Summary

A sustained rise in oil prices could complicate central banks' efforts to tame inflation and manage growth, given the already uncertain environment surrounding US tariffs and international trade.

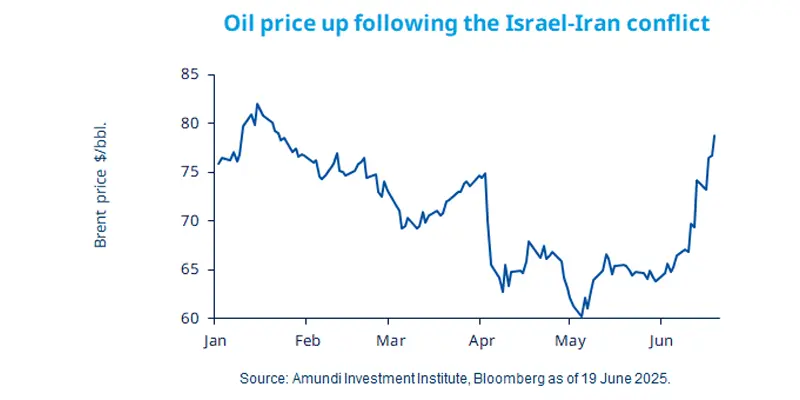

- Oil prices have risen on concerns over supply disruptions following the conflict, with some ripple effects in equities.

- As the situation is still fluid and evolving every day, we expect oil volatility to continue.

- High volatility and uncertainty call for a tilt towards quality assets including bonds which could provide stability.

The conflict between Israel and Iran has brought to the fore the market’s concerns about oil supply, causing prices to jump sharply to their highest level since January. Apart from the human cost, this conflict further complicates the global economic environment. Central banks such as the Fed are trying to, and have so far been successful in, controlling inflation. However, such conflicts, ambiguous tariffs, and lengthy trade negotiations complicate the outlook. The Fed’s decision to keep rates unchanged is an acknowledgement of these uncertainties, including the effect of tariffs on inflation. It will likely resume rate cuts later this year, as inflation subsides. There is one caveat, though – sustained high oil prices (not our base case) and the conflict expanding may reignite inflationary pressures. In any case, investors should stay diversified* and vigilant.

Actionable ideas

Gold

Precious metals such as gold may provide potential stability to portfolios in times of geopolitical conflicts and potential risks around inflation.

Global fixed income

We believe an uncertain growth environment coupled with risks around global conflicts may underline the importance of government bonds in Europe and the UK.

This week at a glance

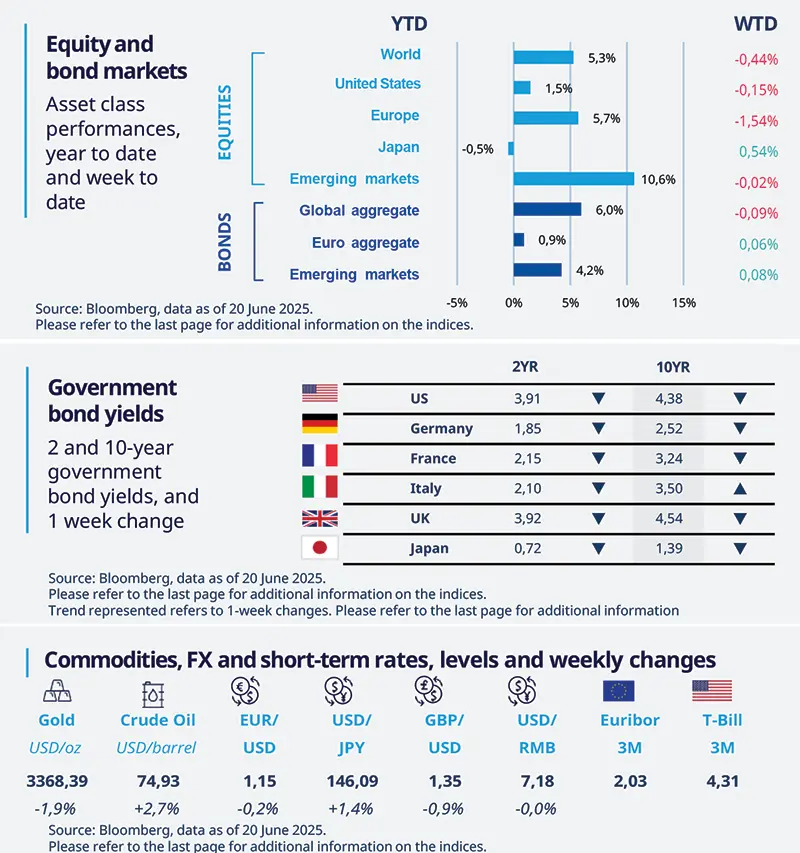

Most global equities declined following the escalation of the conflict in the Middle East and the US strikes. Oil prices increased amid concerns over supply. Bond yields in most developed markets fell in this environment. Earlier in the week, the Fed downgraded US economic growth forecasts for the year.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD). All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 20 June 2025. The chart shows US monthly CPI against the Bloomberg consensus of economists.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US retail sales show signs of weakness in May

US retail sales fell 0.9%, month-on-month, in May. If we exclude the volatile and discretionary spending (a better proxy of core consumer spending), the number was up 0.4%, slightly stronger than expected by consensus. There was also some weakness in restaurant sales. We think, the impact of tariffs is still not evident on prices. Once that happens, we believe consumer spending will be affected.

Europe

Eurozone inflation decelerated in May

The pace of inflation declined to 1.9%, year-on-year, in May. The services component is the main contributor to eurozone inflation. Looking ahead, we think services inflation should moderate as wage growth slows. Therefore, we believe it should not be a concern for the European Central Bank. We expect overall disinflation to continue gradually, provided the shock to oil prices remains limited in scope and time.

Asia

Bank of Japan slows its bond tapering

The Bank of Japan held its policy rate unchanged at 0.5% as expected, signalling a cautious approach to future rate hikes, due to the need to monitor US tariff impacts and heightened global trade uncertainty. The bank also decided it will continue to reduce its bond purchases but will decelerate the pace from ¥400bn to ¥200bn each quarter, starting April 2026.

Key dates

23 June US home sales, PMI – EZ, US, UK, Japan, India | 26 June US durable goods, Bank of Mexico policy rate, Brazil inflation | 27 June US PCE, EZ consumer confidence, China industrial profits |