Summary

Macroeconomic focus

UK monetary policy to avert risk of a wage-price spiral

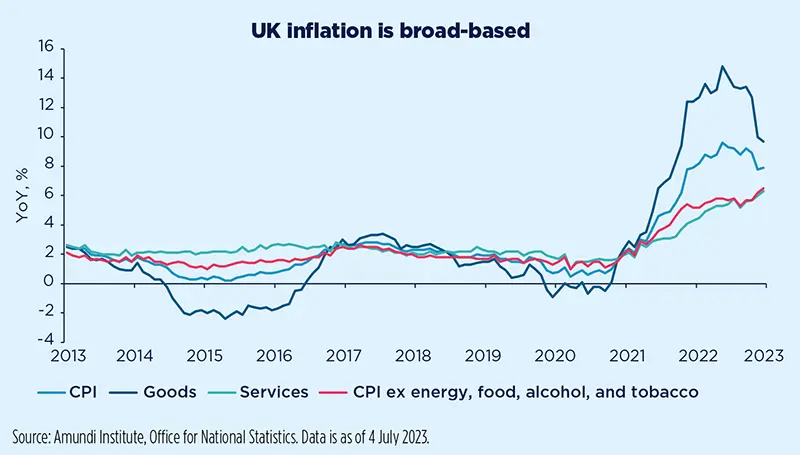

The United Kingdom is the only advanced country with wage growth above core inflation, risking a wage-price spiral. Inflation is broad-based and expected to remain much higher than in the rest of the G7, above 6.0% in 2023 and well above 3.0% by end-2024. Growth will be flat at best, but all risks point to the downside.

Core inflation will be difficult to tame in the short term amid persistent wage pressures on account of a very tight labour market due to the impact of Covid-19 and Brexit, while high mortgage rates add to the cost of living.

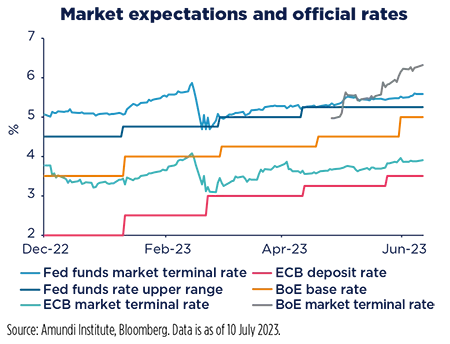

More monetary tightening is inevitable. Markets expect rates to peak well above 6.0%, but the BoE will have to choose between tightening too much – pushing mortgage rates higher and triggering a recession – and patience in attaining its inflation target. We expect a peak rate of around 5.5%.

A high share of variable-rate mortgages will reduce activity in the housing market and sustain pressure on rents, but house prices are unlikely to correct precipitously because of insufficient supply and the fact that around half of homeowners have no mortgage debt. Higher rates will also increase income on savings, thus moderating the overall effect of monetary tightening on activity.

The medium-term outlook is more challenging. The United Kingdom is the only advanced country that has not grown since 2019, with employment levels below the 2019 level. Official forecasts put UK GDP only 1pp higher by 2025. Low potential growth imposes tight fiscal constraints. With taxes already rising – corporate tax was raised from 19 to 25% and income tax allowances have been frozen – public debt-to-GDP ratio is unlikely to fall below 100% by 2025. Bringing debt down below 100% will require primary fiscal surpluses of 2.0% of GDP if long-term rates stay above 3.5%. A labour shortage and reduced trade because of Brexit mean reforms to increase growth would be a way out, but free-trade zones and pinning hopes on AI are unlikely to move the needle.

