Summary

With softer economic growth ahead and the Fed expected to cut rates in 2024, this supports our positive stance on developed and emerging market bonds.

- We expect soft global economic growth in Emerging Markets, with Asia in particular, to remain the growth engine.

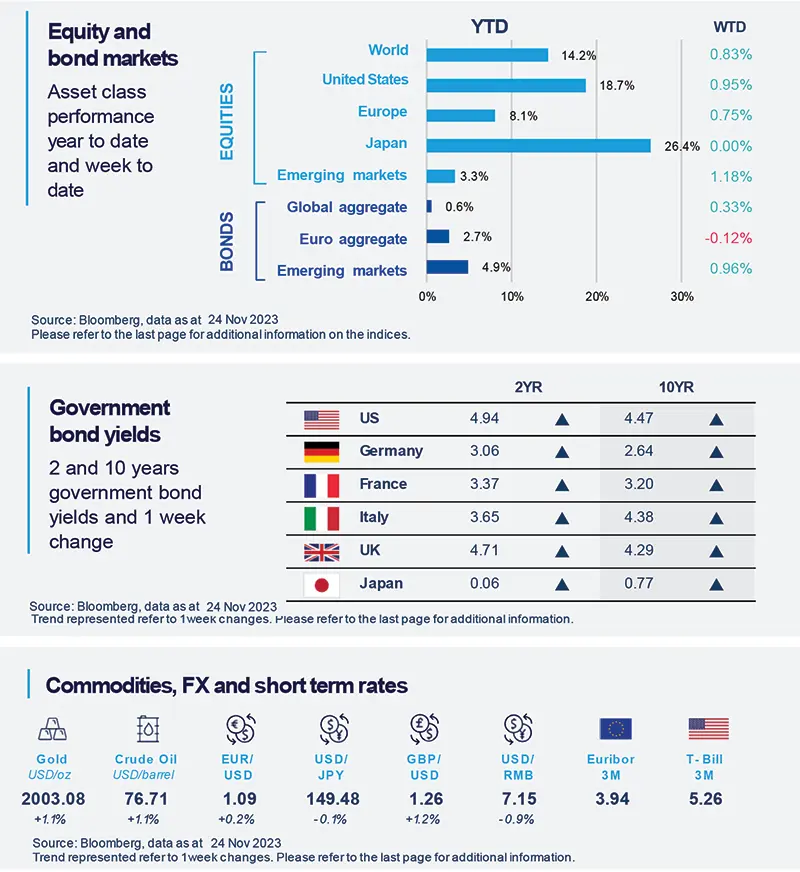

- In November, government bonds are back in positive territory YTD (despite a recent pause) and equities are posting strong performances.

- A pause, followed by cuts from the Fed bode well for government bonds both in Developed and Emerging Markets.

Last week business surveys in the Eurozone and macroeconomic data in the US (durable good orders) confirm our soft global economic outlook for 2023.

In our just released Investment Outlook for 2024, we expect a global slowdown, with Emerging Markets set to remain more resilient compared to Developed Markets (DM).

Asia will be the global growth engine and is expected to contribute for around 2/3 of global growth in 2024. Inflation is a key variable to watch in 2024. We see it moderating and leading DM central banks to start cutting rates later in 2024.

Against this soft outlook, fixed income is king and is our main conviction for 2023 year-end and H1 2024. For 2024 we see opportunities to rotate towards equity, credit and Emerging Markets when Central Banks start cutting rates.

Actionable ideas

-

Government bonds in focus amid peaking rates

Global government bonds seek to offer attractive yields and the potential to benefit from interest rates trending lower in 2024. -

Multi-asset favoured by a return of the bond engine

The supportive outlook for bonds is positive also for multi-asset allocations that could also potentially benefit from rotation opportunities across asset classes and regions.

This week at a glance

The direction remained positive for most bonds and equities markets, although to a lesser extent than the previous week due to mixed macroeconomic data. We had European business surveys (weak but, improving), US orders of durable goods (weak) and US and Euro consumer confidence indices (improving).

Amundi Investment Institute Macro Focus

Americas

US October durable goods orders suggest business equipment investment on a weak footing in Q4

Looking through the most volatile components, core orders were flat while non-defence capital goods ex-aircraft orders declined again. Consistent with deteriorating survey-based capex intentions, data suggests business equipment investment is starting on a weak footing in Q4, as borrowing costs remain high and lending standards tight.

Europe

November business survey: Euro Area still weak but bottoming out, UK improving

Composite Flash Euro Area PMIs are still weak but show improvement particularly in Germany. These signal a potential turning point as also forward looking subcomponents suggest improvements ahead. Both sectors improved while remaining in contraction territory, with manufacturing still behind. The UK is entering an expansion area.

Asia

Bank Indonesia back to business as usual

As expected, Bank Indonesia (BI) left its Policy Rates unchanged at 6.0%, following last month unexpected 25pbs hike. Despite the country sound macro-financial backdrop, the perspective of a Federal Reserve higher for longer triggered a relatively brutal IDR depreciation, followed by BI decision to hike. With the Fed expected pivoting, BI should now pause before starting easing by mid-2024.

Key Dates

|

30 Nov Euro area HICP, |

30 Nov |

1 Dec US ISM Manufacturing, |