Summary

Key takeaways

A critical market barometer: swap spreads measure the difference between swap rates and sovereign yields, serving as a leading indicator of risk aversion and liquidity.

Increasing volatility: since 2008, swap spreads have exhibited greater volatility, with sharp spikes during crises (such as the Covid-19 pandemic and sovereign tensions) and rapid tightening episodes (as seen in 2024). This volatility reflects stress in the interest rate markets and shifts in monetary and fiscal policy.

Persistent structural distortions: despite the theoretical arbitrage opportunities, regulatory and structural constraints limit their execution. These explain the persistance of swap spreads, which reflect structural imbalances and risk premiums in the fixed income markets.

Future outlook: the combination of rising sovereign issuance and declining excess liquidity is expected to drive up swap costs (leading to a narrowing of swap spreads). Conversely, an easing of banking regulation and the unwinding of pension fund hedging programs would likely increase bond prices (widening swap spreads).

Introduction

Swap spreads, key indicators of liquidity stress and risk aversion, play a crucial role for insurers. Beyond measuring price differentials between sovereign and corporate bonds, they directly influence hedging decisions, asset-liability management (ALM) strategies and insurer returns under Solvency II.

In recent years, their heightened volatility has drawn market attention and raised strategic questions: what drives these fluctuations? What are the underlying forces at play? Most importantly, how should they be interpreted to guide future hedging and investment decisions?

In this article, we explore the fundamental mechanisms of swap spreads, analyze past and recent trends, and shed light on the structural forces likely to shape their trajectory in the years ahead.

1. Definition, importance, and evolution of asset swap spreads

What is the swap spread?

Definition

The swap spread is defined as the difference between the market rate of the fixed leg of a swap and the yield of the benchmark sovereign bond with the same maturity.

It serves as a reliable approximation of the excess or shortfall in periodic compensation provided by holding a government bond whose coupons would be indexed to a floating market rate.

The swap spread is defined as the difference between the market rate of the fixed leg of a swap and the yield of the benchmark sovereign bond with the same maturity.

Strategic importance

The swap spread is a critical measure of investors seeking to manage interest rate risk or asset-liability matching. It also serves as a key gauge of the level of risk aversion, liquidity risks, the relative demand for hedging instruments and appetite for sovereign debt.

The reference maturities

For a given currency, the benchmark swap spread is most commonly observed at the 10-year point on the yield curve.

Reference rates

Traditionally, the floating leg of the swap was indexed to benchmark rates such as LIBOR or EURIBOR (typically 3- or 6-months tenors). Since the introduction of SOFR in the United States and the increase in volumes of ESTER-linked swaps in Europe, market participants are gradually shifting toward using these overnight rates as the primary reference for swap spreads calculations2.

Before the 2008 financial crisis, swap spreads were positive across major currencies and maturities of the curve.

Recent trends in swap spreads

A shift in market dynamics before and after the 2008 financial crisis

Before the 2008 financial crisis, swap spreads were positive across major currencies and maturities of the curve. This situation was primarily driven by:

• High volumes of unsecured interbank lending, reflecting strong transaction activity between banks

• Monetary policy with limited money supply to banks

Over this period, most bank refinancing was indexed to floating rates, which carried a credit risk reflective of the banking system’s solvency and provided an indication of short-term funding needs.

When the 2008 financial crisis erupted, swap spreads widened significantly. As central banks adopted excess liquidity policies, swap spreads tightened, with floating rates anchoring to administratively set central bank rates.

Expected convergence with new benchmarks, yet divergences persist

In theory, once the swap market has fully transitioned to overnight-indexed swaps (OIS), which are risk-free rates, swap spreads should not deviate significantly from zero. Indeed, both swap rates and sovereign bonds would then reflect a similar credit risk3.

