Summary

Executive Summary

As traditional banks retreat from lending markets, Private Debt is stepping in to fill the gap. From nearing USD 2tn globally today, Private Debt’s assets are expected to reach USD 3.5tn by 2028. Why is this? Private Debt offer higher yields than public credit and is less sensitive to short-term market volatility, so works well as a portfolio diversifier.

Growing allocations to Private Debt are driving some convergence with Public Debt, although both continue to exhibit distinct behaviours. The scale up of the market is driving partial convergence in risk perception and processes, yet material differences persist — notably the performance drivers — creating complementary, not fully substitutable, opportunities for diversified fixed income portfolios.

Going forward, we’ll see more retail investors allocating towards private debt. This means the industry needs to evolve and develop new products and structures that are suited to retail investors’ needs. This includes evergreen funds, development of a secondary market, lower minimum investment requirements as well as enhanced reporting and fintech distribution to improve liquidity.

Private Debt investors are navigating multiple ruptures at once. Industry-wise, it prepares to welcome new entrants. Cyclically, the asset class benefits from more stable credit conditions, but also faces shocks (trade wars, geopolitics) that impact deal flow. As portfolio diversification becomes more challenging, Private Debt will be even more in demand, but this growth must be managed by exploring new opportunities across regions and sectors.

Key risks include overvaluation from competition, possible rising default from past vintages and risk from growing Payment-in-Kind use, fundraising uncertainty, more frequent liquidity stresses, and NBFI–bank contagion.

In perspective, the ongoing transformation of private debt is unlocking opportunities, from mainstream recognition and fintech-driven access to ESG integration, AI-powered innovation, and global expansion, which will reshape the market and drive growth across new borrower segments and emerging industries.

Private Debt stands at a critical juncture, balancing strong investor inflows and diversification benefits with challenges such as rising competition, retail-driven adjustments, and evolving regulatory landscapes. While risks like overvaluation and declining underwriting standards demand vigilant monitoring and disciplined selection, the industry is well-positioned to capitalise on its scaling growth and transformative trends such as AI and ESG.

Why Private Debt is gaining growing attention?

Private Debt offers alternative performance drivers

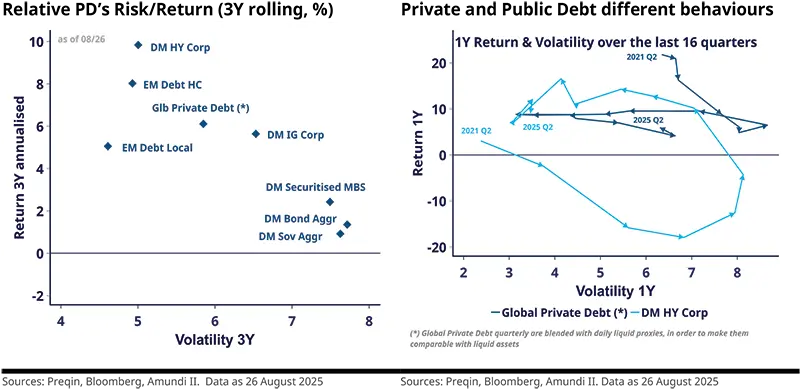

Private Debt typically offers higher yields than public credit, partly due to the illiquidity premium investors receive for committing capital to less liquid loans, as well as a complexity premium for the expertise required to access, source and structure these loans. Furthermore, Private Debt often finances smaller and mid-market companies with more limited access to capital markets, which can provide attractive risk/return profiles and face less competition among lenders. This creates opportunities for higher yields and more favourable deal terms.

Additionally, investors usually hold private loan funds to maturity, focusing on cash flows rather than market price fluctuations. This makes Private Debt less sensitive to short-term market volatility than public credit.

The cash yield on buy-and-hold portfolios also provides a tangible income, making it an ideal product for retirement and for institutions that require recurring income.

