Summary

Will India’s policy push create the de risked clean energy opportunities of the decade?

Key takeaways

India is set to play a central role in the global clean energy transition in the next decade. Now the world’s most populous nation, with over 1.4 billion people, and fourth largest by gross domestic product GDP, it is expected to be the largest driver of global energy demand through 2035. While it is the third largest emitter of GHG, India is already the fourth largest renewable market in the world.

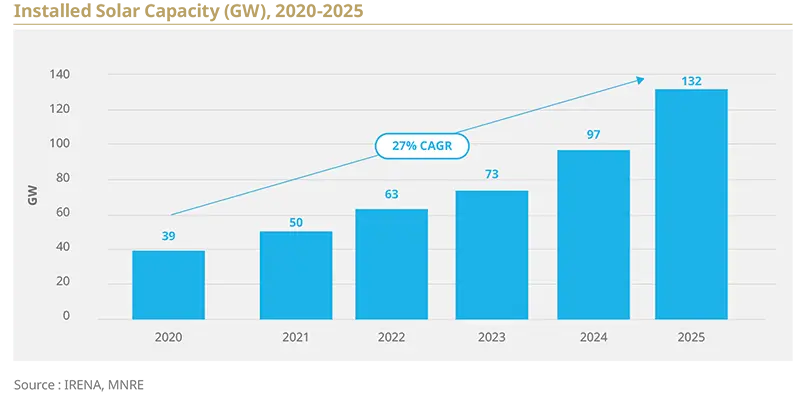

2025 already marked a turning point in India’s energy transition, even if coal remains the backbone of the country’s energy system. India reached its target of 50% of installed electricity capacity from non-fossil fuel sources, five years earlier than the set timeline of 2030. While coal still remains critical for energy generation, its role in India’s energy system is set to gradually decline with greater uptake of clean energy.

The combination of demand-side measures that make electricity demand more predictable with supply-side incentives focusing on scaling production are allowing private capital to enter earlier and at greater scale. Ambitious demand-side measures are strengthening the investment case for RE generation, electric mobility, and domestic manufacturing providing strong visibility of demand, while supply incentives are reducing costs and project risks. Rising electricity demand from electrification in India is likely to reinforce the long-term scale-up of renewable generation.

India’s momentum in capital mobilisation to support the transition is growing, focusing on clear business cases in renewable energies, grid upgrades, transport electrification and clean manufacturing. Over the last ten years, the ratio of investment flows for fossil fuel vs. non-fossil fuel capacity has progressed from 1:1 to 1:4. Alongside private capital raised domestically, Development Finance Institutions (DFIs), foreign investors, and domestic markets are playing an increasingly central role in scaling clean technologies in the country.

Introduction

2025 marked a major milestone in India’s energy transition. The country reached its target of 50% of installed electricity capacity from non-fossil fuel sources1, five years earlier than the set timeline of 20302. At the same time, coal-fired energy generation dropped (3% YoY) for the first time in over five decades3. The first half of 2025 also witnessed the fastest rise in renewable output since 20224. While coal still remains the backbone of energy generation, its role in India’s energy system is set to gradually decline with greater uptake of clean energy.

Now the largest country by population and fourth largest by GDP5, India is expected to be the largest driver of global energy demand through 20356 while it is the third largest emitter of GHG, behind China and the US. With an ambition to achieve Net- Zero by 2070, India is already one of the largest renewable markets in the world and ranks fourth globally in terms of installed renewable energy capacity7. Hence, the country’s energy policy choices will have an outsized influence on global emissions trajectories in the coming decades.

This paper explains the policy dynamics driving clean energy demand and supply in India and explores how they can create de risked opportunities for private investors as capital mobilization accelerates.

Demand-side drivers of India’s clean energy transition

As the population increasingly faces the consequences of climate change and air pollution8, public opinion progressively favors the adoption of clean energy9. At the same time, increasing urbanization10, a GDP growth forecast of over 6% YoY till 203011, rising demand for cooling, a boom in data centers and AI, and transport electrification make India’s rising electricity demand a structural reality. Despite efficiency gains, higher incomes and economic growth will continue to push per capita electricity consumption upward over the coming decades12.

