Summary

Central banks easing into a thus-far resilient economy

The year gone by has been exceptional in some respects. Global equities touched new highs, and emerging market stocks reached close to their 2021 levels. All this happened despite the US administration’s somewhat unconventional policies, particularly on the trade front, leading to a phenomenal performance of safe-haven gold.

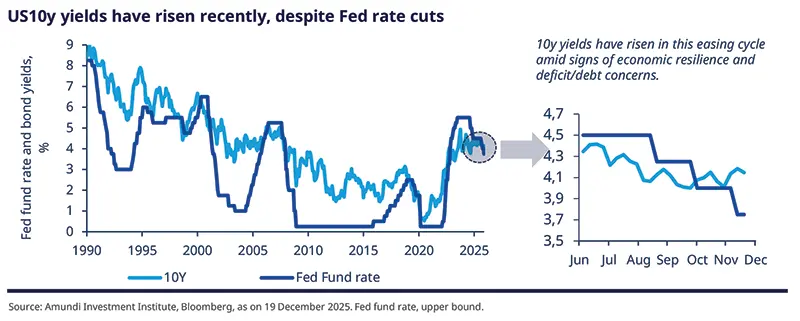

The fact that assets at both ends of the risk spectrum delivered strong returns is remarkable. More recently, European and Japanese bond yields rose. Interestingly, US yields have risen despite the Fed’s rate-cut cycle. Although the long end of the yield curve is less affected by monetary policy decisions (versus the short end), it is still unusual for both to move in opposite directions.

Looking ahead, fiscal policy is likely to do the heavy-lifting, particularly in the US, Germany, and Japan, with monetary policy also expected to provide support. Hence, consumption, labour markets, and the inflation environment will drive policy decisions, while artificial intelligence (AI)-related investments will attract greater market scrutiny. All this will happen along with challenges to US exceptionalism:

Higher income tax refunds set to improve the US growth outlook in H1 2026 slightly, but do not change the prospects beyond that. We have slightly upgraded our 2026 growth projections from 1.9% to 2.0%, but the narrative remains that of below-potential growth. The slowdown in US consumption reflects a softening rather than collapse of the labour market. Additionally, with an eye on the mid-term elections, the Trump administration could spring policy surprises. We expect inflation to matter significantly in a mid-term election year. It may lead to Trump softening his stance on tariffs.

The unorthodox policies of the Trump administration and pressures on the Fed mean real yields in the US are likely to be capped, which would diminish the greenback’s safe haven appeal.

Most global central banks including the Fed, ECB and the bank of England (BOE), will likely reduce rates. We project the BOE will reduce policy rates in 2026 as it did in December. Importantly, a declining fiscal deficit as a share of GDP will allow the Bank of England to reduce policy rates. Collectively, this creates a constructive environment for gilts.

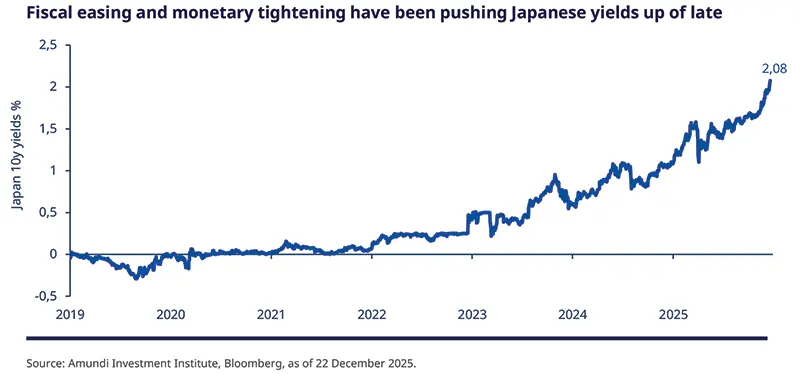

The Bank of Japan (BOJ)’s December rate hike was as per our expectations. The bank will remain an exception and will raise rates once in 2026. A sustained rise in domestic yields would increase the appeal of domestic debt for local investors and could eventually trigger large scale capital repatriation. However, for a sustainable increase in nominal and real yields, the BOJ needs to signal a stronger commitment to rate normalisation, which seems unlikely at this stage.

AI presents opportunities, but markets would question the return potential of capex, rewarding companies that provide greater clarity on monetisation and profitability from such investments. Additionally, we may see the AI investment cycle expand from hyperscalers to utilities (i.e. electricity providers) and to industrial companies that manufacture end-use physical products such as automated robots and autonomous vehicles/equipment. The higher capital needs of these firms will be reflected in increased supply in credit markets.