Private Debt encompasses various sub-strategies, each responding to different performance drivers. Direct lending – the largest segment – involves non-bank lenders providing loans directly to mid-market companies, often in the form of senior secured loans. Mezzanine debt typically sits lower in the capital structure, and carries higher risk and return. Distressed debt involves purchasing the debt of companies in financial distress or bankruptcy, potentially offering high returns but with significant risk and complexity. Specialty finance includes niche lending areas such as consumer finance, asset-backed lending, litigation finance and trade finance. The combination of high-risk/reward pockets alongside larger segments delivering more stable cash flows and lower default risk creates an appealing mix for investors.

Post-financial crisis regulations have constrained banks’ ability to lend to certain borrowers, creating a funding gap that Private Debt funds have filled. Facing fewer regulatory capital requirements and limited or no distribution/underwriting risks, these funds are often more flexible and responsive to borrower needs.

As opposed to public markets, where terms are relatively standardised, private debt agreements are often bespoke, allowing lenders to negotiate tailored terms, covenants and collateral packages that better protect their interests. This flexibility can lead to stronger credit protections and more stable cash flows than those typically found in public credit. Many private debt instruments are also floating rate with a base rate floor, providing a natural hedge against rising interest rates and inflation.

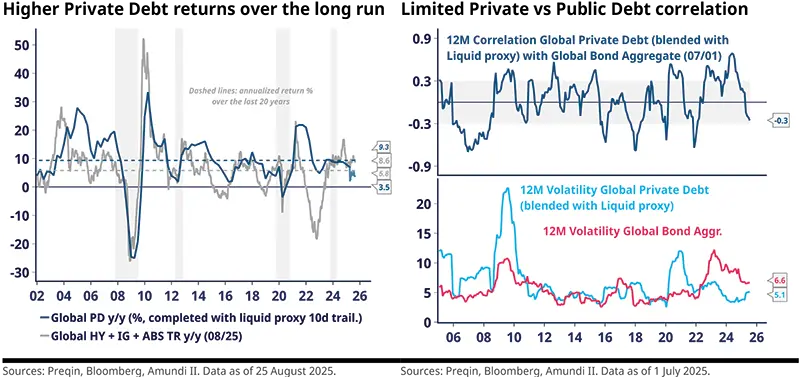

Due to differences in liquidity, borrower profiles and pricing mechanisms, Private Debt exhibits limited correlation with public credit, making it an attractive diversification tool within fixed income portfolios.

Investors are seeking to diversify concentrated exposures to public credit markets

Public credit instruments, including Treasuries, are sensitive to market volatility, interest rate fluctuations and geopolitical events, which can lead to significant price swings. Ballooning deficits and weakening political stability in developed market countries are increasingly impacting Treasury markets and shaping central banks’ agendas.

Public credit markets are also highly competitive and efficient, often resulting in tighter credit spreads and lower risk premiums. This compression limits the potential for outsized returns and makes it more difficult for investors to differentiate performance.

The equity/bond correlation is increasingly volatile and unreliable, leading investors to seek more all-weather diversification.

With investment-grade markets highly correlated to sovereign debt and high-yield bonds representing a relatively small portion of credit markets, investors are seeking alternative fixed income options.

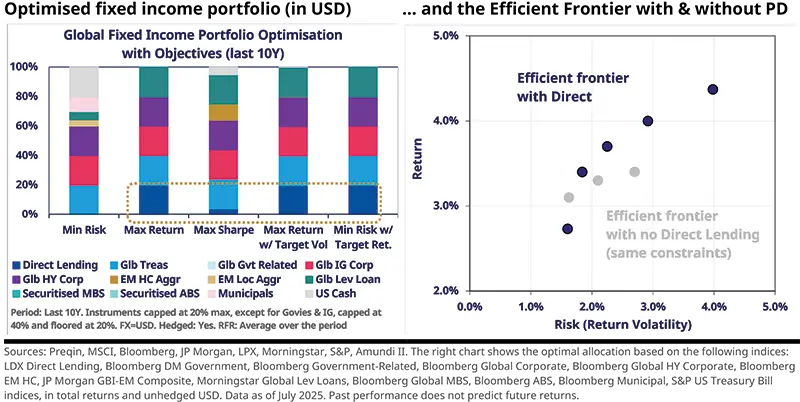

As a result, Private Debt fits well within diversified investment allocations

Private Debt provides enhanced diversification and can help to improve risk-adjusted returns in fixed-income allocations. The simulations below determine the optimal fixed-income portfolio allocations, including Direct Lending for various volatility levels, over the last 10 years, and with some realistic constraints. The efficient frontier, including Direct Lending, is far more favourable than the one excluding Direct Lending.