Emerging markets

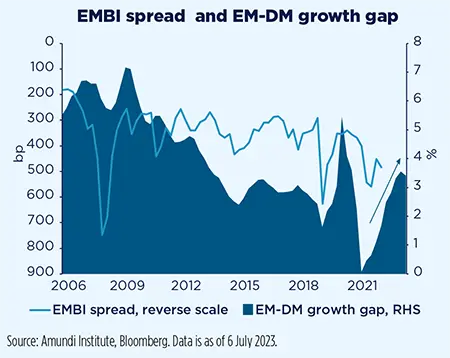

Emerging markets central banks ready to start easing

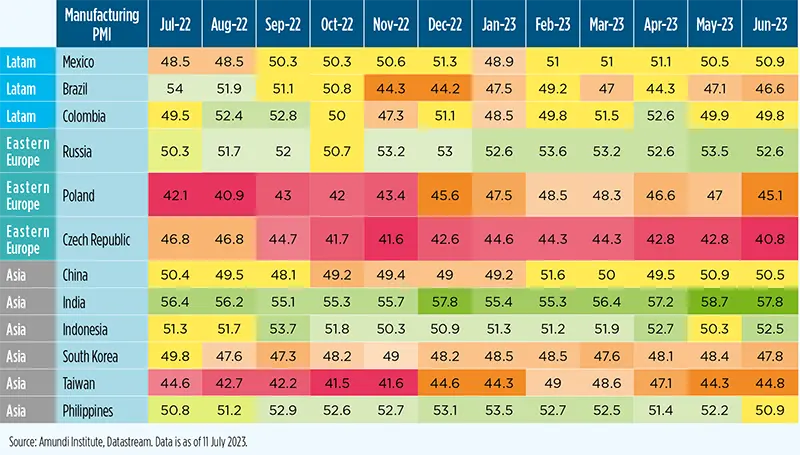

As shown in the most recent trends from economic variables, EM growth momentum remains fragile and, in some instances, is even deteriorating. China’s faster- and sharper-than-anticipated slowdown should result in weaker overall external demand, both for EM and for the rest of the world. From a regional standpoint, manufacturing PMIs (as of June) for Eastern Europe (e.g., Czech Republic, Poland) are heading well below 50. In LatAm, Brazil and Colombia prints remain slightly below 50, with Mexico an exception. Asia’s picture appears more mixed, with South Asia – mainly India – outperforming North Asia. The services sector appears to be more resilient. In any case, both external and domestic demand are decelerating.

Following several months of positive surprises and downward forecast revisions, June inflation data printed slightly below expectations for headline indices. The bulk of the H1 2023 disinflation trend came from LatAm, while in CEEMEA disinflation is advancing at a more gradual pace. In Asia, the disinflationary trend is more moderate, due to generally lower inflation peaks to start with. Mirroring evidence from growth trends, the disinflationary paths of core and services are lagging behind, even though the downward trend has started.

In summary, domestic conditions in several EM are ripe for a monetary policy turn towards an easing cycle. Considering that the Fed is also close to peak official rates, global financial conditions are aligned with domestic conditions vis-à-vis a start to easing in EM. Despite this possible early kick-off, the policy rates adjustment back to pre-tightening levels will need time. Inflation is not reaching its pre-tightening levels quickly and, with base effects fading over the summer, inflation should peak up mildly, flirting with the upper band of CB targets in many countries. The El Nino meteorological phenomenon poses an upside risk to our inflation expectations in the short term, through its fallout on food prices. In addition, over the next few years, inflation should be structurally supported by several factors, including the Net Zero transition, low productivity and stronger protectionist measures.

Macroeconomic snapshot

We upgraded our US growth expectations on the back of Q1 GDP and strong Q2 data. While we still expect the US economy to deteriorate tangibly and fall into a mild recession, we pushed this call back towards year-end, when credit deterioration should weigh on growth. Inflation should remain sticky, at least in the near term and at a core level, but we expect some progressive normalisation, helped by below-par growth.

We expect weak Eurozone activity, as financial conditions tighten and the US economic outlook worsens. Growth will be mixed across the area, with peripheral countries performing better than core ones, thanks to positive Q1 momentum and strong carry-over effects. Overall growth will slow to below potential. Headline inflation will move lower faster than core inflation, while the latter will be sticky and constrain consumption, keeping the ECB in tightening mode.

In early 2023, UK growth proved better than expected, with lower energy prices removing downside risks, but we still see the economy facing headwinds. We expect inflation to remain very high and above target, putting a lid on domestic demand and forcing the BoE to remain hawkish. This will imply very subdued growth in 2023-24 amid the non-negligible risk of a wage-price spiral.

