Summary

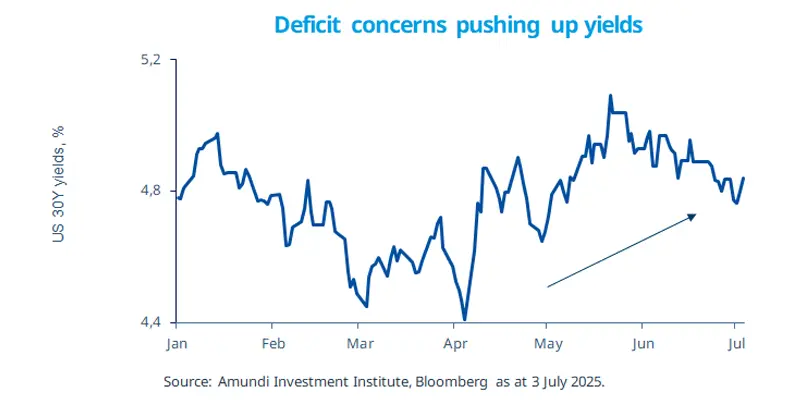

Ballooning US federal deficits will heighten investors’ concerns about the sustainability of US fiscal policy, pushing them to look for opportunities arising in other areas.

The bill will increase the federal deficit and push debt to around 135% of GDP by 2035 (Moody’s estimate).

Markets may demand higher yields on long-term Treasuries to offset uncertainty over the US debt path.

A weaker US dollar and uncertainty on US fixed income may boost appeal for other regions such as Europe and EM assets.

The US tax bill – known as OBBB, One Big Beautiful Bill –was passed by the House of Representatives on 3 July and landed on the President’s desk on Independence Day. The $3.4 trillion bill extends Trump’s tax cuts from his first term and implements campaign promises such as removing income taxes on tips and enforcing immigration controls. It also includes a $5 trillion rise in the debt ceiling and will be partially funded by cuts to Medicaid and other health programmes. However, most of the bill will be financed through additional debt. This is raising concerns over US debt sustainability and the fiscal deficit trajectory and could result in higher volatility in both bonds and the dollar. While US assets remain core for global investors, demand for diversification* into other regions may persist.

Actionable ideas

EM bonds

EM bonds may be favoured in times of a weak dollar, especially in countries with strong domestic growth stories such as India.

Multi asset

A balanced and diversified* approach, using different levers of return, can be beneficial in times of rising government debt and geopolitical tensions and help investors navigate these risks.

This week at a glance

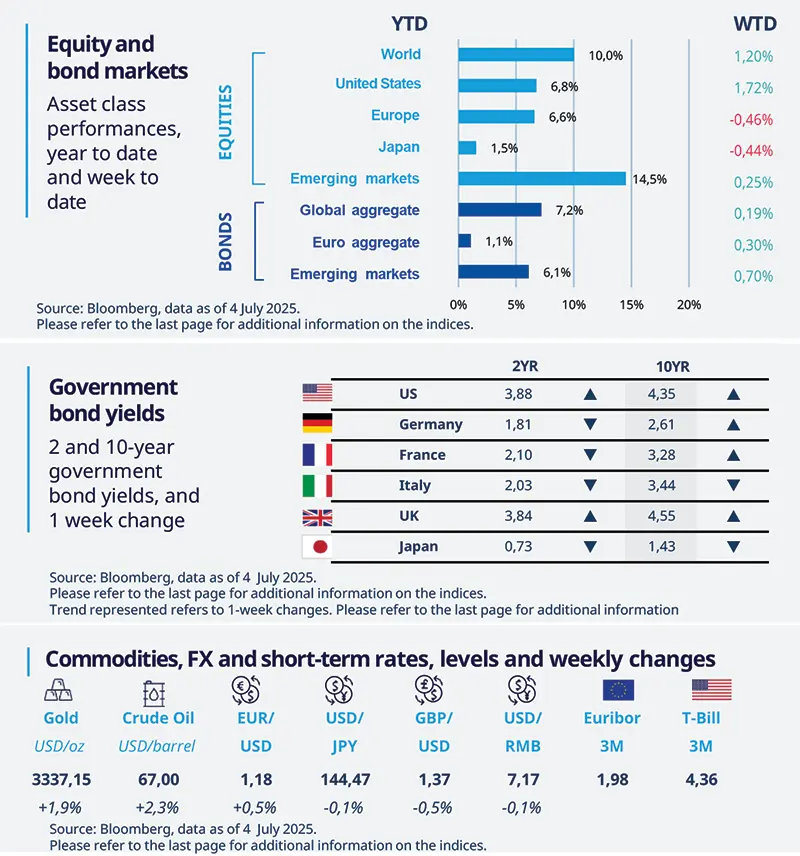

Global equities were mixed amid strong US labour market data and uncertainty stemming from the deadline of the 90-day tariff pause. Gold prices were up for the week. In bond markets, the US 10Y yield rose following a robust employment report. Long end yields in Germany were also up.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 4 July 2025. The chart shows the US 30-year Treasury yields.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Policy uncertainty weighs on private-sector jobs

US non-farm payrolls increased by 147,000 in June. However, private payrolls rose by just 74,000, below consensus. The unemployment rate unexpectedly fell to 4.1% from 4.3% due to a decline in the labour force. Job growth held up in non-cyclical sectors such as education, healthcare, and government, while it proved weaker in other sectors. This highlights how private-sector job growth is stalling due to current trade-related policy uncertainty. The report supports the current wait-and-see Fed stance.

Europe

EZ inflation back in line with ECB target

EZ CPI increased slightly in June to 2.0% YoY from 1.9%, putting inflation back in line with the ECB target. Core inflation – which excludes food and energy – was unchanged at 2.3%, its lowest level since January 2022. Services inflation accelerated slightly, while the decline in energy prices softened. Among major economies, inflation unexpectedly dropped in Germany, while France and Spain saw modest gains and Italy’s inflation was steady.

Asia

South Korea’s trade surplus posts large gain

South Korea's exports rebounded strongly in June, driven by robust AI demand, resulting in the largest trade surplus since 2018. As a bellwether for global trade, this report suggests that global export growth in June likely remained resilient and supports our expectation of a Korean economic recovery in the second half of 2025, lowering the likelihood of Bank of Korea rate cuts.

Key dates

9 July FOMC meeting minutes, | 10 July Bank of Korea policy rate, |

US Federal budget balance, |