Summary

The ongoing tariff-related uncertainty points to the transactional and unilateral approach of the United States that can complicate matters for policymakers around the world.

While tariff implementation has been postponed, policymakers and central banks await clarity on the impact on the economy.

This uncertainty complicates international trade and relationships with major trading partners such as the EU.

Even though tariffs on some countries have been announced, the transactional approach of the United States could stay.

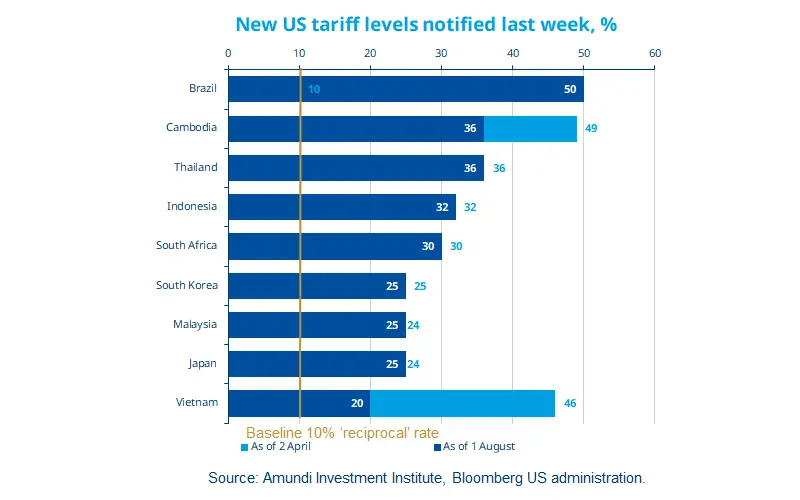

The 90-day extension to the reciprocal US tariffs expired last week. US President Trump announced new rates for several trading partners and delayed the implementation date to 1 August. For instance, new 25% tariffs on Japan and South Korea will come into effect from this date, prolonging the current 10% rate and giving countries more time for negotiations. Trump also announced a 50% tariff for Brazil and on US copper imports and threatened to levy additional tariffs on other BRICS countries. The United States seems to be in negotiations with other trading partners, but this tariff-related ambiguity adds to uncertainty on economic growth, US consumption trends, and inflation. As a result, markets are likely to stay volatile, underscoring the need to keep an eye on assets that could provide some stability.

Actionable ideas

Gold

In the first half of 2025 gold performed strongly, boosted by high uncertainty around US tariffs. Investors may find it beneficial to invest in safe-haven assets in uncertain times.

Multi asset

A balanced and diversified* approach, using different levers of return, can be beneficial in times of high uncertainty and help investors navigate risks.

This week at a glance

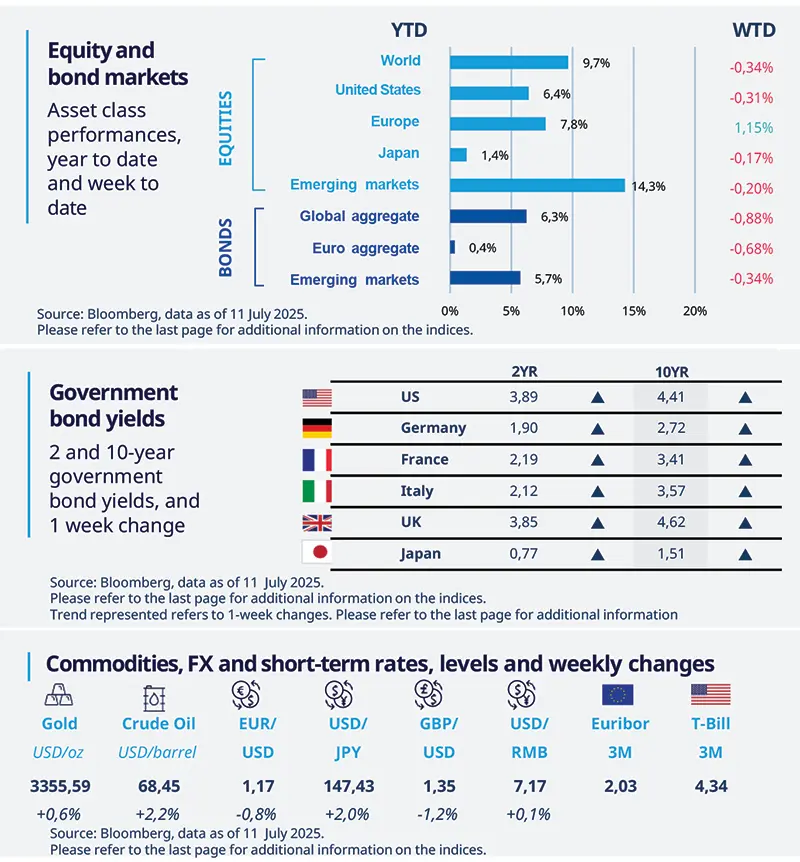

Global equities were mostly down last week, amid escalating tensions on US tariff policy. Meanwhile, government bond yields moved higher. The dollar strengthened against most peers, while gold stayed close to record levels. Oil prices rose despite Saudi Arabia exceeding its OPEC production quota in June.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 11 July 2025. The chart shows the US tariff rates against selected countries (both tariffs announced on 2nd April and those expected to become effective on 1st August).

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Policy uncertainty may be weighing on hirings

Initial claims ticked down in the week of 5 July to 227,000, tentatively signalling a topping in the four-week average trend (now at 236,000). Yet, continuing claims reached a new high (at 1,965,000 the highest level since 2021), with also the four-week moving average up. It is becoming increasingly difficult for workers to return to employment after they lose it, likely reflecting in companies being more cautious in hiring, given the elevated policy uncertainty.

Europe

EZ retail sales slow in May

After three months of accelerating momentum, EZ retail sales (in volume) slowed 0.7% MoM in May, after posting three months of gains. However, the YoY trend remains positive at 1.8%, though moderating. On a monthly basis, key categories like food, drinks, tobacco, non-food products and fuel showed weakness. The moderating consumption could be due to post-Easter payback or to the elevated uncertainty surrounding Trump’s tariff policies.

Asia

China CPI edges up amid deepening PPI deflation

China’s headline CPI inflation turned slightly positive at 0.1% YoY in June, beating expectations, while core CPI – which excludes food and energy -- rose to 0.7%. However, PPI deflation intensified to -3.6% YoY, the weakest since August 2023, pressured by trade shocks. The CPI spike appears temporary, as persistent and broad PPI deflation signals continued deflationary pressure.

Key dates

15 July US CPI, China GDP and retail sales, EZ industrial production | 17 July US initial jobless claims and retail sales, EZ CPI, UK unemployment rate |

US University of Michigan consumer sentiment, US housing starts and building permits |