Japan’s Q1 GDP growth was upgraded to 2.7% from 1.6% QoQ annualised, prompting us to raise our full-year forecast to 0.9% from 0.6%. Although business investments have proven resilient, we anticipate a moderation in H2 due to weakening global demand, with some potential re-acceleration in 2024. As household inflation expectations have been cooling, we project Japan‘s core CPI to have peaked in May at 4.3% YoY and should decline gradually to around 2.5% by year-end and into 2024, against the BoJ’s forecast of a re-acceleration in 2024.

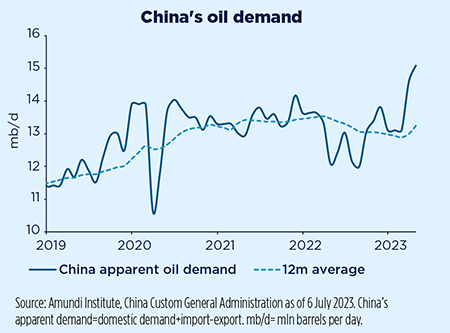

China’s Q2 sequential GDP growth came in at 3.2% QoQ annualised, below our expectation. This, combined with delayed fiscal and housing policy support, has led us to cut our 2023 full-year growth projection to 5.1% from 5.7%. As policymakers focus on a long-term transition, their tolerance for slower growth has risen. With no substantial stimulus measures, China’s growth should stabilise within the 3-4% range over the long term.

In Q2, growth momentum proved robust, especially in the urban sector. Credit supply keeps growing quickly, at around 15% YoY. Economic performance is based on both the supply and demand side. Inflation should bottom over summer (it was around 4.5% on average in May-June) and is expected to move up, while remaining within the target range. The RBI is expected to stay on hold in August and to only start easing in early 2024.

Considering the size of the recent Turkish earthquake and high inflation, the slowdown was relatively contained in Q1 thanks to loose monetary and fiscal policy. Over the rest of the year, we expect real GDP growth to weaken. Despite the recent interest rate hike and, after bottoming out in June at 38% YoY, inflation is likely to keep rebounding due to base effects no longer being at play, Turkish lira’s sharp depreciation, sizeable price or tax hikes for some products, and pension rises.

Brazil’s macroeconomic glass is half full with growth slowing in a resilient fashion thanks to robust Q1 agricultural output and solid labour market conditions, while inflation is moderating and is now within the target range (even though base effects should push it up in H2). BCB made a dovish turn lining up its first cut in August and a gradual easing cycle thereafter. Lula’s administration is acting in a ‘prudently populist’ way and is about to pass a fiscal rule acceptable to markets.

Central bank watch

DM-EM CB asynchrony to feature in H2

Developed markets

Inflation remains a priority and DM central banks (CB) confirmed their commitment to bring inflation back to target:

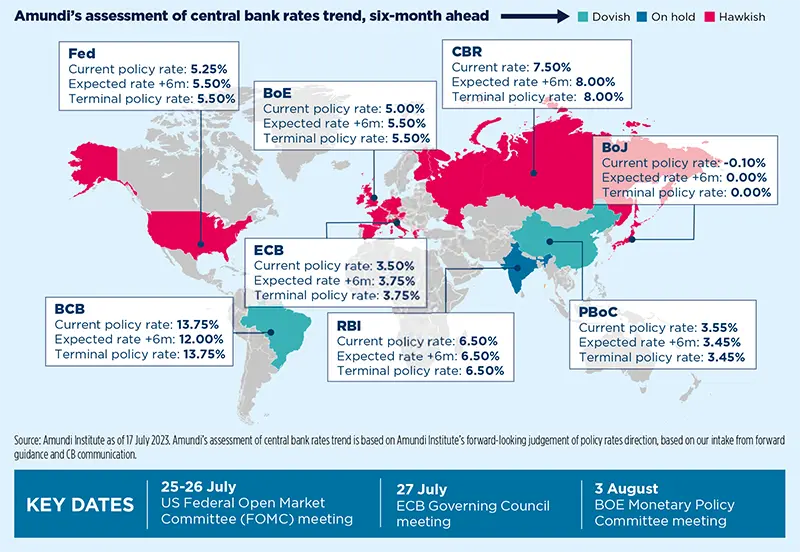

- The Fed held interest rates unchanged in June. However, “a strong majority of committee participants expect that it will be appropriate to raise interest rates two or more times by the end of the year,” Chair Jerome Powell said. “Inflation pressures run high, and the process of getting inflation back down to 2% has a long way to go.”