From a geopolitical perspective, competition between the US and China for AI supremacy is likely to continue. Both countries would strive to build AI ecosystems that serve their national interests, particularly China, which is seeking to achieve ‘semiconductor independence’ from the US.

| Amundi Investment Institute: Monetary policy easing to continue |

Leadership uncertainty persists at the Fed, but what is clear is that the new leader will be more dovish. Monetary policy will remain accommodative, and our projection of two rate cuts by the Fed in 2026 is unchanged. In December, the Fed cut rates as we had expected, and initiated Reserve Management Purchases, mainly buying T bills – an indication that the Fed is keen to maintain liquidity, which remains ample. This is not quantitative easing (QE), but it does imply a balance sheet expansion. However, in the event of heightened policy uncertainty, this could dry up quickly if volatility rises. Following the ECB’s decision in December, our stance of two rate cuts in 2026 remains unchanged. We believe the growth outlook for the euro area is subdued, and the ECB may be underestimating the negative impact of US tariffs on European exports. Additionally, a delay in ETS2 (EU Emissions Trading System 2) implementation could prompt the ECB to lower its inflation forecasts. The ECB’s quantitative tightening (QT) is passive, and the ECB would reverse this stance only if financial conditions tightened significantly. We do not expect that at present. *As on 22 December 2025. |

Both macro liquidity (balance sheet expansion, money supply etc.) and market liquidity are sufficient, but could dry fast in case of policy uncertainty and high volatility. This supports our moderate risk stance.(1)

(1) Market liquidity is derived from trading activity and signifies how quickly a security can be bought or sold without significantly affecting prices.

Risks related to high debt and widening deficits in the developed world, and global geopolitics will persist. In this environment, emerging markets present a strong case for idiosyncratic opportunities, particularly as DM central banks ease policies. We describe our investment convictions in detail below:

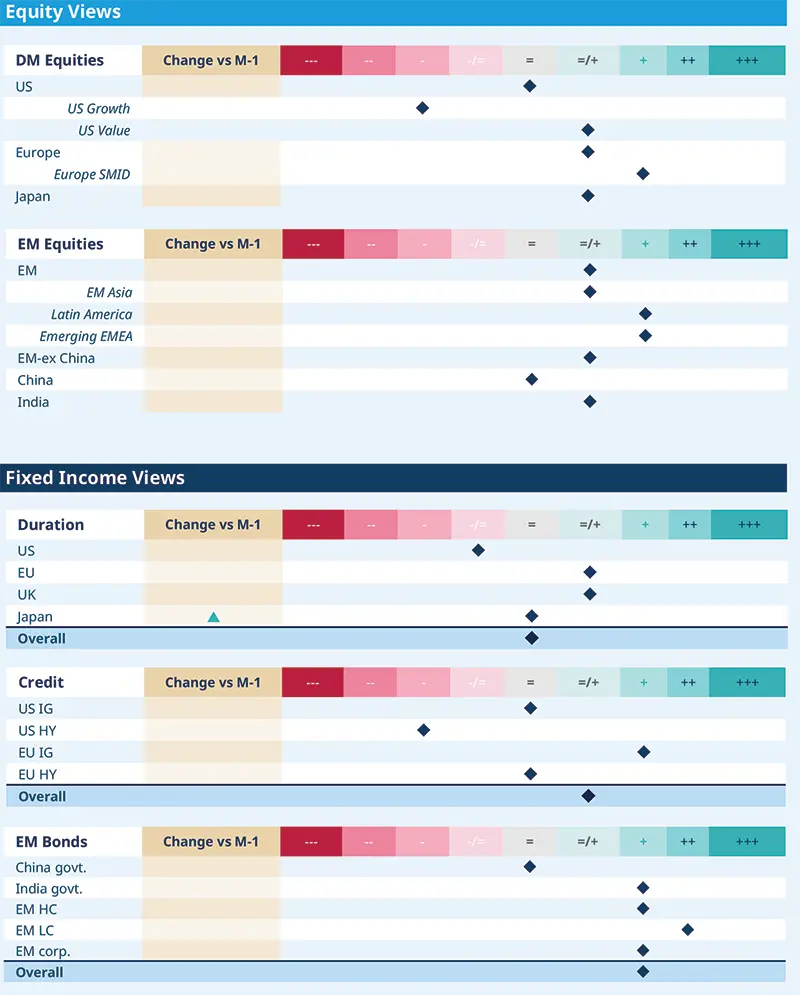

In fixed income, we are overall close to neutral on duration, slightly positive on the EU and UK, but cautious on the US. We have upgraded Japanese duration and are monitoring the BOJ’s policy action, inflation, and fiscal policy. Despite the anticipated rate hike, we think the BOJ is behind the curve and that’s the reason why yields have risen sharply in December. The high fiscal stimulus in the country implies the central bank will continue to raise rates even in 2026. On EM bonds, we maintain our constructive stance, and see greater scope for idiosyncratic stories amid high valuations.

