Summary

- Downgrade action: Fitch Ratings downgraded the credit rating of the US from AAA to AA+ owing to a worsening fiscal situation, increasing US government debt burden, and decreasing governance standards.

- Political uncertainty: This move is also a reflection of growing US political uncertainty. On the domestic front, voters will likely be less concerned about the downgrade per se, and more about the economic environment.

- Market reaction: Initially, US yields were relatively muted as Fitch’s downgrade justification did not include anything new to the original May announcement. But as markets pondered over the US government’s rising financing needs, the 10y yields rose. Going forward, we could see a return of the term premium on the longer dated US government debt, and some widening of credit spreads. However, we do not think investor behaviour would change, including that of institutional investors, because we do not see any impact on the collateral quality of US Treasuries.

- Investment implications: The ratings action points to a deteriorating fiscal situation, which will take longer to play out. But as the US dollar remains the number one reserve currency, foreign demand for Treasuries will remain, and we are unlikely to see a dramatic rise in yields in the near term. Longer term, this may weaken the US dollar’s position as a global reserve currency.

Fitch downgraded US credit rating on 1 August 2023

On 1 August, Fitch Ratings, one of the three main independent debt ratings agencies, downgraded US debt from an AAA rating to AA+ with a stable outlook. This action reflects the expected fiscal deterioration of the US over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers. None of these elements appear likely to change in the short term. Fitch Ratings (‘Fitch’) now joins S&P Global Ratings by assigning the US a rating of AA+; Moody's still maintains the US at its highest investment grade level of AAA, with a risk of downgrading its outlook to negative.

What are the main reasons behind this downgrade?

Declining governance standards, relative to peers, rising government debt and deficit contributed to this ratings downgrade.

Erosion of governance - Fitch cited the US’ complex budget and debt limit process, which has become increasingly mired in US political partisanship and last-minute resolutions, eroding confidence in fiscal management. This stands in stark contrast with other AAA- and AA-rated issuers, which tend to have a stronger fiscal framework. The agency also cited the absence of a firm plan to keep the Social Security and Medicare programs solvent.

Rising general government deficit - Fitch forecasts the US budget deficit to rise from 3.7% of gross domestic product (GDP) in 2022 to 6.3% in 2023, reflecting weaker federal revenues and higher spending, as well as rising debt servicing costs. It expects the general government deficit to increase to 6.6% of GDP in 2024, down from a surplus of 0.2% of GDP in 2022. Furthermore, it expects this gap to widen to 6.9% of GDP in 2025, driven by weak 2024 GDP growth, a higher interest burden and expected wider state and local government deficits of 1.2% of GDP in 2024-2025.

Importantly, the US budget deficit is considerably higher than that of AAA-rated countries, which include Germany, Denmark, the Netherlands, Sweden, Norway, Switzerland, Luxembourg, Singapore and Australia. Compared to these countries, the US budget deficit is twice, or in some cases six times, their deficits.

Furthermore, due to the higher US debt level as well as higher interest rates, Fitch estimates that the US interest-to-revenue ratio is expected to reach 10% by 2025. This stands in contrast to the median level of 2.8% for AA-rated and 1% for AAA-rated debt issuers.

Increasing general government debt - Another important factor is the continued rise of general government debt. Although lower deficits and higher nominal GDP growth have lowered the debt-to-GDP ratio from 122.3% in 2020 to 112.9% this year, the level remains substantially higher than the pre-pandemic level of 100.1% in 2019, and Fitch projects it will rise to 118.4% by 2025. The Organization for Economic Cooperation and Development (OECD) estimates that the debt ratio is more than twice as high as the median of 39.3% of GDP for AAA-rated credit issuers and 44.7% of GDP for AA-rated issuers. In the longer-term, Fitch projects that additional debt/GDP rises will increase the vulnerability of the U.S. fiscal position to economic shocks.

What are the implications of this move on domestic politics, international relations and the geopolitical environment?

The downgrade reflects the ‘new normal’ of political volatility in the US, despite politicians managing to avoid a default over the recent debt ceiling drama. Investors therefore should see the downgrade as a reflection of the political uncertainty that has prevailed over the past years and will only grow as elections approach.

Intended or not, it also reflects the foreign policy unpredictability that the US election could bring in regards to international relations and geopolitics. On US/China, candidates will campaign on ‘who is the most hawkish’ towards China, which could increase tensions with Beijing and could have ramifications for US businesses. On the other hand, if former US President Donald Trump returns to the White House, this would not be good news for the US/Europe alliance or for NATO and the West’s collective stance on the Russia/Ukraine war.

Having said that, the downgrade does not change our overall views on US/China relations nor on the Russia/Ukraine war. While the American voter cares about the economy, a credit rating downgrade that happened in the quiet months of summer will most likely not significantly impact voter behaviour or sentiment. Inflation and ‘perceptions’ of economic problems will carry more weight than a downgrade. Therefore, it is unlikely that the Biden administration will roll back Ukraine support to shore up US financial health.

For US politics and President Biden personally, the downgrade is of course bad news, but for the same reasons listed above, we do not expect it to be a game changer for the 2024 election. Interestingly, even though the credit rating downgrade reflects the current political uncertainty, it does not reflect the fact that the US is a ‘winner’ on many fronts due to the current geopolitical realignment. The US agriculture, energy and defence sectors have benefited from the war, even as the country is far away from the hot conflict.

The downgrade indicates rising policy uncertainty in the US but the American voter will be more concerned about the real economy.

Market reaction and investment implications

How did the markets react to this news?

