Summary

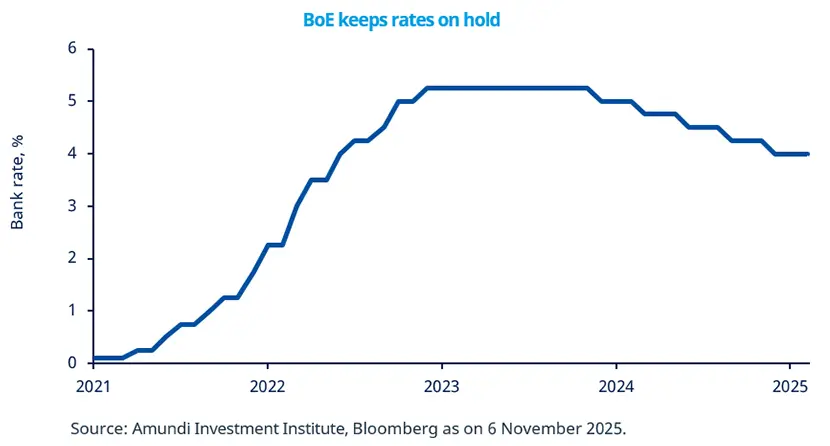

We expect the Bank of England to cut rates in the coming months, as tighter fiscal policy (tax hikes or spending cuts) may exacerbate a slowdown in economic growth. Softening inflation will also enable the bank to reduce rates.

The BoE held rates steady in November, but we expect it to cut them in the coming months, as growth is likely to stay sluggish.

Markets are now looking towards the UK government’s Autumn budget scheduled to be released later in the month.

The Autumn budget should provide details on the UK governments policy related to taxes, and how it aims to reduce debt and tackle the cost of living problem.

At its November meeting, the BoE kept its policy rates unchanged at 4%. Policymakers noted that a deceleration in overall inflation is underway, favoured by a restrictive policy stance, softening labour market, and easing services inflation. Risks around achieving the bank’s 2% inflation target are more balanced, and downside risks from weak demand have grown. Looking ahead, we expect one rate cut in December and two more next year, although further actions may depend on incoming data.

Additionally, we expect economic growth to moderate next year due to domestic pressures and fiscal tightening (efforts to decrease the gap between public expenditure and revenues by either raising taxes, cutting spending, or both). In her upcoming budget, we believe the Chancellor of the Exchequer, Rachel Reeves, could have a difficult task and may need to consider the government’s high borrowing costs, lower productivity, and global economic pressures.

This week at a glance

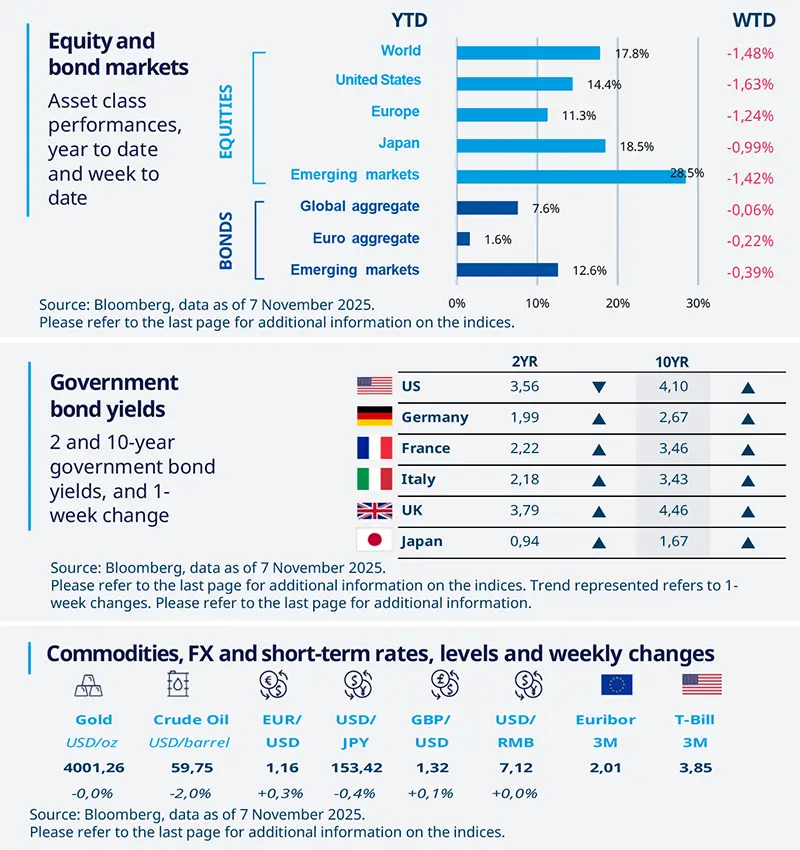

Stocks declined over the week due to concerns over high valuations in the US technology sector, and mixed labour market data. Markets also re-assessed whether the Fed will raise rates in December, leading to an increase in bond yields in most countries. In commodities, oil prices fell owing to worries related to oversupply, whereas gold was almost flat.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 7 November 2025. The chart chart shows the Bank of England’s Bank Rate.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US private sector jobs data shows layoffs

A report by Challenger, Gray & Christmas showed a sharp rise in layoffs in October (vs September), with 153,074 job cuts. This surge is being linked to companies adjusting staffing amid the AI boom, signalling potential labour-market challenges. The government shutdown has paused official labour data releases, making this report especially important. We consider the report to be volatile, and importantly, despite rising layoffs, state jobless claims have not spiked.

Europe

Eurozone retail sales declined

Despite modest improvements in real wages and a rebound in consumer confidence, retail sales in the EZ slipped back into decline, falling 0.1% in both August and September. June marked the last month of growth. Although purchasing power has recovered and optimism has risen, we think consumers remain cautious with their spending. This indicates that even with greater confidence and improved finances, EZ shoppers are still holding back on spending.

Asia

Chinese exports fell in October

Exports in October fell by 1.1% — the first decline since February — driven by a continued fall in sales to the US. Exports to the rest of the world failed to offset the drop seen in the US. While the US–China trade deal may help reduce some uncertainty, ambiguity over the long-term trend persists as both countries continue their tense competition. This complicates the task facing policymakers grappling with weak domestic demand. Despite this, we expect economic growth to be close to the government’s target this year.

Key dates

ZEW survey, EZ industrial production, UK unemployment rate |

UK GDP, US CPI, UK industrial production |

US retail sales, US PPI, EZ GDP, France CPI, Italy trade balance |