Summary

- We believe the recent crisis among several US banks was not due to systemic causes and does not signal a financial crisis of the magnitude of the Global Financial Crisis in 2008.

- While the events have caused stress in the system, the US Federal Reserve not only provided ample liquidity but has signalled that the stability of the US banking system is a priority.

- We believe investors can find opportunities in the banking space by focusing on the banks that have invested in technology or have enviable deposit dynamics as valuations are compelling, while not waiting for consensus earnings to be revised down.

Despite the failure of a handful of banks in the US and one in Europe, our view is that 2023 will not present a financial crisis near the magnitude of the Global Financial Crisis (GFC) in 2008. The three failed US banks, Silvergate, Silicon Valley and Signature, had unique business models that proved to be meaningful weaknesses. They raised concerns about firms with close financial ties to small banks, particularly speculative technology and related stocks, such as cryptocurrencies, that unwound when they were caught in a bubble.

Looking ahead, we believe now is an opportunity to take advantage of the volatility in the banking space by increasing allocations to the banks that we believe to be structural winners – those that have invested in technology or have enviable deposit dynamics.

What are the market impacts of recent events in the US banking sector?

Fixed Income

We believe that Silicon Valley Bank’s failure will contribute to tighter financial conditions. With greater pressure on bank equity valuations, banks may become increasingly conservative in their lending practices and place greater emphasis on liquidity. Tighter financial conditions may contribute to a widening of spreads across the corporate debt market, given a higher market risk premium.

Equities

From an equities standpoint, the crisis in the banking sector has prompted a reaction that ignores fundamentals as investors move to safety. For investors, this has meant a move away from non-US equities and cyclical sectors and toward more stable sectors such as information technology and communication services – a trend for growth over value. International financials and energy have done poorly while the S&P 500 has been slightly positive. We believe a series of economic consequences will result from recent events in the banking sector:

- Credit tightening will put pressure on US corporations.

- The earnings of smaller banks in the US will likely be challenged and there is the potential for more bankruptcies in this area if the regulators do not take action.

- Larger banks should benefit as they receive deposits from smaller banks, but their earnings should not be impacted.

Why large banks now?

A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful.

--- Warren Buffet, October 2008 during the depths of the Global Financial Crisis.

Since the current liquidity crisis started, meaningful fears surrounding banks have been weighing on valuations. However, we must realise the events of 2008 were part of a true credit crisis in which assets (primarily housing) were backed by an exorbitant amount of debt and amplified by derivatives. In contrast, the current situation is a liquidity crisis caused by the US Federal Reserve’s (Fed) removal of quantitative easing liquidity from the monetary system at a pace not seen since the 1930s. While this has caused stresses in the system, the Fed has now provided ample liquidity and has signalled the stability of the US banking system as a priority. It is important to note that large banks – typically those with $100 billion or more in assets – have far more liquidity than small banks. A look at Fed data shows that large banks had 10%

Furthermore, deposit funding is diversified, with the largest proportion coming from the retail segment. Retail deposits accounted for 57% of total average deposits in 4Q 2022. Corporate deposits were next at 34%, and wealth management at 10%. Smaller regional banks are generally more heavily skewed toward commercial deposits and wealth management deposits, which are more prone to rapid withdrawals. Large banks also have much lower loan-to-deposit ratios than small banks.

The unlikelihood of equity raising

There is a fear in the market that banks will need to issue equity to cover potential near-term liquidity shortfalls; we estimate that as of late March 2023, the market is embedding a 20-30% equity dilution from potential equity raising among most large-cap banks. However, we believe this is an unlikely possibility given that the Fed has provided ample liquidity and that, by the end of 2023, the liquidity problems should start to reverse. Alternatively, even if equity raising turns out to be necessary, the embedded earnings decline is far greater than what we view as a plausible range of fundamental outcomes. Loan growth may slow and deposit insurance costs will likely increase, but we do not foresee a meaningful long-term issue.

Where are potential opportunities in the banking sector?

