Summary

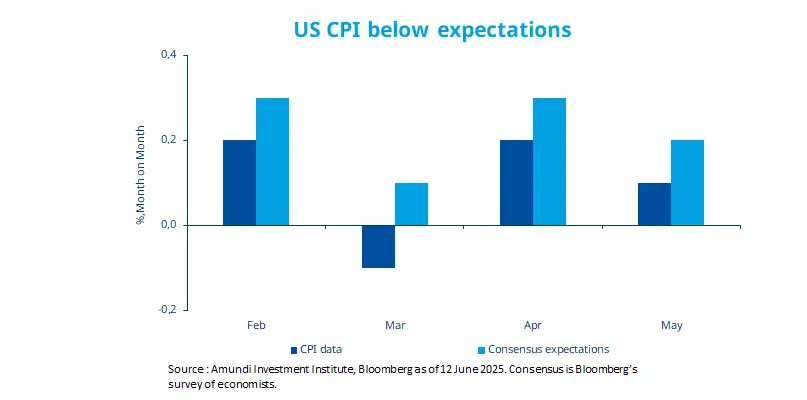

US CPI has been slowing. However, uncertainty on US tariffs and rising tensions between Israel and Iran, which could keep oil prices high, may make central banks job more difficult.

- Consumer prices growth decelerated in May, mainly due to lower energy prices and cooling shelter inflation.

- The Fed is likely to remain vigilant on inflation mainly due to the impact of tariffs and volatility in energy prices.

We believe investors should maintain sufficient safeguards to navigate the uncertainty.

US CPI decelerated to 0.1% (Month on Month) in May, primarily due to lower energy prices. It was the fourth consecutive month in which the CPI came in below expectations. Core inflation, which excludes food and energy, also decelerated. We think the impact of tariffs is not yet visible on the price of goods. However, there are several factors that could create volatility. For instance, the looming July deadline for US tariffs and any potential increase in import duties could affect inflation. The recent US-China negotiations have shown that uncertainty is likely to remain. In addition, any sustained shock to oil prices, following the increase in tensions between Israel and Iran, may complicate the Fed’s plans to bring down inflation sustainably and reduce policy rates.

Actionable ideas

Multi asset

A diversified* approach that utilises multiple levers of return and safeguards may be prudent in times of uncertainty around growth and geopolitical tensions.

Gold

Any escalation of risks on the geopolitical front and still high government debt underscore the importance of gold as a potential source of stability.

This week at a glance

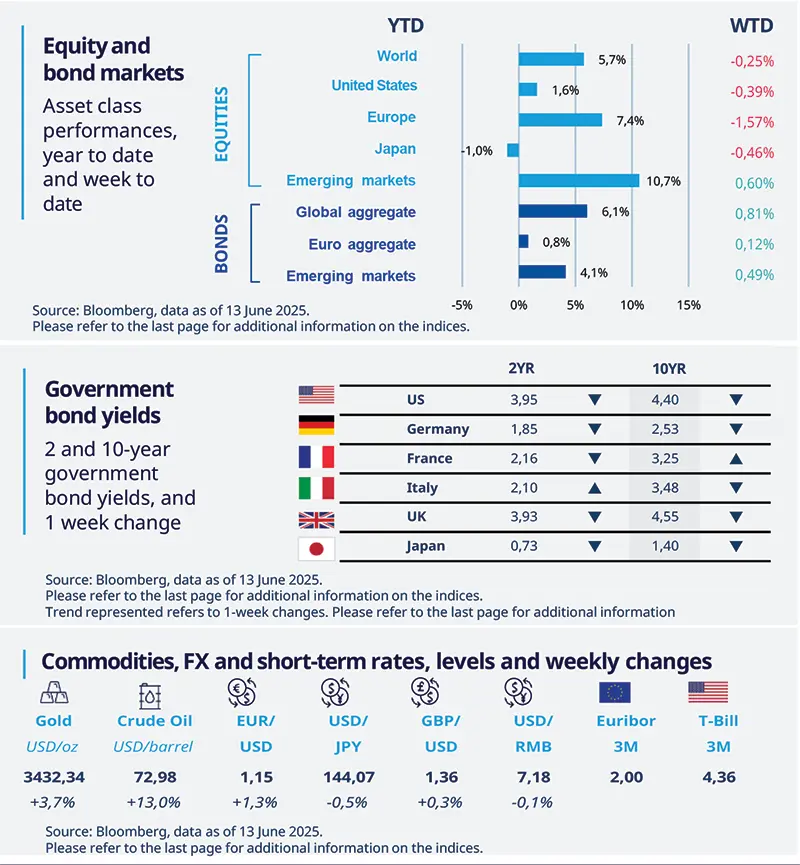

Equities in the developed world fell due to escalating tensions in the Middle East, following strikes between Israel and Iran. Oil prices and the price of safe-haven gold rose. However, the US-China trade talks in London brought some temporary relief to stocks earlier in the week. Most bond yields fell after a soft US CPI report.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 13 June 2025. The chart shows US monthly CPI against the Bloomberg consensus of economists.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US-China talks proceed, but clarity is needed

Details about the ‘London deal’ are fragmented as we write and are subject to final approval by the administration of the two countries. According to reported news, the deal sets US tariffs at 55%, China's at 10%, removes Chinese export restrictions on rare earth minerals, and allows China’s students access to US universities. Still, many details of the deal and specifics on how it will be implemented remain unclear.

Europe

UK growth shrinks in April

After a surge of activity in the first quarter, April GDP contracted by 0.3% MoM. This weakness was partly driven by a stamp duty change (a payback from the surge of activity in March, which pushed GDP up by 0.5% on the month). We believe this should be reversed in May. Yet, the main drag came from contracting services activity (-0.4% MoM) and from the weak manufacturing sector (-0.9% MoM). Growth should remain subdued for the rest of the year, supporting our view of further rate cuts from the BoE.

Asia

India inflation hits a 6-year low

In May, India inflation printed at a 6-year low of 2.8% YoY, down from 3.2% in April, driven by moderating food prices. Core prices – which exclude food and energy components – were muted. We expect inflation to stay below 3% for the next few months, change in the RBI stance from accommodative to neutral despite the benign inflation figures, we expect the RBI to pause at the upcoming monetary policy meeting in early August.

Key dates

17 June US retail sales and industrial production, EZ ZEW survey | 18 June Fed interest rates decision, US housing starts and building permits | 20 June China decision on loan prime rates, ECB monthly economic bulletin |