Private vs. Public debt: converging yet remaining distinct

While private and public debt have been distinct in terms of structure, liquidity and investor base, recent market developments have led to some convergence between the two. As investors seek diversified fixed income solutions and borrowers explore multiple financing options, the boundaries between public and private credit are becoming less defined. However, the behaviours of public and private debt remain largely distinct.

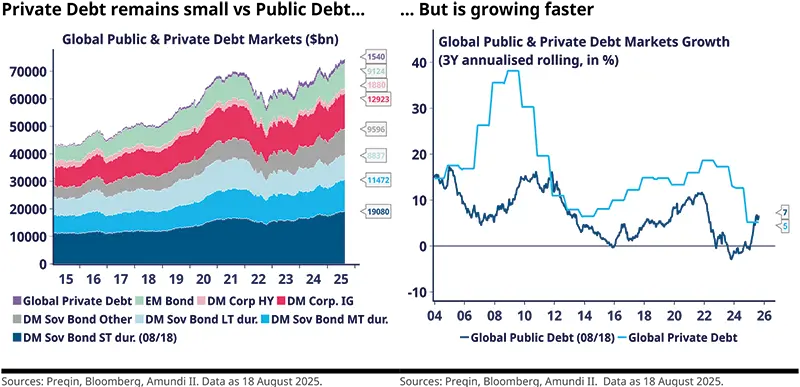

Relative Size: Private Debt remains small vs Public Debt

Public credit markets remain much larger than private debt markets. However, Private Debt is growing much faster, although growth rates have converged since 2022. From nearing USD 2tn globally today, Private Debt’s assets are expected to reach USD 3.5tn by 2028.

Relative liquidity, compensated by an illiquidity premium

Increasing capital adequacy requirements are causing banks to exit certain credit market segments, benefiting private credit providers.

By nature, there remains a divergence in liquidity: Private Debt funds typically involve an 8-10-year lock-up period, which is compensated by an illiquidity premium. We estimate that this liquidity premium levels at around 2% today.

Relative risk/returns show differentiated behaviours

Risk and return profiles are converging to some extent as investors increasingly blend their fixed income strategies to enhance diversification. However, performance characteristics remain distinct, as illustrated in the chart on the right, which shows the trends in return and volatility for Private Debt and High Yield over the past four years.

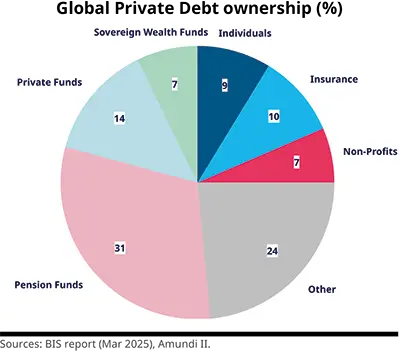

Private Debt ownership is gradually shifting

Institutional investors, particularly pension funds and insurance companies, are more involved with a more integrated approach to credit investing, making less distinction between public and private options. These investors tend to have long-term investment horizons and low liquidity needs.

Retail investors currently make up a small but growing share.

Hybrid structures are growing in popularity. These are funds that invest in both public debt and private lending, seeking flexibility and diversification.

|

More sophisticated borrowers are resulting in a more competitive environment. They are exploring both public and private credit options to meet their financing needs. This leads to a more competitive environment, with private lenders striving to offer timely and more flexible credit solutions.

Regulatory and economic factors are becoming more harmonised, and economic conditions impact both markets simultaneously. For example, higher interest rates may lead public borrowers to seek private alternatives.

Technology and data analytics are being used to seek a more holistic assessment of credit risk across both markets. This is still at an early stage as access to data remains limited in private credit.