- The ECB hiked rates by 25bp in June and signalled it will hike again in July: «It is unlikely that in the near future the central bank will be able to state with full confidence that peak rates have been reached,“ President Christine Lagarde said at the Sintra forum.

- The BoE surprised by raising rates by 50bp at its latest meeting. It opened the door to further moves, as the inflation picture is stubborn, risking a wage-price spiral.

- We believe July is probably the last possible meeting for a yield curve control change from the BoJ. Softening domestic inflation pressures, coupled with increasingly recessionary overseas markets, should keep the BoJ on hold.

Emerging markets

While DM CB are poised to hike rates further, some EM CB see things differently and are out of sync with their DM peers, eyeing cuts as early as their upcoming meetings over the summer. In LatAm, there was a clear shift in bias, amid signals that easing cycles are lurking around the corner for a couple of regional CB. Price pressures are easing across the region including core and services inflation, benefitting – among other factors – from slowing domestic demand. Chile’s central bank nearly kicked things off in June, but the Committee was one vote short to deliver a cut. A July cut is very likely now. Brazil’s central bank (BCB) opted for caution and sounded neutral, but dovishness was evident when it cut its 2024 inflation forecast to 3.4%. Its monetary policy committee is already in data-dependent mode so, all in all, the BCB is likely to start easing in September. Elsewhere, the dovish narrative is more scattered: Poland’s CB governor softened his conditionality, possibly bringing forward its first rate cut to end-Q3 from Q4. While in its mission to avoid a deeper downturn, the People’s Bank of China has been incrementally more dovish since June.

Geopolitics

Implications of Wagner insurrection

While Putin will remain firmly in the driving seat, time is no longer on his side.

The implications of the aborted Wagner insurrection are now apparent. Recent developments have introduced an element of doubt over Putin’s stronghold on power. However, he will remain firmly in the driving seat unless another unexpected coup occurs, even though the likelihood of that is low. The one possible force, the Wagner group, with the military strength to challenge Putin’s regime has been decimated. The regime is now busy discrediting Wagner supporters at home. Putin will invest in shoring up domestic security to avoid another similar incident in the future. While no material change has occurred, the aborted mission will nevertheless have consequences for the war. Putin will relocate some security back home, eroding manpower at the front marginally. Wagner was behind some of Russia’s military gains in Ukraine. Even though it has withdrawn in recent weeks, that force is now missing. More important will be the impact on Russian military morale. The infighting and the Wagner leader Prigozhin’s open challenge of Putin’s war rationale will erode the morale of Russian forces. Animosity to the war is likely to grow at home, as Russians came close to bloodshed in Moscow. All in all, the episode helps Ukraine’s counter-offensive and Ukrainians are likely to accelerate the erosion of Russian morale by hitting targets in Russia. Uncertainty over Putin’s grip on power supports our expectation that China will refrain from sending heavy weapons to Russia. While China will continue to support Russia opportunistically, it will not want to risk its relationship with key EU member states and it will increasingly see Putin as a liability.

Policy

Falling productivity may lead to a poor policy mix

Monetary policy is not the only game in town; now is the time for fiscal consolidation.

For the second year in a row, labour productivity in the Eurozone is likely to decline in 2023. According to the ECB, businesses would prefer to maintain their workforce despite the economic slowdown because of labour shortages in certain sectors, and the ensuing hiring difficulties later in the recovery phase. This phenomenon is likely to last. The resulting resilience of employment is exacerbating inflation in two ways. Firstly, employees are still in a position to negotiate pay rises. Secondly, unit labour costs (ULC) will rise further as productivity falls. ULC largely determine future core inflation, this is why the ECB is considering tightening monetary policy further but, in doing so, the ECB is not taking sufficient account of fiscal policy. Recent papers presented at the Sintra forum show that fiscal policy has ultimately contained the rise in prices despite the support given to aggregate demand. However, the support measures put in place during the energy crisis are now being withdrawn. All in all, next year Europe will suffer the combined effects of tighter fiscal and monetary policy. Such a scenario is difficult to reconcile with the European Commission’s growth forecasts, which expect a return to potential growth (1.5%) in 2024 in the Eurozone. The increase in public debt and the economic slowdown in Europe call for a rebalancing of the policy mix. Fiscal consolidation should become the priority, but it will not materialise if the ECB continues to tighten monetary policy and provokes a recession.

