Summary

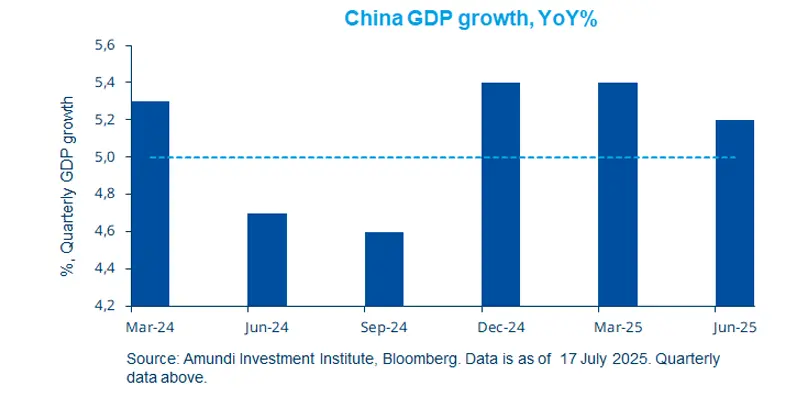

Resilient China’s growth highlights the economy’s ongoing efforts to adjust trade partnerships and manage tariff-related challenges, keeping it on track to reach its growth target for 2025.

Despite the ongoing trade war with the United States, China’s growth remained resilient thanks to trade diversification* into non-US markets.

China is set to reach its 5% growth target for 2025, with less need for additional fiscal stimulus this year.

While ongoing trade negotiations will keep uncertainty high, we see areas of resilience across emerging economies.

China’s economy recorded a higher-than-expected 5.2% YoY GDP growth in the second quarter of 2025. This confirms that the world’s second-largest economy has held up well so far despite the US tariff policy, supported by front-loading by exporters (increasing production ahead of export orders to avoid higher government taxes or tariffs that may be implemented after a deadline) and resilient shipments to markets outside the United States. However, domestic consumption weakened as government subsidies began to phase out in some regions. While this may lead to some softening in GDP growth in the second half of the year, China remains on track to achieve the government’s average growth target of 5.0% for 2025.

Actionable ideas

Emerging market equities

The emerging worlds may offer an array of investment opportunities, backed by different domestic stories, offering diversification* opportunities to investors.

Multi asset investing

Multi-asset investors could potentially exploit opportunities across different asset classes and capitalise on tactical opportunities that may open in emerging markets.

This week at a glance

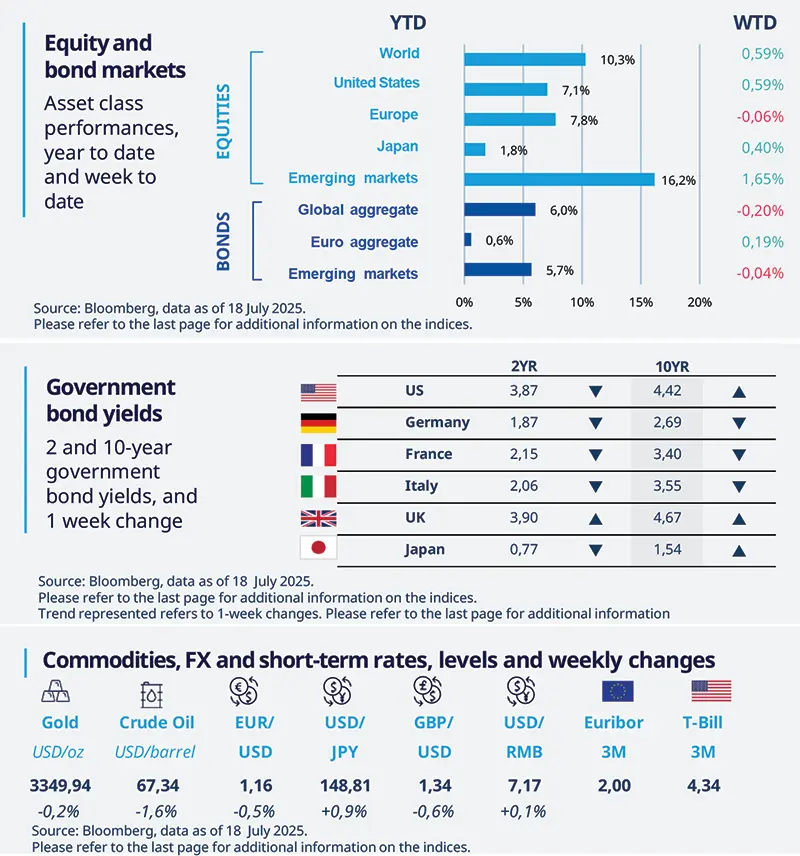

Equity markets were generally up last week amid signals of US economic strength, and the dollar also rose. Bond yields were mixed, with US long-term yields rising and those in Germany declining. In commodities, oil prices fell over the week despite fresh EU sanctions on Russia.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 18 July 2025. The chart shows China GDP YoY growth and the government’s official target.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US CPI up modestly; tariff impact still unclear

US CPI rose 0.3% MoM and 2.7% YoY in June. Core CPI which excludes food and energy components, increased 0.2% MoM, up 2.9% YoY. Services inflation among the largest components softened, offsetting modest tariff-led increases in the core goods component. However, it is still too early to judge the full impact of tariffs, which may take months to be seen. The Fed is expected to stay on hold in July given the uncertain economic outlook.

Europe

EZ sentiment improves, Germany shines

The ZEW indicator of Economic Sentiment for the EZ rose to 36.1 in July, up from 35.3, the highest reading in four months. Analysts expect either stability or modest improvement in economic activity. Germany’s ZEW index rose to 52.7 from 47.5 in June. Hopes for a quick resolution to the US-EU tariff dispute and Germany’s investment programme appear to be propelling an overall optimistic sentiment for the EZ economy.

Asia

US and Indonesia cut tariffs; trade set to expand

In advance of the 1 August deadline, the United States and Indonesia reached an agreement on tariffs: US tariffs on Indonesian goods will be reduced from 32% to 19%, making them among the lowest in the region; Indonesian tariffs on US goods will be cut from an average of 8% to 0%. Additionally, Indonesia has committed to increasing its purchases of US products in the energy and soft commodities sectors, as well as Boeing jets, aiming to reduce the trade surplus.

Key dates

22 July Fed Chair Powell Speech, South Korea Consumer Confidence | 24 July ECB interest rate decision, EZ Composite PMIs, US Composite PMI |

UK Retail Sales, US |