Summary

Introduction

At Amundi Alternative and Real Assets, we are dedicated to building long-term relationships with our clients and partners, which are rooted in proximity and authenticity. Guided by the belief that tomorrow’s economy must unlock new opportunities, we act as facilitators, bringing the right solutions and experts at the right time.

At the end of 2025, we had the pleasure to host our bi-annual webinar on the outlook 2026 for hedge funds during which the Amundi Investment Institute reviewed the macro environment, the trends on the hedge fund industry and the implications for selective strategies.

Over 200 professional investors that registered for the webinar took part of a survey on the opportunities and risks that they foresee for 2026.

This second edition of the Hedge Fund Investor Barometer takes a deep dive in the results, analysing them through the lens of our hedge fund partners and providing the Amundi Investment Institute’s views on each question.

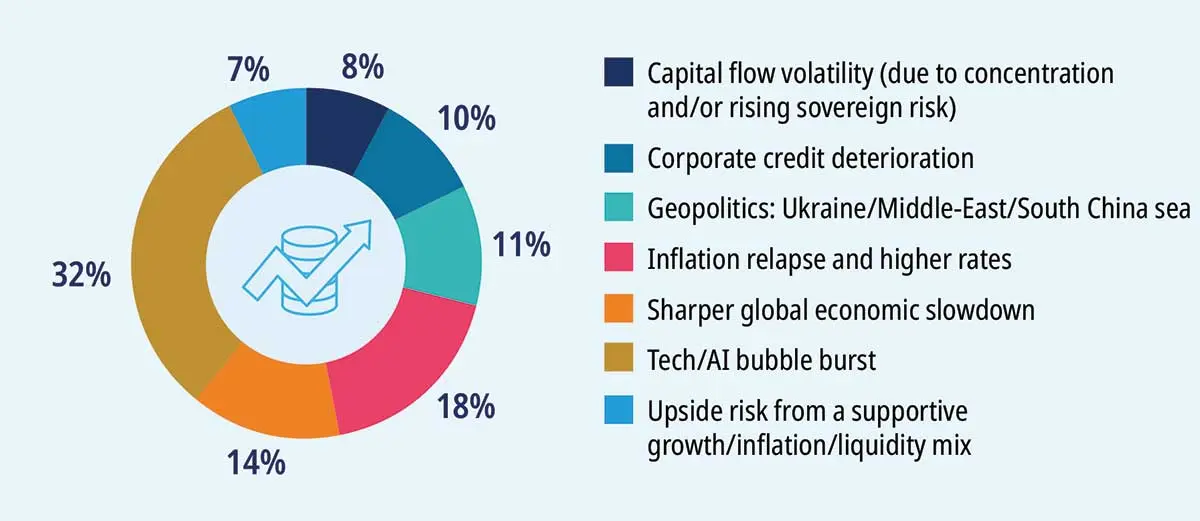

What is the biggest risk for investors in 2026?

Stéphane Parlebas

Portfolio Manager, Chenavari Credit Partners LLP

Looking into 2026, we see risks building beneath a surface of strong performance. In equities, the rapid rise of tech and AI valuations has driven greater concentration in the S&P 500, raising concerns about a bubble-like dynamic. At the macro level, trade wars and rising trade frictions could trigger a sharper global slowdown, challenging still-optimistic growth expectations. At the same time, signs of US economic overheating and elevated sovereign debt across major economies could amplify market volatility. In credit, spreads have tightened to historically low levels, leaving limited compensation for downside risks. Meanwhile, rising long-term rates and increased rate volatility are putting pressure on pricing, as recently seen in Japan, which could push spreads wider on the long end of the curve.

Monica Defend

Head of Amundi Investment Institute

The global economy is adapting to a new regime of “controlled disorder”. AI-driven capex, industrial policy shifts, greater business resilience to tariffs and likely monetary easing should sustain activity and extend the cycle further. We see inflation as a structural theme for 2026 and estimate a moderate but resilient GDP growth at around 3%.