Putting the failures aside as anomalies, we believe banks could present an opportunity for alpha when three key factors are considered: (1) valuation support, (2) types of banks and (3) timing.

Factor 1: Valuation support, both absolute and relative

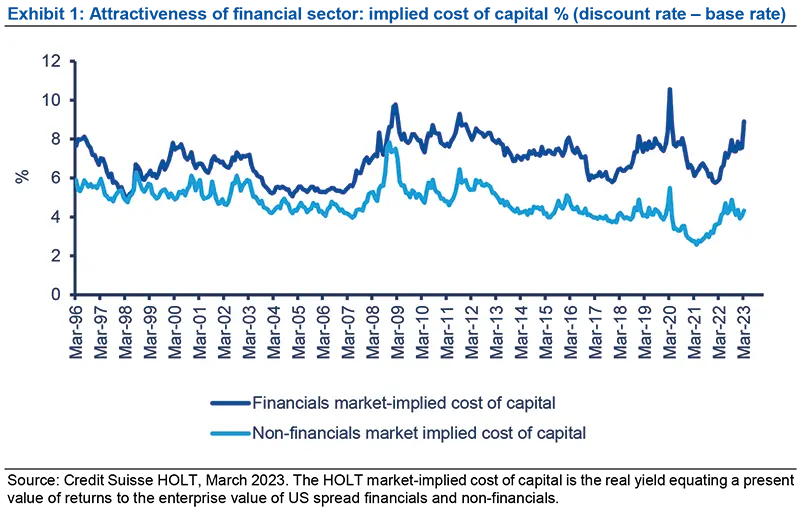

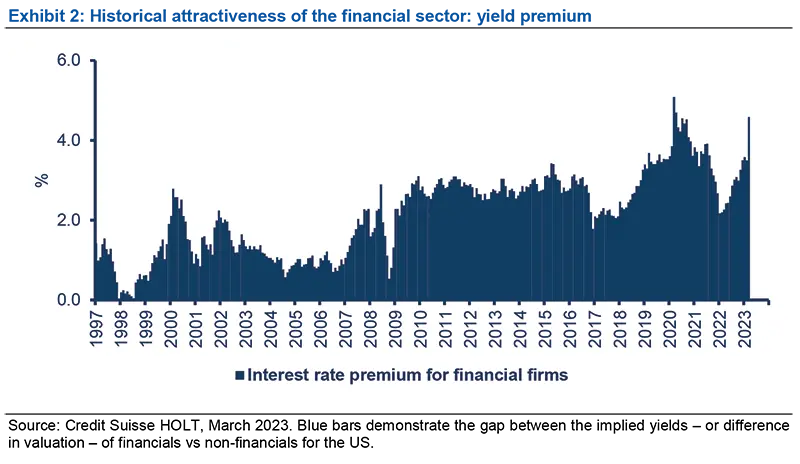

Implied Discount Rate: The current market-implied discount rate for interest rate spreads for firms in the financial sector is at relatively high levels2, even compared to November 2020 (immediately before the Pfizer vaccine was approved), December 2018 (the last behind-the-curve Fed mistake), February 2016 (the depths of the industrial and commodity recession), and the tech bubble of the late 1990s. Each of these periods was fraught with risk and maximum pessimism, but presented opportunities for disciplined investors, both from an absolute and relative perspective to the broader market.

As shown in Exhibit 2, the only times the implied yield was higher than now was during the onset of COVID-19, the GFC and the European debt crisis. In all three of these cases, we saw a reversion of valuations start after the Fed provided liquidity, as it did in mid-March. While it is possible the Fed will need to provide more liquidity to the banks for their government bond holdings, it appears ready, willing and able. Thus, we do not believe the current liquidity situation is on par with COVID-19, the GFC or the European debt crisis in the aftermath of the GFC. One reason the current gap is above the level of the GFC is that should the current liquidity situation lead to a slower economy and / or tightening credit conditions, we have yet to see the impact on the valuations of other cyclical non-financials. When that happens, we expect other cyclicals to underperform financials, which will have already taken a hit.