Scenarios and risks

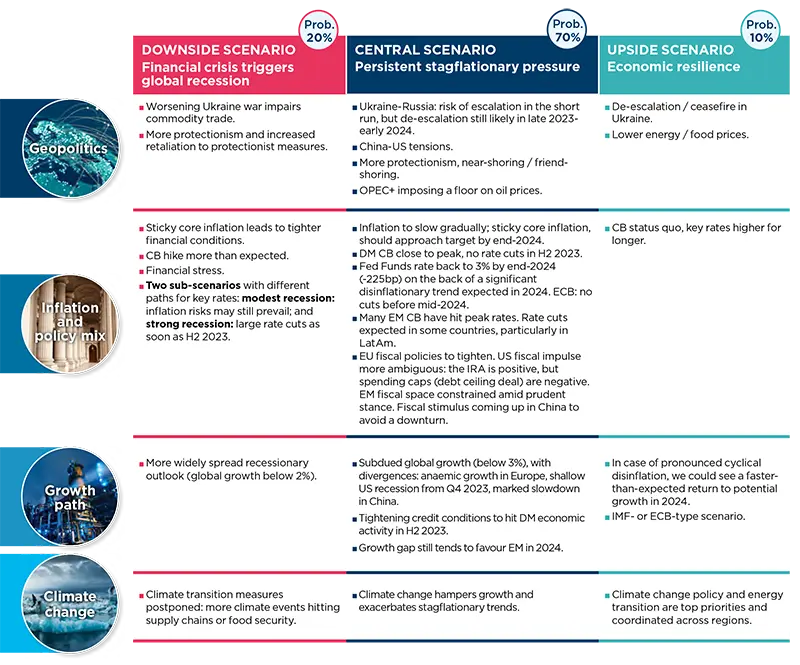

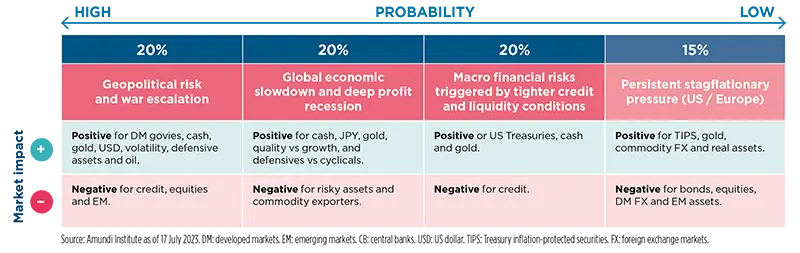

Central and alternative scenarios

Risks to central scenario

Amundi Institute models

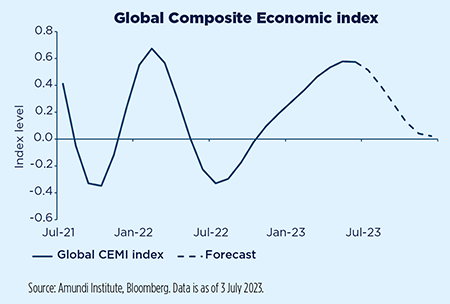

Composite Economic Momentum Index (CEMI)

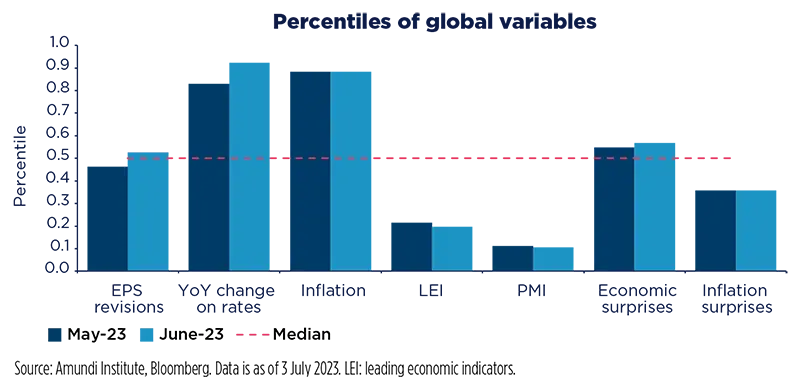

Soft economic or financial data area key determinant for fine-tuning an economic cycle.

