fully equipped to provide liquidity support to the financial system if needed and to preserve the smooth transmission of monetary policy.

Do today’s announcements modify your view on policy rates and quantitative tightening (QT) scenarios?

We expect rate rises to be more gradual and a much more cautious approach to quantitative tightening.

Our assessment is that the ECB’s job on inflation is not done yet. Therefore we have not changed our expectations regarding the ECB’s terminal rate. We expect the ECB to continue to increase its key rates, although more gradually from now on. Indeed, the tightening in financing conditions will reinforce the need for a meeting-by-meeting approach and for limiting the magnitude of subsequent hikes.On QT we believe that both the ECB and the Fed will start to be much more cautious about the withdrawal of liquidity and their balance sheet management. The main risk today is financial stability and a sharper-than-desired tightening in credit conditions. The ECB and the Fed are closely monitoring current market tensions.

What is your assessment of fixed-income markets, in light of recent events?

These events tell us that after a period where prior central bank actions seemingly only had a muted impact on the economy, some form of speed limit has now been reached. This is illustrated by the dramatic flattening of the yield curve (from a historical perspective).

We are keeping our current views and have become even more cautious about risk, in light of the incoming volatility. We are now waiting for next week’s FOMC announcements yet, overall, steepening is coming.

We are also keeping a neutral view on peripheral debt and retain a preference for EUR IG credit as, even though corporate fundamentals are currently good, they will likely deteriorate through time.

How should investors navigate this phase of the market?

Steepening is coming and agility will be key.

Data is not the only driver and agility is going to be the name of the game. We now need to see how the Fed will react but, overall, risk budgets must be tightly managed as dispersion will increase and generate active opportunities. Overall, in this phase of market volatility, aggregate bonds have proven to be a good diversifier and we believe that this trend may continue.