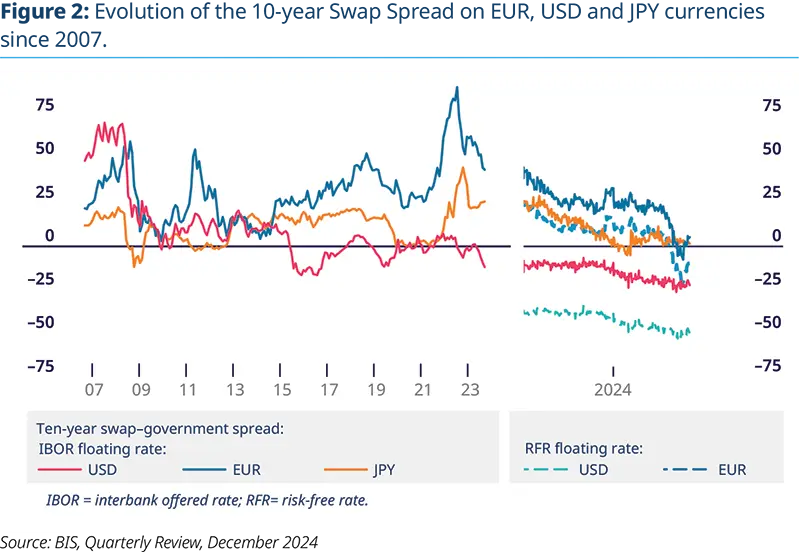

However, despite this theoretical convergence, swap spreads have continued to fluctuate significantly, as illustrated in Figure 1 and Figure 2. This phenomenon has been pronounced in the Eurozone.

Moreover, swap spreads remain heterogeneous:

• across different points on the curve: they are positive at some maturities and negative at others

• or across currencies: for instance, the entire U.S. swap spread curve has been negative for several years, whereas it remained mainly positive in the Eurozone until recently

Investors continue to anticipate high volatility in swap spreads and non-uniform spreads persist across currencies and different points on the same curve.

The persistence of significantly positive or negative swap spread levels, as well as disparities between curve maturities and currencies, should theoretically create arbitrage opportunities. However, investors continue to anticipate high volatility in swap spreads and non-uniform spreads persist across currencies and different points on the same curve.

Market volatility and the uneven compression of swap spreads

While post-crisis compression of swap spreads could have led to a reduction in their volatility, their dynamics have varied across different regions.

In the United States, when the swap spread was still based on LIBOR, it remained around zero for an extended period. However, since the beginning of the current decade, U.S. swap spreads have declined further into negative territory.

In contrast, volatility was higher in the Eurozone, where the swap spreads experienced several peaks:

• The first two spikes corresponded to the sovereign crisis and the Covid-19 pandemic.

• The third volatility spike began in 2021 with the swap spread rising from 25 basis points in early 2021 to over 80 bps by the end of 2022.

• Then, over the past two years, the spread tightened significantly, reaching parity in November 2024. Specifically, in 2024 alone, the swap spread tightened by 50 bps, with half of this movement occurring in Q4 2024.

• As a result, the Euro swap spread turned negative for the first time in November 2024. This contrasts sharply with the situation in the United States, where swap spreads have remained predominantly negative since 2015.

This volatility has been partially observed in JPY, but to a much lesser extent in USD, where the movement has been gradually decreasing. In the USD market, swap spreads have generally compressed over the last three years, with a gradual decline of 25 bps spread over this period.

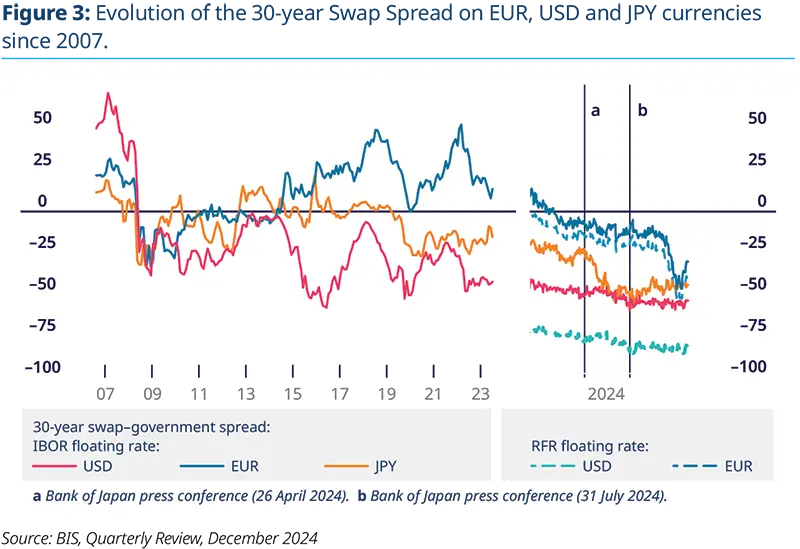

Finally, the USD 30-year swap spread has remained consistently negative in the United States since late 2008, while in the Eurozone it was positive between 2015 and the end of 2023. However, starting in 2024, it has progressively declined further into negative territory.