The tech capex cycle remains central, but the tech theme is broadening beyond the US to China, Taiwan, India, Europe and Japan. Given high concentration and more policy volatility ahead of midterms, we favour geographic and sector diversification, combining AI exposure with defensive and cyclical themes, names from financials, industrials and defence sectors as well as green transition stocks linked to electrification and grids.

Investor portfolios must rebalance across styles, sectors, sizes and regions to mitigate risks and capture opportunities, in particular towards Emerging Markets (EM), European assets, private credit, infrastructure, hedge funds and gold. Diversification1 remains the most effective defence.

1. Diversification does not guarantee a profit or protect against a loss.

Andrew Sandler

Partner and Portfolio Manager, Sandler Capital Management

The biggest risk for markets in 2026 is a sudden shock that freezes confidence - whether from a forced Fed pivot to contain resurgent inflation, policy error, heightened political fragmentation that undermines pro-capital markets policy, or systemic cyber or geopolitical events - culminating in the rapid unwinding of heavily owned assets that drains household wealth and forces consumers to pull back.

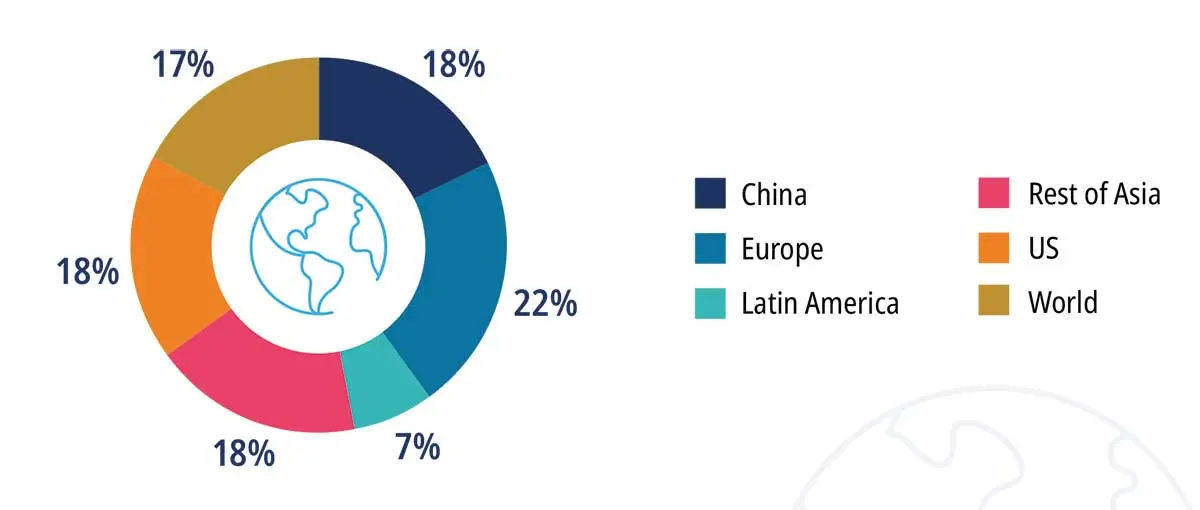

Where do you see the main regional opportunity from an allocation or diversification standpoint?

Simon Davies

Founder and CIO, Sand Grove Capital

Europe is in the fast lane for mergers and acquisitions. We continue to see cheap valuations which create very attractive ‘value-with-catalyst’ opportunities and an increased number of mid-cap deals attracting competitive bidding.

The European dealmaking landscape offers excellent alpha potential relative to other global markets as we see fewer dedicated managers leading to better chances of dislocated pricing opportunities. The pipeline is already very healthy, driven by a regulatory landscape which is encouraging European ‘super-champions’ and powerful thematic trends in areas such as energy transition, infrastructure, and digital transformation.

Monica Defend

Head of Amundi Investment Institute

While shorter-term forces, including tariffs and wage, will likely keep US inflation higher for longer, we believe the European Central Bank could hit its inflation target this year and expect the dollar to continue to weaken which will benefit Emerging Market assets.

Reforms, defence and infrastructure push, and industrial policies oriented toward strategic autonomy, can reshape Europe’s macro-financial ecosystem, potentially unlocking opportunities in euro corporate credit, small and mid-caps, and themes tied to defence, infrastructure and strategic autonomy.