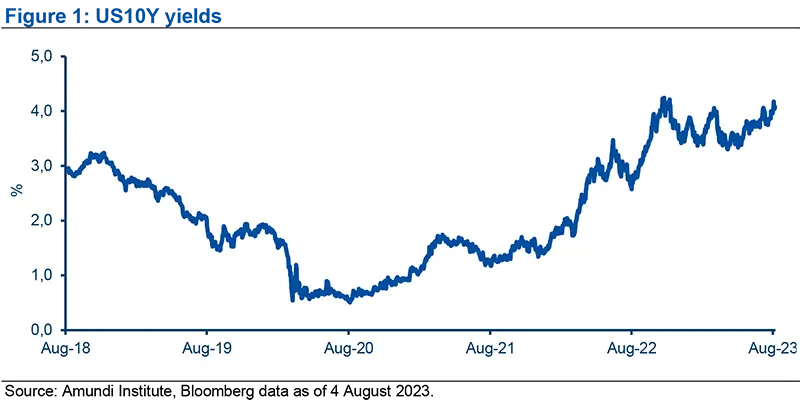

As markets realised that US government financing needs were higher than anticipated, 10-year yields were pushed sharply higher to nearly 4.25%, close to cycle highs.

US 10Y Treasuries - The justification for the downgrade did not include anything new to the original May announcement and, as a result, market’s initial reaction was relatively muted. Notably, 10-year Treasury yields rose higher following ADP’s release of its jobs report, which impacted markets more than the downgrade. However, there was an additional indirect impact: as markets realised that US government financing needs were higher than anticipated, 10-year yields were pushed sharply higher to nearly 4.25%, close to cycle highs.

The rating of government enterprises was not changed so rating-sensitive investors will be not be forced to sell.

Yield curve - The rating action could also return some of the ‘term premium’ that has been missing from the longer-dated (10-30 year maturity) portion of the US yield curve as investors demand more yield compensation to finance long-term US government debt. This would result in a steepening of the US yield curve.

Risk assets - While the ratings action did not include any new fundamental information on the evolution of the US fiscal situation, Fitch’s action could serve as a catalyst to push overall market risk premia higher, leading to wider credit spreads and lower equity prices, as investors look for reasons to reduce market exposure after the recent run in risky asset markets. However, we think the collateral quality of US treasuries has not been impacted.

How do you think investor behaviour will evolve as a result of this move?

Investors such as pension funds who need long maturity assets to match their liabilities are unlikely to change their behaviour.

Fitch prevented a ratings cascade by keeping its rating of US government-sponsored enterprises (GSE) at AAA, and not adjusting the US country debt ceiling. This means that ratings-sensitive investors will not be forced to sell, which has muted market reaction. In addition, the Dodd-Frank Wall Street Reform and Consumer Protection Act prevents regulators from referencing ratings from the major rating agencies, so there is minimal direct impact on banks’ capital. However, many regulations are now based on internal ratings. Because both S&P and Fitch have downgraded US debt, we assume most investors will review the rating they assign to US debt.

Importantly, the downgrade from (AAA to AA+) will not reduce the demand from core institutional investors. Under the Basel framework Commercial banks have a zero-capital requirement for government bonds rated AAA to AA-. Similarly pension funds, who need long duration assets to match their typically longer liabilities, will not be affected by a one notch downgrade because they tend to focus more on returns with appropriate hedges for interest rate risk. In addition, with regard to collateral in repo markets, sovereign bonds within the AAA to AA- rating range all fall in the same collateral haircut recommendations of regulators. Global FX reserve managers, another large constituency for US Treasuries, would also not differentiate much between AAA and AA+. All these factors likely explain the absence of any reaction in the CDS market, unlike earlier in the summer ahead of the debt ceiling negotiations.

We think the US economy is posting strong growth numbers and inflation appears to have peaked, although the path to the Fed’s target will be volatile, and investors are already braced for higher for longer policy rates. Notwithstanding the difficult adjustment from high inflation, the appetite for bonds remains positive. While we believe the near-term economic impact of this downgrade will be limited and unlikely to persist, we believe this points to a weakening in the political/policy resolve to address a deteriorating fiscal situation, which will take longer to play out.

What would be the long-term effects of the ratings action?

As long as the US dollar remains the number one reserve currency, foreign demand for US Treasuries will persist.

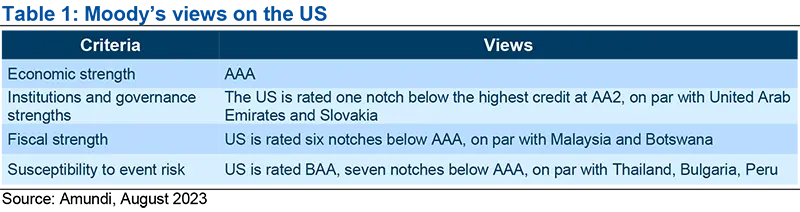

With Fitch’s downgrade, two of the three major ratings agencies have downgraded US debt. Moody’s is the final agency to keep US debt at AAA. Given its rating criteria, we believe it could be close to downgrading US debt from stable to negative, and from AAA to AA+.

However, as long as the US dollar remains the number one reserve currency, foreign demand for US Treasuries will remain, and we are unlikely to see a dramatic rise in yields. As there is currently no credible alternative to the dollar. On a longer-term basis, this downgrade could have a negative impact on the US dollar’s position as the global reserve currency.

Interestingly, the downgrade highlights a material fiscal issue. It points to a deterioration in the standards of governance and a worsening of government finances as growth slows, especially because any bipartisan efforts to address the secular rise on US government debt remains elusive. The Congressional Budget Office projects US debt at close to $50 trillion in 2033, from the current $33 trillion level. We see the Fitch downgrade as highlighting this political impasse in the US.