In equities, we believe it is a time for diversification but with greater selection and towards segments with strong long-term convictions on valuations, earnings, and economic outlook. Additionally, we think markets will demand more clarity on return on capital of corporate investments in the tech and AI space. Hence, this is an opportune time to move into regions such as Europe. Emerging markets such as India also present opportunities linked with their domestic growth potential.

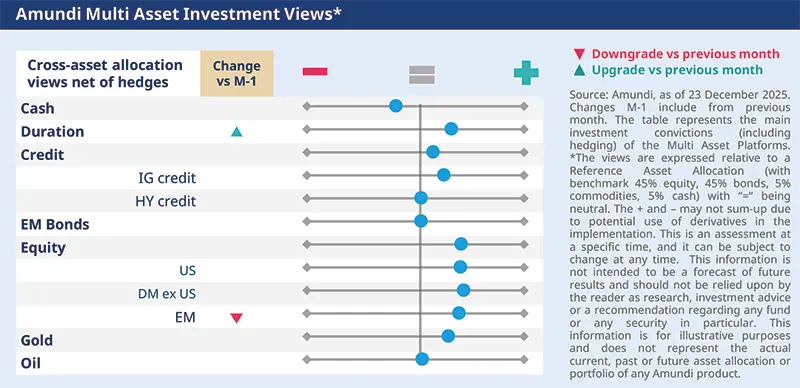

In multi-asset, we maintain our active stance, and tactically have lowered our conviction on Chinese equities, all the while staying positive on emerging markets as an asset class. On fixed income, we are less cautious on Japanese duration, with an eye on monetary and fiscal policies.

Concerns about weakening US labour markets and high risk-asset valuations are balanced by fiscal and monetary support, and abundant liquidity. Against this not so straightforward backdrop, we have slightly reduced our pro-risk stance.

FIXED INCOME

Neutral duration with regional divergences

Amaury D’ORSAY |

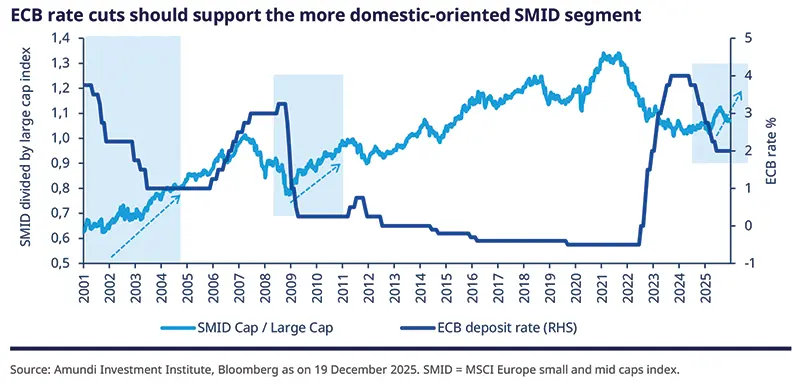

While the global economy has been reasonably resilient, there are some minor nuances across the main regions. For instance, in the EZ, wage inflation is low, and overall disinflation looks on track. Our expectations of ECB rate cuts in 2026 remain, despite recent hawkish comments from some board members. In Japan, a key question for us is at what yield-level Japanese debt becomes sufficiently attractive, and how much further fiscal easing is likely from the government.

In this environment, we prefer to play across geographies in the search for stability and additional yields. For the latter, we find opportunities in corporate credit and EM bonds (also good from a diversification perspective) that are a source of high-quality yields.

Our overall duration stance is close to neutral – marginally positive on the EA, and UK, but cautious on US (2Y). Our steepening expectations are maintained across DM, except Japan.

In Japan, we turned neutral following the increase in yields. But yields are still not attractive enough to trigger material capital repatriation. On the other hand, the BOJ will need to control inflation, which underscores the importance of raising rates.

Corporate credit is driving the market’s hunt for yield and high quality. In EU IG, the financials sector is attractive with its high capital buffers and profitability. In HY, where we are neutral, select names in telecom and financials offer good value.

We are positive on EM bonds but acknowledge expensive valuations in some segments. We like LC debt in Brazil, Mexico, Hungary and India, where yields are attractive, and disinflation is ongoing.