Investor education and awareness are improving, with investors becoming more familiar with the benefits and risks of private credit, increasingly considering it a credible and reliable alternative.

As a result, private and public credit spreads are slowly converging. Morgan Stanley estimates that direct lending spreads on leveraged buyout (LBO) loans vs comparably rated syndicated loans have shrunk by 40 bps over the last 3 years (March 2025). KBRA sees a similar convergence between direct-lending middle-market loans and syndicated loans.

Overall, while risk perceptions and processes are converging between both worlds, their performance drivers and behaviours remain differentiated.

Retail investors growth will drive complex adjustments and new industry structures

A significant portion of future Private Debt inflows is expected to come from retail investors, necessitating a range of complex adjustments beyond those required for most other market entrants. In response, the Private Debt industry is evolving by developing new products and implementing new investment structures to better meet the needs of retail investors.

Evergreen Funds. These funds allow for more frequent subscription and redemption terms, and are likely to become very popular with retail investors. The structure of evergreen funds can accommodate varying investment horizons, allowing investors to enter and exit more flexibly.

Secondary Market Development in Private Debt. Liquidity in Private Debt has traditionally been limited due to long lock-up periods, but secondary markets are gradually improving investor flexibility. Emerging platforms facilitate the buying and selling of private debt interests, enhancing price discovery and reducing the illiquidity premium. Some funds also offer liquidity features like periodic redemptions or evergreen structures. While still developing, these secondary markets are expected to grow with technological advances and rising investor demand, making private debt more accessible.

Lower Minimum Investment Requirements. Due to rising competition and demand for private credit, fund managers may lower minimum investment thresholds to reach retail investors in addition to high-net-worth individuals and institutions.

Increased Transparency and Reporting. Retail investors are likely to demand transparency regarding fees, performance and risk that is on par with what institutional investors receive, as the latter already benefit from a high level of transparency. Fund managers may respond by offering enhanced reporting and communication about investment strategies and outcomes, which can help build confidence among retail investors in private credit.

Diversified Product Offerings. The product menu for retail investors may grow to include sector-, thematic-, or regionally-focused funds, as well as funds tailored to specific risk profiles such as income generation, capital appreciation or risk mitigation.

Use of Technology and Platforms. Fintech platforms are rising to grow private credit access for retail investors. These platforms can streamline the investment process, provide educational resources and offer a range of private market products. Technology can also enhance due diligence, making it easier for retail investors to assess potential investments.

Regulatory Developments. Regulators may develop new frameworks to protect investors while promoting access to alternative investments. Initiatives to maximise investor education might also be important.

Regulatory changes and investor protections also demand adaptations

As the private credit market matures, several regulatory changes and investor protections are anticipated.

Stricter disclosure requirements. More information about fees, performance, risks, and investment strategies.

Financial advisors will be required to assess clients’ suitability based on risk tolerance, investment goals, and financial situation.

Specific frameworks for these activities will include fundraising limits, investor caps, and types of offerings allowed for retail clients.

Regulatory guidelines and standards will be developed to prevent "greenwashing."

Regulators will seek to boost liquidity for retail investors, by developing secondary markets/platforms for exchange of private assets.

There will be increased oversight of private fund managers through audits and compliance checks.

Measures could include more robust reporting requirements for suspicious activities and increased penalties for violations.

Efforts will be made to standardise terms and structures in private markets to enhance comparability and transparency.

These will allow experimentation with new private products and structures in a controlled environment.

More programmes developed to educate investors on how to assess private funds and the importance of diversification.

In perspective, Private Debt stands at multiple crossroads

Private Debt is at multiple crossroads, with both new risks and opportunities

From an industry standpoint, it is both mature, as it has grown significantly, but also at an early stage, as it is broadening access to new entrants, particularly retail investors. This will likely lead to increased competition and a focus on risk management.

From a cyclical standpoint, the surge in interest rates to combat extreme inflation is behind us. Private debt now benefits from more benign macroeconomic and credit conditions, although these are being unsettled by a series of shocks (trade wars, volatile capital flows, geopolitics), which affect deal-making and corporate issuance.