“Over the next twenty years, India is on track to see the single largest increase in energy demand of any country worldwide, and even larger than entire continents and regions such as Southeast Asia, Middle East and Latin America. Along with industrial activity, rising cooling needs in buildings and growth in transport are the primary drivers for this growth. Importantly, data localisation laws and rapid digitalisation contribute to the doubling of data centre capacity by 2030, fuelling electricity demand further.”

“Although coal will remain the largest source of electricity generation for the coming decade, the share of renewables expands steadily. To stay on track to meet net zero by 2070, India will cumulatively need to invest USD 1.3 trillion in clean power generation capacity, storage, and grids over the next decade, creating a demand-driven and policy backed pipeline of opportunities for long term investors.”

Mr. Siddharth Singh

Co-lead on Energy and AI and the India Energy Outlook, International Energy Agency

Government schemes supporting demand for solar power

Subsidies for renewables increased by 31% YoY to nearly USD 4 billion in FY 2024, signaling strong and continued policy support for renewables13. Solar power, which is a pivotal enabler of India’s clean transition has been the primary focus of this demand-side strategy. The Indian government has introduced various schemes to support solar adoption at the micro-level, such as the PM Kisan Urja Suraksha Evam Utthan Mahabhiyan Yojana (PM-KUSUM) scheme aimed at making the country’s vast agricultural sector energy efficient by installing decentralized solar power plants and solar pumps on agricultural lands14.

More recently, the PM Surya Ghar Muft Bijli Yojana (PMSGY) aimed at subsidizing the adoption of rooftop solar panels was launched in Q1 2024. With a total outlay of USD 8.5 billion15, the scheme targets covering 10 million households and adding 30GW of residential rooftop solar capacity by 2027.

The country has already added ~5GW of rooftop solar capacity16 covering 1.6 million households17. Moreover, the government is supporting the expansion of utility-scale solar generation through a Central Finance Assistance (CFA) scheme18. Some of the world’s largest solar parks, outside of China, are now located in India, including the recently commissioned Khavda Renewable Energy, which is expected to be five times the size of Paris19.

Consumer incentives are accelerating EV adoption

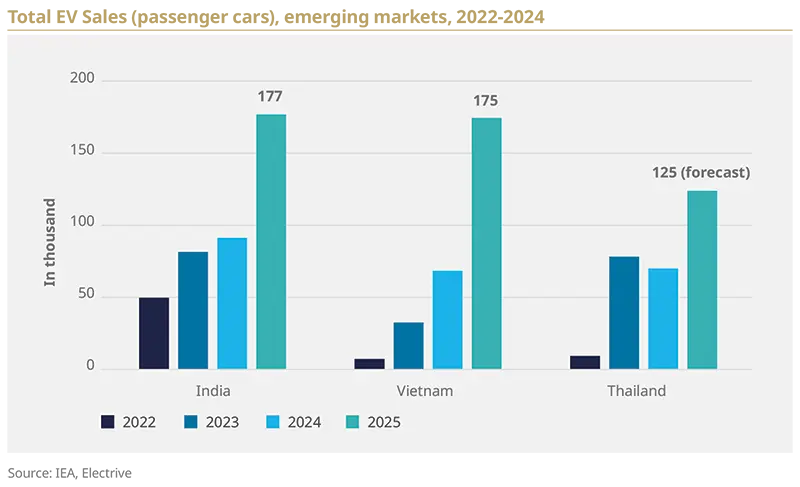

Electric mobility is also emerging as a major source of electricity demand, supported by improving economics and targeted consumer incentives. In 2025, total EV sales in India crossed two million units (~ 8% of total vehicle sales) growing ~20% YoY20 signaling robust EV demand. Government’s consumer subsidies like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) I and II schemes and more recently the PM e-DRIVE scheme have been pivotal to support EV adoption, especially in the two-wheeler segment.

Further supporting this trend, India’s EV charging network has expanded rapidly, growing nearly fivefold between 2022 and 202521. Consumer demand for passenger EVs is further expected to grow resiliently, as stricter fuel emissions requirements come into effect in the country by 202722.

Supply-side enablers of India’s clean energy transition

India has also been complementing the rising demand with robust supply-side measures for expanding clean energy generation through targeted incentives and production linked incentives (PLI) scheme for domestic manufacturing.

