Summary

While the IMF has upgraded its global growth forecasts, policy uncertainty, high government deficits, and risks around protectionism may affect economic activity. This underscores the need for diversification and exploring regions with resilient growth stories.

- The impact of US tariffs on inflation is limited for now but political pressure on US institutions is growing.

- In addition, risks around global trade wars, particularly between the US and China, still persist.

- Hence instead of being carried away by euphoria, there is a need to focus on quality assets and diversification1.

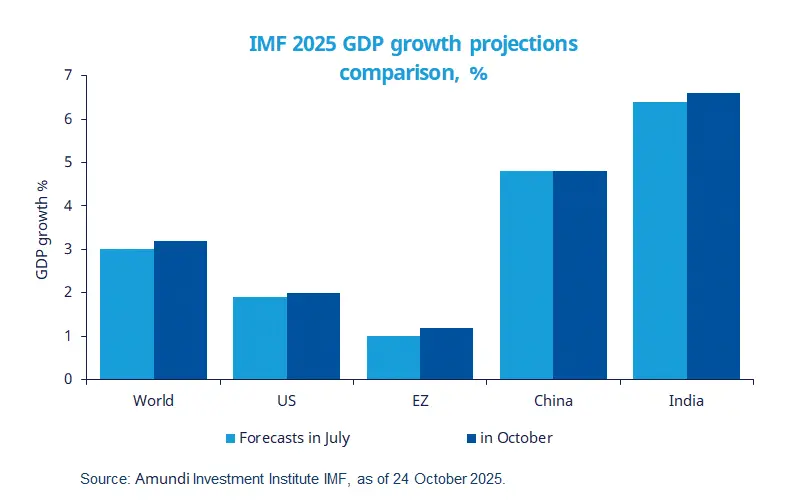

In its latest World Economic Outlook, the IMF upgraded its 2025 global growth forecast to 3.2%. Global trade and financial conditions have proven resilient, helped by trade deals between the US and some of its trading partners. We believe the global trading system is bruised but not broken: roughly 70% of trade is flowing as before. An artificial intelligence–driven (AI) productivity upswing has also supported prospects for global growth.

Looking ahead, risks related to trade wars, uncertainty over fiscal policy, and labour-supply issues could hinder growth. For next year, global growth is forecast at 3.1%, but this masks the risks. In the US, domestic consumption remains the main pillar of growth, although weakening labour markets are an important concern. In the euro area, much depends on the implementation of Germany’s fiscal stimulus. The EU’s defence push is viewed as a gradual evolution. Finally, the IMF’s growth forecasts for China were unchanged and are close to the Chinese government’s target.

This week at a glance

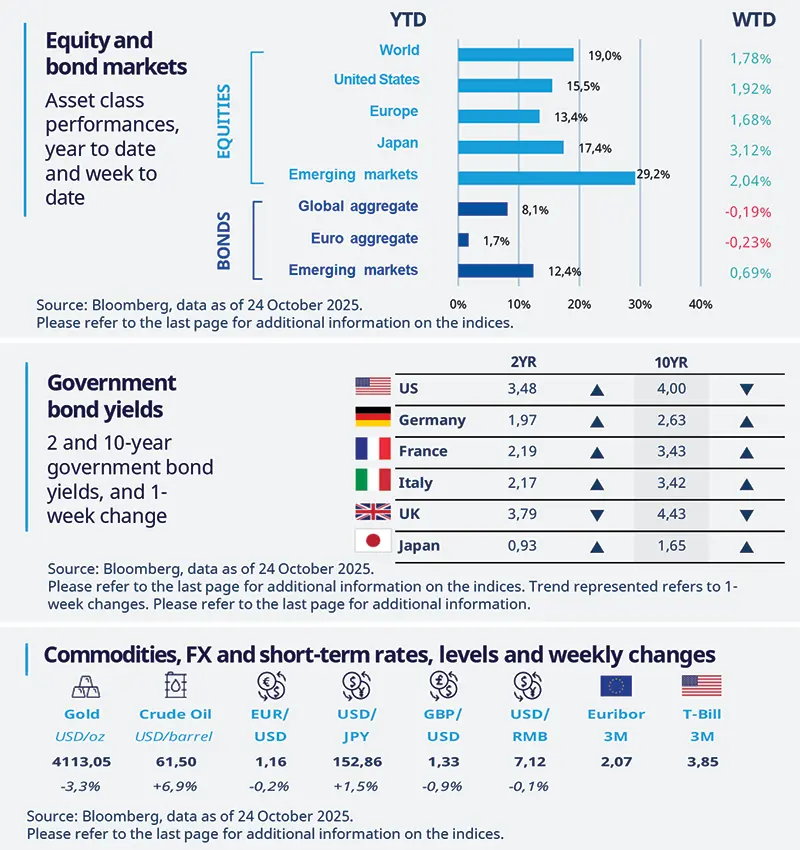

Equity markets rose on the back of optimism around strong corporate earnings so far and expectations of easing trade tensions between the US and China. That said, some concerns over a protracted US government shutdown persisted. Oil prices surged after the US imposed new sanctions on Russia’s largest producers, citing Moscow’s lack of commitment to peace in Ukraine.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 24 October 2025. The chart shows the IMF real GDP growth forecasts for 2025.

1Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US home sales grew in September

Declining mortgage rates helped increase existing home sales by 1.5% in September. Most of the growth came from single-family homes in the West and South, while sales in the Midwest declined. The supply of homes for sale remains steady. Although lower rates are expected to support demand into 2026, high inventories of new homes may keep price growth modest. However, housing affordability remains very low, posing challenges especially for first-time buyers.

Europe

European consumer confidence strengthens

A preliminary consumer confidence indicator released by the DG ECFIN for the EU and EZ areas rose in October, for the second month in a row. These scores edged closer to the long-term average for the EU region. In addition, the data builds on a slight increase in September, when consumers felt more optimistic about their households’ future finances and planned more major purchases.

Asia

New Japanese Prime Minister

The new Japanese prime minister, Sanae Takaichi, has vowed to tackle the country’s rising cost of living. Her views have gained prominence after recently released inflation data showed an acceleration in September. Her proposals include subsidies for electricity and other tax relief. If implemented, these measures may affect government finances and could eventually influence bond yields and the yen.

Key dates

Fed interest rate decision, US retail inventories |

ECB and BoJ interest rate decision, US and EZ GDP growth rate, |

EZ inflation rate, US personal income and spending |