From an investor standpoint, portfolio diversification has become a major challenge and imperative. Diversifying assets with all-weather protection – including Private Debt – will be in high demand. Private Debt stands to benefit significantly but must manage growth, explore new opportunities across countries and sectors, and continue delivering performance without taking on additional risk.

We go into further detail below.

Maturity and Growth

Private markets have matured over the last decade. They started in the early 2000s, took off after the financial crisis (GFC), and are now nearing USD 2 trillion in assets under management, which might be underestimated.

There is more investor depth, increased competition among lenders, and more efficient pricing and underwriting standards.

It is also at an early stage of broadening to new types of investors, especially retail, with multiple adjustments still needed to accommodate this.

Increased Competition

Growing capital flows into private credit might lead to increased competition for attractive deals, potentially causing crowding, looser underwriting standards and lower yields.

|

Macro Conditions

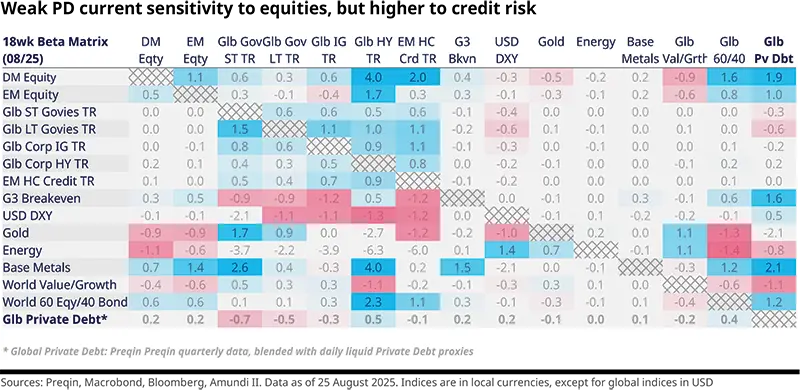

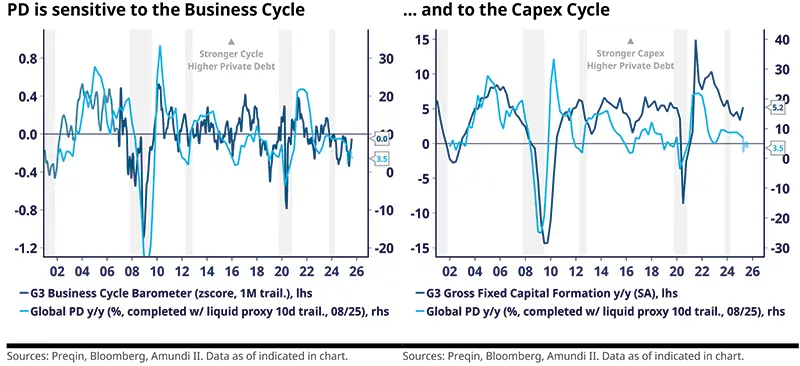

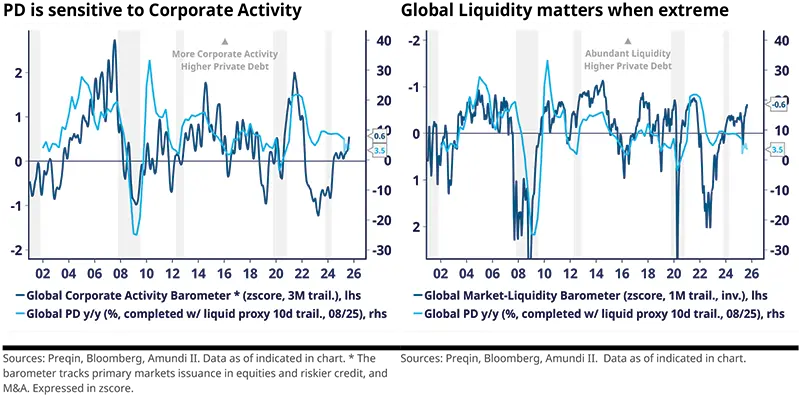

The private debt cycle is influenced by macroeconomic conditions. Private Debt is particularly sensitive to the business and capex cycles, as well as to credit growth. Conversely, Private Debt tends to respond positively to inflation and higher rates, while showing limited sensitivity to public bond volatility.