Volatility was higher in the Eurozone, where the swap spreads experienced several peaks.

2. Arbitrage opportunities and relative values: theories, constraints and market realities

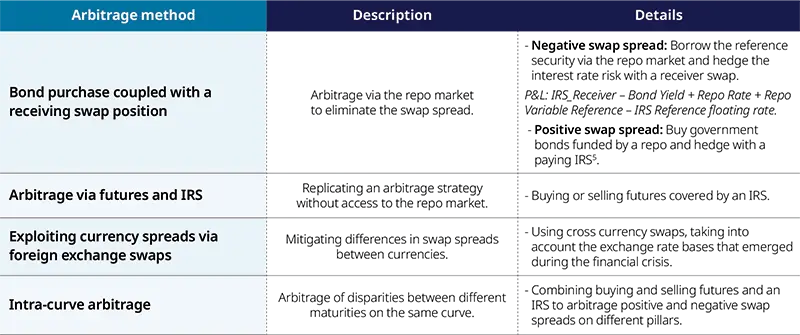

Arbitrage opportunities are often seen as a natural mechanism for correcting financial market spreads. However, despite the existence of theoretical arbitrage strategies, swap spreads persist. In this section, we explore the mechanics of arbitrage as well as the structural constraints that prevent full convergence.

The theoretical possibilities for swap spread arbitrage

In a context of excess liquidity, swap spreads represent a price differential between two underlying assets with comparable solvency risk. In theory, these spreads should remain at zero, with low volatility across all maturities and currencies 4.

From a theoretical perspective, price discrepancies could be arbitraged through various mechanisms, which are illustrated in the table below.

Opportunities beyond arbitrage

Beyond pure arbitrage, many market participants can Leverage on swap spreads to enhance financial performance. Thus, an insurance company will be able to choose between using a receiver interest rate swap or investing in a long-term bond to align cash flows with expected liability outflows.

A bank that doesn’t want to take duration risk can opt to build its liquidity buffer (HQLA buffer) using money market instruments or long-term bonds hedged in an asset Swap. These strategies help smooth out significant price discrepancies between sovereign bonds and IRS.

However, in recent years swap spreads have exhibited high volatility, and market participants expect this trend to persist in the coming years. Regulation is often cited as the main obstacle to the implementation of arbitrage strategies. Additionally, the market structure, where flow dynamics often differ between bond and derivatives markets, should continue to enable the existence of significant swap spreads, both positive and negative.

In recent years, swap spreads have exhibited high volatility, and market participants expect this trend to persist in the coming years.

Regulatory constraints and limits to swap spread arbitrage

Banking regulations have gradually restricted the ability of banks to operate in the repo and derivatives markets by imposing capital requirements on transactions due to market risk exposure and counterparty risk. Even though repo transactions are collateralized, regulators still require banks to cover counterparty risks. This applies particularly relevant in cases of early settlement due to default, where the collateral value may not fully cover the outstanding exposure.

This capital requirement can also be applied to bonds hedged with swaps (asset-swapped bond positions), even if they are intended to be held to maturity.

More recently, banks have faced an additional leverage ratio constraint, where every balance sheet exposure generates regulatory capital requirement indexed to the nominal value of the transaction6. This requirement is even stricter for Global Systematically Important Banks (G-SIB), which are the most active participants in the repo and interest rate derivatives markets. Several studies have shown that this leverage constraint is one of the most significant barriers to arbitraging price discrepancies between sovereign bonds and swaps7.

Furthermore, market volumes and the margin requirements (including initial margins and variation margins to cover valuation changes) limit the ability of non-bank players to reduce these price discrepancies.

While no major regulatory tightening is expected in the coming years, existing rules will likely continue to constrain both banks and non-bank institutions, which are affected either directly or indirectly (e.g. through financing costs). As a result, significantly positive or negative swap spreads are likely to persist in the coming years.

3. The fundamentals of swap spread evolution

Swap spreads are influenced by various economic and structural factors.