Viability Gap Funding supporting the take-off of nascent clean energy technologies

The Indian government has introduced Viability Gap Funding (VGF) schemes for renewable energy technologies in nascent stages like offshore wind and battery energy storage systems (BESS). The VGF scheme for offshore wind energy projects with an outlay of ₹7,453 crore (approx. US$1billion) targets 1 GW of offshore wind capacity23 by reducing the cost of electricity from offshore wind projects, which is currently almost 2.5 time more than the cost of solar energy, improving their commercial viability for distribution companies (DISCOM)24. Similarly, the VGF for BESS targets providing capex support for a capacity of 30 GWh25. Another priority area has been green hydrogen – the National Green Hydrogen Mission (NGHM) was launched in 2023, with the target of spurring annual production of at least 5 MMT by 203026.

Biofuels: reconciling the energy transition with rising fuel demand

Biofuels are a strategic component of India’s energy transition, already accounting for 13% of India’s total final energy consumption. India’s transport sector is a major consumer of imported fuels, and the rapid adoption of biofuels could significantly reduce emissions, lower the fuel import bill, and help increase farmers’ incomes in the country. As demand for transport is high and electrification alone cannot meet short-term decarbonisation targets, India is prioritising a multi-fuel mix that combines biofuels with electrification and other measures. India’s rationale for supporting the bioenergy is threefold. Firstly, biofuels can help cut carbon emissions, secondly, they increase India’s energy security and reduce the country’s reliance on imported fuels, and thirdly, biofuels industry can help increase farmers’ incomes in the country. To that end, the government has set clear goals of achieving 20% ethanol blending by 2025 (which has been accomplished), 5% biodiesel blending by 2030, 5% Compressed Bio Gas (CBG) blending by 2028, and 2% sustainable aviation fuel blending for all international flights by 2028. The government has provided strong supply side support for the biofuels sector through Central Financial Assistance (CFA) for biogas plants, including subsidies to the pipelines connecting bio- Compressed Natural Gas (CNG) plants with city gas distribution networks. On the demand side, the Sustainable Alternative Towards Affordable Transportation (SATAT) scheme pegs compressed biogas prices to CNG retail prices, and regulatory mandates have introduced requirements for city gas distribution companies to begin blending CBG by Q2 2026. The IEA forecasts the share of bioenergy in India’s final energy use to grow by 45% between 2023 and 2030.

Sources: S&P Global, IEA, BBC |

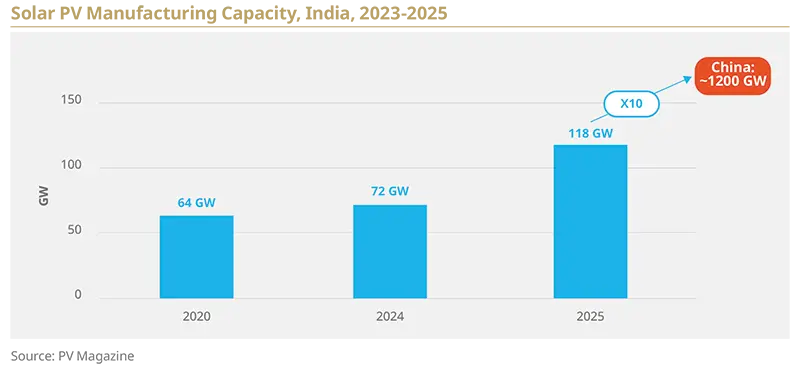

Production-Linked Incentives (PLI) catalyzing domestic Solar PV and EV manufacturing

Alongside efforts to scale generation, PLIs are proving to be catalytic for domestic cleantech manufacturing. In the case of high efficiency solar PV, PLIs have helped India scale up solar PV module manufacturing to a cumulative capacity of 118 GW, by the end of 2025. On top of this, another 9.7 GW of solar cell capacity and 2.2 GW of ingot and wafer capacity has been added27. While growth in solar manufacturing in India is growing fast it still does not match that of China, which operates at a scale of more than ten times that of India. Since the launch of the National Solar Mission, levelized cost of electricity (LCOE) for solar power in India has fallen to US$ 38/MWh, which is nearly a 90% reduction in just over a decade28. Concurrently, the installed solar capacity has increased to over 105 GW from a mere 17 MW in 201029, which underscores the role of domestic manufacturing in making solar power economically viable and scalable in the country.

Further PLIs to support the domestic EV ecosystem have also been introduced30. With Indian automakers like Tata Motors, Mahindra, and Ola Electric leading the EV revolution, S&P Global predicts EV production in India will scale to over 1.3 million units by 2030, making up 20% of total passenger vehicles production in the country31.