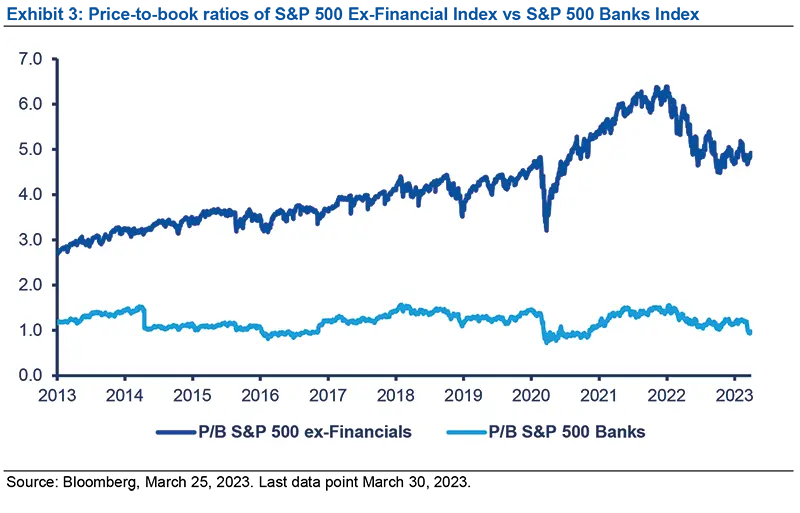

Price-to-Book Ratio (P/B) – Given the nature of spread financials, it is useful to use a price / book basis of the S&P 500 bank industry. Here, we see a similar observation – the valuation of financials is near the lows of prior stress moments. For the rest of the market, it is not.

We favor banks that have meaningfully invested in the technology that should help transform their businesses, improve margins, provide a more stable earnings stream and expand market share.

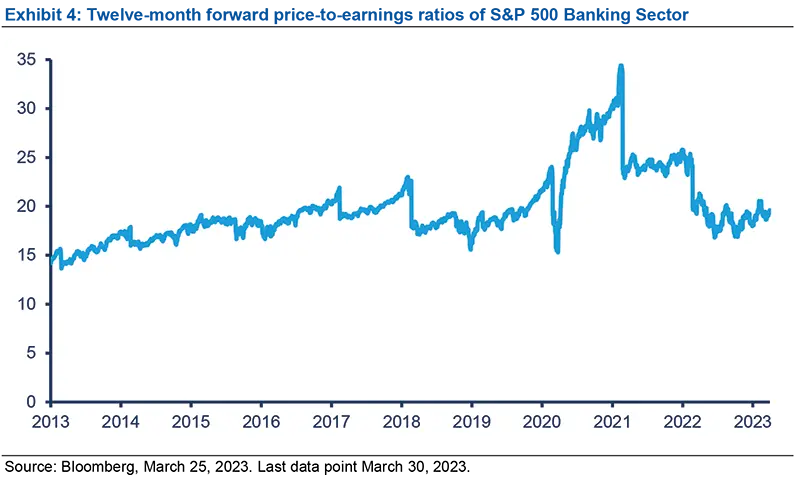

Twelve-month forward price / earnings (P/E): We see the same thing for banks and relative to the market. While the “E” may decrease, we believe it is much less than the market fears and thus, valuations are low.

Factor 2: Types of Banks

We favour what we believe are the “structural winners,” or the top banks, that have meaningfully invested in the technology that should help transform their businesses, improve margins, provide a more stable earnings stream and expand market share. In our analyses of banks, this is a critical determinant of competitive advantage.

Further, we look for companies that have deposit advantages. This can include those among the top banks using brand and technology, as well as regional banks that are focused on thriving regions of the US, such as the Southeast, where we see continued migration from other US regions.

We also favour some large regional banks, or “super-regionals,” which have revenue opportunities from the integration of recent acquisitions and should demonstrate above-industry peer growth and operating leverage from benefits related to mergers and acquisitions. Moreover, we expect more potential acquisition opportunities of the super-regionals for smaller, distressed banks that will contribute to growth potential.

