Summary

The latest US corporate earnings season exceeded expectations across sectors beyond technology. With the US government shutdown now over, markets will refocus on labour and inflation data to gauge the Fed’s likely policy moves.

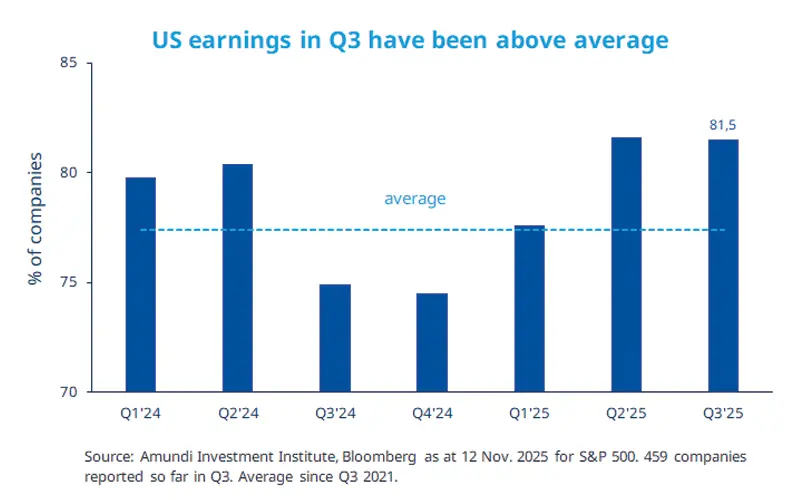

The Q3 US corporate earnings season has boosted market sentiment, but concerns remain over high prices in some sectors.

Markets now await new macro data as statistical services resume, following the end of the longest US government shutdown on record.

With US concentration risk remaining high, diversifying into Europe and emerging markets is essential.

For the quarter ended 30 September 2025, over 81% of companies beat earnings expectations led by the information technology, consumer staples, and financial sectors. This is well above the historical average and the second-best since the last quarter of 2021. Along with some other factors, these earnings boosted sentiment in the stocks markets which have continued their ascent this year. Looking ahead, while US consumption may slow in the near term, we believe US stock markets remain very concentrated, with a handful of stocks driving the broader markets. In this context, diversification* beyond the expensive segments could be key. Additionally, the period saw the longest (six weeks) US government shutdown on record, but markets seemed to have taken this in their stride. On the economic front, the resumption of normal statistical services will now allow the Fed to get more evidence on labour markets and consumer prices as per its mandate.

This week at a glance

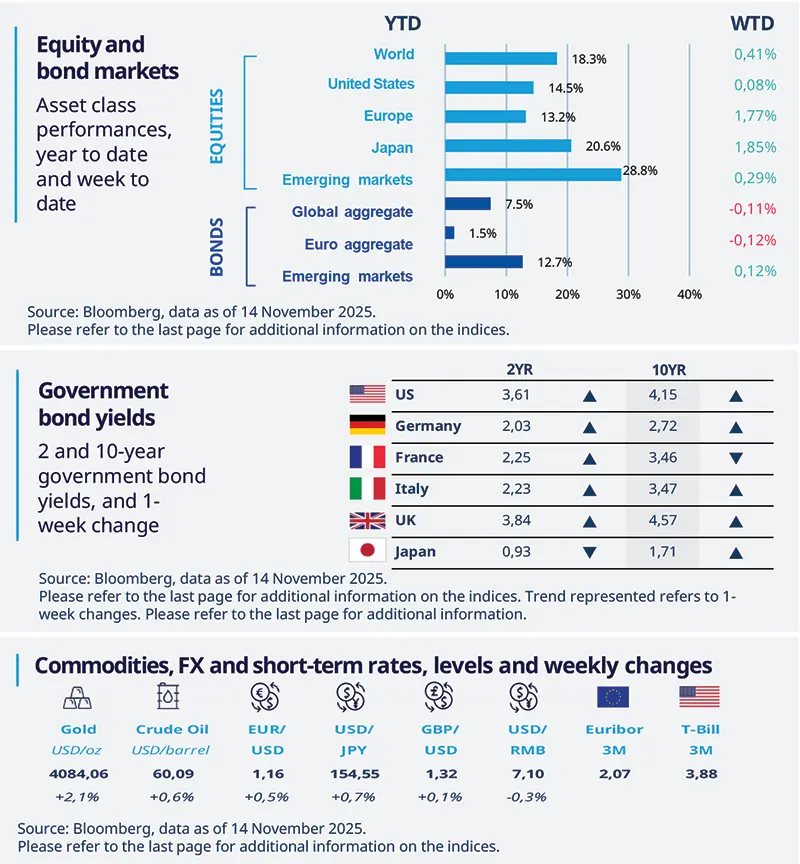

Last week was volatile for financial markets, with relief over the end of the US shutdown offset by concerns over AI valuations and uncertainty over prospects for further rate cuts by the Fed, after several speakers struck a cautious tone. US Treasury yields increased as investors priced in fewer rate cuts. Gold prices was up, close to historic highs.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 14 November 2025. The chart shows US earnings data.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US small business paint cautious near-term outlook

Small-business confidence weakened in October, with the NFIB index falling 0.6 points to 98.2. Both profits and sales were down, reflecting weakening demand and lingering uncertainty due to the government shutdown (the survey was conducted while the shutdown was still ongoing). Overall, businesses are less optimistic about near-term growth, but are experiencing gradual relief from supply-chain issues. This paints a cautious outlook for small businesses.

Europe

UK GDP softens more than expected

UK GDP disappointed expectations in Q3, growing only 0.1% from the previous quarter, when it had risen by 0.3%. The outcome may be partly explained by a one-off drop in manufacturing, cautious household spending, and a softer global economy. Household consumption rose a modest 0.2% QoQ, while export growth contracted marginally. We expect the economy to remain soft in the fourth quarter of 2025 and the BoE to cut rates in December.

Asia

Weak Indian inflation paves the way for rate cuts

India’s headline inflation hit a record low of 0.3% YoY in October, down from 1.4% in September and well below the central bank’s 4% target midpoint. The result was aided by a strong pass-through from reductions in the Goods and Services Tax (GST) and by a sharp fall in food prices, while core inflation (which excludes food and energy) edged up slightly to 4.4% YoY from 4.3%. Low inflation may reinforce our conviction in any forthcoming official rate cuts.

Key dates

US housing starts and building permits, US FOMC minutes |

US existing home sales, China loan prime rates, EZ consumer confidence |

S&P global manufacturing and services PMIs |