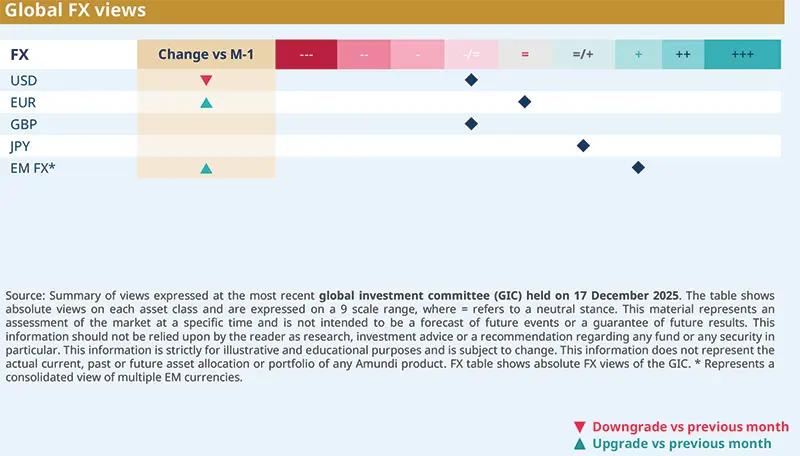

In FX, we downgraded the US dollar to cautious due to negative seasonality around the year-end, and fading US exceptionalism. Fed is not in a hiking mode, and tariffs remain a source of uncertainty.

On EM FX, we are slightly more positive. We prefer high-yielding FX such as the BRL and the TRY. Any positive sentiment from progress on a Russia–Ukraine agreement could be reflected in the FX of some eastern European currencies, such as the PLN.

EQUITIES

Diversify with small and mid cap in Europe

Barry GLAVIN |

The global economy has played out reasonably well, and that’s being reflected in market performance amid ample liquidity. What’s not reflected in the markets is policy uncertainty, signs of consumption slowing down, and risks of high valuations. In this environment, our focus remains on fundamentals and staying tilted towards businesses where risk-reward is well balanced. Increasingly, we find such businesses in regions outside the US.

For instance, Europe is making strong commitment to high public spending and to onshoring strategic supply chains. Additionally, in emerging markets, our positive view is reinforced by this year’s outperformance versus the developed world. Overall, we maintain our barbell approach, with a positive stance on quality industrials and defensive sectors.

In Europe, defence and infrastructure spending plans are long-term game changers, and lower energy prices should also support the region. We favour more domestically-exposed SMID segments in Europe. In the AI theme, we explore businesses that will benefit from increased demand for equipment and electricity (companies providing electrical infrastructure to data centres etc). We are also less cautious on European financials than before.

The UK budget has been well-received and valuations and dividend profile paint an attractive picture.

In contrast, we think the US is an expensive market, and we are selective However, Japanese valuations are attractive.

EM offers a combination of strong export and domestic consumption stories, but we favour a selective approach.

We prefer Latin America due to its cheaper valuations relative to much of the EM, and we also favour emerging Europe.

In Asia, we are neutral on China due to stretched valuations and less favourable macro environment than before. Indian equities – and the financials sector in particular – are areas we are exploring.

In the Middle-East and North Africa region, earnings profile in South Africa is robust, notwithstanding the political environment. The recent credit rating upgrade is an affirmation of our stance.

From a sector viewpoint, we are cautious on technology, materials, and energy, but positive on consumer discretionary.

MULTI-ASSET

Risk-on: recalibrate, but not retreat

Francesco SANDRINI CIO Italy & Global Head of Multi-Asset | John O’TOOLE Global Head - CIO Solutions |

We are seeing mixed macro signals in the US. Job markets are deteriorating, but the pace (of deterioration) is stabilising, the Fed is easing and is conscious of maintaining liquidity, and fiscal policy is supportive. In Europe, consumption is subdued, but inflation is declining. These factors, combined with strong liquidity and benign credit conditions in the markets, somewhat offset (but not completely eliminate) the risks posed by high valuations. Hence, we made some adjustments to our views on risk assets, without changing our medium- term stance. In addition, we maintain that safeguards in the form of gold and hedges on DM equities are essential amid high valuations.

Our views on equities are optimistic, including on the US, UK and EU. Fed easing and earnings are supportive. But markets would increasingly scrutinise the return potential from companies’ capex in AI and in the broader US tech sector. In EM, we are seeing a deterioration in China’s domestic sentiment, when valuations are stretched, leading us to tactically move to neutral on China. We continue to monitor the economic environment there. We’d like to stay more balanced through a positive view on the broader EM, which includes China.

We maintain our constructive view on duration mainly through the US and Europe, but have reduced our negative view on Japan following the rapid rise in yields in recent months driven by the BOJ’s intent to normalise policy. But we are still cautious on Japan. In the US, we think the short-end and the middle of the yield curves are more attractive vs the long end. In Europe, we see lower rates going forward as growth is a bit fragile. We are also positive on Italian BTPs vs the bund. We continue to seek value in EU IG as well as EM bonds.

Our FX views rely on structural challenges to the USD. Additionally, we are positive on NOK and JPY vs the EUR. The NOK would be supported by Norway’s cyclical exposure at a time of decent global growth.

We’ve moved to a more balanced stance on EM equities, reflecting the strong movements, while on duration we have tactically recalibrated our views on Japan.

VIEWS

Amundi views by asset classes

Definitions & Abbreviations

Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint. ETS2