Summary

The ongoing tech revolution is transformative, rendering some businesses obsolete while others prosper. Therefore, it is important to distinguish structural winners from market noise — those that maintain strict capital discipline and visibility on returns from their AI investments.

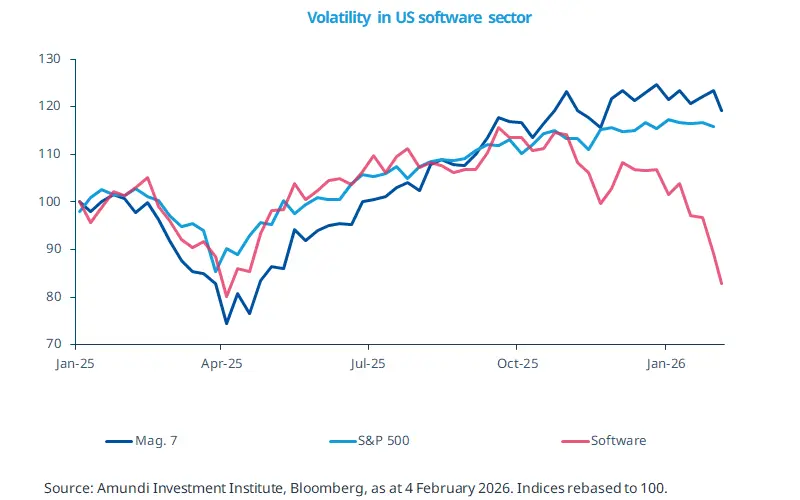

US software stocks declined about 20% YTD as on 4 Feb, due to concerns that advancement in AI would impact businesses of some companies.

This also suggests that the market expects clearer evidence on the potential returns from the substantial AI investments.

While winners of today may be different from tomorrow, companies that allocate capital in a disciplined manner should emerge as long-term winners.

The tech revolution's impact on different parts of the economy and society is unquestionable. The sell-off in American software companies - tiggered by newsflow around an artificial intelligence-led (AI) productivity tool that could affect some software companies - is a reflection of this structural trend. Near term, this is the market’s way of demanding clarity on the massive AI investments companies are making. But this may not necessarily be a verdict on their business models. What’s clear is that markets would increasingly differentiate companies that provide more clarity on financial benefits of AI investments from those where the return potential is ambiguous. This was also evident after the corporate earnings of some large tech companies were released. Additionally, the volatility in markets in areas of ‘consensual trades’ affirms our view that diversification* is crucial in these times.

This week at a glance

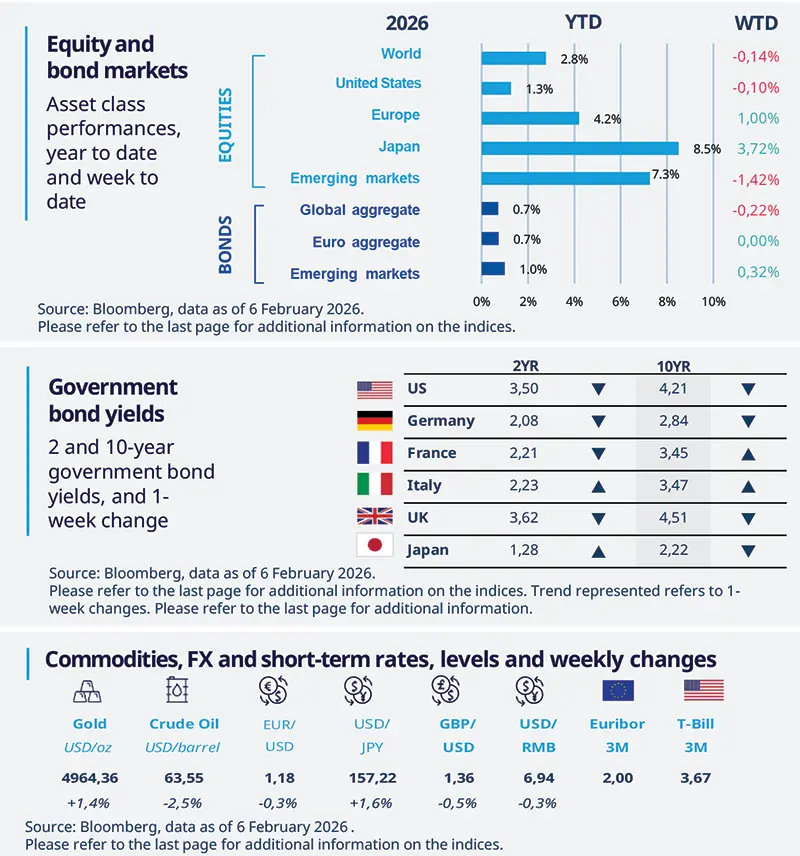

Equities were mixed across the world. In the US, investors expressed concerns about valuations and the scale of AI-related investments. The IT sector sell-off affected EM equities while Japanese and European stocks rose. US bond yields fell amid weak labour data. In commodities, gold prices rose over the week, whereas crude oil declined.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 6 February 2026. The chart shows the price of gold.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US job markets are showing mixed signs

Latest labour market data show a mixed picture, with slight signs of weakening. Although JOLTS job openings have fallen and unemployment claims have risen, employee layoffs remain contained. These indicators suggest that labour market conditions have deteriorated, but they do not point to a crisis. Therefore, we believe the Fed should maintain a balanced approach to policy in pursuit of its dual mandate, keeping further easing on the table.

Europe

Early signs of domestic demand revival in Europe

Economic growth for the quarter ended December was robust. Italy’s Q4 GDP expanded at a better‑than‑expected pace of 0.3% despite headwinds in the manufacturing sector. German growth was fuelled by household and government expenditure, while France saw a modest but positive contribution to growth from domestic demand. These developments are nascent signs of normalisation in domestic demand, in line with our expectations.

Asia

India outlines a balanced budget

India’s annual budget for the financial year 2026-27 (12 months ending 31 March) looks balanced, and gives some spending flexibility to the government. We also observe mild consolidation, and focus on capital expenditure (to expand by 11.5%) and industrial sector. The fiscal deficit target is mildly improved to 4.3% of GDP (from 4.4%). Additionally, the government seems to prioritise labour-intensive as well as the more productive sectors. Overall, we think the policy path did not change.

Key dates

EZ Sentix investor confidence, NY Fed inflation expectations |

UK GDP, India CPI |

EZ trade balance and employment, US CPI |