Summary

The Fed's hawkish tone signals that the Central Bank is incorporating a

more uncertain outlook. This calls for keeping a tactical approach to

bond investing.

- The ECB remained data-dependent, without pre-committing to any rate path ahead.

- Trump’s tariff policy is a wildcard that could affect the Fed’s monetary policy next year.

- Fed Chair Powell said they are at a point at which it would be appropriate to slow the pace of cuts.

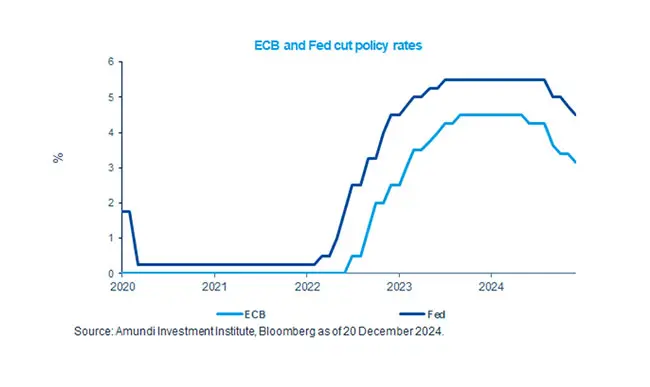

Both the Fed and the ECB cut policy rates by 25bp at their December meetings. On 12 December, the ECB cut rates by 25bp, removing some hawkish language as interest rates got closer to an estimated neutral level. On 18 December, the Fed also cut by 25bp, but the overall tone was hawkish. The Fed now only expects inflation to hit target in 2026. Even though the Fed does not explicitly incorporate possible policy changes under the new administration, the projection of higher inflation in 2025 suggests they are anticipating a more uncertain outlook. On 19 December, the BoJ left policy rates unchanged at 0.25%. The tone was cautious and the statement said that there are still uncertainties on Japan’s economic activity and prices. The Bank of England also kept rates unchanged, given the higher-than-expected inflation data released recently.

This week at a glance

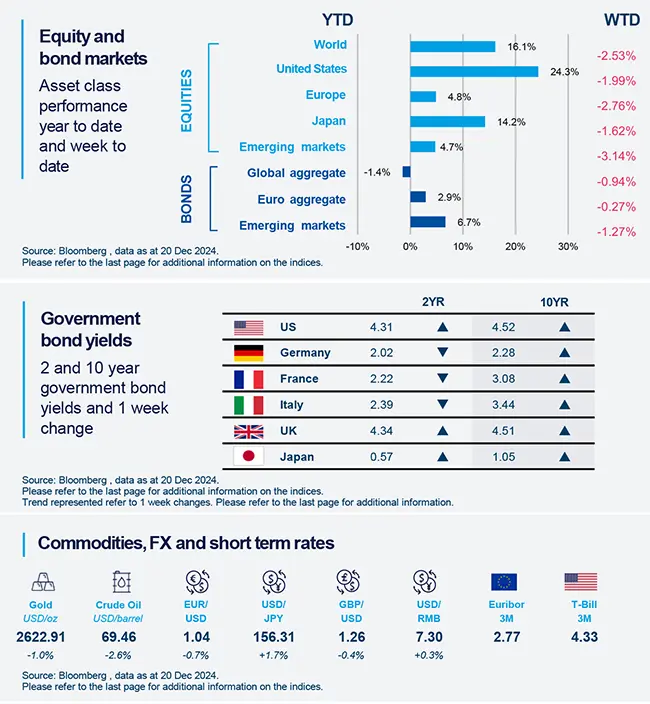

Equity markets were generally down, in particular following the Fed hawkish tone. Meanwhile, bond yields inched higher and the equity volatility (VIX index) surged to the highest levels since last August. Gold was down in the week, while the dollar edged higher.

Equity and bond markets (chart) Source: Bloomberg.

Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as 20 December 2024. The chart shows Fed, ECB, and BoJ official rates.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

S&P Global US Composite PMI driven by services

December US Composite PMI increased to 56.6 from 54.9, led by the services sector, while manufacturing activity dipped further into contractionary area. The composition of the manufacturing PMI was weak, with decreases in the output, new orders, and employment components. Survey respondents noted that weak export weighed on manufacturing activity. The services survey hinted at moderating inflation, with both the input and output prices components on the decline.

Europe

EZ PMI contracts for the fourth consecutive month

December HCOB Eurozone Composite PMI increased to 49.5 from 48.3, staying in contractionary area for the fourth month in a row. The manufacturing sector remained weak, but the services sector rebounded into expansionary area. This data appears in line with our growth downgrade at end-2024 and a weak start to 2025, although we are not expecting a contraction.

Asia

China: a bumpy road to consumption recovery

Nominal retail sales growth dropped to 3.0% YoY in November from 4.8% in October, below market expectations. This marked the weakest growth in retail activity since August. The earlier start of annual online sales event has contributed to the volatility in monthly data. However, if we read two months together, consumer demand stayed soft and the recent growth was mainly supported by the government subsidies.

Key dates

27 Dec Japan Unempl. rate and industrial prod., US goods trade balance | 2 Jan China, EZ, UK, and US Manufacturing PMIs | 3 Jan UK ISM Manufacturing |