Summary

Asia and emerging markets' rally reflects a move beyond US mega-caps, as investors broaden the tech theme and diversify across regions and sectors to avoid concentration risk. Overall, we believe diversification and flexibility will be structurally important going forward.

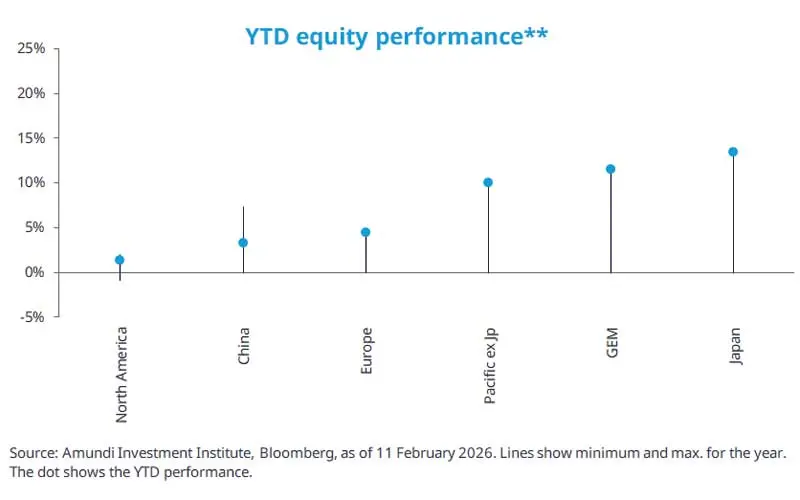

Most equity indexes in Asia rose more YTD than both the US and Europe, except for China. Within EM, Latin America also saw strong gains.

Looking to Asia, the rally suggests that investors are moving outside of US mega caps to AI supply-chain enablers.

With persistent uncertainty, diversification* across countries and sectors, with a focus on quality and balance-sheet discipline, has become paramount.

Since the start of the year, Asian indexes are leading equity markets, with the MSCI Asia Pacific registering its best performance relative to the S&P 500 since 2000. This outperformance is linked to robust demand for semiconductors and AI-related components, confirming a rotation of investors’ interest from companies with a high level of AI investment to companies that control scarcity inside and outside of the IT sector: critical chips and memory, power equipment, grid infrastructure, thermal management.

Another factor supporting global EM is a weaker US dollar and dovish monetary policy, with room to cut further. Finally, medium term valuations are not excessive.

Overall, the range of YTD equity performance affirms the importance of diversification * across regions and sectors to avoid concentration and overvaluation risk. While Asia has felt recent volatility, especially in AI‑sensitive areas, we believe the trend of diversification * still has room to run.

*Diversification does not guarantee a profit or protect against a loss.

** MSCI Index.

This week at a glance

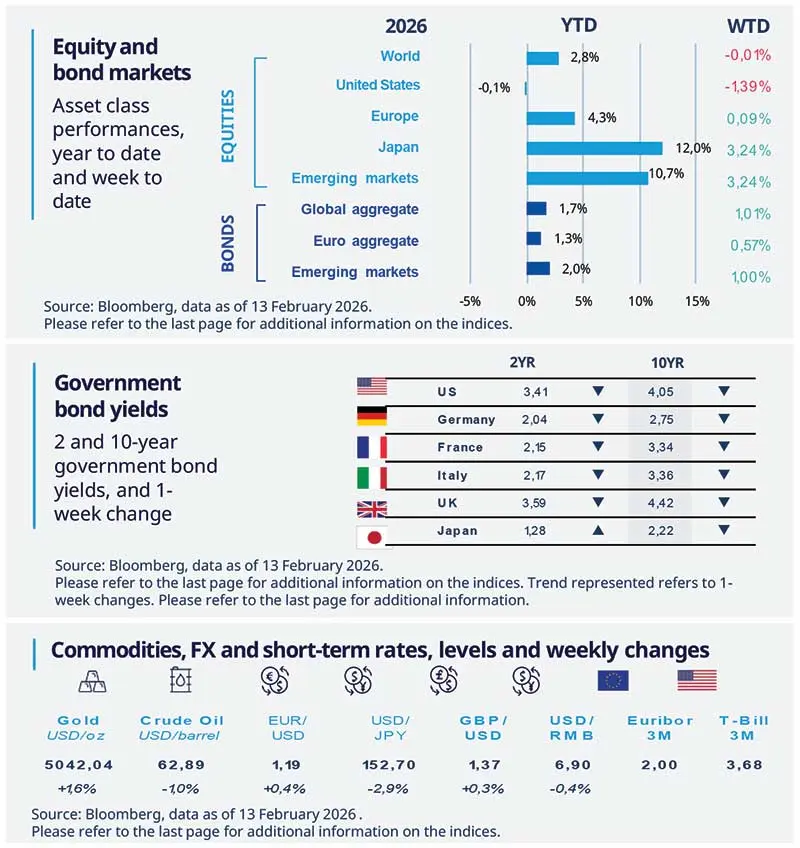

US equities fell on AI-related concerns that rippled into Asian emerging markets — notably IT enablers — while Japan hit a record high after receiving electoral backing for the prime minister. In the bond market, volatility drove flows into US Treasuries, pushing yields lower. Gold rose, confirming a rebound after a sharp sell-off on Thursday.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 13 February 2026. The chart shows the price of gold.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US jobs data stronger than expected

January's jobs data beat expectations, with payrolls up, lower unemployment and higher payroll income. The release included downward revisions to private‑sector job gains over 2025; while seasonal adjustments may have slightly overstated the monthly rise, the overall picture points to early labor‑market stabilization that should support household incomes and spending, consistent with PMI and small‑business surveys signaling an improved hiring outlook.

Europe

Sentix index signals an upturn may have begun

The Sentix Economic Index for the Eurozone rose sharply in February, climbing 6 point, to +4.2. Current situation and Expectations also improved accordingly for the third time in a row. The German economy is contributing to the encouraging development in the area, with the relative Index rising to its highest level since July 2025, alongside the Current Situation and the Expectations. The reports suggest across the board an upturn may have begun.

Asia

India inflation jump under the new series

India's inflation jumped to 2.8% in January on the new series, re entering the 2–6% target band after four months (December was 1.33% under the old series). The rise was driven by food, which has exited a deflationary phase. The new CPI uses 2024 as its base year (replacing 2012) and revises item coverage and weights — notably replacing gold and silver with jewelry, raising the weight of motor fuels and reducing that of food. The RBI has upgraded its 2026 inflation outlook and will publish its full FY 2027 projection at the April policy review.

Key dates

Japan GDP, EZ industrial production |

UK CPI, US industrial production |

EZ preliminary PMI, US GDP |