Summary

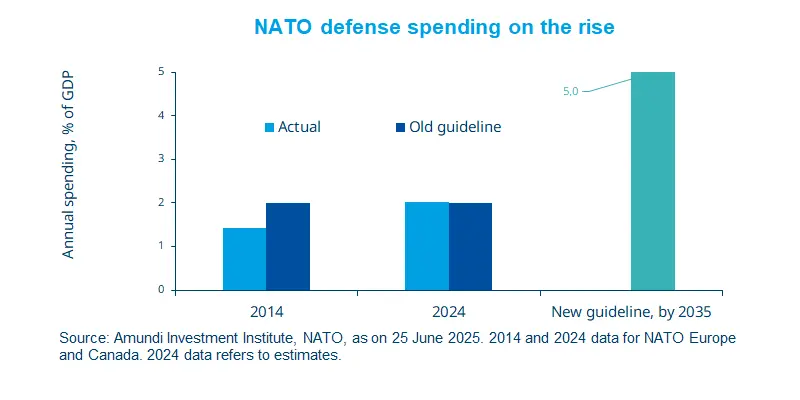

Renewed security challenges in a fragmented world indicate that Europe must strengthen its strategic autonomy. NATO’s latest declaration to raise defence spending may present such an opportunity for the region.

The new world order, intensified by threats like the Russia-Ukraine war, is driving calls for higher defence spending.

This is a reminder for Europe to invest more in defence, infrastructure and enhance integration of its institutions.

From an economic perspective, this may be positive for the region’s economic growth in the long term.

In June 2025, the NATO committed to allocating 5% of member countries’ GDP annually to defence and related security spending by 2035. Financing this is a big question, particularly for Europe, and Germany appears best positioned. Government’s intention is evident from its plans to raise more debt and from the approval of the German budget by the Chancellor’s cabinet. While there is clear recognition of the need to do so in other countries such as France, Italy and Spain, fiscal space is limited. This suggests that, at some point, common debt at the EU level may be necessary. Another proposal made earlier this year is a European Defence Mechanism. Overall, increased defence and infrastructure investment, joint debt issuance, and deeper EU integration, may enhance confidence in European markets and the euro.

Actionable ideas

European defence

The renewed push in Europe to invest more in the defence sector may open up opportunities in the equity space linked with the sector.

Global equities

In an environment of rotation outside expensive segments, equities in areas like Europe, the UK and Japan currently look attractive.

This week at a glance

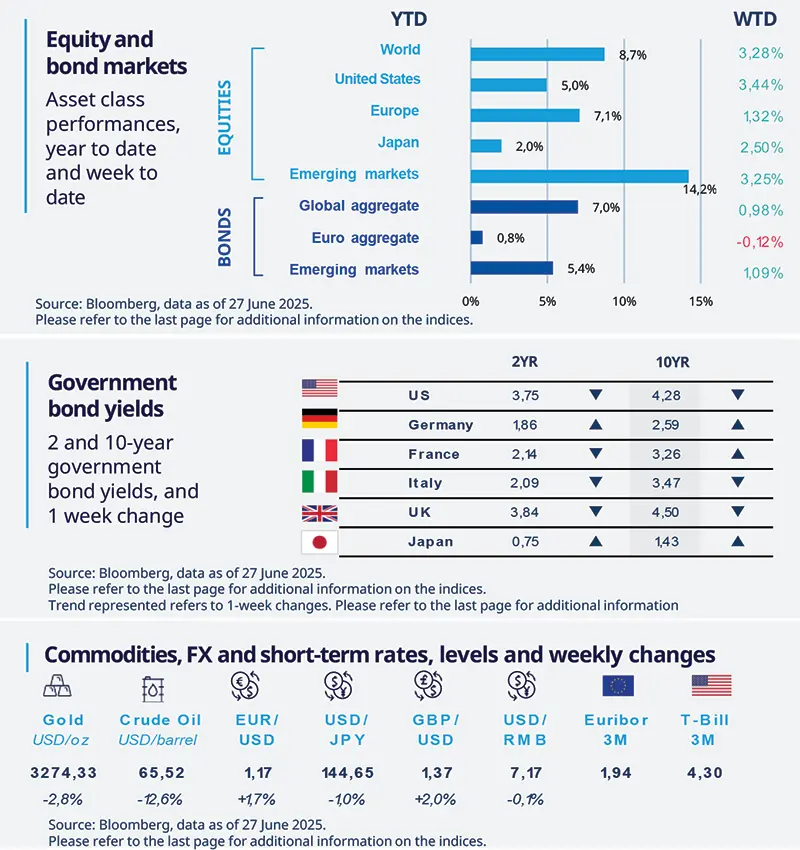

Global equities rose on the back of optimism on trade talks between the US and its main trading partners. Oil prices plunged owing to easing geopolitical tensions, following a cease-fire between Israel and Iran. The situation remains fluid. In bond markets, US yields declined on renewed expectations of Fed rate cuts, given weak economic data.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD). All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 27 June 2025. The chart shows US monthly CPI against the Bloomberg consensus of economists.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US consumer showing signs of fatigue

The third update to the US GDP growth for the first quarter came in below market expectations at -0.5% mainly due to decelerating growth in services spending. The overall data supports our view that US consumption and labour markets are important factors to monitor when it comes to economic activity. However, we maintain a scenario of no recession in the country.

Europe

Eurozone PMI held steady in June

The preliminary data for composite PMI came in at 50,2 in June. A number above 50 means expansion, and below 50 shows contraction. The overall data was similar to May but the services component of the index showed a slight improvement. Manufacturing, however, stayed in contraction territory. We also noticed divergences across countries, with Germany showing signs of improvement possibly due to sentiment around fiscal stimulus.

Asia

China’s industrial profits fell in May

Profits for industrial firms declined by 9.1% year-on-year, reflecting pressures in both domestic and export markets. Although a tariff truce between the US and China took effect around mid-May, some damage had already been done. Looking ahead, the latest trade talks between the two countries are expected to benefit industrial exporters. However, the overall trade environment is likely to remain volatile.

Key dates

30 June Japan and India industrial production, UK GDP | 1 July EZ CPI, US ISM, Indonesia CPI, South Korea trade balance | 3 July US labour markets, |