Capital mobilisation momentum in India’s clean energy transition

As demand- and supply-side forces for clean energy continue to align, India is also witnessing strong momentum in capital mobilisation to support the transition. Over the last ten years, the ratio of investment flows for fossil fuel vs. non-fossil fuel capacity has progressed from 1:1 to 1:4. Greater certainty around project pipelines, falling costs, and supportive policy frameworks have improved the risk–return profile of clean energy investments.

In 2024, US$ 25 billion was raised for clean energy driven by private equity, venture capital and green bonds. In the first half of 2025, nearly US$ 12 billion were raised already32. Despite broader volatility, 10 major clean energy and electric mobility companies went public in 202433.

Development finance enabling green finance through de-risking

In 2024, India was the largest recipient of DFI funding, with inflows of around US$2.4 billion for clean energy generation alone34. This kind of financing has been a key enabler for India’s green transition, by providing specific support in areas where private capital is scarce. For instance, World Bank’s Low-Carbon Energy Programmatic Development Policy Operations with a total funding of US$ 3 billion35 is supporting India’s green hydrogen ambitions. The operation has supported the waiver of transmission charges for renewable energy in green hydrogen projects, has helped create a legal framework for a national carbon credit market36 in the country, and is now helping boost the production of green hydrogen and electrolyzers37.

The significance of such engagement lies in the role DFIs play in de-risking investments, thereby crowding in larger volumes of private capital to complement public finance. Asian Development Bank-led India Green Finance Facility (IGFF) approved in 2025 is expected to be a gamechanger for promoting blended finance for India’s energy transition. Supported by Green Climate Fund’s US$ 200 million commitment38, the IGFF will help mobilise over US$ 2.5 billion in clean energy investments, notably thanks to a US$ 65 million risk sharing facility39.

Green bond issuance scaling India’s sustainable finance market

Alongside DFI engagement, India’s sustainable finance market has expanded rapidly, with green bonds playing a central role in channeling capital into the clean transition. This momentum reflects a broader shift in India’s financial ecosystem toward ESG-aligned instruments40. By the end of 2024, India had issued US$55.9 billion in green, social, sustainability, and sustainability-linked (GSS+) debt, marking an increase of 186% since 202141. Green bonds account for over 80% of all GSS+ issuance, with most of the proceeds directed towards renewable energy and electric mobility. India is now ranked as the 18th largest source of aligned GSS+ debt globally, and fourth amongst emerging market peers.

Issuance of sovereign green bonds has further helped develop this market by improving liquidity and deepening the domestic investor base for sustainable finance. The government has issued INR 477 billion (approximately US$5.7 billion) in sovereign green bonds, helping set price benchmarks and affirming foreign investors’ confidence in rupee-denominated green finance instruments.

Foreign Direct Investments (FDI) reinforcing clean energy investment momentum

The final push for mobilizing capital for clean energy comes from FDI into the sector, which has grown resiliently over the past years. India’s robust macroeconomic landscape and attractive investment returns have made the country one of the most attractive countries for FDI, with over US$ 80 billion in FDI inflows in FY 2024-2542. Cumulatively for the period from 2020- mid 2025, the country has attracted approximately US$19 billion in FDI for clean energy projects. In the first three quarters of 2025, nearly US$ 3.5 billion came in, almost equaling the total FDI for renewables in 2024 (US$3.7 billion), underscoring the sector’s strong appeal to foreign investors43.

Conclusion

India’s clean energy transition is being built bottom-up, anchored in predictable electricity demand growth and government-created offtake certainty. Demand visibility is being complemented by supply-side incentives helping to scale the clean energy ecosystem, while development finance and a maturing green bond market are crowding in private capital to support the transition.

However, the alignment between supply creation and end-use demand remains uneven across technologies. While solar power and EVs are driven by demand, green hydrogen is currently pushed from supply-side incentives, with demand expected to emerge later. Meanwhile, thermal coal power, which remains the largest source of energy generation in India, is being only indirectly addressed through incremental displacement by clean energy.