The bulk of developed markets (DM) debt is public, whereas the private sector in most DM countries has maintained relatively low leverage. This means the private sector has significant growth potential. The ramp-up in defence and infrastructure spending in Europe would also contribute to supporting Private Debt.

The main constraint comes from policy uncertainty, which keeps companies in a cautious, wait-and-see mode. Corporate activity and credit impulse have stayed resilient in recent months, but are not decisively picking up yet, resulting in mixed Private Dept.

Regulatory Landscape

Stricter regulations may limit funds’ ability to raise capital or invest in certain types of loans. However, these regulations tend to impact banks more than private funds, which may contribute to private credit expansion.

Unlike banks, private funds can only extend loans using their own capital and face less regulatory pressure. Banks, subject to tightening capital adequacy requirements, must prioritise capital use and may shrink their range of activities and products.

Major regulatory shift post-GFC

|

Investor Sentiment

The private debt cycle depends on investor appetite, which is influenced by market conditions, performance and perceived risks. Surveys suggest appetite remains strong.

Focus on Risk Management

The maturing credit cycle and broadening retail access are leading to increased focus on risk management and due diligence, with more rigorous borrower assessments and portfolio diversification.

Emerging Trends

Private Debt is likely to be involved in sectors exposed to German spending in the EU, which will need funding. To a lesser extent, the rise of ESG (Environmental, Social, and Governance) investing is also a trend.

Key risks that Private Debt will need to navigate

- Credit/Default Risk & Interest Rates. Private Debt may lend to companies without access to traditional financing, especially in cyclical sectors sensitive to interest rates. This risk is manageable but requires constant monitoring. Managers tend to avoid the most cyclical sectors.

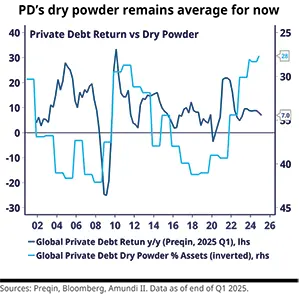

- Private Debt Dry Powder & Capital Raising. Dry powder stands at USD 450 billion, but does not appear pressing currently. More concern exists about capital raising going forward.

- Regulatory Risks. Evolving regulatory frameworks can alter operations and the attractiveness of Private Debt investments, affecting capital raising, investment types and transparency.

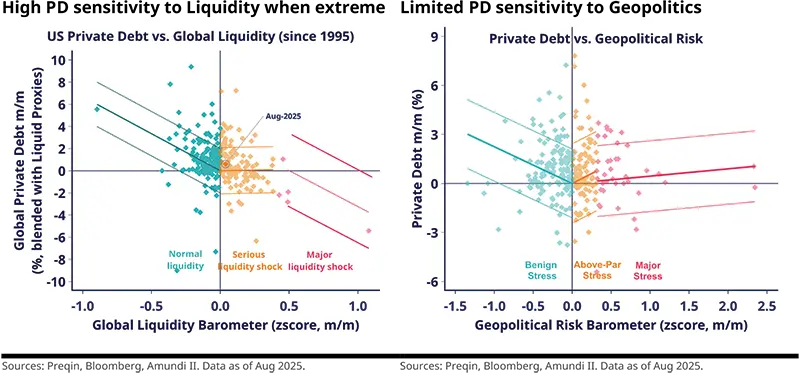

- Geopolitical Risks. Private Debt is not fully immune but is more sensitive to macroeconomic than geopolitical uncertainty, unless geopolitics significantly impacts growth (see the right chart below).

- Lack of Standardisation. Variations in terms, structures and reporting practices can lead to ineffective risk/reward analysis.