What is the model about?

- The rationale: soft economic data is helpful for fine-tuning economic cycle phases based on hard data. Surveys on business confidence, positive / negative data surprises against expectations or revisions, and the financial response to rates are important, as they provide valuable information regarding sharp and short-lived fluctuations which are key drivers of tactical asset allocation choices and asset rotations within asset classes. Our global CEMI is a synthetic measure of economic strength or weakness based on a composite basket of soft data, from both DM and EM.

- Model setup: the CEMI combines a comprehensive set of economic and financial data, including: OECD leading indicators, PMI (as a proxy for business confidence), earnings revisions, CPI, 10y government nominal rates, inflation and economic surprises.

- Model output: the global index is the outcome of the aggregation of the above seven variables based on a principal component analysis run on four regions (United States, Europe, Japan and GEM). A forecast for each index is calculated according to a proprietary econometric model in order to assess the inertia and forward-looking trajectory in regional CEMI indices.

What are the current signals?

- The global economic cycle is peaking and decelerating progressively, as global strength is losing momentum due to slowing manufacturing PMIs, economic surprises and leading indicators. So far, aside from Japan, the United States has offset European weakness and the weaker-than-expected GEM recovery.

- The GEM recovery is a necessary condition to avoiding a global recession, as it could offset expected weakness cross Western DM.

Infographic - Markets in charts

Equities in charts

Developed markets

Fear of missing out is back.

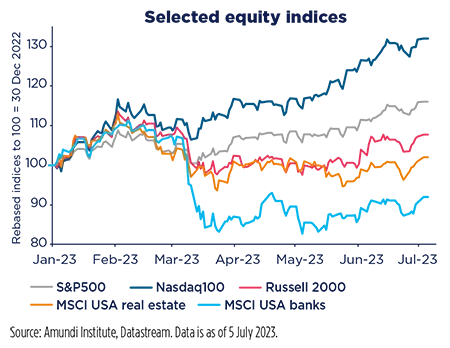

| Rally broadening to the laggards |

|---|

Laggards join the Nasdaq-driven rally, as resilient economy makes investors fear they are missing out.

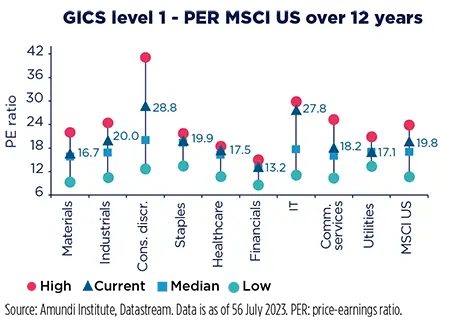

| US equity expensiveness is uneven |

|---|

If the MSCI US PE ratio is back to around 20x its 12-month forward EPS, this is due to IT and consumer discretionary stocks.

Emerging markets

EM Asia has been enjoying a healthy trend for earnings revisions.

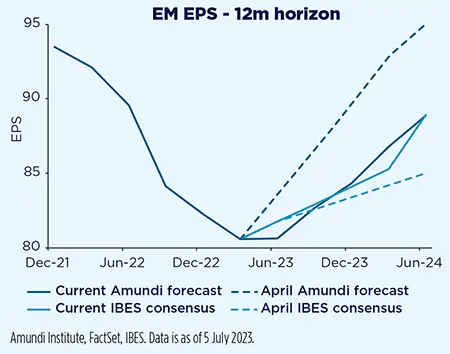

| EM EPS set to rebound over the next year |

|---|

Our forecast for GEM earnings over the next twelve months (in USD) was cut from 14% in April to 10% currently. Now we are aligned with consensus that, instead, moved up from 5% to 9% over the same time span.

