Summary

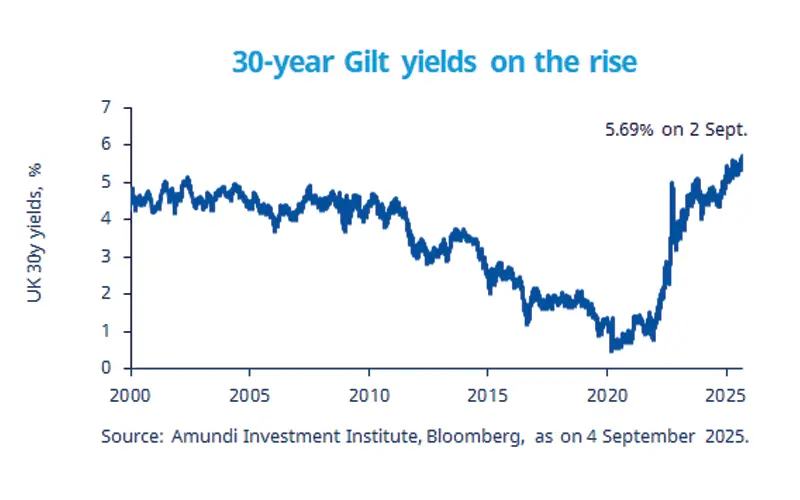

The rise in UK long‑dated yields mirrors those of other major developed markets, with added pressure from higher inflation, confirming that stress on the long end of the curve remains a key market theme.

Long-dated gilts yields rose to high levels, in light of concerns over fiscal deficits across the developed world.

UK debt is lower than some European peers, and the deficit is expected to decline, with the November budget in focus.

Despite uncertainty, parts of the UK yield curve may offer attractive valuations vs other developed markets, in particular the short-term maturities.

Yields on long-term government bonds in developed markets have been rising this year. In the UK, 30-year gilt yields reached their highest level since 1998, driven by inflation worries and concerns over government debt — though the UK’s debt-to-GDP ratio remains below that of some large European countries. Structural changes, such as fewer pension scheme buyers, add further complexity.

Government measures — higher employer national insurance, increased minimum wage, and energy price adjustments — have halted inflation’s decline, meaning the UK could face higher policy rates for longer compared to other advanced economies. On a positive note, the government is showing an intention to improve its finances, and the fiscal deficit is also expected to decline. The main market focus will be on the November budget and the Bank of England’s actions.

Actionable ideas

Global opportunities in short-term bonds

Global short-term bonds may offer appealing yields and benefit from expected rate cuts by major developed market central banks.

European and UK equities

We believe the UK offers strong businesses at attractive prices with good dividends. In the broader European region, there are opportunities in businesses focused more on domestic consumption in the middle cap space.

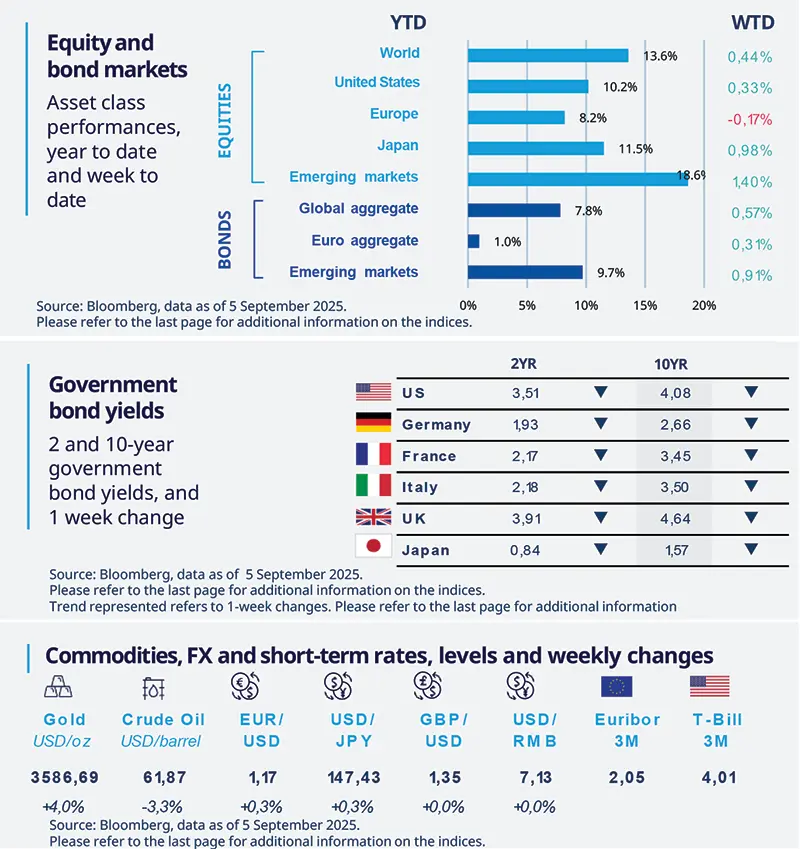

This week at a glance

US equities rallied last week as markets priced in a potential shift toward lower interest rates from the Fed — reinforced by weak labour market data. Bond yields were down, with the Treasury two-year falling to its lowest level in almost three years. In commodities, gold rose while oil prices fell.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 5 September 2025. The chart shows the US Dollar Index.

1Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US service sector activity gains momentum

Services activity rose strongly in August, signalling solid Q3 growth, while manufacturing showed early signs of recovery driven by domestic demand. Employment remains weak, suggesting some labour market softness ahead. On the inflation side, service-sector inflation pressures persist and there are signs of possible spillovers from tariffs too; manufacturing cost pressures eased slightly but remain a concern.

Europe

Eurozone PMI signals cautious optimism

According to PMI data, Eurozone growth remained modest in August, with services slowing but manufacturing improving and new orders rising slightly, led by Spain and Italy. Germany’s growth slowed, and France stayed in contraction territory despite a PMI uptick. On inflation, signals of price pressures ticked up somewhat, potentially adding complexity to the ECB’s inflation outlook amid sluggish overall growth and weak export demand.

Asia

Manufacturing in Asia ramps up, although tariff concerns persist

Asia's manufacturing sector reported broad-based improvement in August. ASEAN manufacturing PMI rose to 51 from 50.1, led by increasing demand. East Asian economies saw the same measures rebounding from July's pessimism, although concerns about US tariff impacts remained. India and China also registered notable rises in manufacturing PMI.

Key dates

8 Sep China Balance of Trade – Exports & Imports YoY | 10 Sep US PPI MoM, China Inflation Rate YoY |

ECB Interest Rate Decision, US Core Inflation Rate MoM |