Potential Wave of Defaults. There is an untested potential wave of defaults for past vintages (in particular those having faced Covid, extreme inflation and rate increases), as a benign default environment has prevailed since Private Debt took off post-2008. Currently, default rates are low but rising slightly. Fitch reported a 5.2% default rate for syndicated loans in 2024. Law firm Proskauer reported a 2.7% default rate on private credit loans in Q4 2024, up from 2.0% in Q3 2024.

Growing Payment-in-Kind (PIK) levels in Business Development Companies (BDCs). PIK allows borrowers to defer interest payments by adding them to the loan principal, providing immediate relief in a high-rate environment. Increased use of PIK may signal deeper financial issues, as it increases the debt burden and hidden leverage.

Contagion risk from the interconnection between banks and non-bank Financial Institutions. The growth of Private Debt, largely intermediated by non-bank financial institutions (NBFIs), is intensifying the interconnectedness between banks and NBFIs. The pro-cyclical nature of Private Debt and the opacity of their exposures are exacerbating potential risks to financial stability. Losses in Private Debt could spill over to banks through direct credit exposures and market linkages, potentially amplifying financial shocks. While the risk doesn’t look pending, credit exposure of banks to NBFIs, leverage ratios in NBFIs, defaults and delinquencies will be among the signals to monitor.

Concentration Risk. Concentrated portfolios on limited borrowers or sectors can pose risks.

Operational Risks. Linked to due diligence, loan servicing and portfolio management.

Liquidity Risk. Global liquidity remains benign and does not pose a near-term threat. However, over the longer term, several factors – including ballooning public debt in most developed markets, intensifying bank disintermediation, and the gradual rebalancing of global capital flows – could increase pressure on liquidity in the future (see the left chart below).

- Market Competition. There is a serious risk of the overvaluation of assets due to crowdedness and/or declining underwriting standards as lenders seek to deploy capital.

Both charts highlight Private Debt’s response to changes in global liquidity and geopolitical risks, as measured by in-house indicators expressed in z-scores. The left chart evidences a favourable risk asymmetry to liquidity stress: although Private Debt is impacted by extreme shocks (red), it remains resilient during more frequent liquidity stresses (orange) and fully benefits from benign liquidity conditions (green). The right chart, constructed similarly, demonstrates Private Debt’s negligible exposure to most geopolitical stresses.

Private Debt is at a turning point: opportunities ahead as it changes scale

Several surprising consequences are possible or likely as Private Debt continues to grow.

Increased competition may lead to innovation, with new products developed for niche markets or underserved borrowers.

Regulatory changes and increased scrutiny could impact market dynamics.

Private Debt may shift from being influenced by macro conditions to becoming a prime influencer of macro conditions, for better or worse (e.g., liquidity events, bubbles).

Greater focus on ESG and impact investing is expected, with private credit serving as a key channel for this transformation. ESG factors are increasingly incorporated into private debt investing, despite challenges in standardisation and reporting.

New borrower segments may emerge, including smaller businesses (Possible), startups, AI-related companies, and firms in emerging industries.

Increased focus on risk management could improve the overall quality of private credit investments and potentially modify public credit approaches. But this would come at a cost.

There is potential for global expansion of Private Debt into emerging markets or regions with less developed financial systems, offering new growth avenues but also new risks.

Full Recognition of Private Debt as a mainstream fixed income asset class is very likely.

Disintermediation of traditional banking is expected to continue, potentially leading to consolidation, failure or revolution in banks’ lending practices, altering corporate financing dynamics.

Private Debt is likely to become a prime actor in AI, with more AI used to screen borrowers and enhance credit risk assessment and portfolio monitoring. Fintech platforms are expanding access to private credit by streamlining investment processes and enabling secondary market trading.

Market disruption from technology and fintech integration could lead to surprising changes.

Overall, the attractive performance and diversification benefits of Private Debt are likely to drive accelerating investor inflows, helping to align risk perceptions and processes more closely with those of Public Debt. Retail investor flows will necessitate significant adjustments, which the industry is already addressing, while navigating regulatory changes. Private Debt faces multiple simultaneous changes. A key risk in this journey will come from increasing competition for more efficiently priced opportunities. However, Private Debt looks very well positioned to capitalise on secular trends such as AI, ESG and bank disintermediation.