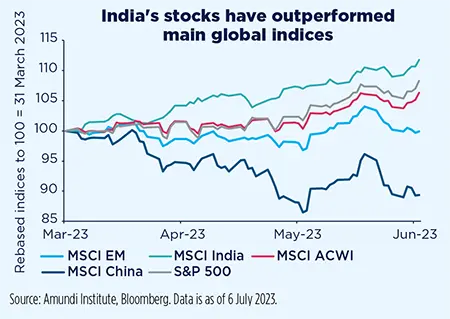

| India’s stocks shined in Q2 |

|---|

India’s stock market returns should stay robust over the long run, amid the nation’s strong GDP growth outlook, buoyed by its young demographics and reform momentum.

Bonds in charts

Developed markets

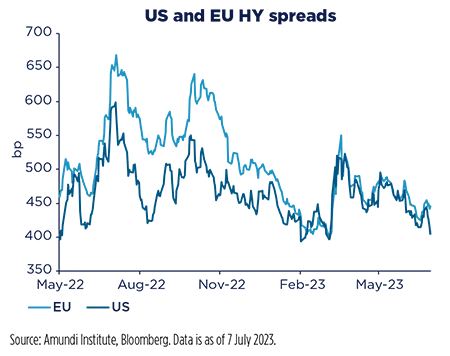

US HY spreads are now almost back to their pre-SVB level.

| Markets expect terminal rates to rise |

|---|

The flattening trend of yield curves has accelerated, as markets expect main DM CB to do more to bring inflation back to 2%.

| US HY outperformed and spreads are tight |

|---|

Despite macroeconomic uncertainty and a hawkish Fed, US HY outperformed European peers in June. US HY spreads are now almost back to their pre-SVB level.

Emerging markets

EM FX should benefit from the expected dollar weakness in H2.

| EM currencies set to outperform this year |

|---|

EM currencies have performed well so far this year, benefitting – among other factors – from our view that the dollar will weaken throughout the year.

| Strong LC bonds, but HC ones to catch up |

|---|

EM LC bonds have been the best asset class in the EM universe so far this year. HC bonds have moved to narrow the gap recently and our scenario is consistent with a further recovery ahead.

Commodities

Modest upside still likely for oil

We see oil range trading at around $80/barrel for Brent in the near term, with more traction late in H2.

Despite rounds of OPEC+ cuts and investors’ risk-on mood, oil prices have not broken out of their trading range. We expect oil prices to remain in a volatile range in the short term, floored by attractive valuations, but capped by mixed technicals. Yet, resilient global demand and evidence of tightening OPEC+ supply are likely to send the oil markets into deficit in late H2, providing traction. A mild and delayed global recession and easing liquidity stress would help. However, rebuilding OPEC’s spare capacity and an economic slowdown should limit the upside. We see oil range trading at around $80/barrel for Brent in the near term, with more traction late in H2, with the price settling at $85-90/barrel.

Currencies

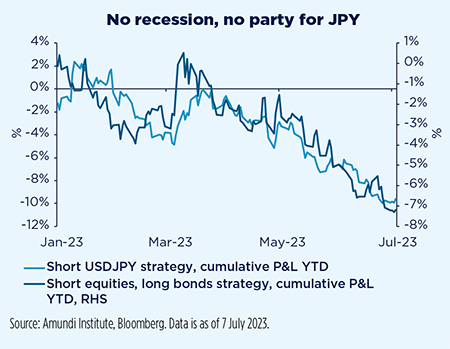

JPY: no recession, no party

It is the recession scenario – which the market has not yet priced in – that requires a stronger JPY.

We entered 2023 assuming both local (a hawkish BoJ) and global (recession) conditions would support the JPY. Reality has proven different so far, but a closer look at the main forces behind market trends may help understand why – even amid risks – JPY asymmetry remains positive from here. Beyond a hawkish BoJ pivot, it is the recession scenario – which the market has yet not priced in – that requires a stronger JPY.

In this scenario, equities tend to fall, duration should be diversified, and investors are likely to unwind carry positions, in turn pushing funding currencies higher. The 2023 market has not yet priced this in but, with an upcoming US recession, JPY tailwinds may return gradually.