Growth premia and expected Fed cuts should support EM opportunities amid shifting geopolitical equilibria. EM bonds stand out for high income and diversification2, while EM equities offer a diversified set of opportunities, spanning China’s tech and rare earths to the ‘Make in India’ transformation.

Both Emerging Markets and Europe are areas where short-term opportunities will meet long-term themes this year.

2. Diversification does not guarantee a profit or protect against a loss.

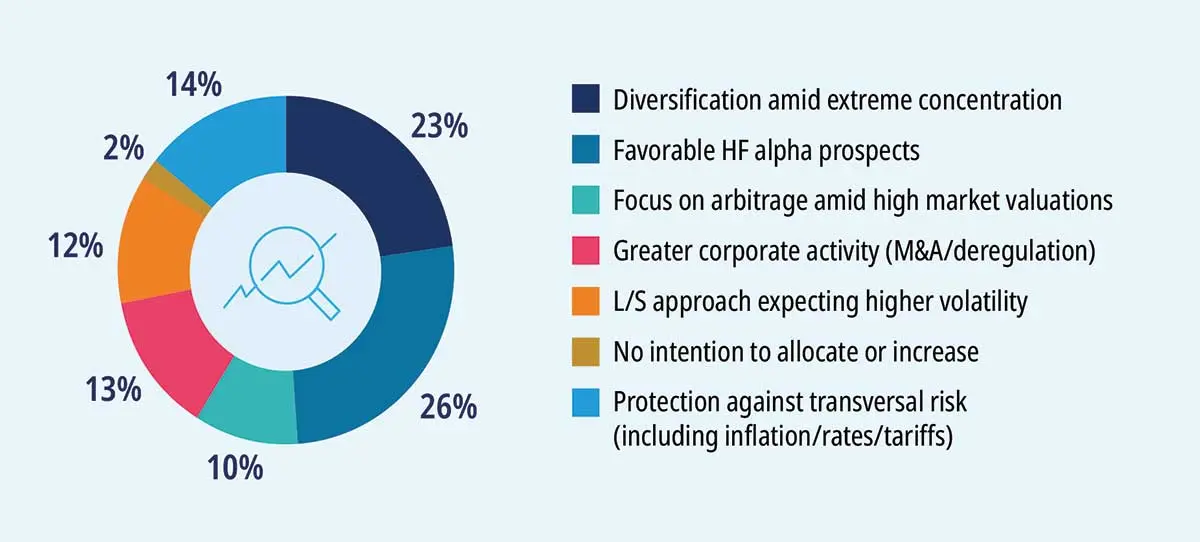

In 2026, what are the key triggers that would lead you to increase your allocation in hedge funds?

Jean-Baptiste Berthon

Cross Asset Strategist, Amundi Investment Institute

Short-term economic and market tailwinds co-exist with multiple longer-term tailrisks, which will lead investors to focus on fundamentals and opportunities at a micro level. A less directional and more versatile environment could limit overall hedge fund exposures, however, the on-going reassessment of risks and recalibrations of expected monetary/fiscal policies will open frequent tactical windows.

While we expect a milder contribution from beta exposure, hedge fund alpha will likely remain supportive both from tactical arbitrage and pure selection. Hedge funds also provide access to juicier and riskier segments at an acceptable cost of risk, in particular in credit and EM markets.

Nicolas Gaussel

CEO and Co-CIO, Metori Capital Management

The survey results highlight investors’ focus on diversification and anticipation of favourable alpha prospects. In an environment characterised by elevated concentration and interrogations on market valuations, the ability to capture opportunities across market regimes becomes increasingly important. Strategies that can systematically adapt to evolving market trends are particularly well suited to this context, supporting both portfolio diversification and long-term performance objectives.

Arnaud de Lasteyrie

CIO, Machina Capital SAS

With a pocket of mega-caps weighing on the indices, diversification is no longer a luxury but a necessity. Thanks to their vast libraries of signals, quantitative hedge fund strategies address investors’ top three priorities: proven alpha, diversification3, and downside protection4. At Machina, we have developed our own optimization approach to address the limits we see in some more traditional, industry-standard, approaches. A careful selection of managers remains key.