Understanding these fundamental forces is essential to anticipate long-term movements. This section outlines the key factors that shape swap spread dynamics.

The most significant factor affecting swap spreads is the volume of government bond issuance and changes in monetary policy, particularly Quantitative Easing

(QE) and Quantitative

Tightening (QT).

Contributing factors to swap spread movements

Issuance volumes and monetary policies

The most significant factor affecting swap spreads is the volume of government bond issuance and changes in monetary policy, particularly Quantitative Easing (QE) and Quantitative Tightening (QT).

• After the 2008 financial crisis, government budget deficits increased sharply, leading to a surge in bond issuance. Central banks absorbed a large share of these bonds during QE programs, preventing swap from rising significantly relative to government bond.

• Post-pandemic trends: However, following the pandemic, the further widening of deficits, combined with a shift toward QT, forced the market to absorb larger volumes of bonds, leading to a reduction in swap spreads.

In Europe, three trends contributed to a distinctive evolution of swap spreads:

• In Europe, German bonds are used as the reference for asset swap spread calculations. Since Germany’s deficit did not increase significantly, bond

issuance volume grew less compared to other Eurozone countries. This limited the widening of swap spreads relative to Bund yields.

• On the other hand, other Eurozone countries have significantly expanded their deficits, resulting in higher bond issuance and persistent yield differentials. These differences have created opportunities for banks and institutional investors to allocate capital strategically (typically banks for their HQLA buffers), often through long-term bonds hedged via asset swaps.

• Finally, during financial turbulence, investors rush into German bonds, reinforcing their status as a safe haven. This influx drives Bund yields lower, which in turn widens swap spreads and increases their volatility.

These structural factors have contributed to a persistently elevated Euro swap spread, a trend not observed in other major currencies.

Monetary policy expectations

Anticipations of monetary policy shifts also play a significant role in swap spread movements.

Moreover, interest rate futures carry idiosyncratic risks (such as fiscal policy and sovereign risks), making them a less natural hedge for interest rate risk than IRS. As a result, most market participants prefer to express their monetary policy or the evolution of inflation expectations through IRS rather than futures or bonds.

Consequently, IRS levels can be more reactive than bond yields. This dynamic implies a widening of swap spreads in anticipation of monetary tightening and a narrowing during easing phases.

However, risk aversion can counteract monetary policy expectations. In an environment where investors seek to reduce their exposure to risky assets, sovereign bonds serve as a natural safe haven. In such cases, their yields may contract more rapidly than IRS rates, even if heightened risk perception initially triggers a period of market stress before any subsequent easing.

Repo market

Despite the constraints imposed by banking regulations on capital requirements, repo market conditions influence short-term swap spread (typically up to 2 years). When repo rates exceed a certain threshold (typically 10 basis points or more), the carry trade generated by purchasing or selling securities financed through repo markets can create significant arbitrage opportunities, even after accounting for regulatory costs.

Furthermore, if a government observes that its debt is trading at a significantly higher cost than repo rates, it may issue short-term debt securities and place the raised funds in money markets.

This phenomenon notably occurred between 2020 and 2023, a period during which repo rates were significantly lower than ESTER.

Risk aversion can counteract monetary policy expectations. In an environment where investors seek to reduce their exposure to risky assets, sovereign bonds serve as a natural safe haven. In such cases, their yields may contract more rapidly than IRS rates.

Other factors

Numerous other factors can also impact the evolution of swap spreads.

Among them, the volume corporate and financial bond issuance plays a key role.

These issuances, which issuers partially hedged through IRS (Interest Rate Swap), exert upward pressure on swap spreads. Conversely, in a low-rate environment, issuers may engage in rate locking operations using paying IRS in anticipation of their future bond issuances, leading to tightening pressure on swap spreads.

Subscriptions or redemptions flows in funds that hedge duration risk with paying IRS can also influence swap spread levels. The magnitude of these pressures depends on various factors, including corporate investment and bank lending activity, market flow dynamics, expectations of interest rate trajectories, and absolute rate levels.

Finally, cross-currency swap spread differentials can also be arbitraged after accounting for the forward FX basis8.

Limitations of these factors

The relative supply of government bonds, monetary policy expectations and the levels seen in the repo market seem to explain the recent developments in swap spreads on the reference pillar and in the short term. However, they are insufficient for the spreads between curve pillars and currencies. It is necessary to examine the dynamics of flows in order to explain them.

