- Investors can no longer expect double-digit returns as inflation has roared back to life and central banks are tightening policy.

- A higher-for-longer interest rate environment will require a different approach to asset allocation and portfolio construction.

- Pension plans are looking to real assets and private markets to generate income.

- Geographical diversification and a flexible approach will help investors seize opportunities during spells of high volatility.

Inflation, whose surge triggered a broad-based market rout this year, has peaked. But there won’t be a revival of the double-digit returns seen in the past twelve years.

Nearly half of the pension plans interviewed in the latest Amundi-CREATE research institutional survey believe this year’s inflationary spike marks a major break with the past, and 56% of survey participants stated that inflation is now a big factor in their asset allocation.

Future-proofing pension portfolios may, however, prove very challenging in the new regime.

It’s unclear whether central banks will manage to tame runaway prices and ensure inflation expectations are anchored to their targets.

Rate-setters’ recent actions showed a steadfast commitment to eradicate the problem root and branch, and the pace of rate rises is likely to slow soon. But the time it takes for monetary policy to filter through to the economy means there will be a lag before rising borrowing costs put the brakes on inflation. Additionally, there is still room for policy missteps, as excessive rate hikes could trigger a deep recession, rather than the highly desirable economic ‘soft landing’.

In the post-pandemic world, many are gearing up for a stagflationary scenario that combines low growth and inflation running hot. Half of the pension plans surveyed cited stagflation as their central global economic scenario over the next three years. Policymakers will have to work hard to keep expectations moored, given intensifying worker wage demands are piling pressure on corporate margins, and stoking inflation.

Investors can no longer count on central banks to prop up asset prices. This was possible when inflation was low but not when they have to tamp down price pressures and inflation expectations. As a result, 40% of respondents claim central banks have lost their ability to influence market prices. Today, governments are running large budget deficits in public finances to support the post-pandemic reconstruction, food security and the energy transition. This will require low rates to keep the debt burden manageable, and higher inflation to vaporise it.

The outlook for investors remains complex. Many of the pension portfolios constructed during – and for – the deflationary environment of the past 40 years have to be recalibrated. Moreover, major selloffs in stocks and bonds moved in lockstep in 2022, weakening bonds’ role as a generator of income and a diversifying element in portfolios.

As a result, asset allocation is adapting to the new environment.

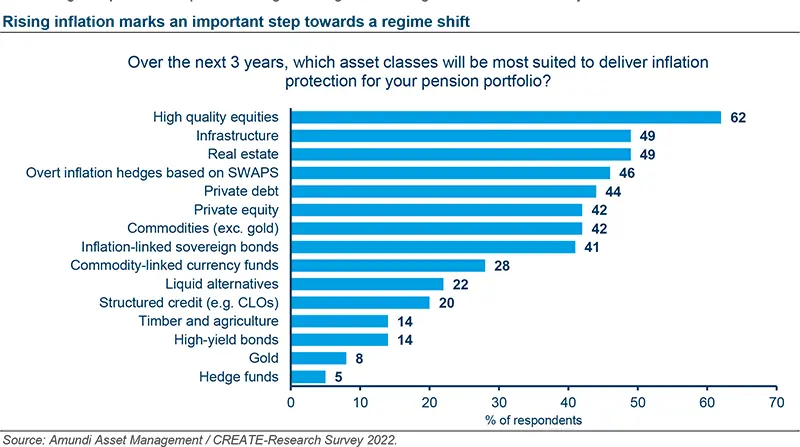

The first change has been a shift to inflation-protection assets. In our survey, more than two-thirds of pension portfolios have increased their allocations from financial to real assets such as real estate, infrastructure and private debt, and a further 64% are advancing further into private markets. These asset classes will insulate investors if policymakers turn out to be a little more tolerant of inflation than they are publicly letting on. Of course, special attention must be paid to liquidity considerations, particularly if a deep recession causes all asset prices to retreat in lockstep.

Second, the search for returns is moving beyond the traditional 60:40 equity-bond mix, to a more flexible approach. Holding more ‘dry powder’ can help investors ride out the waves of periodic market ructions creating bargains for buying underpriced assets.

Amid greater regional dispersion of growth and inflation, the geographical disconnect between markets may enhance the benefits of cross-border diversification. The performance of developed and emerging markets has been deviating since 2015, becoming even more pronounced since the onset of the Covid-19 pandemic, and the Russian invasion of Ukraine.

Finally, as central bank support melts away and market prices transition back towards fundamentals, there may well be a revival of value investing. Periods of high inflation and rising rates throughout the last century favoured value stocks, as investors paid particular attention to their intrinsic worth. Now investors are once again embracing companies that produce tangible things. A new regime will demand many more such reassessments.