3. Diversification does not guarantee a profit or protect against a loss.

4. The Funds on the Amundi Alternative Fund Platform do not offer a capital guarantee or protection.

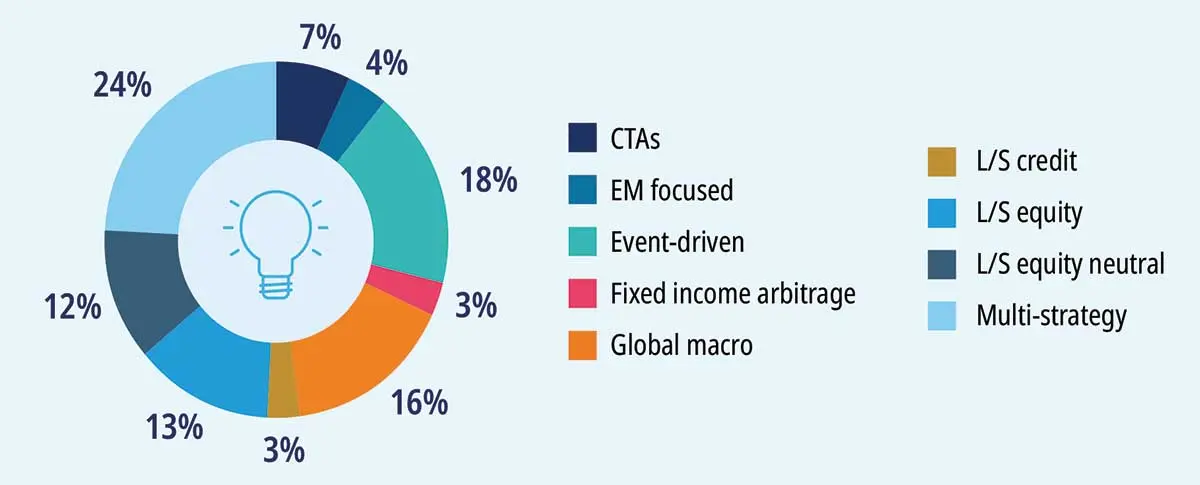

In your opinion, which strategy will stand out in 2026?

Jean-Baptiste Berthon

Cross Asset Strategist, Amundi Investment Institute

We favour Long/Short Equity strategies with a neutral stance on stronger alpha conditions and fundamental pricing, durable themes, and more balanced long and short5 opportunities.

We remain constructive on Emerging Markets Fixed Income (EM FI), supported by improving macro fundamentals, easing rates, and further decoupling from US markets. In addition to providing access to beta at an affordable risk, EM FI strategies also start to show more differentiation.

Global Macro will benefit from diverging monetary policies and frequent tactical windows.

Finally, Event Driven strategies will be boosted by reviving corporate activity and mergers and acquisitions. We favour European exposure that will benefit juicier risk/reward.

5. Note that the Funds of the Amundi Alternative Fund Platform do not take short positions directly but through the purchase of derivatives within the limits described in the Prospectus and Supplement.

Philip Seager

Head of Portfolio Strategy, Capital Fund Management LLP

As reflected in the survey, investor interest is well distributed across strategies, highlighting a strong preference for diversification. Multistrategy ranks first - unsurprising in an uncertain market environment - as it naturally combines multiple return drivers within a single portfolio and can adapt across market regimes.

At CFM, having navigated multiple market cycles since 1991, we share that view and have consistently developed quantitative multistrategy portfolios focused on alpha - combining return potential, diversification, and downside protection.

Drew Fidgor

Portfolio Manager, TIG Advisors, LLC

After a meaningful acceleration in 2025, deal flow is poised to expand further in 2026. As trade policy uncertainty eased, market sentiment improved, setting the stage for a more compelling opportunity set supported by strong corporate appetite for mergers and acquisitions. This environment increasingly favours transformational, complex, and hostile transactions, which we expect to gain momentum throughout the year.