The simultaneous acceleration of energy demand and large-scale clean energy deployment underscores both the scale of the challenge and the opportunity embedded in India’s transition pathway. Investors can watch opportunities across power generation, networks and end use electrification as India scales clean energy, as well as growth in clean technology manufacturing and new low carbon fuels. The acceleration of public private partnerships and blended finance structures will be decisive to help reduce early stage risks and support deployment.

Effective execution, including grid readiness, storage deployment, improving distribution companies’ financial health, land acquisition, and a just transition will be decisive for India to effectively embed clean energy into its growth trajectory and unlock investment opportunities across technologies and asset classes.

1. Reuters

2. This was one of India’s five “panchamrit” goals declared at COP26 in Glasgow (CGEP)

3. IEA, Carbon Brief

4. Reuters; India hits 50% non-fossil power milestone ahead of 2030 clean energy target

5. IMF

6. IEA, World Energy Outlook 2025

7. The Economic Times

8. According to a study in Lancet Planetary Health, long-term exposure to air pollution increased deaths by 1.5m deaths/year in India, when compared to conditions if India met WHO’s recommendations for safe exposure.

9. According to Yale Programme on Climate Change Communication, 86% of Indians support the government’s commitment to net-zero by 2070

10. World Bank

11. IMF

12. Electricity consumption per capita grew by >200% between 2000-2023, despite reduction in energy intensity of the economy. IEA

13. IISD, Mapping India’s Energy Policy

14. Solar Quarter

15. Climate Laws of the World

16. Figure as of June 2025; In certain states like Maharashtra, Karnataka, and Rajasthan, consumers receive additional support from state governments further accelerating solar uptake by households. Tata Power

17. Institute of Energy Economics and Financial Analysis

18. Approx.. US$27,000 USD for a detailed project report, and US$20,000 per MW for every solar park project. Ministry of New and Renewable Energy

19. CNN

20. Times of India

21. Public charging stations rose from 5,151 in 2022 to 11,903 in 2023 and reached 26,367 by early FY25, marking a strong 72% CAGR. IBEF

22. Corporate Average Fuel Efficiency (CAFE-III) will take effect on April 1, 2027 – manufacturers must lower average carbon emissions to 91.7 grams per kilometre (g/km), from the current 113.1 g/km. Business Standard

23. Global Wind Energy Council

24. The government has also waived off Interstate transmission charges for RE including green hydrogen, is promoting windsolar hybrid projects, and releasing more round-the-clock renewable tenders.

25. JMK Research and Analytics

26. NGHM provides two concrete supply-side measures as part of the Strategic Interventions for Green Hydrogen Transition program with a total outlay of approx. US$2 billion – US$ 500 million have been earmarked to support domestic manufacturing of electrolyzers, while US$1.5 billion will be used to incentivize green hydrogen production. (MNRE; IFRI, India’s Green Hydrogen Strategy in Action)

27. PV Magazine

28. The weighted average levelized cost of electricity (LCOE) for utility-scale solar stood at approximately US$376/MWh, around 50% higher than the global average in 2010. (Rana, Jindal, 2025)

29. Rana, G. S., & Jindal, R. (2025). Factors affecting solar levelized cost of electricity in India & policy recommendations. Energy and Climate Change, 6, 100207. https://doi.org/10.1016/j.egycc.2025.100207

30. The Indian government has also introduced PLIs for supporting the domestic electric vehicles ecosystem. The PLI-Auto scheme and the PLI for Advanced Chemistry Cell (PLI-ACC) have a combined financial outlay of around 5 billion USD for a five year period starting in 2021.

31. S&P Global

32. BloombergNEF

33. BloombergNEF

34. IEA, World Energy Investment 2025

35. There have been 2 editions of the Low-Carbon Energy Programmatic Development Policy Operations, each with financial outlay of US$ 1.5 billion each. The first one, approved in 2023, was focussed on waiving off transmission charges for RE in green hydrogen projects and helping build a framework for carbon credits. The second one, approved in 2024, supports reforms to boost the production of green hydrogen and electrolyzers, and incentivize battery energy storage solutions, amongst other things. World Bank

36. Phase 1 of the Carbon Credit Trading Scheme currently excludes power generation, which is India’s largest source of GHG emissions. This substantially limits the scheme’s near term emissions impact.

37. World Bank

38. Green Climate Fund

39. Asian Development Bank

40. India’s great transformation: opportunities for global investors

41. Climate Bonds Initiative

42. PIB, Ministry of Commerce and Industry

43. CEEW