Factor 3: Timing

We believe this is an opportunity to take advantage of volatility in the space and increase allocations to what we believe are the structural winners in the sector.

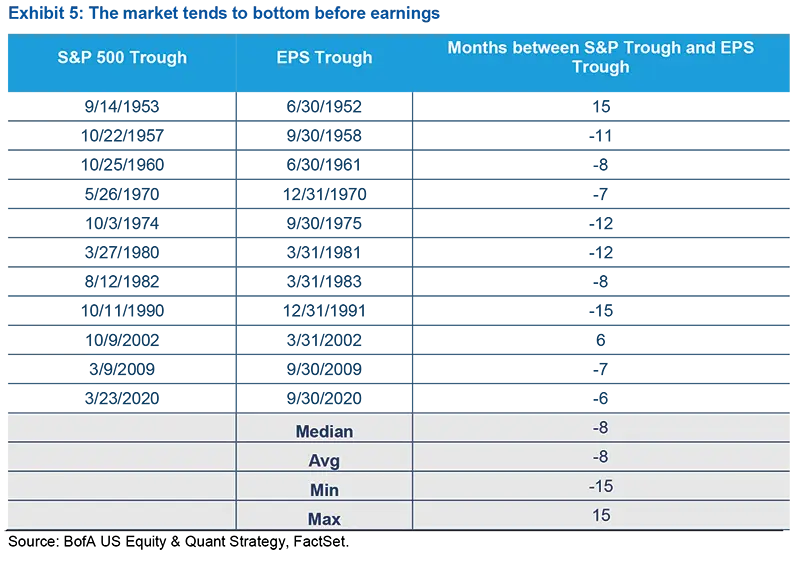

While value may be compelling, some investors may have concerns about timing the normalisation of current conditions. Specifically, some investors believe that consensus earnings for banks have yet to see meaningful negative revisions and it will be better to wait until these negative revisions occur before buying bank stocks. We disagree.

Since Regulation Fair Disclosure was implemented to stop companies from selectively disclosing important information, changes in consensus earnings estimates have become less useful in explaining share price performance. Moreover, consensus can be wrong when there are significant changes in the near-to-medium-term forecast of a company. For instance, from 6 to 23 March 2023, the S&P 500 Banks Industry Group declined nearly 22% and the KBW Bank Index 28%, but aggregate earnings estimates for the industry are flat-to-down just a small amount year-to-date – which is not a helpful factor for analysis after the fact.

Furthermore, we have observed that in other industries (e.g. semiconductors) and the overall market, the relationship between share price performance and consensus has grown less meaningful. Active investors can take advantage of this market inefficiency when combined with valuation support.

Moreover, in the periods referenced above as comparable valuations for banks (August 2011, February 2016, December 2018), waiting until consensus earnings estimates were revised down would be too late. A matter of a few months can make the difference between underperformance and outperformance.

Conclusion

Our long-term view is that those banks which are structural winners, based on technology-driven competitive advantages and / or enviable deposit advantages, will continue to return to the utility / consumer staple-like economic profile that preceded the housing bubble for decades, rewarding the group with relatively defensive valuations. Going forward, we expect the discount on banks from this liquidity situation to disappear given the measures by the Fed, the Swiss National Bank and others to add liquidity to the banks that need it. Moreover, as we have seen since the aftermath of the GFC, most banks have continued to demonstrate resilience through economic stress after economic stress, as shown in periods such as the zero-to-near-zero interest rate environment, industrial and commodity recession, slowing growth / the Fed’s mistake of 2018, and COVID-19. As a result, we believe this is an opportunity to take advantage of volatility in the space and increase allocations to what we believe are the structural winners in the sector.

1 “Assets and Liabilities of Commercial Banks in the United States,” the Fed’s weekly aggregate estimate of commercial banks in the US, for the week ending March 15, 2023.

2 Based on information from the HOLT database, which determines the cost of capital (i.e. discount rate) implied by current valuations.