Swap spread curve inversion

The inversion of the curve of swap spreads (short spreads greater than long) is an important market signal:

30-year swap spread: since the financial crisis, the 30-year swap spread has remained systematically negative in USD. It became so in Japan from 2019 and in Europe from 2024.

Spread between the 30-year and 10-year swap spreads: this spread is also sinking further into negative territory. This is mainly due to life insurance companies’ purchase programs that hedge the duration of their liabilities with IRS rather than with very long-term bond purchases. This trend has been reinforced by the inversion of the swap spread curve and the negative 30-year levels on major currencies since the financial crisis.

Even though it is well anticipated, the rising volume of government bond issuance is expected to continue driving a further tightening of swap spreads.

Predictable trends in the evolution of swap spreads

The outlook for swap spreads in the coming years is shaped by several key factors:

Increase in government bond issuance

Even though it is well anticipated, the rising volume of government bond issuance is expected to continue driving a further tightening of swap spreads. This trend is likely to be observed both in Europe – where Germany may relax its fiscal constraints following the February legislative elections – and in the United States, where the new administration’s budget deficits could further increase the supply of government securities. These pressures will be even stronger as central banks persist with their policy of quantitative tightening policies.

Rising Repo Costs

The increase cost of repo transactions, as the ECB continues to reduces excess liquidity, could also limit arbitrage opportunities in short-term maturities. This, in turn, may lead to a widening of swap spreads.

Volatility driven by political uncertainties

Uncertainties surrounding the implementation timeline and modalities of the new administration’s policies – along with the persistent concerns they may generate – could contribute to episodes of market volatility. These periods of heightened uncertainty may result in temporary widening of swap spreads, particularly on the short end of the curve.

Evolution of banking regulations

In the medium term, changes in banking regulations -particularly potential adjustments to leverage ratio requirements – could allow banks to increase their exposures to repo markets. This could help reduce swap spread fluctuations, as they would be more efficiently arbitraged.

End of pension fund hedging programs

In Europe, the anticipated unwinding of pension fund hedging programs could lead to a widening of the swap spread. Additionally, this could contribute to a steepening of the swap spread curve, particularly at longer maturities.

Sources

1. In practice, for a given maturity, the swap spread is typically calculated as the difference between:

- the market rate of a swap that starts at the maturity of the benchmark bond futures contract for that tenor and has a maturity matching the cheapest-to-deliver reference bond,

- and the market yield of that same cheapest-to-deliver reference bond.

2. The US swap spread market is already referenced against SOFR, while the European swap spread market, by default, is still referenced against EURIBOR. Since there is a

significant basis between overnight rates and term benchmarks like LIBOR or EURIBOR, this can lead to diverging swap spreads across currencies.

3. The absence of credit risk on short-term rates remains a subject of debate. Even if they are described as “Risk Free Rates”, short-term rates such as ESTER, for example, will remain anchored at levels close to the central bank’s reference rate. This situation could change if central banks decide to completely eliminate or significantly reduce excess liquidity. In addition, EURIBOR has a credit risk component since the contributions to the fixing are generally consistent with the credit quality gap between the contributor and the panel average. This was also the case for LIBOR rates, which were definitively discontinued in September 2024.

4. This statement makes sense when the swap reference rate is an overnight rate (e.g. EONIA or SOFR). The EURIBOR-indexed swaps contain a credit risk component representative of the credit quality of the panel of contributing banks. Under “normal” market conditions and on the majority of maturity pillars, this difference rarely exceeds twenty basis points.

5. In practice, arbitrage opportunities in this market are generally limited to short maturities (up to 2 years). Furthermore, for an arbitrage trade to be financially viable, the potential profit from the transaction, or P&L, must exceed at least 10 basis points to offset regulatory costs (see next section).

6. In practice, this requirement penalizes exposures that are not cleared with a clearing house and that increase the size of the balance sheets by the amount of the treated nominal amount.

7. See in particular “Negative Swap Spreads”, Federal Reserve Bank of New-York Economic Policy Review, October 2018.

8. For example, an issuer that can issue the Euro and US Dollar markets will assess the difference between the EUR and USD swap spreads from which the EUR/USD exchange base for the maturity in question must be subtracted.